28Mar2025

Latest News & Report / Vietnam Briefing

Comments: No Comments.

Vietnam’s medical device manufacturing industry has been experiencing rapid growth in recent years, driven by increasing healthcare demands, technological advancements, and significant foreign investment. The country has become an attractive destination for foreign investors seeking opportunities in the medical device sector.

Overview of the Medical device manufacturing industry in Vietnam

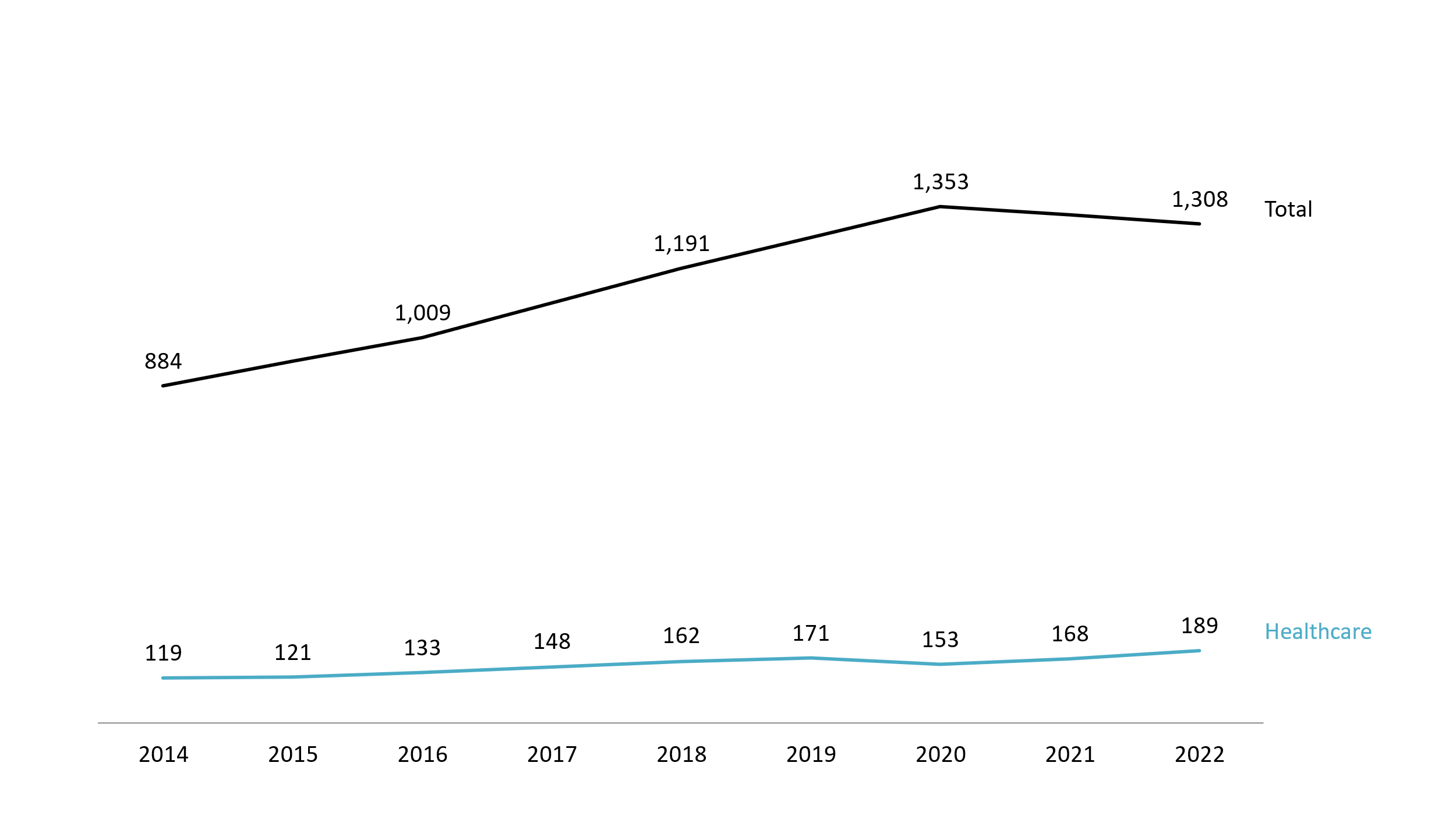

Vietnam, with an aging population and rising expenditure for healthcare from both citizens and the government, presents a burgeoning market and drives the growth of the medical device manufacturing industry. The population has been growing older as the number of elderly people increased from 9.5 million in 2014 to 14.2 million in 2024[1], and its proportion is expected to increase from 14% in 2024 to a fourth of the total population by 2050[2]. While this elder group poses the greatest demand and spending potential, increasing demand for healthcare services is shared among the general population. In particular, from 2020 to 2022, annual total expenditure per capita decreased by 3.3% nationwide and 13.5% in urban areas[3], but spending for healthcare increased by nearly 25%, from 153 USD to 189 USD.

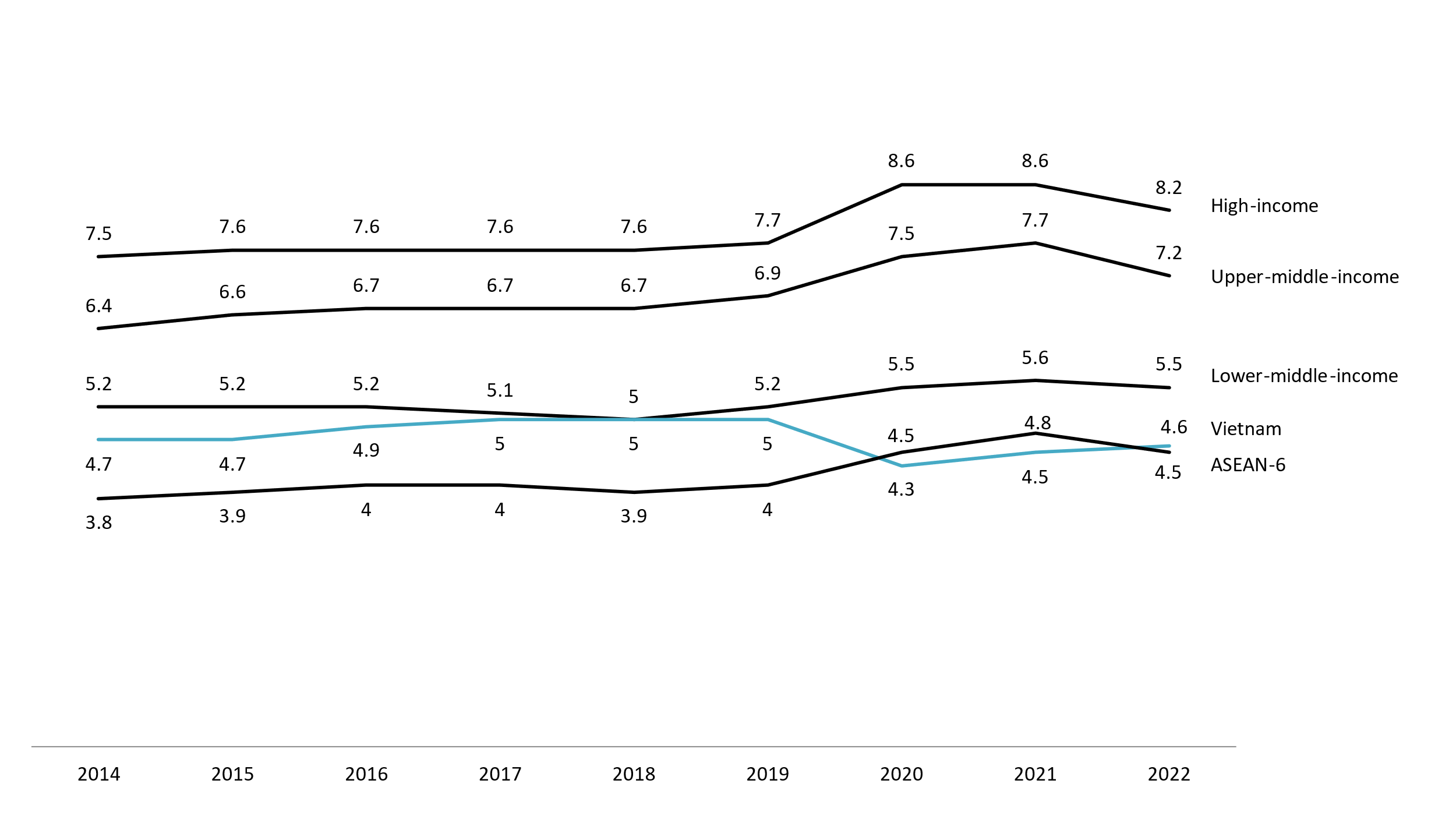

Vietnam’s expenditure for healthcare per capita, from 2014 to 2022

Unit: USD

Source: WHO Global Health Expenditure Database, GSO, B&Company’s Synthesis

With such drivers, Vietnam’s medical equipment market expects a substantial growth in the near future. The market is estimated to be 1.67 billion USD at the end of 2023, making it the 8th largest in the Asia-Pacific region[4], and is projected to reach 2.1 billion USD by the end of 2026[5], with a CAGR of 8%.

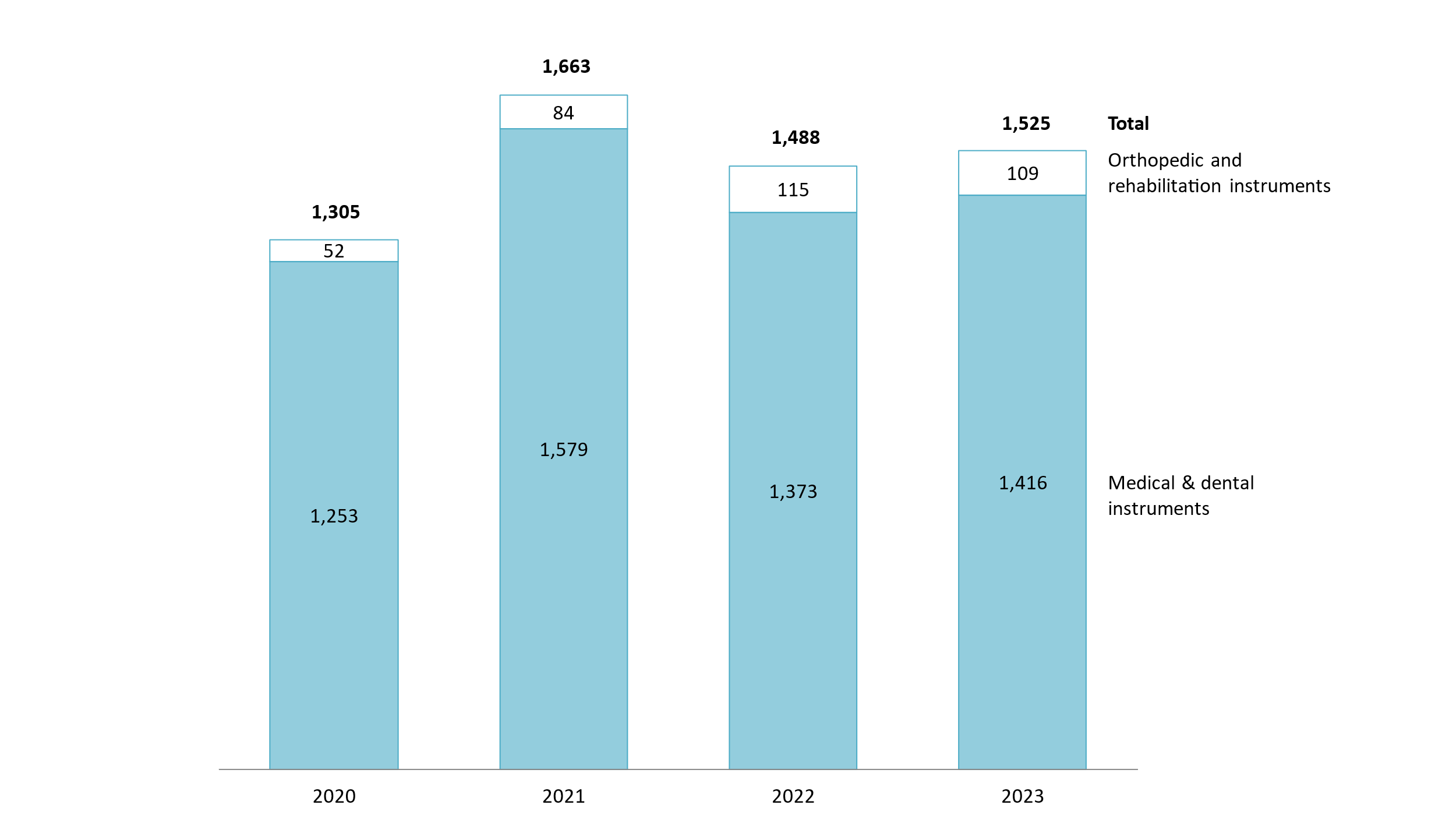

According to B&Company Vietnam’s Enterprise database, the industry has a total of 588 companies with a total net revenue of 1,525 million USD. According to Decision No. 27/2018/QD-TTg[6], the industry can be divided into two sub-industries[7], which are:

(1) Manufacturing of medical and dental instruments and supplies (VSIC code 32501) includes the production of essential diagnostic, surgical, and therapeutic equipment such as dental chairs, syringes, and endoscopic devices. 484 companies in the sub-industry generated the majority of the medical device manufacturing industry’s revenue with 1,416 million USD in 2023, or 93% of total revenue.

(2) Manufacturing orthopedic and rehabilitation instruments (VSIC code 32502) focuses on the production of prosthetics, orthopedic implants, mobility aids, and rehabilitation devices. In 2023, the sub-industry had a total of 104 companies, posting a net revenue of 109 million USD.

Net revenue of the Medical device manufacturing industry in Vietnam, from 2020 to 2023

Unit: million USD

Source: B&Company Vietnam’s Enterprise Database

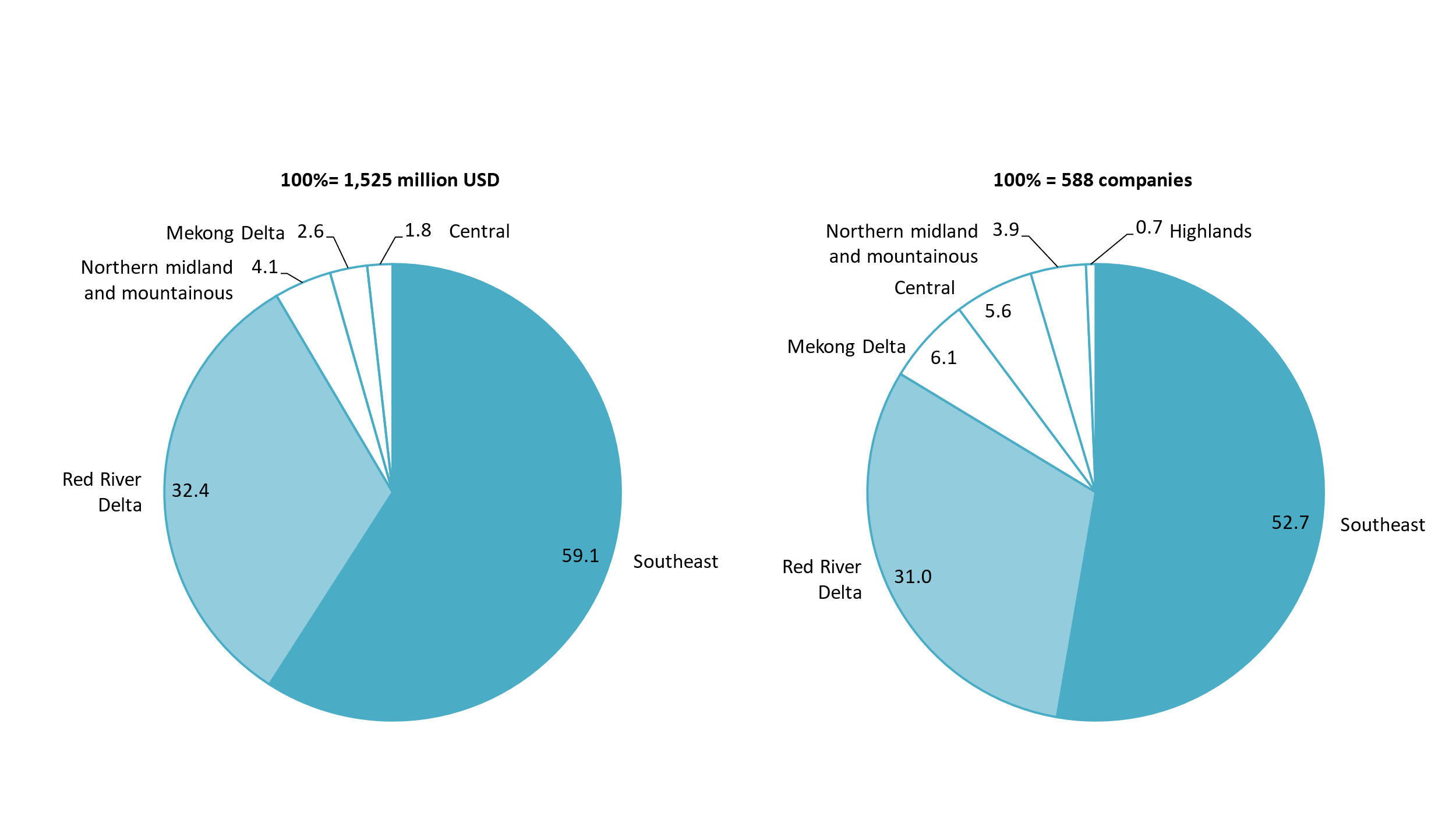

The industry is heavily concentrated in the Southeast and Red River Delta, as both regions accounted for over 91% of the industry’s total net revenue in 2023. Binh Duong led the nation in net revenue in 2023 with 466 million USD, accounting for 31% of the industry’s total, followed by Ha Noi (420 million USD-28%), Dong Nai (297 million USD-20%), and Ho Chi Minh City (134 million USD-9%).

Net revenue and company number of Vietnam’s medical device manufacturing industry by region in 2023

Unit: %

Source: B&Company Vietnam’s Enterprise Database

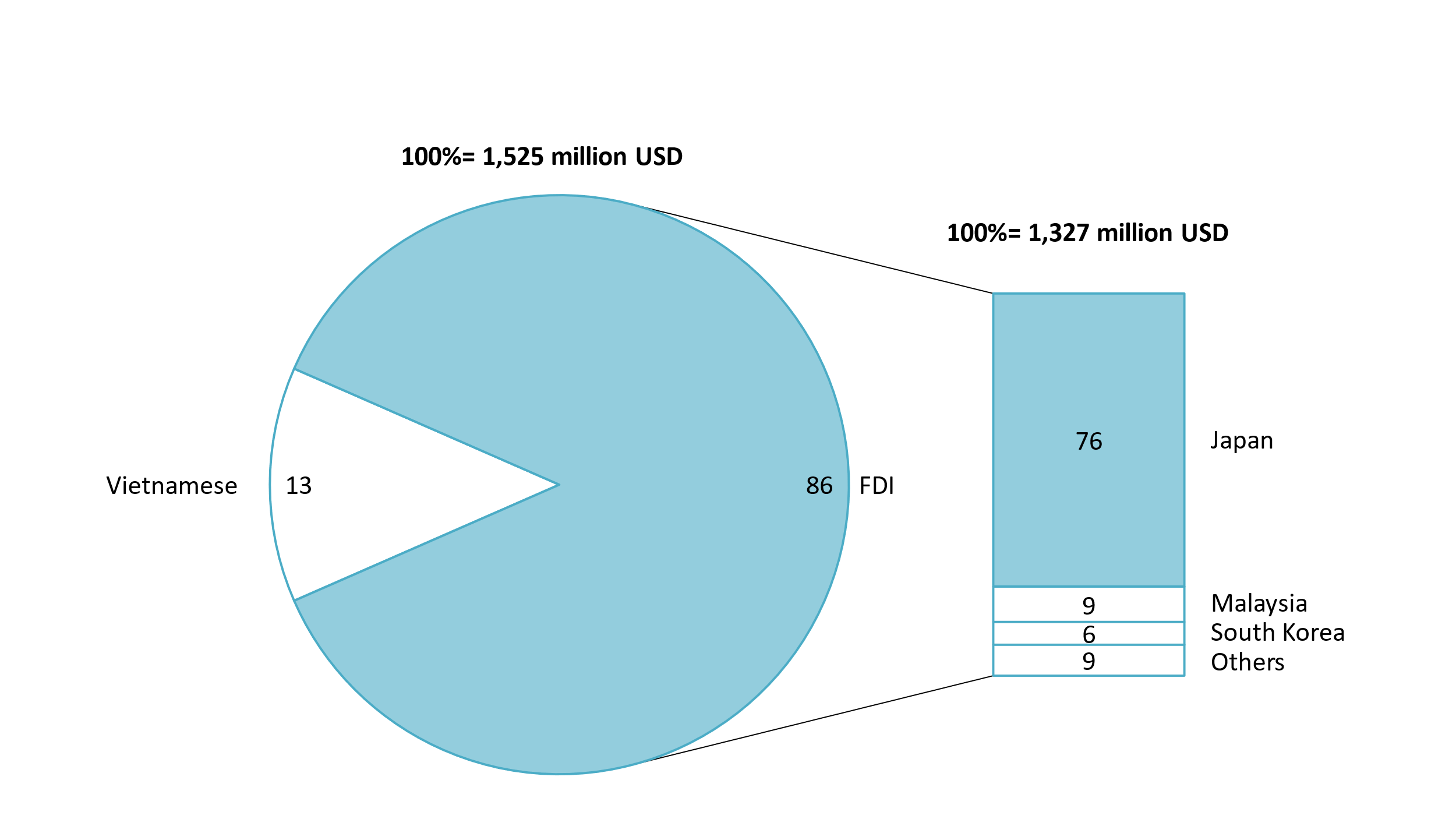

Foreign investment in Vietnam’s Medical device manufacturing industry

Foreign investment plays a critical role in the development of Vietnam’s medical device manufacturing industry. The MoH highlighted that Vietnamese manufacturers are mainly small and micro-sized businesses[8], limiting their capability in R&D investment and high-tech production[9]. Consequently, FDI companies dominate the market, generating over 1,300 million USD in 2023. Among them, Japan led in both number of companies and net revenue in 2023, with many leading manufacturers in the industry (Table 1).

Net revenue of Vietnam’s medical device manufacturing industry by source of investment in 2023

Unit: %

Source: B&Company Vietnam’s Enterprise Database

Table 1: Leading medical device manufacturing companies by net revenue in 2023

| No. | Company Name | VSIC | Investing country | City/Province |

| 1 | Terumo BCT Vietnam Co., Ltd. | 32501 | Japan | Dong Nai |

| 2 | Terumo Vietnam Co., Ltd. | 32501 | Japan | Ha Noi |

| 3 | Hoya Lens Vietnam Co., Ltd | 32501 | Japan | Binh Duong |

| 4 | Omron Healthcare Manufacturing Vietnam Co., Ltd. | 32501 | Japan | Binh Duong |

| 5 | B.Braun Vietnam Co., Ltd. | 32501 | Malaysia | Ha Noi |

| 6 | Asahi Intecc Hanoi Co., Ltd. | 32501 | Japan | Ha Noi |

| 7 | Matsuya R&D (Vietnam) Co., Ltd. | 32501 | Japan | Dong Nai |

| 8 | Mani Hanoi Co., Ltd. | 32501 | Japan | Thai Nguyen |

| 9 | Nikkiso Vietnam, Inc. | 32501 | Japan | Ho Chi Minh City |

| 10 | Digital Age Dental Laboratories Co.,Ltd. | 32502 | United States | Binh Duong |

Source: B&Company Vietnam’s Enterprise Database

Inward foreign investment can be expected to be on the rise due to the rising demand domestically and the government’s policies. The Vietnamese government plans to allocate nearly one billion USD from 2021 to 2025 as medium-term investment capital for the healthcare sector to develop infrastructure, facilities, and equipment to support and improve the general health services for the public[10], adding in the growing demand from the aging population. In 2024, Ho Chi Minh City announced the Pharmaceutical Industry Development Project until 2030, with a vision for 2045[11]. This initiative aims to attract foreign investment by establishing a 338-hectare specialized industrial cluster for pharmaceutical and medical device manufacturing in Le Minh Xuan 2 industrial park, which is expected to be operational in 2031[12]. The MoH also encourages domestic production by developing policies and frameworks for better commercialization of medical devices manufactured locally, as well as relaxing bidding regulations for public hospitals[13].

Manufacturing medical devices and equipment at a factory in Vietnam

Source: Thanh nien

Opportunities and challenges

Vietnam’s medical device manufacturing industry is expanding, offering opportunities for both local and foreign companies. The government actively promotes foreign investment and domestic production through favorable policies. With domestic supply covering only 10% of demand, Vietnam remains heavily reliant on imports[14], creating a lucrative market for international investors.

While the medical device manufacturing industry in Vietnam offers strong growth potential, there are challenges manufacturers should notice and be prepared for. Healthcare spending is rising but remains low relative to GDP compared to similar economies, potentially limiting market expansion. Furthermore, the government imposes strict regulations on the supply and circulation certification of medical devices to ensure safety. Companies are required to register their products with the IMDA or provincial health departments depending on the classifications[15], which can take up to 2 to 3 years[16] to obtain valid documents. These regulatory hurdles may complicate production, distribution, and investment planning.

Current health expenditure as percentage of GDP of Vietnam and other country groups, from 2014 to 2022

Unit: %

Source: WHO

Conclusion

Vietnam’s medical device manufacturing industry is at a pivotal stage of growth, with significant foreign investment driving its expansion. While challenges remain, the country’s favorable investment climate and increasing healthcare needs make it a highly attractive destination for international medical device manufacturers.

[1] GSO. The trend of rapid population aging in Vietnam, current situation, and solutions <Assess>

[2] UNFPA. Vietnam – Aging <Assess>

[3] GSO. Statistical Yearbook of Vietnam – 2023 <Assess>

[4] Investment Newspaper. Vietnam medical device market attracting foreign investors <Assess>

[5] International Trade Administration. Vietnam Country Commercial Guide – Healthcare <Assess>

[6] Vietnam Government Portal. Decision No. 27/2018/QĐ-TTg establising the Vietnam Standard Industrial Classification System <Assess>

[7] We excluded companies under VSIC code 26600 – Manufacturing of irradiation, electromedical and electrotherapeutic equipment as they are usually classified as Manufacturing of computer, electronic and optical products.

[8] According to B&Compmany Vietnam’s Enterprise Database, small and micro-sized companies in the sector made up around 90% of total domestic companies in 2023 (526 out of 588 companies).

[9] MoH. Draft Proposal on “Development of the Domestic Medical Equipment Industry Until 2025 with a Vision to 2030” <Assess>

[10] Vietnam Government Portal. Decree No. 29/2021/QH15 on Medium-term Public Investment Plan for 2021 – 2025 <Assess>

[11] Ho Chi Minh City Government Portal. Decision No. 657/QD-UBND approving the Pharmaceutical Industry Development Project until 2030, with a vision for 2045 <Assess>

[12] The SaigonTimes. Establishing a Pharmaceutical Industrial Park in Ho Chi Minh City: What Incentives Do Businesses Need? <Assess>

[13] sGovernment News. Developing the Domestic Medical Equipment Industry <Assess>

[14] Investment News. 90% of Medical Equipment in Vietnam Relies on Imports <Assess>

[15] Vietnam Government Portal. Decree No. 98/2021/ND-CP on the Management of Medical Equipment <Assess>

[16] Thanh nien. Locally Manufactured Medical Equipment Faces Fierce Competition from Imports <Assess>

* If you wish to quote any information from this article, please kindly cite the source along with the link to the original article to respect copyright.

| B&Company

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |