08Apr2025

Latest News & Report / Vietnam Briefing

Comments: No Comments.

Bilateral trade between Vietnam and Japan has shown strong momentum in recent years. As Vietnam strengthens its manufacturing and export capabilities, Japan remains both a strategic partner and a demanding market. This article highlights Vietnam’s trade performance with Japan in 2024, key product categories, and the opportunities and challenges that lie ahead for Japanese companies that are expanding their business into Vietnam market.

Export and import situation between Vietnam and Japan

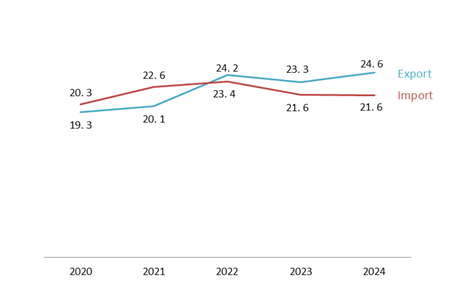

Vietnam’s export-import turnover (2020-2024)

Unit: Billion USD

Source: B&Company synthesis from GSO

Despite a temporary decline in Vietnam–Japan trade turnover in 2023, the overall trend from 2020 to 2024 remained upward. Notably, Vietnam recorded a trade surplus with Japan for three consecutive years (2022–2024), underscoring Japan’s continued role as a promising export market for Vietnamese businesses.

In 2024 alone, total bilateral trade between Vietnam and Japan reached 46.20 billion USD, marking an increase of 2.77% compared to 2023[1]. Vietnam enjoyed a trade surplus of 1.23 billion USD[2]. According to statistics from Japan Customs, Japan’s imports from Vietnam grew at a higher rate than its overall import growth from global markets. On the other hand, Vietnam is currently Japan’s 8th largest import partner[3].

Main products and growth trends of trading categories

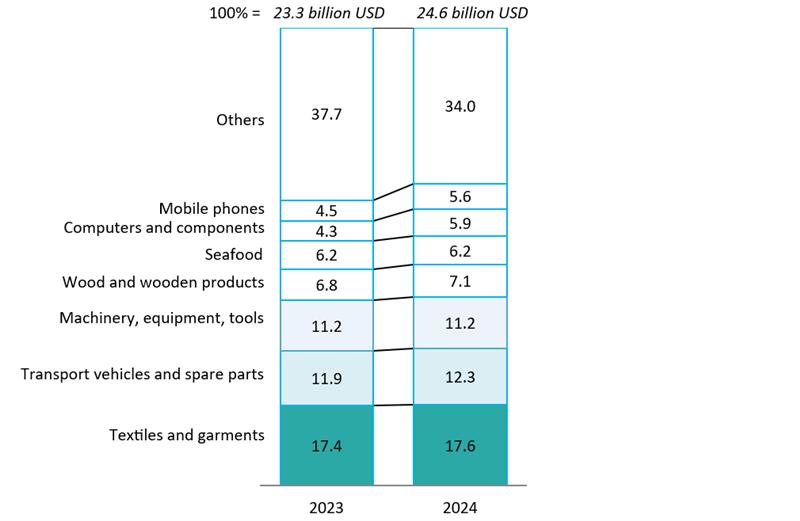

Vietnam’s export turnover to Japan by products (2023 – 2024) (%)

Source: B&Company synthesis from GSO

Notably, Vietnam’s key export items to Japan including textiles and garments, wood and wooden products, seafood, transport vehicles and spare parts, machinery and equipment, computers, electronic products and components, mobile phones, footwear, all recorded growth in export turnover in 2024, ranging from 0.65% to 37.65% compared to 2023[4]. Among those, textiles and garments accounted for the largest share, reaching approximately 17.6%. Notably, 4 out of the top 8 export items were electronics-related products such as transport vehicles and parts, machinery, computers, and phones. Seafood was the only agricultural product in the top 8, representing 6.2%. Export turnover of several other agricultural and food products in 2024 also witnessed strong growth compared to 2023, such as coffee (up 30.74%), fruits and vegetables (up 15.39%), and confectionery and cereal-based products (up 26.81%)[5].

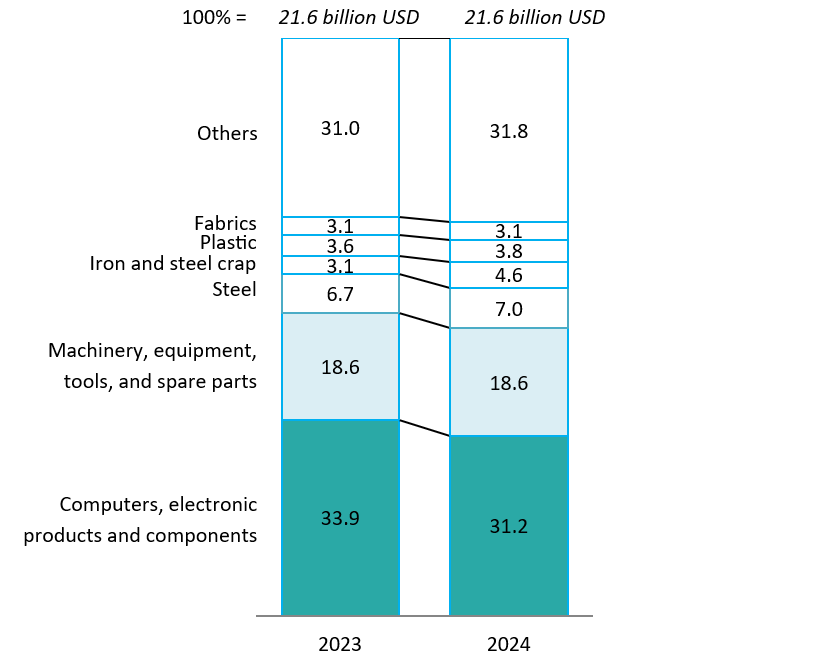

Vietnam’s import turnover from Japan by products (2023 – 2024) (%)

Source: B&Company synthesis from GSO

Regarding import turnover, electronics and steel remained the top import categories, underscoring Japan’s industrial export strength[6]. In 2024, Vietnam’s imports from Japan totaled 21.6 billion USD, representing a slight decline of 0.2% compared to 2023[7]. Notably, some key sectors saw a downturn, including computers, electronic products, and components, which fell by 8.4% compared to 2023. Machinery, equipment, tools, and spare parts also experienced a slight drop of 0.1%[8].

Opportunities and threats for Japanese companies expanding into the Vietnam market

Over the past three decades, Vietnam and Japan have developed a strong bilateral trade relationship, supported by the active efforts of both governments in promoting trade liberalization. The two countries are currently connected through four free trade agreements (VJEPA, AJCEP, CPTPP, and RCEP[9]), which have significantly lowered market entry barriers and paved the way for long-term economic collaboration. These agreements not only benefit Vietnamese exporters but also present considerable opportunities for Japanese companies looking to expand into Vietnam.

Moreover, Vietnam and Japan have economies that complement each other with minimal direct competition in their export-import structures. Vietnam primarily exports goods to Japan from key sectors such as aquaculture (e.g. seafood), energy and raw materials (e.g. crude oil, coal), light industry (including textiles, footwear, wooden products, and electric cables), and electronics (notably computers and components). In return, Vietnam imports from Japan mainly industrial production inputs, including machinery and equipment, electronic components, various types of steel and fabrics, automotive parts, raw materials for textiles and footwear, plastics, chemicals, and metals. This synergy presents opportunities for Japanese firms to introduce their products and technologies into a receptive Vietnamese market.

However, Japanese exporters must overcome several challenges to access the Vietnamese market. These include Japan’s strict fierce competition from other international companies and the legal adapting process.

Japanese companies will have to face severe competition from other foreign investors. In recent years, Vietnam has consistently been regarded as a preferred destination for foreign investors. According to the Ministry of Planning and Investment, in 2023, the country attracted 36.61 billion USD in FDI, marking a 32% increase compared to 2022 and the third-highest level in the past 15 years[10]. Disbursed capital also reached a record high of approximately 23.18 billion USD[11].

Adapting to the legal environment remains one of the major challenges for investors seeking opportunities in Vietnam. In a survey conducted by JETRO[12] with Japanese enterprises investing in the Asia-Pacific region, 56% of Japanese companies expressed their intention to expand business operations in Vietnam within the next 1–2 years[13]. However, many remain hesitant, and one of the main reasons is the barrier posed by administrative and legal procedures. Notably, 62% of the surveyed companies stated that obtaining licenses and completing administrative procedures in Vietnam is very complicated[14].

Conclusion

Overall, the trade relationship between Vietnam and Japan offers significant opportunities regarding the complementary economic structures of two countries and favorable conditions for bilateral cooperation created by multiple FTAs. However, Japanese companies must remain aware of challenges such as fierce competition and complex legal procedures while looking to expand into the Vietnam market.

[1] VnEconomy. Vietnam’s exports to Japan still have significant room for growth” <Access>

[2] VnEconomy. Vietnam’s exports to Japan still have significant room for growth” <Access>

[3] VnEconomy. Vietnam’s exports to Japan still have significant room for growth” <Access>

[4] VnEconomy. Vietnam’s exports to Japan still have significant room for growth” <Access>

[5] VTV.vn. Vietnam exports nearly 25 billion USD worth of goods to Japan <Access>

[6] VTV.vn. Vietnam exports nearly 25 billion USD worth of goods to Japan <Access>

[7] VTV.vn. Vietnam exports nearly 25 billion USD worth of goods to Japan <Access>

[8] VTV.vn. Vietnam exports nearly 25 billion USD worth of goods to Japan <Access>

[9] VJEPA – Vietnam–Japan Economic Partnership Agreement, AJCEP – ASEAN–Japan Comprehensive Economic Partnership, CPTPP – Comprehensive and Progressive Agreement for Trans-Pacific Partnership, RCEP – Regional Comprehensive Economic Partnership

[10] Vietnam Federation of Commerce and Industry. Vietnam’s potential and opportunities to attract foreign investment <Access>

[11] Vietnam Federation of Commerce and Industry. Vietnam’s potential and opportunities to attract foreign investment <Access>

[12] Japan External Trade Organization

[13] Znews. Japanese businesses hesitate to invest in Vietnam due to complicated procedures <Access>

[14] Znews. Japanese businesses hesitate to invest in Vietnam due to complicated procedures <Access>

* If you wish to quote any information from this article, please kindly cite the source along with the link to the original article to respect copyright.

| B&Company

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |