01Dec2025

Highlight content / Highlight Content JP / Highlight content vi / Industry Reviews / Latest News & Report

Comments: No Comments.

Vietnam’s logistics industry plays a vital role in facilitating trade, supporting industrial production, and driving economic growth. With its strategic location and expanding infrastructure, the sector has achieved strong momentum in recent years. However, challenges such as high logistics costs, infrastructure overload, and limited digital transformation still constrain efficiency. These issues, nevertheless, create significant opportunities for foreign investors to enter the market—particularly in multimodal transport, smart warehousing, and cold chain logistics—with the right strategies and local partnerships.

Vietnam’s Logistics Market Potential

Vietnam’s logistics market is expanding rapidly. With the double-digit growth of the logistics service industry over the past years and contributing about 5.17% of Vietnam’s GDP by 2024, logistics is becoming one of the most dynamic service industries in the economy[1].

At the same time, Vietnam’s Logistics Performance Index (LPI) ranked 43rd out of 139 countries in 2023, up 21 places from 2016 — positioning the country among the leading emerging logistics markets[2].

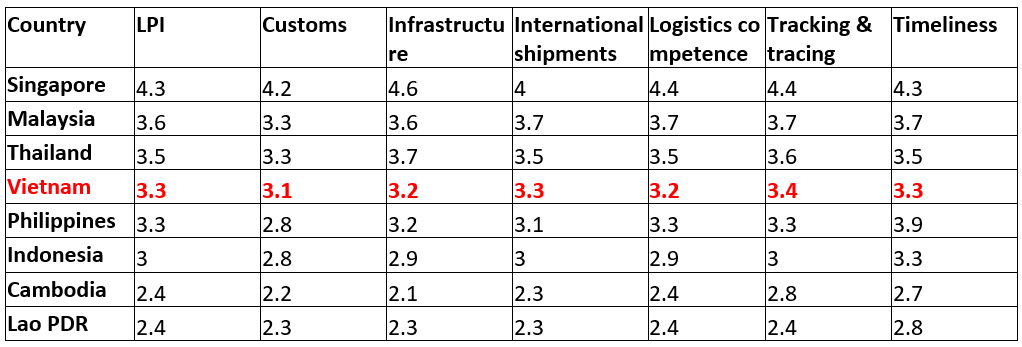

Table: Logistics Performance Index (LPI) 2023 of Vietnam and some ASEAN countries

Source: World Bank

According to the above table, component indicators such as Tracking & tracing (3.4) and Timeliness (3.3) are relatively high, reflecting progress in the ability to track goods and ensure delivery time. However, aspects such as Customs (3.1) and Infrastructure (3.2) are still lower than the leading countries in the region, showing great room for Vietnam to continue improving infrastructure and customs procedures to improve overall logistics efficiency.

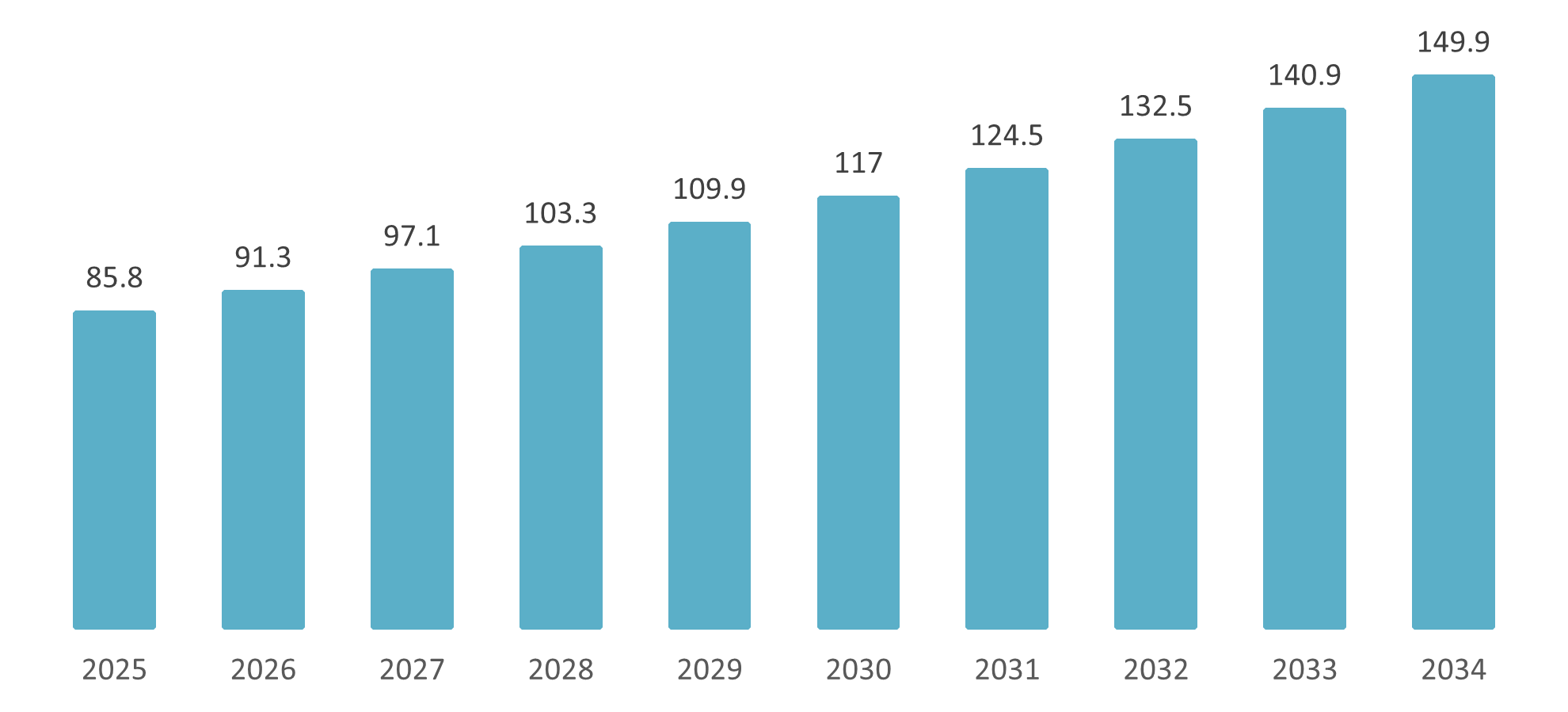

According to the Vietnam Logistics Market Size & Share Report 2025–2034 by Expert Market Research, the market is projected to grow at a CAGR of 6.4% during 2025–2034, reaching approximately USD 85.8 billion by 2025.

Vietnam Logistics Market Forecast (2025–2034)

Unit: Billion USD

Source: Vietnam Logistics Market Size & Share Report 2025–2034, Expert Market Research

The boom of e-commerce has become a key driver of logistics demand in Vietnam. Over the past several years, the e-commerce sector has consistently maintained an annual growth rate of 16–30%, sustaining strong double-digit expansion[3]. Notably, according to the Vietnam E-commerce Market Forecast 2025–2030, the country’s e-commerce market is projected to reach USD 27.73 billion in 2025, growing at a CAGR of 21.65%, and could expand further to USD 62.51 billion by 2030.

The rapid development of e-commerce has created strong demand for logistics services, particularly in transportation and warehousing.

Transport and warehousing infrastructure: Vietnam is investing heavily in infrastructure to enhance national logistics capacity. Key projects such as Long Thanh International Airport, the expansion of Cai Mep–Thi Vai Port, and the North–South Expressway are improving connectivity between major economic centers and seaports[4]. At the same time, multiple logistics centers and bonded warehouses are being developed in Ho Chi Minh City and nearby industrial provinces to meet the fast-growing demand for goods.

Policies and incentives: The government has launched the Logistics Development Strategy 2025–2035 (Vision 2050), focusing on building regional logistics hubs, promoting multimodal transport, and encouraging private and foreign investment in the logistics sector[5]. Tax incentives, simplified administrative procedures, and expanded land access further strengthen Vietnam’s appeal as an emerging logistics investment destination[6].

Current Limitations and Investment Opportunities

High logistics costs: Logistics expenses account for 16.8–17% of Vietnam’s GDP, significantly higher than the global average of 10–11%[7]. This high cost structure erodes export competitiveness and raises product prices domestically, as transportation, fuel, and toll expenses are passed on to consumers. It also discourages foreign investors in supply chain–intensive industries and limits small firms’ ability to expand. Combined with the sector’s reliance on road transport, these costs contribute to congestion, higher emissions, and reduced overall efficiency of Vietnam’s logistics network.

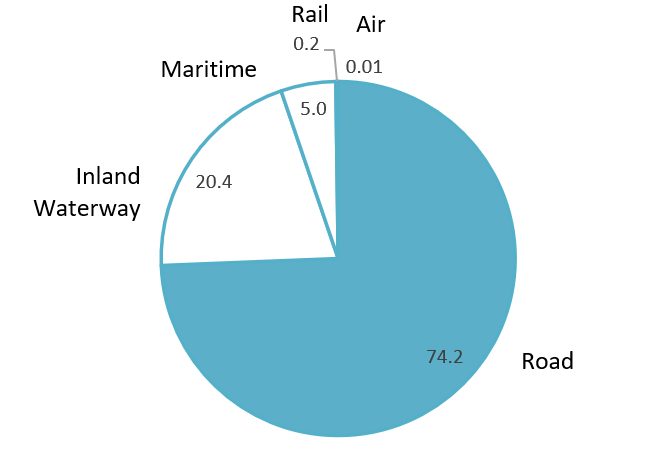

Unbalanced transport structure: The sector remains heavily reliant on road transport. In the first nine months of 2024, roads accounted for ~74.2% of total freight volume, while inland waterways represented 20.4%, maritime 5%, and rail and air only 0.2% and 0.01%, respectively[8].

Vietnam freight transport structure in the first 9 months of 2024

Unit: % ; 100% = 1.9 billion tons of cargo transported

Source: VALOMA (2024)

This overreliance on road transport has led to increased congestion, particularly around key ports and urban gateways, while high fuel costs, toll fees, and limited expressway capacity further hinder cost efficiency. As a result, despite infrastructure expansion efforts, logistics expenses remain elevated compared to regional peers, highlighting the need for better multimodal connectivity and infrastructure diversification.

Limited human resource quality: Only 5–7% of logistics workers have formal training in supply chain management, IT, or foreign languages, making it difficult for local firms to meet international standards[9].

Overloaded infrastructure: Vietnam’s logistics network faces congestion at ports, gateways, and major transport routes. Access roads to ports and inter-provincial expressways are often overcrowded, prolonging delivery times and driving up logistics costs — emphasizing the need for investment in multimodal connectivity and smart infrastructure.

Overloaded infrastructure has become a major challenge for Vietnam’s logistics industry

Source: Hanoimoi

In addition to existing limitations, Vietnam is entering a period of supply chain modernization, creating significant opportunities for international companies to participate in the logistics sector. The strong growth of e-commerce, import–export activities, and infrastructure investment provides a solid foundation for foreign investors to expand their presence in Vietnam. Key opportunities include:

– Multimodal infrastructure: The government promotes the development of regional logistics hubs, inland container depots (ICDs), and railway–seaport connectivity to reduce dependence on road transport — offering PPP or joint-venture opportunities for foreign infrastructure investors[10].

– Warehousing and e-commerce logistics: Vietnam’s e-commerce market is projected to reach USD 39 billion by 2025, driving demand for smart warehouses, fulfillment centers, and last-mile delivery services[11].

– Cold chain and specialized logistics: The total cold storage capacity in Vietnam is expected to reach 1.7 million pallets by 2028, a 70% increase from 2023 — indicating strong potential for investment in cold storage, refrigerated transport, and value-added services[12].

How B&Company can support your success

With over 15 years of experience in market research and investment consulting for Japanese and international firms, B&Company helps foreign investors understand the market, find reliable partners, and execute effective strategies in Vietnam’s logistics sector.

– Market research and opportunity analysis: In-depth reports on market size, regulations, trends, and competition to assess potential and investment risks.

– Partner search and business matching: A proprietary database of over 900,000 Vietnamese companies enables B&Company to screen, evaluate, and connect local partners in transport, warehousing, and logistics services.

– Legal and investment support: Advisory on procedures for obtaining Investment Registration Certificates (IRC), business registration, and required sector-specific licenses.

– Strategic consulting and long-term collaboration: Guidance on JV, PPP, or direct investment models, along with support in business development, recruitment, and market communication.

B&Company serves not only as a consultant but also as a strategic bridge, enabling foreign companies to enter and expand in Vietnam’s logistics market with confidence, compliance, and sustainable growth.

* If you wish to quote any information from this article, please kindly cite the source along with the link to the original article to respect copyright.

| B&Company

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |

[6] Ministry of Industry and Trade

[7] Vietnam Investment Review <Access>

[8] Ministry of Industry and Trade, Vietnam Logistics Report 2023

[9] Ministry of Industry and Trade, Vietnam Logistics Report 2023

[10] Ministry of Industry and Trade, Vietnam Logistics Report 2023

[11] Vietnam E-commerce Association (VECOM) <Access>

[12] FiinGroup