Alongside e-commerce and ride-hailing services, Vietnam’s food delivery market is one of the most dynamic in the region, attracting numerous major players. The demand for delivery services in Vietnam surged during the pandemic and continues to be an essential part of daily life, thanks to reasonable costs and convenience.

Market growth of Food delivery platforms

Vietnam’s food delivery app market (for meals) has experienced remarkable growth in recent years. According to a report by Momentum Works, the Gross Merchandise Value (GMV) on food delivery platforms in Vietnam reached $1.4 billion in 2023, marking a 27% increase—the highest growth rate in Southeast Asia. This data was compiled from four main platforms: Grab, ShopeeFood, Baemin, and Gojek[1].

These numbers highlight the growing trend of online food ordering in Vietnam, presenting lucrative opportunities for F&B businesses alongside traditional in-house dining.

Consumer behaviors on Food delivery application

According to Grab’s 2023 Food and Grocery Trends Report[2], frequent users of Grab’s delivery application are typically aged 18-24, mostly office workers, single. Consumers often install 2-3 applications to avoid relying solely on GrabFood or ShopeeFood[3]. Group orders increased fourfold in 2023, with users spending twice as much on these orders, typically placed at lunchtime for office delivery. Additionally, factors like technology, customer data, and user experience are crucial for the success of food delivery platforms. Despite the exit of some significant names, these challenges underscore the ongoing market potential.

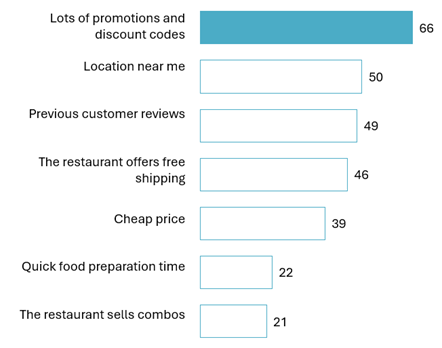

Vietnamese consumers increasingly use delivery apps to explore new restaurants and dishes, relying on these platforms as essential discovery tools. According to Grab, the main reasons for trying new restaurants or menu items include available offers and positive reviews. Promotions are often preferred over lower prices due to the perceived “bargain” feeling. Key factors influencing orders, as noted by iPOS.vn, are promotions, proximity, and customer reviews.

Factors influencing food order decisions

Unit: %, N = 3,791

Source: iPOS.vn

Market competition of food delivery applications

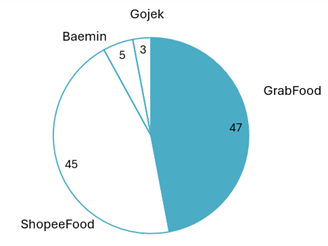

While profitable, the market is also highly competitive. Data from Momentum Works indicates that the Vietnamese meal delivery market is dominated by Grab and ShopeeFood, holding GMV shares of 47% and 45%, respectively, in 2023.

Proportion in Total GMV of food delivery platforms in Vietnam

100% = $1.4 billion

Source: Momentum Works

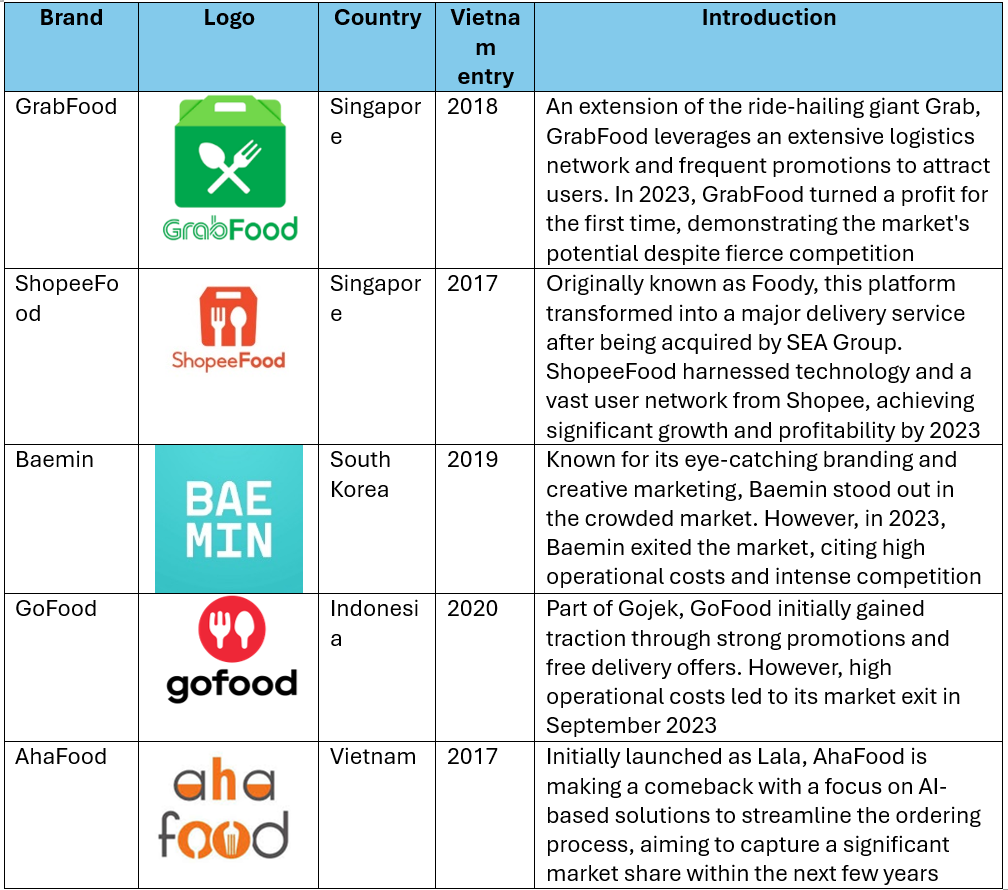

Although some believe the market battle is nearing its end with GrabFood and ShopeeFood as the main competitors, the reality is more complex. There remains significant potential, especially as consumers expect new, local applications to emerge and enhance competition amid foreign application dominance.

Key players in food delivery in Vietnam will continue to compete to attract consumers

Source: Znews

Below is a brief introduction to the major players and their journey in the food delivery industry for the period 2023-2024:

Conclusion

The food delivery application market in Vietnam is set for continued growth, driven by increasing consumer demand, digital innovation, and fierce competition among key players. This growth is significantly bolstered by the expansion of the F&B market, which is expected to continue its upward trajectory with a CAGR of 10.25% from 2023 to 2027, reaching an estimated value of 34.11 million USD by 2027. Together, these factors create a robust environment for the flourishing food delivery industry.

In addition, understanding local consumer preferences and maintaining competitive advantages through promotions, service quality, and strategic partnerships will be vital for sustained success. As the industry evolves, it promises exciting opportunities for businesses and a richer dining experience for Vietnamese consumers.

| B&Company, Inc.

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |

Read other articles