27May2025

Latest News & Report / Vietnam Briefing

Comments: No Comments.

Vietnam’s ride-hailing market is among the fastest-growing in Southeast Asia, driven by urbanization, digital transformation, and an ecosystem of delivery apps. With the nationwide expansion of Xanh SM, the market is poised for a fencing competition.

Overview of the Ride-Hailing Market in Vietnam

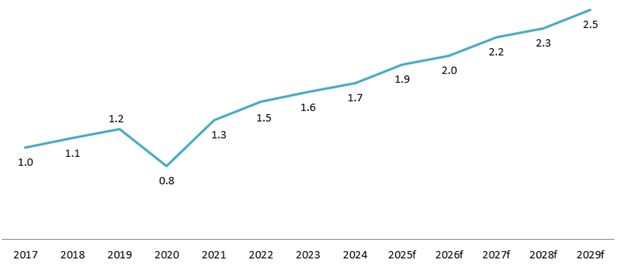

In 2024, Vietnam’s ride-hailing market was valued at 1.7 billion USD, with a CAGR of 8% from 2017 to 2024. Despite a significant decline in 2020 due to the impact of COVID-19 when the market value dropped to just 0.8 billion USD, the sector has shown strong signs of recovery, maintaining a steady CAGR of 7% and is projected to reach 2.5 billion USD by 2029.

Total revenue of Ride-hailing Market in Vietnam from 2017 to 2029

Unit: Billion USD

Source: Statista

The adoption of ride-hailing services has also been growing steadily, from 22.8 million to 28.1 million users between 2017 and 2024. Following the trend, Vietnam’s ride-hailing market is forecasted to reach 37 million users in 2029, corresponding with a penetration rate of 36%. Key urban cities such as Ho Chi Minh City and Hanoi witness the most activities of the industry and ride-hailing services have become an integral part of everyday activities.

Key Player in the Market

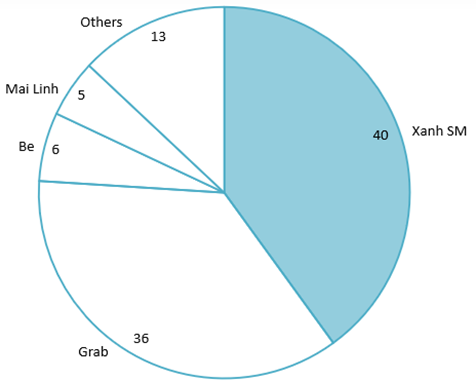

According to a report by international market research firm Mordor Intelligence on Vietnam’s ride-hailing services in Q1 2025, Xanh SM is leading in both the traditional taxi and app-based ride-hailing markets, capturing 40% of the market share and generating 400 million USD in revenue. Grab follows closely with a 36% share, while Be ranks third with just 6%[1].

Market share of ride-hailing services in Vietnam in Q1 2025

Unit: Percentage

Source: Modor Intelligence

Technology-based ride-hailing services dominate the market, accounting for 82% of total market share[2]. This strong preference is largely driven by the simplicity and convenience of booking compared to the traditional type. Firstly, as of early 2025, Vietnam had around 80 million internet users, with an online penetration rate of 80%. Combined with the country’s 4G coverage reaching an impressive 99.8%, customers can easily book rides via mobile apps without the hassle of locating a traditional taxi[3]. Secondly, Vietnam’s public transportation system remains underdeveloped and insufficient to meet growing urban mobility needs. This gap makes ride-hailing services a highly attractive option due to their availability and responsiveness[4]. Lastly, technology-based ride services are often more affordable and supported by frequent and generous promotions. Discounts can reach up to 80%, especially for bike-hailing services, while traditional options tend to be priced at the discretion of individual drivers.

Ride fares of some ride-hailing brands in Vietnam in May 2025[5]

| Vehicle | Services | Minimum fare for

the first 2 km (Unit: VND) |

Fare per additional km

(Unit: VND/km) |

| Two-wheeler | Xanh SM bike | 13,200 | 4,200 |

| Grab bike | 13,500 | 4,300 | |

| Be bike | 12,787 | 4,328 | |

| Four-wheeler | Xanh SM car | 30,500 | 11,900 – 14,700 |

| Grab car | 29,000 | 10,00 | |

| Be car | 30,520 | 10,337 – 11,332 | |

| Mai Linh | 27,500 | 10,300 – 13,900 |

Source: B&Company Synthesis

Prospects and Challenges for Investors in the Market

Overall, the ride-hailing market is expected to continue its upward trajectory in the coming years, ultimately reaching 2.5 billion USD by 2029. Technology-based ride-hailing services are becoming increasingly popular, especially as companies launch more promotional programs targeting a wide range of customer segments. These efforts are making ride-hailing significantly more affordable compared to using personal vehicles[6].

– Xanh SM has launched a membership rewards program offering fare discounts for frequent users[7].

– Be is targeting students by offering up to 25% off rides that start or end at schools and universities in Hanoi[8].

– Grab has introduced a budget-friendly GrabBike package, Grab Economy, providing up to 20% off rides in select cities including Hanoi, Ho Chi Minh City, Da Nang, and others[9].

In addition, mobile wallets like MoMo, ZaloPay, and VNPay, which are widely used by younger consumers, have partnered with ride-hailing platforms to offer seamless, cashless payments. Other services such as parcel and food delivery are also becoming more common, contributing to an integrated ecosystem that caters to Vietnam’s fast-paced urban lifestyle and drives greater consumer engagement[10].

However, the ride-hailing market is becoming increasingly consolidated and dominated by major brands like Xanh SM and Grab. This trend makes it difficult for other brands to compete when entering the market. Moreover, Xanh SM is expanding its market presence by signing partnerships with two large competitors, Be[11] and Mai Linh[12], as well as the latest addition, Taxi G7[13].

Conclusion

The ride-hailing market in Vietnam presents a dynamic and rapidly evolving landscape. While opportunities still exist for innovation in service offerings, such as discounts for student groups or niche partnerships with local businesses, challenges remain, including fierce competition in major cities such as Hanoi and Ho Chi Minh City and market concentration in Xanh SM and Grab. Utilizing brands’ competitive strength and adapting to the evolving demands of consumers will assist companies in future success.

[1] Mordor Intelligence (2025). Ride – hailing Market in Vietnam Size & Share Analysis <Access>

[2] Mordor Intelligence (2025). Ride – hailing Market in Vietnam Size & Share Analysis <Access>

[3] Data Reportal (2025). Vietnam Digital Market in 2025 <Access>

[4] VnEconomy (2022). The Challenge of Increasing Public Transportation in Vietnam <Access>

[5] Fares are based on rates in Hanoi and Ho Chi Minh City; pricing in other provinces may differ.

[6] VnExpress (2024). Trending in Tech-based Ride-hailing Services Among Vietnamese <Access>

[7] Xanh SM (2024). Membership Rewards Program <Access>

[8] Be (2021). Student Discounts Program <Access>

[9] Grab (2024). Grab Introducing Budget Friendly Package <Access>

[10] VietnamBiz (2023). Ride-hailing Platforms Collaborate with E-wallet Systems <Access>

[11] Be (2023). Be Group and GSM Sign Cooperation Agreement <Access>

[12] Tien Phong Newspaper (2024). Mai Linh Taxi Cooperates with VinFast Car Company from GSM <Access>

[13] Xanh SM (2025). G7 Buys 899 Electric Cars from VinFast, Establishes Cooperation with the Green Ecosystem SM <Access>

* If you wish to quote any information from this article, please kindly cite the source along with the link to the original article to respect copyright.

| B&Company

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |