16Oct2025

Latest News & Report / Vietnam Briefing

Comments: No Comments.

Vietnam’s cold chain logistics sector is undergoing a significant transformation, transitioning from a nascent, capacity-constrained market to one that is sophisticated, highly compliant, and positioned for rapid growth. This evolution is driven by the country’s burgeoning agricultural exports, especially in seafood, fruits, and vegetables, along with the rising demand for temperature-sensitive pharmaceutical products. The combination of these factors creates a unique and high-yield investment opportunity, particularly for international investors, including those from markets with advanced logistics expertise, such as Japan.

Market Overview

According to FiinGroup, from 2020 to 2023, the total designed cold storage capacity increased by approximately 44.8%. The 2025 update (with data as of December 2024) records around 1.3 million pallets, 117 cold storage facilities, 1,499 refrigerated trucks, and 47 cold transport providers; the capacity is projected to exceed 1.7 million pallets by 2028[1], with about 13 new projects planned for 2024–2028.

Vietnam’s cold chain logistics market is experiencing rapid expansion due to two key drivers: booming agricultural exports and a surge in domestic consumption of fresh and chilled products. In 2024, Vietnam set a record for agricultural exports, including high-value perishables such as seafood, fruits, and vegetables, which require meticulous temperature control.

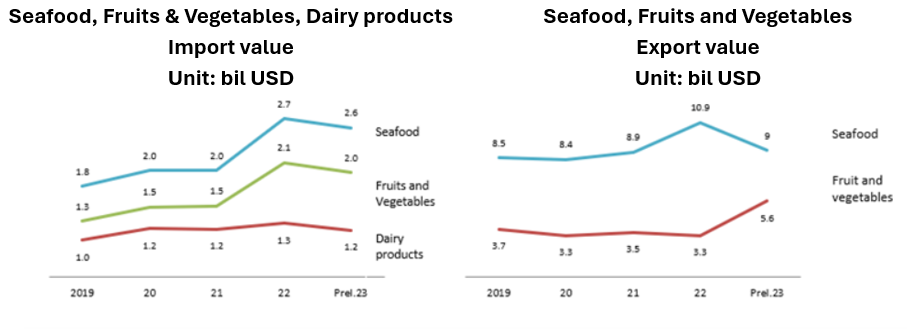

– Seafood imports grew significantly from $1.8 billion in 2019 to $2.7 billion in 2022, with a slight dip projected for 2023. Meanwhile, fruit and vegetable imports steadily increased, while dairy imports remained stable.

– On the export side, seafood saw a rise from $8.5 billion in 2019 to $10.9 billion in 2022, with a minor decline expected in 2023. Exports of fruits and vegetables also showed growth, while dairy exports stayed low and steady.

Source: GSO, General Statistic Yearbook (2023)

The pharmaceutical sector is also a key area of growth, projected to increase from $6 billion in 2023 to $8.7 billion by 2028 in terms of total sales value of pharmaceutical products[2], driven by an aging population[3] and a rising demand for temperature-sensitive pharmaceutical products[4]. The increasing need for cold chain compliance[5], particularly in the Ethical (ETC) channel, is fueling further infrastructure requirements.

This combination of expanding agricultural exports, rising domestic consumption, and growing pharmaceutical needs highlights the crucial role of cold chain logistics in Vietnam’s economy and its promising growth prospects in the coming years.

Main players

Vietnam’s cold chain logistics sector is experiencing significant growth, driven by expanding agricultural exports, increasing domestic demand for perishable goods, and a rising need for pharmaceutical cold storage. The market remains fragmented, with several key players contributing to its development.

Table 1. Leading Cold Storage Companies in Vietnam

| Name | Country | Year of operation | Capacity (‘000 pallets) | Region | ||

| North | Center | South | ||||

| Lineage Logistics | America | 2023 | 81 | Ha Noi | x | HCMC |

| Transimex | Vietnam | 2010 | 77 | x | Da Nang | HCMC, Tay Ninh |

| Hung Vuong | Vietnam | 2003 | 72 | x | x | HCMC |

| AJ Total | Korea | 2021 | 60 | Hung Yen | x | Tay Ninh, Dong Nai |

| Meito | Japan | 2014 | 56 | x | x | HCMC, Tay Ninh |

| Harano TNS | Korea | 2023 | 51 | Bac Ninh, Hai Phong | x | x |

| Gemadept | Vietnam | 2016 | 50 | x | x | Can Tho |

| ALS | Vietnam | 2017 | 45 | Ha Noi, Bac Ninh | x | x |

| ABA Cooltrans | Vietnam | 2016 | 40 | Ha Noi | x | Ho Chi Minh |

| Phan Duy Corporation | Vietnam | 2009 | 30 | x | x | Tay Ninh |

Source: B&Company

Vietnam’s cold-storage sector saw several standout moves in 2024–2025, underscoring rising demand from food, retail, and 3PL players.

– Korea’s LOTTE Global Logistics broke ground on a ~US$34 million cold-chain hub in Nhơn Trạch Industrial Park, Đồng Nai, on March 19, 2025, spanning ~5.5 ha and slated to start operations in May 2026.

– Japan’s Daiwa House Logistics Trust completed the acquisition of the built-to-suit “D Project Tan Duc 2” in Long An on July 5, 2024, for roughly US$19.9–20 million, backed by a 20-year long-term lease with a Japanese 3PL tenant.

– Nichirei TBA Logistics Vietnam inaugurated its Long Hậu (Long An) cold store on June 27, 2024, offering ~20,000 pallet positions across 10 rooms with a temperature range from −25 °C to 22 °C.

Together, these greenfield and M&A moves highlight deepening Japanese and Korean participation, the emergence of Long An and Dong Nai as logistics hot spots, and growing preference for built-to-suit assets anchored by long leases.

Cold Chain Infrastructure Challenges

Vietnam’s cold-chain is expanding fast, but exposing structural gaps that investors and operators must solve to win.

– Market Scarcity and Premium Pricing: Vietnam’s cold chain remains supply-constrained: capacity topped ~1 million pallet positions in 2023 and is forecast to exceed ~1.7 million by 2028, yet demand still outpaces supply. Unlike Thailand, where 40–50% of agricultural exports move through cold chains, Vietnam’s coverage is only ~20–25%, leaving high-value perishables (seafood, fruit) underserved and investment-ready. Scarcity has supported premium rates—about US$1.27 per pallet/day in 2024 versus US$0.94 in Indonesia—but a projected ~70% capacity build-out by 2028 will intensify competition, pushing operators to differentiate with value-added services (real-time monitoring, cross-docking, integrated processing).

– Improving Cold Storage for Agriculture and Seafood: Post-harvest losses remain the cold chain’s biggest pain point: poor handling and temperature control can waste ~25% of fruit and veg (up to 35–45% in worst cases) and cut seafood value by ~20%. The fix is investment in modern pre-cooling, storage, and first-mile control—where even a 10% loss reduction delivers outsized financial returns. To unlock premium exports, operators must pair infrastructure with compliance (HACCP, VietGAP) and end-to-end traceability (e.g., Agridential), which are now essential for US/EU/Japan buyers.

– Cold Storage Challenges in the Pharmaceutical Sector: Vietnam’s pharma cold chain demands specialized, certified infrastructure: strict temperature control for biologics and vaccines, validated systems, and full compliance with MoH’s GSP/GDP rules (Circular 36/2018/TT-BYT, Circular 05/2024/TT-BYT). Only certified facilities can handle these products, raising entry barriers. Logistics remain challenging—maintaining lane integrity and last-mile control in uneven infrastructure—while rising demand for temperature-sensitive drugs (aging population) heightens the need for modernization and investment to protect product integrity.

Strategic Investment Opportunities in Vietnam’s Cold Chain Sector

Vietnam’s cold chain logistics market is entering a high-growth phase, underpinned by strong demand from agriculture, seafood, and pharmaceuticals.

– Service: growth is moving beyond storage for agriculture and seafood to higher-value offerings: pharmaceutical logistics that meet Good Storage Practice and Good Distribution Practice, e-commerce fulfillment with controlled temperatures for picking and packing, and refrigerated transport that links pre-cooling at farms and factories to ports and intermodal depots.

– Region: the South (Binh Duong, Dong Nai, Long An, Ba Ria–Vung Tau, Can Tho) remains the main volume base thanks to deep-sea ports and border with Mekong Delta; the North (Hai Phong, Bac Ninh, Hung Yen) supports export manufacturing and pharmaceutical flows; and the Central corridor is rising, with Da Nang, Quang Nam, Thua Thien Hue, Khanh Hoa, and Binh Dinh offering shorter routes between North and South and new export gateways.

– Operating models: the fastest path is to partner with capable Vietnamese logistics companies to secure land, permits, and customers. Additionally, the facilities should be designed to adopt high technology, such as automated racking to maximize space, and warehouse and transport management systems linked to temperature and humidity sensors. This approach reduces operating costs, raises throughput, and meets the documentation and traceability standards required by buyers in the United States, the European Union, and Japan.

Conclusion

Vietnam’s cold chain sector represents a high-yield investment opportunity, underpinned by a scarcity of capacity, growing demand, and increasing compliance standards. Investors who focus on specialized, integrated solutions that combine compliance, technology, and energy efficiency will secure long-term returns. With its growing agricultural and pharmaceutical industries, Vietnam is poised to become a regional hub for cold chain logistics, offering a premium pricing model and significant growth potential through the end of the decade. Strategic investments in this sector can provide robust returns, especially for those who move quickly to capture early-stage opportunities in this dynamic market.

[1] https://fiingroup.vn/NewsInsights/Detail/11065024

[2] https://www.trade.gov/market-intelligence/vietnam-pharmaceutical-industry-updates

[3] https://www.trade.gov/country-commercial-guides/vietnam-healthcare

[4] https://www.kenresearch.com/vietnam-cold-chain-for-pharmaceuticals-market

[5] https://english.luatvietnam.vn/circular-no-36-2018-tt-byt-dated-november-22-2018-of-the-ministry-of-health-on-good-storage-practices-for-medicinal-products-and-medicinal-materials-169783-doc1.html

* If you wish to quote any information from this article, please kindly cite the source along with the link to the original article to respect copyright.

| B&Company

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |