06May2025

Latest News & Report / Vietnam Briefing

Comments: No Comments.

Vietnam is undergoing a major administrative overhaul, reducing its provincial-level units from 63 to 34 (28 provinces and 6 centrally-governed cities). This reform results in larger economic zones with similar development orientation, representing one of Vietnam’s boldest moves to date to boost efficiency and attract investment.

Economic Situation of Newly-merged Provincial-level Administrative Units

Vietnam’s economy is becoming more concentrated, and the proposed provincial mergers are set to enhance regional strengths by creating larger, more dynamic economic centers.

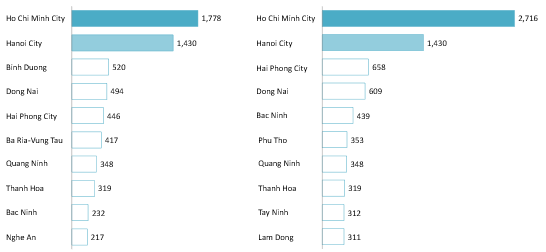

In 2024, Ho Chi Minh City and Hanoi led the country in GRDP with around 1,800 trillion and 1,400 trillion VND, representing around a third of Vietnam’s total GDP. On the other hand, other provinces’ GRDPs were below 500 trillion VND, with only ten surpassing the 200 trillion VND mark.

Top 10 Provinces by GRDP Before (left) and After (right) 2024 Administrative Mergers

Unit: Trillion VND

Source: Resolution No. 60-NQ/TW, Decision No. 759/QD-TTg, General Statistic Offices (GSO), Provincial Statistics Offices, B&Company synthesis

The consolidation plan further intensifies this concentration, especially in the case of Ho Chi Minh City, which is set to merge with Binh Duong and Ba Ria-Vung Tau, two other provinces with the highest GRDP. The new economic center of the Southern Vietnam is estimated to have a total GRDP of 2,716 trillion VND, or over 100 billion USD, which is twice the size of Hanoi’s GRDP and represents roughly one-quarter of Vietnam’s total economic output.

Other centrally-governed cities undergoing mergers, such as Hai Phong, Da Nang, and Can Tho, are also projected to experience significant economic growth, with estimated increases of 48%, 85%, and 112%, respectively. Meanwhile, Hue, despite becoming a centrally-governed city, will have the smallest GRDP among its peers at 80 trillion VND, ranking sixth-lowest nationally in economic size.

Foreign Investment Situation of Newly-merged Provincial-level Administrative Units

For foreign and domestic investors, the mergers signal a changing landscape of opportunities. Larger provinces with unified leadership can offer larger markets and more coherent development strategies. After the proposed merging, the FDI landscape of Vietnam remains highly concentrated in the Red River Delta and the Southeast region. Ho Chi Minh City, Bac Ninh, and Hai Phong City led in both registered FDI capital in 2024 and total accumulated FDI capital, with Ho Chi Minh City accounting for nearly 28% of Vietnam’s total inward capital since after merging with Binh Duong and Ba Ria-Vung Tau, two major regional FDI attraction provinces.

Registered FDI capital in 2024 (Left) and Total accumulated registered FDI capital since 1988 (Right) by provinces

Unit: %

Source: MPI, B&Company synthesis

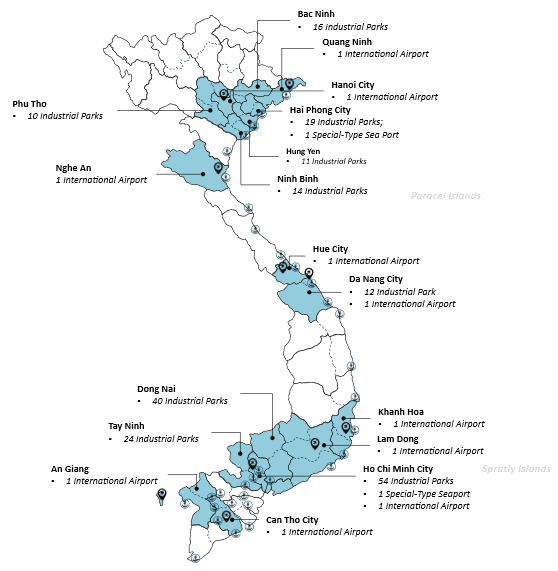

Infrastructure Developments of Newly-merged Provincial-level Administrative Units

One of the primary goals behind the merging of provincial-level administrative units is to enhance infrastructure planning and connectivity. These new administrative configurations significantly improve access to regional logistics networks, including expressways, ports, and international airports, setting the stage for more integrated and efficient development.

The merging of provincial-level administrative units pave the way for the formation of large-scale industrial hubs in the Southeast and Red River Delta to meet growing demand in manufacturing and processing. Ho Chi Minh City is expected to lead the country with over 54 industrial parks [1], followed by Dong Nai (40) and Tay Ninh (24). Hai Phong, Bac Ninh, and Ninh Binh are major industrial hubs in the Red River Delta, whereas Da Nang quickly emerged as a major center for industrial activities in the central region with 12 industrial parks as of 2023.

By streamlining governance across wider areas, the new structure allows for more efficient management of large industrial zones, offering greater flexibility and options for businesses. This, in turn, boosts regional competitiveness, attracts both domestic and foreign investment, and unlocks new development potential. With increased land availability, companies can more easily secure suitable sites for factories, easing the pressure on industrial land in high-demand areas[2].

Importantly, many of these key industrial provinces either contain or are adjacent to major international airports and seaports, enhancing trade connectivity. In the north, the Hai Phong Special-Class Seaport, along with international airports in Hanoi and Quang Ninh, anchors industrial development in the region. In the south, Ho Chi Minh City’s industrial growth will be reinforced by improved access to the Ba Ria–Vung Tau Special-Class Seaport. The merging process enables more coordinated infrastructure development, ensuring better integration between ports and their hinterlands.

Significantly, landlocked provinces that were previously disadvantaged in terms of logistics now gain improved access to seaports and maritime trade routes. Many Highland provinces like Dak Lak will now have access to the sealine and seaport structure, which can help to boost the regional economy, such as tourism. This enhanced connectivity helps reduce logistics costs, increase economic development potential, and level the playing field for inland businesses.

Major Economic and Industrial Infrastructure of Vietnam

Source: B&Company Vietnam synthesis

Implications for investors

The provincial mergers create larger, more integrated markets and should improve the business environment. With fewer administrative units, decision-making should be quicker, which should ease the time and cost of starting projects. It also means harmonized regulations (land use, taxes, incentives) across the merged area. New provincial capitals (already designated or planned) will coordinate infrastructure spending more efficiently. Provinces that gain coastline or major transport links can now plan ports, tourism, and industry with national support. Lastly, with the intention to “boost economic zones” and attract investment, foreign investors can expect larger, more cohesive markets; aligned development strategies; and potential new incentives for designated mega-regions. With fewer provincial boundaries to cross, companies can negotiate with one authority on land and licenses for large-scale projects.

Conclusion

Vietnam’s provincial-level administrative unit mergers will reshape the economic map, creating mega-provinces with vast markets and unified infrastructure. New provinces offer integrated supply chains, major transport hubs, large labor pools, and cohesive development orientations. Overall, foreign businesses should focus on the merged regions’ enhanced infrastructure and economies of scale as they plan investments in Vietnam’s evolving landscape.

[1] GSO. Vietnam Statistical Yearbook – 2023 <Source>

[2] VIR. Industrial hubs strengthened following provincial mergers <Source>

* If you wish to quote any information from this article, please kindly cite the source along with the link to the original article to respect copyright.

| B&Company

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |