08Apr2025

Latest News & Report / Vietnam Briefing

Comments: No Comments.

The carbonated soft drink (CSD) market in Vietnam is undergoing a transformation as shifting consumer preferences, health awareness, and digital engagement reshape how brands approach the market. While carbonated beverages have long been a popular refreshment among Vietnamese consumers, especially the younger generation, recent trends reveal both challenges and opportunities for future growth.

Market Overview of Carbonated Soft Drink

In 2025, the carbonated soft drink ( CSD ) segment is expected to generate approximately US$1.88 billion, accounting for around 21% of the total soft drink market, with a projected CAGR of 4.27% from 2025 to 2029 [1].This makes Vietnam one of the more dynamic CSD markets in Southeast Asia. Urbanization, rising middle-class incomes, and youthful demographics (with over 50% of the population under 35) continue to drive demand for ready-to-drink beverages.

Carbonated soft drink in a supermarket in Hanoi

Source: VnExpress

Consumer Preference for Carbonated Soft Drink

Consumer preferences for carbonated soft drinks in Vietnam are shaped by a mix of traditional tastes, health consciousness, and brand influence.

Young consumers, who make up a large portion of the market, are increasingly drawn to low-sugar or sugar-free variants, sparkling fruit-flavored beverages, and drinks with added functional benefits. Additionally, Vietnamese consumers are becoming more selective, often favoring brands that emphasize natural ingredients, sustainable packaging, and local identity.

For usage behavior, according to a survey in 2023 by Coc Coc on over 1600 respondents [2], the 25-29 age group has the strongest consumption, with the most common usage being 2-3 times/week. For the sale channel, offline channels continue to dominate Vietnam’s carbonated soft drink (CSD) market despite the growing presence of e-commerce. Traditional grocery stores remain the most common point of sale, with 67% of consumers regularly purchasing CSDs there. Convenience stores are also gaining popularity, preferred by 48% of respondents, reflecting the increasing role of modern retail. Other important offline locations, such as supermarkets, restaurants, and local markets, remain essential in everyday shopping habits.

When choosing carbonated soft drinks, Vietnamese consumers place the greatest emphasis on factors such as brand reputation, packaging, personal preferences, and product ingredients, with 66% of respondents citing these as key considerations. Price also plays a significant role in purchasing decisions, highlighting the importance of both quality and affordability in consumer choices.

Carbonated Soft Drink Main Player in Vietnam

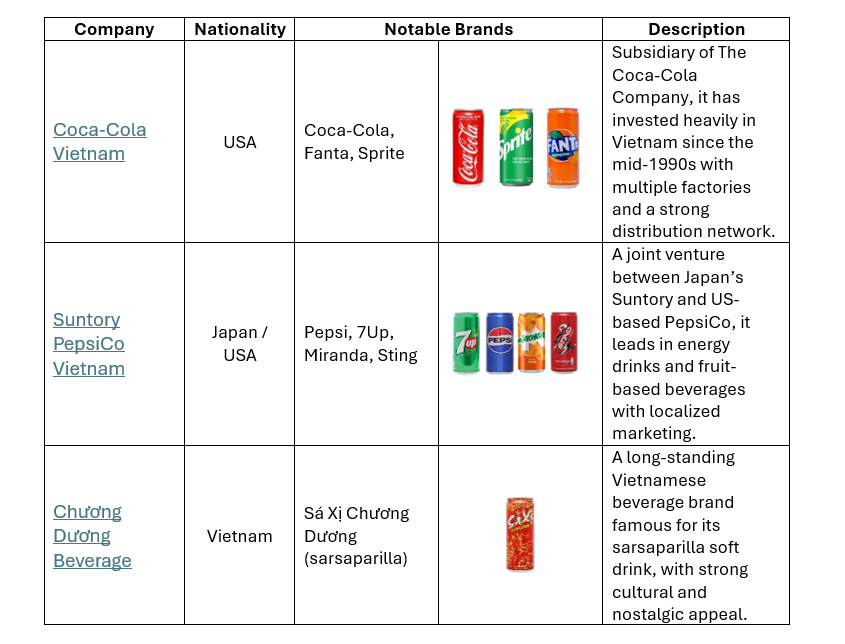

Vietnam’s CSD market has traditionally been dominated by global players such as Coca-Cola and PepsiCo, which have successfully localized their marketing strategies and maintained strong distribution networks. Local brands like Chuong Duong also hold niche appeal, particularly in regional markets or among price-sensitive consumers. Despite occasional disruptions caused by economic downturns and pandemic restrictions, the market has demonstrated resilience.

Carbonated Soft Drink Major Companies

Source: B&Company synthesis

In response to growing concerns over sugar-related health issues, the government has proposed measures like a special consumption tax on sugary drinks. Although the policy is still under review, its potential implementation could affect retail pricing and consumer demand. This has encouraged beverage companies to diversify their portfolios with low-calorie, sugar-free, and functional beverages to better align with shifting consumer preferences. For example, major brands like Coca-Cola and Pepsi have also launched healthier options like Coca-Cola Zero Sugar or Pepsi Zero Calories.

Meanwhile, consumer environmental awareness is prompting brands to adopt eco-friendly packaging solutions, such as PET recycling initiatives and low-carbon aluminum cans. These sustainability efforts resonate strongly with younger consumers and are increasingly trending in product development and brand positioning.

Conclusion

The future of Vietnam’s carbonated soft drink (CSD) market looks positive, although it will undergo some changes. As health concerns increase and the government considers a sugar tax, the growth of traditional sugary drinks may slow. However, the market is not expected to decline. Instead, there will likely be a growing demand for healthier and low-sugar options, driven by changing consumer preferences.

Consumers, especially younger demographics, are showing strong interest in healthier CSD alternatives—such as low-calorie, sugar-free, and functional sparkling beverages infused with vitamins or natural ingredients. This shift creates opportunities for brands to innovate and expand their product portfolios.

[1] https://www.statista.com/outlook/cmo/non-alcoholic-drinks/soft-drinks/carbonated-soft-drinks/vietnam

[2] https://qc.coccoc.com/vn/news/bao-cao-thi-truong-nganh-nuoc-ngot-co-ga

* If you wish to quote any information from this article, please kindly cite the source along with the link to the original article to respect copyright.

| B&Company

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |