05Aug2025

Latest News & Report / Vietnam Briefing

Comments: No Comments.

Vietnam’s Carbon Market Potential: Scale and Financial Outlook

Vietnam has strong potential to develop a carbon market, supported by favorable natural conditions and carbon-generating sectors like forestry and agriculture. The country could generate around 57 million carbon credits [1]. At a modest price of USD 5 per credit, this translates to 300 million USD in revenue; if prices rise to USD 10–20, annual earnings could reach 400 million USD to 1 billion USD.

Vietnam has already demonstrated its capability. In March 2024, it sold 10.3 million forest carbon credits to the World Bank’s FCPF for 51.5 million USD [2]. By the end of 2023, over 300 projects had been registered under international standards (CDM, VCS, Gold Standard), with 150 projects issuing a total of 40.2 million credits—many traded globally [3].

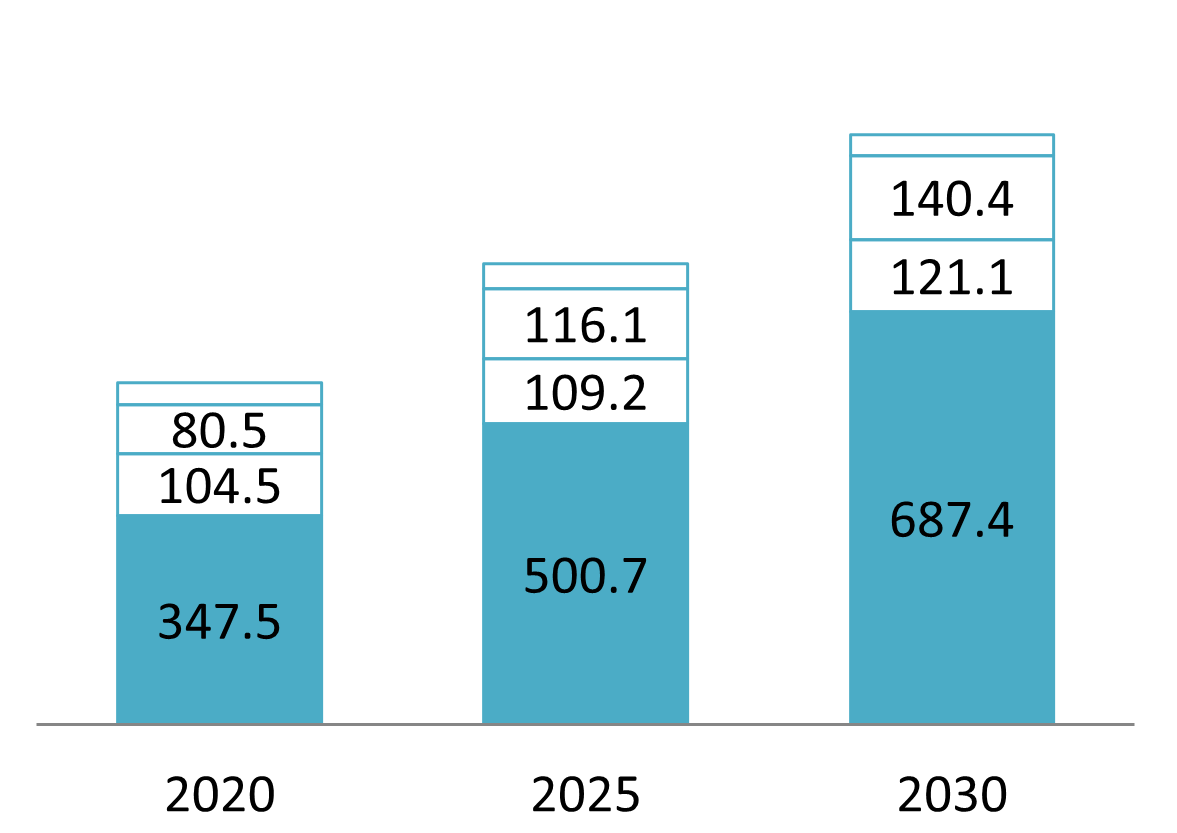

Vietnam carbon credit resource

Unit: Million tons of CO₂

Source: Financial Investment Section – Sài Gòn Giải Phóng Newspaper

In the agriculture sector, although it is a significant source of emissions, it also holds the potential to generate up to 57 million carbon credits annually [5]. Key initiatives include alternate wetting and drying (AWD) techniques in rice cultivation, organic farming, biogas systems, and fertilizer optimization. A notable boost is the USD 120 million USD low-emission rice farming program in the Mekong Delta, funded by the World Bank [6].

The energy and waste management sectors also provide additional sources of carbon credits. While wind and solar projects tend to generate lower-value credits due to market saturation, higher returns can be achieved through biomass power, methane recovery from landfills, and waste-to-energy technologies. Success stories include the Bac Lieu wind power plant and wastewater treatment projects in Tay Ninh [7, 8].

Beyond emission reductions in conventional sectors, Vietnam also benefits from natural carbon from forestry and blue carbon. Forestry is considered a potential “green gold mine.” With 14.9 million hectares of forest, the sector could generate 50–70 million credits through REDD+ initiatives, reforestation, and sustainable forest management [9]. Blue carbon is an emerging frontier. With 1 million km² of sea territory and rich coastal ecosystems—mangroves, seagrass beds, and wetlands—Vietnam holds strong potential to produce high-value credits while delivering co-benefits such as biodiversity conservation, coastal protection, and support for local livelihoods.

Carbon Credits: From Compliance Cost to Strategic Asset

Carbon credits are evolving from a compliance tool into a strategic asset in the context of sustainable development. Defined under Vietnam’s 2020 Law on Environmental Protection, a carbon credit represents the right to emit one ton of CO₂ or equivalent and can be traded under a “cap-and-trade” system, where the government sets emission limits and allocates allowances to businesses [10]. Companies emitting below their cap can sell surplus credits to those exceeding their limit, creating a carbon market.

This mechanism not only ensures regulatory compliance but also unlocks revenue opportunities. For high-emission businesses, buying credits is a necessary expense—but also a push toward cleaner technologies. Meanwhile, companies that actively reduce emissions or develop projects such as reforestation or renewable energy can sell excess credits, turning them into stable income and financial assets. In some cases, credits may even be used as collateral to access green finance.

Beyond financial value, carbon market participation strengthens brand image and ESG performance—critical in attracting responsible investment. With growing investor focus on sustainability, a strong carbon profile enhances access to capital. In Vietnam, private sector actors have already taken the lead. For instance, CT Group launched the ASEAN Carbon Credit Trading Platform (CCTPA) ahead of the government-run exchange, signaling strategic foresight and early preparation for a low-carbon economy [11].

Decoding the Legal Framework – The “Rules of the Game” in Vietnam’s Carbon Credit Market

Three Foundational Legal Pillars

Vietnam’s carbon credit market is built on three key legal instruments that form a comprehensive framework from policy orientation to implementation:

– Law on Environmental Protection 2020 (effective from January 1, 2022): This law officially introduced the concept of a domestic carbon market for the first time and provided a legal definition of carbon credits [10]. It lays the groundwork for using economic instruments to manage emissions and respond to climate change.

– Decree No. 06/2022/ND-CP: This decree implements the Law on Environmental Protection and outlines a two-phase roadmap for developing the carbon market (before and after 2028) [12]. It also defines GHG inventory responsibilities, carbon offset mechanisms, and reporting methods.

– Decision No. 13/2024/QD-TTg: This decision updates the list of facilities subject to mandatory GHG inventories, expanding the scope to 2,166 facilities [13]. This list serves as the foundation for future allocation of emissions quotas.

Decree No. 119/2025/ND-CP: A Game-Changer for Market Activation

Issued on June 9, 2025, and effective from August 1, 2025, Decree 119/2025 marks a critical milestone in officially launching Vietnam’s carbon market [14]. It amends and supplements key provisions in Decree 06 to improve feasibility and reflect the government’s adaptive approach. The carbon market will be implemented in two phases:

– Pilot Phase (Aug 2025 – Dec 2028): Focuses on developing detailed regulations, establishing the national carbon registry system, and piloting a carbon credit exchange. During this phase, international trading of credits will be restricted to prioritize domestic supply and ensure alignment with Vietnam’s Nationally Determined Contributions (NDCs).

– Operational Phase (From 2029): The market will enter full-scale operation with emissions quota auctions and international credit trading, enhancing market competitiveness and attracting global climate finance.

A notable improvement is the increased carbon offset allowance, from 10% to 30% of emissions above allocated limits. This adjustment offers more flexibility for businesses and boosts market liquidity during the early stages.

Compliance Roadmap for Businesses

With the legal foundation in place, businesses—especially those on the mandatory list—must be proactive in meeting key compliance obligations:

– GHG Inventory: The 2,166 facilities identified under Decision 13/2024 must complete their 2024 emissions inventories and submit reports by March 31, 2025. Reporting will continue every two years.

– MRV System (Measurement – Reporting – Verification): Enterprises must establish a reliable MRV system aligned with national technical guidance and standards such as TCVN ISO 14064-1:2011. GHG inventories must be verified by a certified third party before submission to authorities.

Key Milestones in Vietnam’s Carbon Credit Market (2024–2030)

| Timeline | Key Activities | Legal Basis | Affected Stakeholders |

| 2024 | First GHG inventory | Decision 13/2024/QD-TTg | 2,166 regulated facilities |

| By Mar 31, 2025 | Submission deadline for 2024 GHG inventory | Decree 06/2022/ND-CP | 2,166 regulated facilities |

| Aug 1, 2025 | Decree 119/2025 comes into effect | Decree 119/2025/ND-CP | All carbon market stakeholders |

| End of 2025 | Pilot carbon credit exchange begins | National Carbon Market Plan | Businesses, investors, institutions |

| 2025–2028 | Nationwide pilot phase (no international trading) | Decree 119/2025/ND-CP | Domestic actors |

| From 2029 | Full operation, quota auctions, global connectivity | Decree 119/2025, Law on Environment | The entire economy, international investors |

Outlook: A Historic Opportunity for Net Zero Leadership

Vietnam stands at a pivotal moment. With a rapidly evolving legal framework, abundant and diverse natural potential, and strong international support, the country is well-positioned to build a transparent, dynamic, and efficient carbon market. If implemented effectively, Vietnam can not only achieve its Net Zero 2050 target but also emerge as a regional hub for high-quality carbon credits. This positions the country to transform climate challenges into a new engine for green growth and long-term prosperity.

[1] Vietnamnet, What is the price of Vietnam’s 57 million forest carbon credits? <Access>

[2] World Bank, Viet Nam Receives $51.5m World Bank Payment for Reducing Emissions Through Forest Preservation <Access>

[3] Department of Climate Change, Be cautious when selling carbon credits <Access>

[4] Sài Gòn Giải Phóng Newspaper, Goods and trading parties are ready for the carbon credit market <Access>

[5] Packaging Recycling Organization Vietnam, Selling Carbon Credits: Great Potential in the Agriculture Sector <Access>

[6] VnEconomy, The one-million-hectare high-quality rice project will receive $120 million in support from the World Bank. <Access>

[7] Báo Kinh tế Đô thị, Bac Lieu Wind Power earns 1.8 million EUR from selling carbon credits <Access>

[8] Carbon Market News, 10 Vietnamese projects have successfully sold carbon credits to international markets <Access>

[9] Nhan Dan, Promoting the establishment of a carbon credit trading exchange <Access>

[10] The National Assembly, Vietnam’s 2020 Law on Environmental Protection <Access>

[11] ASEAN Carbon Credit, Vietnam launches its first carbon credit trading exchange <Access>

[12] Decree No. 06/2022/NĐ-CP by the Government, Regulations on greenhouse gas emission reduction and ozone layer protection <Access>

[13] Decision No. 13/2024/QĐ-TTg by the Prime Minister: Issuing the updated list of sectors and facilities required to conduct greenhouse gas inventories <Access>

[14] Decree No. 119/2025/NĐ-CP by the Government: Amending and supplementing several articles of Decree No. 06/2022/NĐ-CP dated January 7, 2022, on greenhouse gas emission reduction and ozone layer protection <Access>

* If you wish to quote any information from this article, please kindly cite the source along with the link to the original article to respect copyright.

| B&Company

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |