27Oct2025

Latest News & Report / Vietnam Briefing

Comments: No Comments.

The electric vehicle (EV) market in Vietnam is set to boom in the 2024-2025 period, with strong growth rates in the Southeast Asian region. This impressive growth is the result of the Government’s green vehicle promotion strategy, combined with the efforts of leading domestic enterprises such as VinFast. This article provides an overview of the market size, key trends, market leaders as well as opportunities and challenges for foreign investors in the Vietnamese electric vehicle sector.

Market Overview

Vietnam is emerging as a potential electric vehicle market thanks to soaring demand and strong support policies. According to Mordor Intelligence, the size of the Vietnamese electric vehicle market is estimated to reach 3.12 billion USD in 2025 and 7.4 billion USD in 2030, with a high CAGR of 18.9%[1].

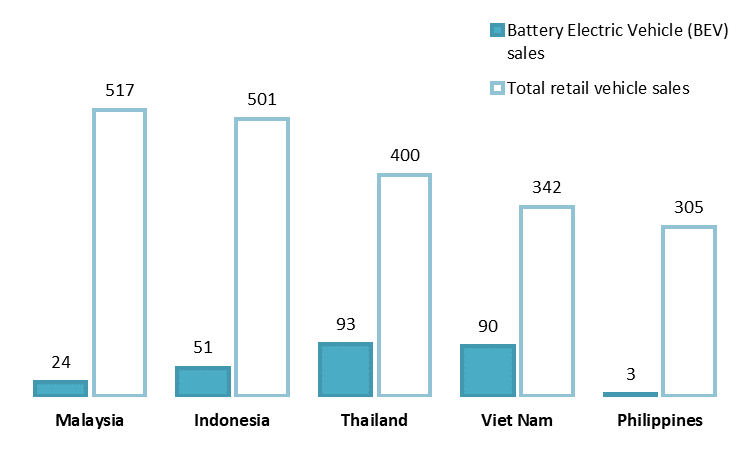

Car sales in the 5 largest markets in Southeast Asia in the first 8 months of 2025

Unit: Thousand cars

Source: Vnexpress

After the first 8 months of 2025, in terms of battery electric vehicles (BEV), Vietnam currently ranks second in Southeast Asia, just behind Thailand. In terms of penetration rate, Vietnam is the highest in the group (~26.3%), surpassing Thailand (~23.2%), Indonesia (~10.2%), Malaysia (~4.5%) and the Philippines (~1.1%). This shows that BEV is taking an increasingly large position in the automobile retail structure in Vietnam compared to other countries in the region.

In addition, the Government’s support has contributed significantly to promoting the market. According to Decree No. 10/2022/ND-CP of the Government, from March 2022, battery-powered electric cars will be completely exempt from registration fees for the first 3 years, then only 50% compared to gasoline cars until 2027. The special consumption tax for electric cars has also been sharply reduced to 3% (applied until February 28, 2027) compared to the previous level of 15%[2]. By cutting down on initial costs, the biggest barrier for buyers is removed, creating a big push to encourage people to switch to green cars. In addition, the Government has set an ambitious target: by 2030, to build at least 150,000 public charging stations. These are positive signals showing the determination to develop infrastructure and a sustainable electric vehicle market.

Market Trends

– Exploding demand and green transition: Vietnam is witnessing a major change in consumer habits as people are increasingly interested in environmentally friendly vehicles. Not only individual customers but also taxi and transport companies are joining the electric vehicle trend. In particular, Green SM has been the pioneer in introducing electric taxis nationwide, setting the foundation for the electrification of public transportation services in Vietnam[3]. Alongside this, VinBus — a subsidiary of Vingroup — has launched Vietnam’s first electric bus network, currently operating in major cities such as Hanoi, Ho Chi Minh City, and Phu Quoc[4]. The Government has issued Decision 876 requiring 100% of road motor vehicles to switch to electric or clean energy by 2050[5].

– Domestic enterprises lead: VinFast has emerged as the “locomotive” of the Vietnamese electric vehicle wave. The company has built a comprehensive ecosystem from a network of more than 150,000 charging ports across the country, to the Green SM electric taxi service, to promote use[6]. Thanks to its flexible pricing strategy and diverse product line from popular to high-end, VinFast has quickly expanded its domestic electric vehicle market share to 17.6% of the overall automobile market in 2024 – a leap after only 3 years of completely switching to electric vehicles.

– Wave of foreign car companies entering the market: Given the market potential, many foreign car companies have been entering Vietnam with large investment plans. BYD – the world’s largest EV manufacturer – will start selling electric car models from July 2024 and is surveying the construction of an assembly plant in Phu Tho. Low-cost Chinese brands are also appearing in droves: MG (SAIC), Chery, Wuling in joint venture with TMT[7]. The group of affordable electric cars from China is creating significant price competition pressure on VinFast and other brands. In the high-end segment, German brands such as Mercedes-Benz, BMW, Audi, Porsche or American company Tesla have also introduced electric cars in Vietnam from 2022-2023.

– Charging infrastructure and policies continue to improve: Authorities in major cities such as Hanoi, Da Nang, and Ho Chi Minh City are supporting businesses in developing charging stations through free land rental and charging point planning. The government also requires the early issuance of common technical standards for batteries and charging stations nationwide to ensure uniformity[8].

The Green SM taxi fleet, with its distinctive Cyan color, was ready to serve Ho Chi Minh City residents from April 30, 2023

Source: CongAnNhanDan

VinFast charging station system is present in all provinces and cities of Vietnam

Source: Vinfast

Main players in the Vietnam EV market

| No | Car Brand | Country | Market Share & Unit Sold | Short description | Website |

| 1 | VinFast | Vietnam | ~70% market share (Q1/2025)

87,000 vehicles (2024) |

Absolute leader in the domestic market

Comprehensive ecosystem: diverse product segments 150,000+ charging points. |

https://vinfastauto.com/vn_en |

| 2 | BYD | China | ~5% market share (rough estimate) | The world’s largest EV company

Entering the Vietnamese market from 2024 with Atto 3, Dolphin, Seal Planning to build a factory in Vietnam (Phu Tho) for long-term investment. |

https://www.byd.com/vn

|

| 3 | Wuling (TMT) | China | ~1.5% market share

1,358 vehicles (2024) |

Assembling the cheapest mini EV model in the market (VND 250-300 million)

Serving both individual customers and low-cost taxis Expecting to launch new models (Bingo, Hongguang EV…) in 2025. |

https://wuling-ev.vn/

|

| 4 | MG (SAIC) | China | ~1% market share (rough estimate) | Launching mid-range EV models (ZS EV, MG4…) from 2023

Familiar brand advantage (MG UK, part of SAIC) Focusing on the small urban car segment, competitive price with VinFast VF e34. |

https://mgmotor.vn/home/

|

| 5 | Chery (Omoda) | China | ~0.5% market share (rough estimate) | Re-entering the Vietnamese market in late 2023

Expected to launch electric vehicle models under the Omoda and Jaecoo brands in 2024 Emphasizing modern design and affordable prices to rebuild brand recognition in Vietnam. |

https://jaecoovn.com/

|

| 6 | Tesla | The USA | <0.5% market share

several dozen vehicles |

No official dealer, Tesla cars enter Vietnam through private imports

Mainly Model 3, Model Y models serve technology lovers and high income earners Symbolic presence, very small market share. |

https://www.tesla.com/

|

| 7 | Hyundai (TC Motor) | Korea | <1% market share (rough estimate) | Ioniq 5 prototype to be tested domestically from 2023

Promoting EV supply chain in Vietnam Expecting to introduce more electric vehicles (Kona EV, Ioniq 6…) to diversify the green product portfolio. |

https://hyundai.thanhcong.vn/

|

| 8 | Mercedes-Benz | Germany | <0.5% market share

several dozen vehicles |

Selling EQS, EQB, EQE car lines in Vietnam from 2022

Emphasizing technology and brand class Customer base limited to the luxury segment. |

https://www.mercedes-benz.com.vn/

|

| 9 | BMW | Germany | <0.5% market share

several dozen vehicles |

Introducing BMW iX3, i4, i7 models from late 2023

Focus on high-end customers who love new experiences Low sales volume, mainly present to position the EV brand. |

https://www.bmw.vn/vi

|

| 10 | Audi | Germany | <0.5% market share

several dozen vehicles

|

Distributing Audi e-tron GT, e-tron SUV… through authorized dealers

Building a luxury EV brand in Vietnam Sales are insignificant, directly competing with Mercedes EQ and BMW i-series. |

https://www.audi.vn/en/

|

Source: B&Company’s synthesis

VinFast currently dominates Vietnam’s EV market—thanks to its home-field advantage, it leads in infrastructure, distribution, and consumer trust—while foreign brands remain small; even the top outsider, Wuling, held only ~1.5% in 2024.

That said, the landscape may shift: BYD plans local production and pushes tech-led, aggressive pricing, and other Chinese brands (MG, Chery, Wuling) aim to launch more models in 2025, boosting the small-EV segment. Hyundai leverages its existing assembly base to add EVs, while Tesla, Mercedes, BMW, and Audi maintain a foothold ahead of premium demand.

Overall, competition should intensify, benefiting consumers (more choice, better prices) and pushing domestic brands to keep innovating on quality.

Implications for foreign investors

Opportunities: Vietnam actively courts foreign EV investment with a supportive legal framework and incentives: corporate income tax breaks (preferential rates and holidays), import duty exemptions on equipment/components, and land-rent reductions based on project scale/location. The government also waives registration fees for EVs through February 2027 and applies a 3% special consumption tax (vs. 35–50% for gasoline cars), lowering prices and boosting demand. With nearly 100 million people and a 2040 target to phase out fossil-fuel vehicles, Vietnam is a fast-growing market with ample room for EV manufacturers, component suppliers, charging infrastructure, and related services[9].

Challenges: fierce competition from domestic players—VinFast, backed by Vingroup and deep local insight, currently dominates the market, forcing rivals to invest heavily and stay patient to win share. Fragmented infrastructure: the EV charging network remains sparse relative to demand, fueling user concerns about driving range. Supply chain and cost barriers: EV components imported from China and South Korea do not enjoy the 0% preferential tariffs granted to ASEAN-origin parts, making local assembly costs less competitive[10] .

Strategic implications:

– Form joint ventures or partnerships with local players: to leverage market know-how and existing networks, reducing market-entry risk.

– Invest in components, batteries, and charging stations: areas still under-supplied and encouraged by the government—capturing tax incentives while building a long-term supporting ecosystem for EVs.

– Position products appropriately: Vietnam’s market spans from mass to premium; choose segments aligned with your comparative advantages.

– Proactively develop infrastructure and services: including supporting public charging rollout, offering battery leasing/swapping, and providing technology solutions (e.g., charging management and payments) to create added value for customers.

* If you wish to quote any information from this article, please kindly cite the source along with the link to the original article to respect copyright.

| B&Company

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |

[1] https://www.mordorintelligence.com/industry-reports/vietnam-electric-vehicle-market

[2] https://vanban.chinhphu.vn/?pageid=27160&docid=205090

[3] https://vingroup.net/en/news/detail/2771/gsm-officially-launches-vietnams-first-pure-electric-taxi-firm

[4] https://vinbus.vn/en/vinbus-initiates-zero-emission-public-transport-in-vietnam

[5] https://luatvietnam.vn/tai-nguyen/quyet-dinh-876-qd-ttg-226589-d1.html

[7] https://vneconomy.vn/automotive/buc-tranh-thi-truong-xe-dien-viet-nam-2025.htm