13Jun2025

Latest News & Report / Vietnam Briefing

Comments: No Comments.

The economic landscape of Vietnam’s North Central and Central Coastal[1] region is poised for transformation following the 2025 administrative unit mergers. This strategic adjustment, set to take effect by August 15 per Conclusion No. 157-KL/TW[2], signed on May 25, aims to improve governance, streamline resource allocation, and foster regional connectivity for long-term development.

Overview of the North Central and Central Coastal after the 2025 Administrative Unit Mergers

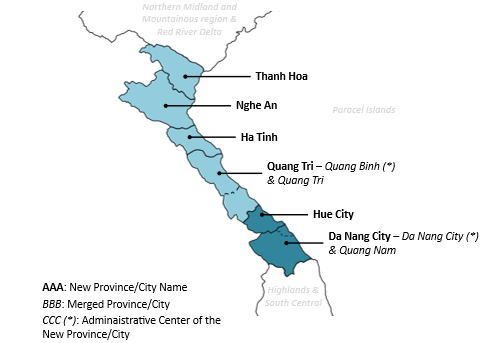

Vietnam’s North Central and Central Coastal region is a major industrial-service-urban coastal center of the country and plays an important role in the development of Central Vietnam. Under Decision No. 759/QĐ-TTg[3], key changes include the merger of Quang Binh and Quang Tri provinces and the consolidation of Da Nang City and Quang Nam into a single centrally-governed city. The remaining provinces, including Thanh Hoa, Nghe An, Ha Tinh, and Hue City, maintain their administrative boundaries but are still influenced by broader regional policies.

The North Central and Central Coastal provincial-level administrative units after the 2025 mergers

Source: B&Company Vietnam

The North Central and Central Coastal is a dynamic region due to its strategic position, long coastline, and abundance of natural resources. The region accounted for 10% of Vietnam’s total GRDP at 1,123 trillion VND, with a growth rate of nearly 9% in 2024. After the merger, the region has a mix of large and small economy localities, with Thanh Hoa leading the region with its 2024 GRDP of around 320 trillion VND, followed by Da Nang City, which overtakes Nghe An due to its merger with Quang Nam at a GRDP of 280 trillion VND. Hue City, without any mergers, posted the lowest GRDP in the region and the lowest among all centrally-governed cities, at 80 trillion VND.

Socio-economic indicators in 2024 of the North Central and Central Coastal provinces after the administrative mergers

| No. | Provinces | Population

(Unit: Thousand people) |

Total Area (Unit: Km2) | GRDP

(Unit: Billion VND) |

Growth rate

(Unit: %) |

| 1 | Thanh Hoa | 3,764 | 11,115 | 318,752 |

12.2 |

| 2 | Da Nang City | 2,819 | 11,860 | 279,907 | 7.3 |

| 3 | Nghe An | 3,442 | 16,487 | 216,943 | 8.0 |

| 4 | Quang Tri | 1,584 | 12,700 | 113,688 | 6.6 |

| 5 | Ha Tinh | 1,330 | 5,994 | 112,855 | 7.5 |

| 6 | Hue City | 1,236 | 4,947 | 80,000 | 8.2 |

| Total | 14,175 | 63,103 | 1,122,145 | 8.8 | |

Source: Resolution No. 60-NQ/TW, Decision No. 759/QD-TTg, General Statistic Offices (GSO), Provincial Statistics Offices, B&Company synthesis

Regional Economic Characteristics and Investment Situation of the North Central and Central Coastal

The North Central and Central Coastal region of Vietnam holds a strategic geo-economic position as a transitional zone connecting Northern Vietnam, the Central Highlands, and the East-West economic corridor, linking Laos, Thailand, and Myanmar to the Pacific Ocean. The region’s geographic diversity, bordered by mountains to the west and the East Sea to the east, shapes its development orientation toward a balanced mix of industry, services, and agriculture. The region also acts as a critical transportation and energy corridor for the country, with major highways, railway lines, and seaports facilitating regional integration. These locational strengths have attracted increasing investment into infrastructure, processing and manufacturing industries, renewable energy, and tourism, setting the stage for deeper participation in national and global value chains.

Outlined under Resolution No. 26-NQ/TW[4] in 2022, Decision No. 376/QD-TTg[5], and Decision No. 1281/QD-TTg[6] in 2024, the current development orientation for Vietnam’s North Central and Central Coastal region focuses on restructuring key economic sectors, emphasizing the marine economy, and enhancing regional connectivity across three defined subregions. While recent administrative mergers have led to structural adjustments, particularly as some coastal provinces are integrated with the Highlands, the North Central and Central Coastal provinces largely retain their existing development objectives and act as the main driver of the Central’s economy:

(1) Developing internationally competitive industries with strong integration into global value chains, prioritizing foundational sectors, green technologies, processing, and emerging industries;

(2) Modernizing logistics systems through advanced technologies, and establishing national and international hubs connected to the regional seaport network and major global transport corridors;

(3) Positioning tourism as a spearhead economic sector by capitalizing on the region’s marine and island resources, natural landscapes, cave ecosystems, biodiversity reserves, world heritage sites, and cultural-historical assets;

(4) Restructuring the agriculture, forestry, and aquaculture sectors toward ecological models linked with processing industries, ensuring sustainability and high efficiency;

(5) Promoting rapid and sustainable development of the marine economy, particularly in services, marine industries, tourism, and maritime economic activities;

(6) Strengthening regional linkages by forming industry clusters and large coastal economic zones connected to urban centers, tourism hubs, and eco-tourism destinations for international visitors.

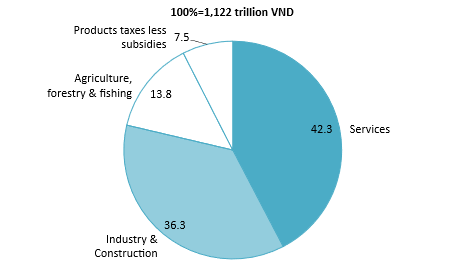

In 2024, the services sector of North Central and Central Coastal Vietnam contributed nearly 500 trillion VND, accounting for 43% of the regional GDP, fueled by logistics, commercial activities, financial services, and particularly the tourism sector, which increased sharply before the Covid-19 pandemic[7] and has quickly rebounded in recent years[8]. The region’s industry & construction has also quickly transformed from traditional mining and processing industries to high-tech and high-value manufacturing and processing industries.

GDP Composition of the North Central and Central Coastal in 2024

Unit: %

Source: General Statistic Offices (GSO), Provincial Statistics Offices, B&Company synthesis

The GRDP compositions of Northern Central provinces are highly diversified, with a strong emphasis on the services and industry & construction sectors, aligning with the region’s development orientation. Thanh Hoa led the region with a GRDP of 319 trillion VND in 2024, half of which was contributed by the industry & construction sector. On the other hand, Da Nang City, with a GRDP of 280 trillion VND, is service-driven, with the sector’s composition in the GRDP at over 70% before the merger and at 54% after combining with Quang Nam’s economy. Apart from Da Nang City, the agriculture, forestry, and fishing sector makes up a significant share of GRDP across the region, especially in Nghe An (22%) and Quang Tri (18%), due to strong crop farming, livestock, and fisheries. However, these provinces have been increasing their services and industry & construction sectors by promoting tourism and attracting foreign investors in high-tech manufacturing sectors.

GRDP composition by provinces in the North Central and Central Coastal post mergers in 2024

Unit: %

Source: General Statistic Offices (GSO), Provincial Statistics Offices, B&Company synthesis

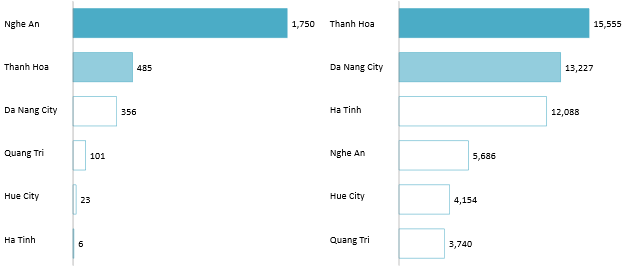

The FDI landscape in the North Central and Central Coastal region is marked by notable disparities. Nghe An has emerged as a rising star in recent years, attracting 1.75 billion USD in registered capital, welcoming global manufacturers such as Foxconn, Goertek, Everwin, JuTeng, and Luxshare ICT[9]. Despite a relatively low FDI influx in 2024, Ha Tinh remains among the region’s top three FDI destinations, largely due to the Vung Ang economic zone, a center for steel manufacturing, supporting industries, post-steel processing, thermal power, and deep-water seaport, which is also one of Vietnam’s three key international maritime trade hubs[10]. Thanh Hoa continues to lead the region in FDI attraction thanks to the Nghi Son economic zone, and new projects, such as Sumitomo Corporation’s 3 trillion VND Thang Long Thanh Hoa Industrial Park[11], are poised to revitalize the province’s FDI sources in the future. Following its merger with Quang Nam, Da Nang City now ranks 10th nationally in total registered FDI. The province positions itself as the future center of high-tech manufacturing and processing industries, such as semiconductors, electronics, automotives, etc. With Da Nang Hi-Tech Park, one of Vietnam’s three national high-tech parks and the only one located in the central region, the province serves as a strategic hub for technology-driven industries after attracting over 1 billion USD in investment[12].

New registered FDI capital in 2024 (Left) and Total accumulated registered FDI capital in 2024 (Right) by provinces of the North Central and Central Coastal

Unit: Million USD

Source: MPI, B&Company synthesis

Potential Changes in Economic Development Orientation of North Central and Central Coastal Provinces Following Administrative Unit Mergers

While the provincial boundaries of the North Central and Central Coastal provinces remain largely unchanged, connectivity has been a rising matter for regional development. Unchanged provinces, like Thanh Hoa and Nghe An, are likely to engage in more inter-provincial economic planning, regional infrastructure coordination, and collaborative investment promotion due to their similar economic foundation and development orientation. After the merger, Quang Tri will expand the planning and economic development space while forming a growth pole of sufficient scale, high competitiveness, and strong connectivity within the Northern Central region. Da Nang City, being the bridge between the Northern Central, the South Central, and the Highlands, will be better positioned to compete with economic centers such as Hanoi and Ho Chi Minh City.

Economic landscape and the development orientation of North Central and Central Coastal provinces after merging

| Provinces | Economic landscape | Possible economic development orientation |

| Thanh Hoa | Thanh Hoa is one of the economic powerhouses of the Northern Central region. Nghi Son Economic Zone will continue to be a key growth driver in the industrial sector, while tourism is also highly promoted. | · Prioritizing key manufacturing and processing industries, including petrochemical and related industries; power generation; mechanical, electronics, and metal; etc.

· Promoting agriculture, forestry, and aquaculture linked to high value chains; · Developing sea tourism, ecotourism, and cultural tourism; · Establishing a tier-I regional logistics center in the Nghi Son Economic Zone. |

| Nghe An | While unchanged, Nghe An’s economic orientation is shifting toward industrialization with growing foreign investment. Its proximity to the Laos border also supports cross-border trade and logistics services.

|

· Developing high-tech industries as key drivers of provincial economic growth; promoting potential sectors, handicrafts, and rural trades;

· Shifting the service sector structure toward rapid growth of key services; · Developing sea tourism, ecotourism, and cultural tourism; · Restructuring the agriculture, forestry, and fisheries sectors to leverage the advantages of localities and ecological zones; · Developing sea economy. |

| Ha Tinh | Ha Tinh has a strong industrial base, spearheaded by the Vung Ang Economic Zone. The province’s economy is largely driven by heavy industry and construction, though agriculture and fisheries still contribute significantly. | · Prioritizing manufacturing and processing sectors with potential and comparative advantages such as steel and steel-based manufacturing, power generation, processing of agricultural products, etc.;

· Developing high-value services such as commerce, tourism, and logistics; · Restructuring the agriculture, forestry, and fisheries sectors to leverage the advantages of localities and ecological zones. |

| Quang Tri

Merged from: · Quang Binh; · Quang Tri. |

The merger forms a more economically competitive and administratively efficient province, connecting both regions’ strong tourism and agriculture-fishing base while creating potential in the energy-generating industry. | · Modernizing manufacturing and processing industries while expanding energy production, particularly from sustainable marine-based sources;

· Developing logistics services with strategic connections to Laos and regional special economic zones; · Strengthening agriculture, forestry, and aquaculture through integration into high-tech, high-value value chains; · Promoting tourism as a key economic sector by enhancing connectivity between major destinations. |

| Hue City | Hue City has positioned itself as a center for culture, tourism, and information technology. The Chan May-Lang Co Economic Zone and the planned expansion of Hue airport aim to support economic diversification, with foreign investment flowing into high-tech, education, and healthcare services. | · Promoting tourism as a spearhead sector with diverse offerings, including cultural, ecological, and marine tourism;

· Developing service industries aligned with the digital economy, such as finance, banking, and ICT; · Prioritizing sectors with strong potential and comparative advantages, such as textiles and garments; · Promoting high-tech, high-value manufacturing and processing industries; · Advancing agriculture, forestry, and fisheries through concentrated commodity production integrated with processing industries. |

| Da Nang City

Merged from: · Da Nang City; · Quang Nam. |

The merger boosts Da Nang City’s competitiveness through the consolidation with a similar provincial economy, expanding Da Nang’s technological and service economy with Quang Nam’s industrial and tourism strengths. | · Promoting tourism as a key economic sector, with emphasis on marine tourism, ecotourism, and MICE travel;

· Transitioning to high-tech, high-value manufacturing and strengthening supporting industries; · Expanding high-value service sectors, particularly trade and e-commerce; · Enhancing logistics, transportation, and warehousing while fostering private investment in transport services, public transit, and inland waterways; · Advancing sustainable, high-tech agriculture linked to processing industries. |

Source: Economic planning of North Central and Central Coastal, B&Company synthesis

Conclusion

The 2025 administrative unit mergers in Vietnam’s North Central and Central Coastal region mark a significant shift in the country’s approach to regional governance and development. Provinces such as Quang Binh-Quang Tri and Da Nang-Quang Nam stand to gain new scale, synergies, and investment appeal. Meanwhile, neighboring provinces must adapt to stay competitive. With coordinated planning and sustainable growth strategies, the Northern Central region is well-positioned to become a dynamic driver of Vietnam’s economy in the years ahead.

[1] For the analysis purposes under this article, we will analyze the the North-Central and Central-Central subregions of Vietnam’s North Central and Central Coastal region, including Thanh Hoa, Nghe An Ha Tinh, Quang Binh, Quang Tri, Hue City, Da Nang City, and Quang Nam. Quang Ngai, Binh Dinh, and South-Central provinces will be covered in a separate article due to their administrative mergers with the Highlands.

[2] TVPL. Conclusion No. 157-KL/TW on the implementation of the resolutions and conclusions of the Central Committee and the Politburo regarding the reorganization of the organizational apparatus and administrative units <Source>

[3] TVPL. Decision No. 759/QD-TTg approving the Proposal on Reorganization of Administrative Units at Various Levels and the Construction of a Two-Tier Local Government Structure <Source>

[4] TVPL. Resolution No. 26-NQ/TW on the Socio-Economic Development and National Defense and Security Assurance of the North Central and Central Coastal Region to 2030, with a Vision to 2045 <Source>

[5] TVPL. Decision No. 376/QĐ-TTg on the Approval of the Master Plan for the North Central and Central Coastal Region for the 2021–2030 Period, with a Vision to 2050 <Source>

[6] TVPL. Decision No. 1281/QĐ-TTg on the Issuance of the Implementation Plan for the Master Plan of the North Central and Central Coastal Region for the 2021–2030 Period, with a Vision to 2050 <Source>

[7] VIOIT. Some Tasks and Solutions for Economic Development of the North Central and Central Coastal Region until 2030, with a Vision to 2045 <Source>

[8] Government News. International Tourist Arrivals Increase, Signaling a Strong Recovery for Central Vietnam’s Tourism Sector <Source>

[9] VnEconomy. Nghe An Province continues to promote FDI attraction efforts for 2025 <Source>

[10] Ha Tinh Government. Vung Ang Economic Zone – the growth engine and key development hub of Ha Tinh Province <Source>

[11] VnEconomy. Thanh Hoa Selects Global Corporation for VND 2,918 Billion Industrial Park Project <Source>

[12] VnEconomy. Da Nang Hi-Tech Park has attracted over 1 billion USD in FDI <Source>

* If you wish to quote any information from this article, please kindly cite the source along with the link to the original article to respect copyright.

| B&Company

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |