Vietnam’s population is rapidly aging, with the number and proportion of elderly citizens rising steadily, especially in urban areas. This demographic shift is fueling increasing demand for nursing homes and senior care services, presenting significant growth opportunities in the nursing home market.

Overview of Vietnam’s Ageing Population

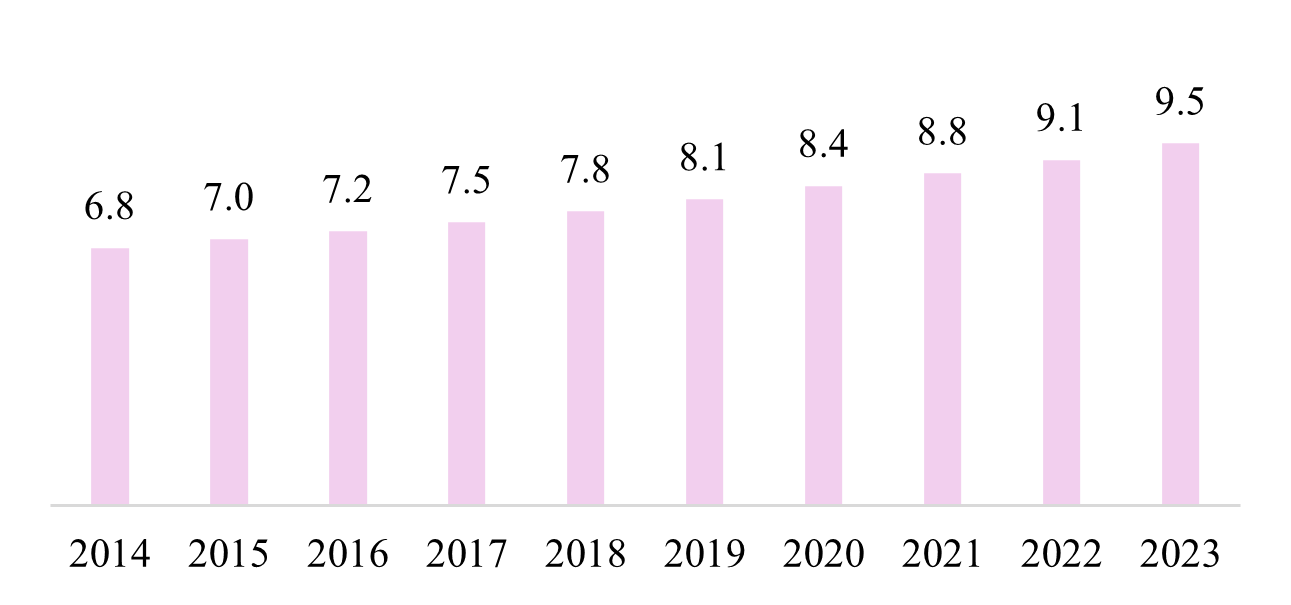

Vietnam is experiencing one of the fastest rates of population ageing in the world. According to Statista, the population aged 65 and above increased from 6.8% of the total population in 2014 to 9.5% of the total population in 2022.

Share of the population aged 65 and older in Vietnam from 2014 to 2022

Unit: %

Source: World Bank

In addition, the United Nations Population Fund (UNFPA) projects that by 2036, Vietnam will enter the aged society stage, with people aged 60 and above accounting for 20% of the population or those aged 65 and above making up 14%. By 2049, Vietnam will become a super-aged society, with people aged 60 and above constituting 25% or those aged 65 and above comprising over 20% of the total population[1].

The ageing trend is more pronounced in cities due to a combination of factors, including urbanization, migration of younger people from rural to urban areas, and declining birth rates. Currently, there are significant disparities in birth rates across regions, with 21 provinces and cities experiencing low birth rates, particularly in the Southeast, Mekong Delta, and Central Coast regions. Given the ageing population situation, the growing number of seniors, many of whom lack a spouse or do not live with their adult children, is driving up demand for health care and support services, including nursing homes[2].

Rising Trend of Nursing Homes

Given such an aging population situation, the swelling ranks of seniors, many of whom lack a spouse or do not live with their adult children, is driving up demand for health care and support services, including nursing homes. While still a relatively new concept in Vietnam compared to Western countries, nursing homes are becoming an increasingly common solution for families struggling to care for elderly relatives. The majority of these homes are concentrated in major cities like Hanoi, Ho Chi Minh City, Danang, and Can Tho. Some popular players in Vietnam’s nursing home market include Binh My Nursing Home, Thi Nghe Nursing Center, and Damoca Premium Nursing Home.

Thi Nghe Nursing Center in Ho Chi Minh City

Source: Doctorscare

As Vietnam grapples with the challenges of an ageing population, there is significant potential for collaboration with Japan, a country that has been at the forefront of addressing this issue. The Japanese nursing home model has been adopted in Vietnam. Phuong Dong Asahi Nursing Home in Hanoi, developed and operated by the Phuong Dong Medical Complex, is one of the facilities applying this 5-star Japanese-style model. Located on a 10-hectare campus, Phuong Dong Asahi is equipped with advanced facilities from Japan and other countries. It has a team of well-trained, dedicated medical staff providing healthcare and lifestyle services to over 400 elderly residents. Launched in late 2023, the home offers not just healthcare, but also premium retirement amenities like Onsen baths, massage, spa, restaurants, entertainment, and green spaces for the residents to enjoy their golden years, etc.

Services at Phuong Dong Asahi Nursing Home

Source: Congly

Challenges

Despite the emerging trend, the supply of nursing home services in Vietnam still falls far short of growing demand, even as the country enjoys an ample labor pool of trained nurses and caregivers. In 2024, the country had only nearly 100 private nursing homes, in addition to government-run facilities. Challenges also remain in improving the quality and affordability of nursing homes. Many facilities suffer from outdated infrastructure, a shortage of qualified medical staff, and high operating costs. Cultural attitudes that attach a stigma to “abandoning” elderly relatives to institutions, coupled with the strained finances of many families, also limit demand.

Outlook for the Future and Insight for Business

As Vietnam’s population ages, nursing homes is expected to play an increasingly critical role in meeting the diverse, growing needs of seniors. Nursing homes in the future are likely to adopt more of a community-based approach, with service models aimed at helping residents maintain a sense of normalcy, social connections, and independence. Intergenerational programs bringing together seniors and youth, pet therapy initiatives, cooking and gardening clubs, and regular outings can all contribute to more vibrant nursing home environments.

Insight for business

Given such supply shortage, filling the supply-demand gap signals immense potential for growth in the nursing home industry. Regarding quality improvement, nursing home services are suggested to develop towards the following approach. Firstly, creating communities geared toward optimizing the quality of life for residents will be key. Secondly, incorporating “smart” technologies will also be essential to providing effective, efficient care. Electronic health records, remote monitoring systems, online communication platforms, and mobile applications can all enhance healthcare delivery, safety, and family connections for nursing home residents.

Conclusion

In conclusion, Vietnam’s rapidly ageing population presents both challenges and opportunities for the country’s developing nursing home market. The growing demand for quality senior care services, particularly in urban areas, highlights the need for increased investment and development in the sector. Collaboration with international partners, a focus on providing high-quality care, and addressing cultural and infrastructural challenges will be key to the sustainable growth of the nursing home market.

As Vietnam navigates the complexities of its demographic shift, prioritizing the development of a compassionate and innovative senior care industry will ensure that its elderly citizens receive the dignified care they deserve while also fostering economic growth and social progress. The successful evolution of Vietnam’s nursing home market will serve as a testament to the country’s commitment to the well-being of its ageing population and its ability to adapt to the changing realities of the 21st century.

[1] https://www.tapchicongsan.org.vn/web/guest/thong-tin-ly-luan/-/2018/910502/gia-hoa-dan-so-o-viet-nam–thuc-trang%2C-xu-huong-va-khuyen-nghi-chinh-sach.aspx

[2] https://tienphong.vn/viet-nam-co-toc-do-gia-hoa-dan-so-nhanh-nhat-the-gioi-post1654112.tpo

| B&Company, Inc.

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |