18Feb2025

Industry Reviews / Latest News & Report

Comments: No Comments.

Overview of Vietnam’s livestock sector

The livestock sector is a major part of Vietnam’s agricultural economy with a growing momentum in recent years. In 2024, the sector was estimated to be over 26 billion USD[1], accounting for 26% of Vietnam’s agriculture GDP value[2]. The main outputs include livestock meat, eggs, and milk, all showing strong growth trends. Between 2019 and 2024, total meat production achieved a CAGR of 5%, while egg and milk production grew at CAGRs of around 5% and 4% respectively[3] [4].

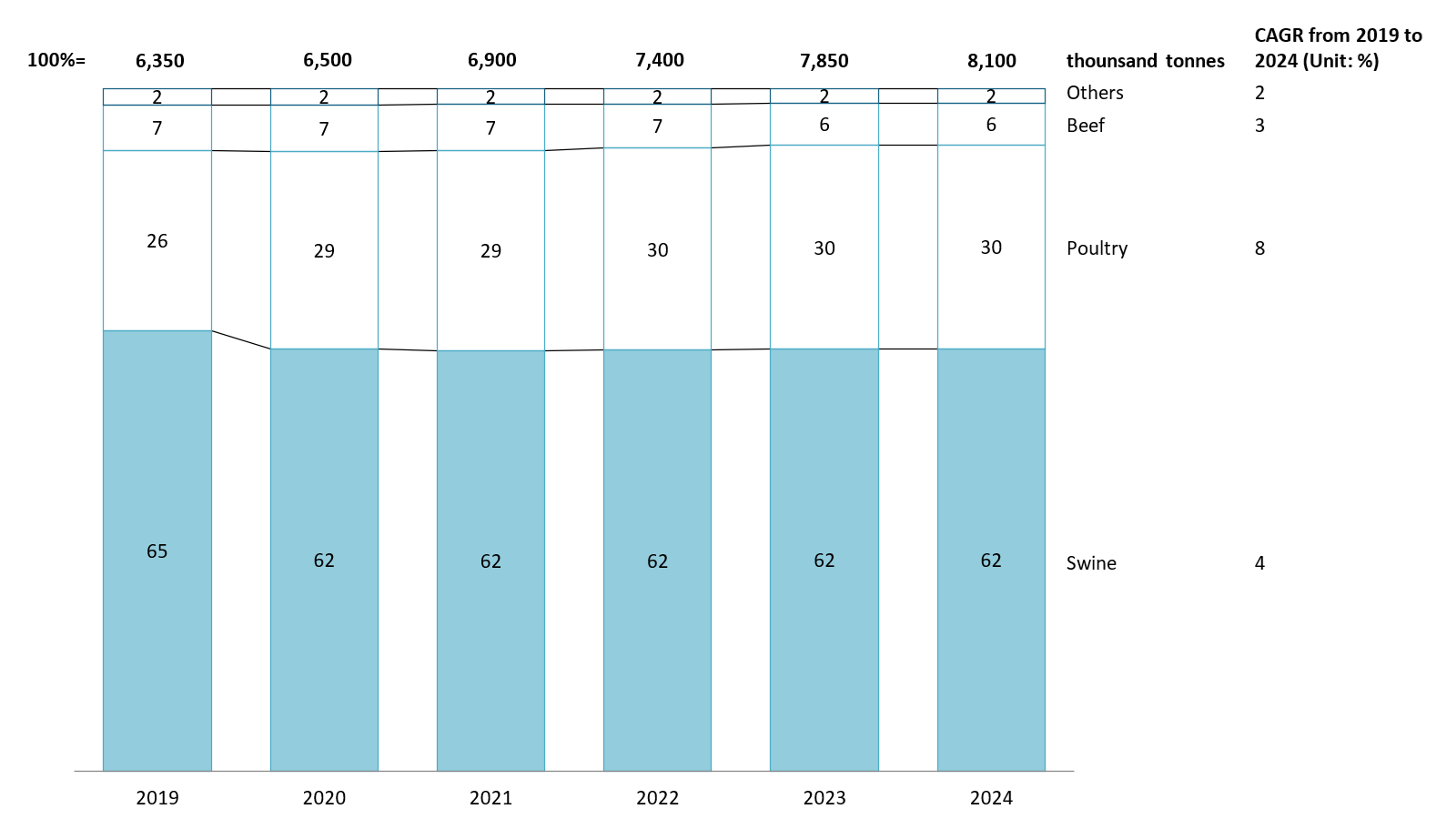

The swine and poultry industries are key drivers of Vietnam’s livestock sector due to their dominant share of total output and consistent growth. Together, swine and poultry output accounted for over 90% of the sector’s meat production in 2024, showing relatively consistent growth. Between 2019 and 2024, pig and chicken populations grew annually by 6% and 4%, respectively, while cow numbers fluctuated, and buffalo numbers steadily declined[5]. In 2024, the U.S. Department of Agriculture (USDA) highlighted that Vietnam’s pork production ranked 6th globally with an output of 3.55 million tonnes in retail weight, corresponding to 3% of global output[6].

Main meat products of Vietnam’s livestock sector in living weight, from 2019 to 2024

(Unit: thousand tonnes and %)

Source: Statistical Yearbook of Vietnam, MARD, B&Company synthesis

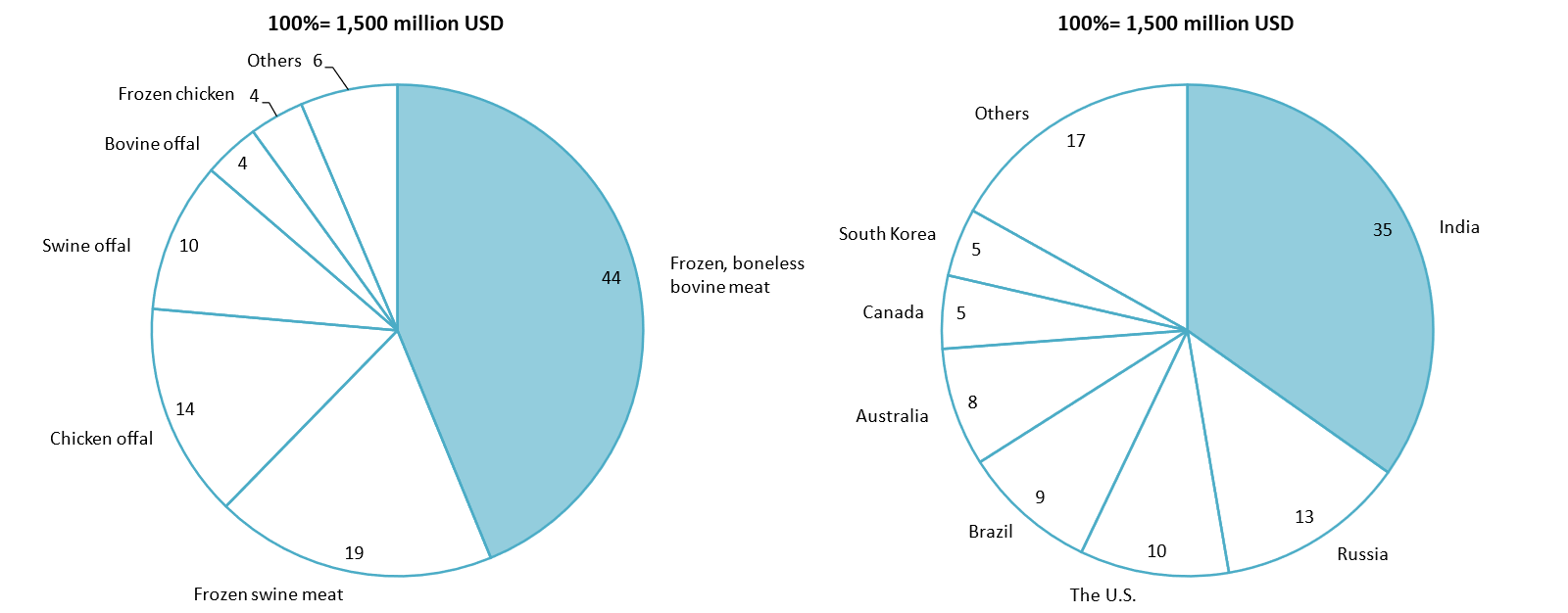

Despite strong domestic production capability, the sector has recorded a major trade deficit, especially in the meat industry. In 2023, Vietnam imported 1.5 billion USD of meat products, while only exported around 110 million USD[7]. Frozen bovine meat, primarily from India[8], led in imported value at 660 million USD, accounting for 44% of total imported meat in the same year. The import of frozen swine meat surged between 2019 and 2020[9] as the government compensated for domestic supply damaged by outbreaks of African swine fever[10]. Since then, it has become Vietnam’s second imported meat product by value, making up 19% of the total meat imports in 2023.

Structure of Vietnam’s meat imports in 2023 by product category and source country (Unit: %)

Source: Trade map, B&Company synthesis

The FDI situation in Vietnam’s livestock sector

In 2022, the livestock sector had 81 licensed FDI projects, accounting for 16% of active projects in agriculture, forestry, and fishing[11]. However, the sector attracted 2.2 billion USD in investment, representing a significant share of the 3.84 billion USD total registered capital in these sectors[12].

Vietnam’s livestock industry is highly concentrated, with FDI companies dominating over 50% of total net revenue in 2022[13]. In the same period, the Southeast region, Mekong Delta, and Red River Delta accounted for 90% of revenue, 60% of which came from FDI firms. Although they made up less than 5% of sector participants, large FDI companies contributed over half of total revenue.

Foreign-invested companies are prominent in livestock supply, particularly in the pork and chicken markets. In 2022, they accounted for 43% of the pork supply, followed by farming households at 38% and Vietnamese companies at 19%[14]. Vietnam Poultry Association (VIPA) also highlighted that FDI companies controlled 90% of the supply of white-feather chickens and 55% of the supply of traditional-breed chickens[15]. Animal feed production also saw strong FDI involvement, with foreign firms producing 13 million tonnes in 2022, securing a 63% market share[16].

Opportunities and challenges for international investment

While investment from Japanese companies in Vietnam’s livestock sector remains limited[17], the elvolving landscape of the sector promises new business opportunities.

(1) Investment in animal breeding and farming is strongly supported due to the sector’s high demand

Domestically, Vietnam has a high and rising meat consumption, especially for pork meat[18]. The government is also working to establish new markets for livestock products, such as China and Halal markets[19]. Vietnam and Japan also aim to improve the bilateral trade, with better support for the export of chicken and a new trade route for Vietnam’s pork meat[20].

With a modern and controlled farming-to-slaughtering process, companies will be able to benefit from emerging international markets and bypass international technical barriers. Koyu & Unitek Co., Ltd. was the first Vietnamese company to export chicken products to Japan through selective chicken breeds, quality animal feeds, and a modern production line. In 2021, Vilico, a subsidiary of Vinamilk, and Sojitz Corporation partnered to establish a 500-million-USD farming and slaughtering facility with a capacity of 10,000 cows and 10,000 tonnes of animal products per year, highlighting the potential of the sector.

Vinabeef Tam Đảo Livestock and Chilled Beef Processing Complex in Vĩnh Phúc Province

Source: Vinabeef

(2) Investment in animal feeds has high potential due to strong demand and government’s support

Vietnam is a major importer of animal feeds and input materials, making domestic production less competitive domestically and internationally[21]. To reduce reliance on imports, the government has shown strong commitment to support the sector. Decree No. 106/2024/ND-CP, signed in 2024, pushed forward 3 priority schemes to support the livestock sector[22], notable of which are the financial incentives to support the supply and production of input materials for animal feeds.

Table 1: Government’s financial incentives to support the domestic supply of livestock feed

| No. | Incentivized activites | Financial support value

(Unit: million VND/project) |

| 1 | Building technical Infrastructure to establish raw material cultivation areas | Up to 5,000 |

| 2 | Purchasing materials and equipment for raw materials processing | Up to 1,000 |

| 3 | Purchasing foreign equipment to produce ingredients for feed supplements | Up to 2,000 |

| 4 | Purchasing foreign technology licenses to produce single ingredients for feed supplements | Up to 2,000 |

| 5 | Purchasing bulk feed storage tanks for medium- and large-scale livestock farms | Up to 100 |

| 6 | Purchasing plant varieties for animal feed | Up to 200 |

Source: Decree No. 106/2024/ND-CP

However, the sector still contains challenges that should be noted by investors. Firstly, animal wellness is an important concern for the sector as the domestic supply is threatened by diseases, such as the African swine fever. Free trade agreements such as the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPAPP) will reduce the country’s tariff rates for most meat products to 0% by 2030[23]. While it has potentials to increase Japan’s exports to Vietnam, the Vietnamese market is expected to be flooded with highly affordable meat products from other countries, increasing the competitiveness of the market[24].

Conclusion

Vietnam’s livestock sector is on a positive trajectory with a prospective investment landscape. The domestic market sees fierce competition, with FDI companies dominating the supply of animal feeds, pork, and chicken meat. While some challenges exists, the growing domestic demand and expanding international market for Vietnam’s livestock products make the sector highly attractive for foreign investors.

[1] The livestock industry was estimated to have a total value of 23.7 billion USD in 2022 <Assess>, with a growth rate of 5.72% in 2023 <Assess> and 5.4% in 2024 <Assess>

[2] Financial Times (2025). The value of the livestock industry accounts for over 26% of GDP <Assess>

[3] GSO (2020). Statistical Yearbook of Vietnam – 2019 <Assess>

[4] MARD (2024). Appendix 1: Results of Key Indicators for the Agricultural and Rural Development Plan in 2024 <Assess>

[5] GSO. Statistical Yearbook of Vietnam <Assess>

[6] USDA. Production – Pork <Assess>

[7] International Trade Centre. Trade map <Assess>

[8] According to Trade map, India provided 74% of Vietnam’s imported frozen bovine meat.

[9] According to Trade map, Vietnam’s imported frozen swine increased from 53.8 million USD in 2019 to 315.9 million USD in 2020.

[10] Department of Animal Health (2021). Imported pork accounting for 3.6% <Assess>

[11] MARD (2023). Promoting the development of pig farming in the new economic landscape <Assess>

[12] GSO (2023). Statistical Yearbook of Vietnam – 2022 <Assess>

[13] B&Company Vietnam’s Enterprise Database.

[14] VCBS (2023). Pig Farming Industry Report <Assess>

[15] Vietnam Livestock Magazine (2023). Prospects for white-feathered chicken farming in Vietnam <Assess>

[16] Vietnam Livestock Magazine (2023). FDI enterprises accounting for more than 60% of the animal feed production in Vietnam <Assess>

[17] According to B&Company Vietnam’s Enterprise Database, in 2022, Japan only had 4 companies operating primarily in Vietnam’s livestock sector.

[18] OECD (2024). Indicators – Meat consumption <Assess>

[19] MARD (2024). Report on the Implementation of the 2024 Agricultural and Rural Development Plan and Deployment of the 2025 Plan <Assess>

[20] VCCI (2023). Promoting market access for Vietnam’s livestock and agricultural products in Japan <Assess>

[21] Department of Livestock Production (2024). Animal feed enterprises amid constantly fluctuating raw material prices <Assess>

[22] Along with financial incentives to support the supply and production of input materials for animal feeds, Decree No. 106/2024/ND-CP also grants financial supports for advertising activities for livestock products and relocation of livestock farms.

[23] VCCI (2019). Summary of Chapter 2 – National Treatment and Market Access for Goods focuses on two main aspects of international trade <Assess>

[24] USDA (2021). Vietnam Livestock Market Update <Assess>

* If you wish to quote any information from this article, please kindly cite the source along with the link to the original article to respect copyright.

| B&Company

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |