The pharmaceutical retail sector in Vietnam has been rapidly growing, with significant potential due to the increasing focus on health and rising healthcare expenditure. Alongside traditional private pharmacies, chain drug stores have been expanding in both number and influence, gradually shaping consumer behavior by offering a wider range of products and convenient additional services.

Overview of Vietnam’s pharmaceutical retail market

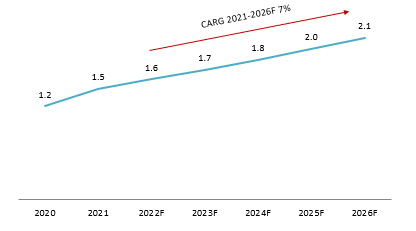

The average per capita spending on pharmaceuticals is expected to rise significantly from VND 1.5 million in 2021 to VND 2.1 million by 2026 with CARG of 7%. However, this figure remains considerably lower than the global average. With a large population and a rapidly growing economy, Vietnam’s pharmaceutical market is seen as having substantial potential for future development. The southern region of Vietnam is expected to be the largest market in the country.

Pharmaceutical expenditure per capita in Vietnam

(Unit: MVND)

Source: WHO và Fitch Solutions

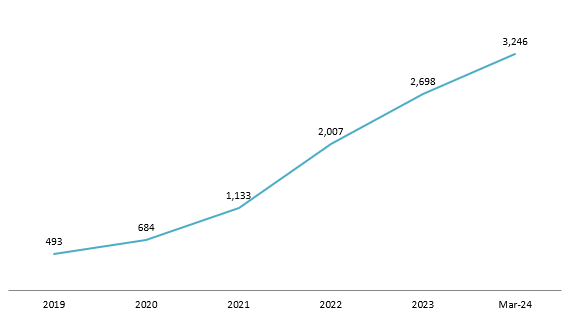

The number of chain drug stores nationwide reached 3,246 as of March 2024 , mainly due to the expansion of nearly 600 FPT Long Chau stores nationwide. In comparison with 2019, the number of chain drug stores has increased by approximately six times. Regarding operational locations, retail stores are predominantly concentrated in Ho Chi Minh City and Hanoi with an overwhelming number of stores. Additionally, the large chains tend to expand the number of stores to other provinces to cover all of Vietnam.

The rise of the pharmaceutical retail chain in Vietnam until March 2024 (Unit: stores)

Source: Q&Me and B&Company compilation

Key players in Vietnam pharmaceutical retail market

The pharmaceutical retail chain market is led by 3 local brands, including FPT Long Chau (1,614 stores), Pharmacity (899 stores), and An Khang Pharmacy (526 stores). Overall, the local brands dominate the recent market with 7 brands, while the remaining are one Japanese chain (Matsumoto Kiyoshi) and one Singaporean chain (Guardian).

| Name | Ho Chi Minh | Hanoi | Others | Total |

| FPT Long Chau | 280 | 180 | 1,154 | 1,614 |

| Pharmacity | 396 | 106 | 397 | 899 |

| An Khang Pharmacy | 149 | 27 | 350 | 526 |

| Guardian | 83 | 13 | 8 | 104 |

| Medicare | 10 | 0 | 59 | 69 |

| Phano Pharmacy | 12 | 0 | 3 | 15 |

| Matsumoto Kiyoshi | 6 | 2 | 0 | 8 |

| ECO pharma | 7 | 0 | 0 | 7 |

| Omi Pharma | 0 | 4 | 0 | 4 |

| Total | 943 | 332 | 1,971 | 3,246 |

Source: Q&Me and B&Company compilation

However, there is a difference in the types of products offered. While Vietnamese retail chains distribute a wide range of products, from medicines (both over the counter and prescription drugs), supplements, cosmetics, and home medical equipment, foreign retail chains are known for offering a diverse selection of supplements and cosmetics.

Matsumoto Kiyoshi

Source: VnEconomy

Matsumoto Kiyoshi is a leading retail chain specializing in pharmaceuticals and cosmetics in Japan, established in 1932 in Chiba under the name Matsumoto Yakuho. In Vietnam, Matsukiyo signed a joint venture agreement with Lotus Food Group (Hoa Sen Food Processing Joint Stock Company) to establish Matsukiyo Vietnam and opened its in 2020. Matsumoto Kiyoshi focuses on distributing beauty care products and supplements originating from Japan. Some notable brands that Matsumoto is distributing are Argelan, Recipeo, The Retinotime, and Spirulina. . All stores are located in major shopping malls. In terms of sales methods, Matsumoto Kiyoshi offers both in-store sales and online sales via the e-commerce platforms Shopee and Lazada.

Omi Pharma (Ominext Group)

Source: Omi Pharma’s website

Omi Pharma is a member of Ominext Group, a Vietnamese technology company specializing in healthcare and medical information for the Japanese market. With 15 years of experience and deep expertise in healthcare for a demanding market like Japan, they have launched a pharmacy chain with a Japanese-inspired style in 2019. Omi Pharma distributes products originating from Japan including functional food, health food, baby products, etc from various brands such as DHS, Unicharm, Hatomugi, Tanaphar, Elaphe, Yao City, PH Japan, DEVE, PHARMAACT, SELECT, KOSÉ, Pigeon. The company envisions each pharmacy as a mini healthcare station, styled like a convenience store, offering a variety of products and services such as health measurement tools, health check-ups, preventive health information, and consultations. In terms of store locations, Omi Pharma has 4 stores in Hanoi, with 3 located in shopping malls. For sales methods, Omi Pharma offers both direct purchases and online shopping through its website or the OmiCare app.

Consumer behavior shifts following the rise of the pharmaceutical retail chain

Instead of opting for private pharmacies, consumers in big cities tend to visit chain pharmacies due to the assurance of quality and the wide variety of medications available.

Additionally, customer service through the website or social networking service like Zalo provided by pharmaceutical retail chain offers greater convenience for consumers when seeking consultations, prescriptions, or purchasing medication.

Online purchasing is another promising point that differentiates private pharmacies and pharmaceutical retail chains. While customers may need to go directly to the private pharmacies, with pharmaceutical retail chain, customers can order from the website or EC platform and even upload the prescription on the website to check if the brands have the medicines that they need.

Example of private pharmacy in Vietnam

Source: Suc Khoe va Doi Song

As consumers’ increased focus on health, leading to a shift from reactive healthcare to proactive prevention as a way to safeguard their health. As a result, when purchasing pharmaceuticals, consumers are not only seeking medications for illness treatment but are also proactively looking for functional foods and supplements to enhance and maintain their well-being.

Challenges with pharmaceutical retail chain in Vietnam

Despite the continuous growth in the number stores of pharmaceutical retail chain, Vietnam’s pharmaceutical retail market is still largely dominated by private pharmacies or drug counters, both in urban and rural areas. According to a report by Vietdata (2022), the store number of pharmaceutical retail chain only took 3-5% of over 60,000 private pharmacies.

Another challenge is the competition among the pharmaceutical retail chains themselves due to the rising number of stores. Under market pressure, some brands such as An Khang Pharmacy (owned by MWG), plans to close around 200 pharmacies within its chain in 2024 (to focus on improving profitability and optimizing operating costs (The Leaders, 2023).

Additionally, pharmaceutical distribution remains restricted for foreign enterprises. According to Circular 34/2013/TT-BCT, foreign-invested pharmaceutical companies are allowed to import but are not granted distribution rights in Vietnam, except for pharmaceuticals produced by these companies within the country, which also applies to pharmaceutical businesses. This poses a significant barrier for foreign companies operating in Vietnam’s pharmaceutical market and explains why foreign pharmaceutical retail chains in Vietnam only distribute cosmetics and supplements.

Insights for business

Regarding pharmaceuticals, ensuring quality control and verifying products is a major concern for retailers and consumers. The pharmaceutical sector is known for its high customer loyalty. Once customers become accustomed to purchasing from a particular pharmacy chain, they tend to continue buying from that chain as long as the quality and service remain good. The key issue lies in whether the product supply is reliable in terms of variety, quality, and quantity.

Additionally, the pharmaceutical retail market in Vietnam is currently highly competitive, with numerous players both domestic and international. Among the pharmaceutical retail chains, the top three largest are all Vietnamese. To remain competitive, retailers must differentiate between product value and service. It’s not just a competition over products, but also a battle of scale.

The number of stores and brand recognition also play a significant role in influencing customers’ decisions on where to purchase pharmaceuticals. Currently, there is a growing demand for Japanese healthcare products, dietary supplements, and cosmeceuticals, which are widely available in many retail pharmacies. Major cities such as Hanoi and Ho Chi Minh City represent significant opportunities due to their large populations and high consumer spending power.

Given the intense competition and the dominance of local retail chains, Japanese companies should consider partnering with established pharmacy chains to enter the Vietnamese pharmaceutical retail market. By leveraging the extensive networks of these local chains, Japanese companies can effectively penetrate the market and reach a broad customer base. This strategy not only enhances market presence but also taps into the existing customer loyalty and distribution channels of these retail partners.

Conclusion

In summary, Vietnam presents a promising pharmaceutical market, with increasing health expenditure over time. While most pharmacies are still privately owned, the network of chain retail stores is growing and gaining consumer acceptance due to their assurance of product quality and superior customer service. For Japanese companies interested in this market, it would be advantageous to consider partnerships with major pharmacy chains. Leveraging these chains’ extensive networks and enhancing service offerings, such as online consultations and customer support, can help build consumer loyalty in this highly competitive market.

| B&Company, Inc.

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |

Read other articles