By: B&Company Vietnam

Industry Reviews

Comments: No Comments.

Overview of Vietnam Electronics Retail Market

Vietnamese consumer electronics market has been underpinned by the country’s healthy economic growth and its tech-savvy young population. The market’s main products include audio & video electronics, household appliances, mobile phones, digital cameras & other gadgets[1].

During 2014-2018, retail sales of consumer electronics was at 13.8% CAGR, with forecasted sales of VND169.8 trillion (~USD7.5 billion) in 2020[2]. Amid the pandemic period (2019-2020), the CAGR dropped significantly to -0.98%. Nevertheless, this sector still managed to have a slight revenue growth of 0.2% in 2020[3].

Consumer Purchasing Behaviour

According to Deloitte’s Vietnam Consumer Survey (2019), the monthly household expenditure for consumer electronics accounts for 10% of total monthly household expenditure. In fact, 33% of Vietnamese respondents indicated that they would want to spend more on mid-tier mobile phones, digital cameras and other gadgets[4]. The spending trend is expected to continue growing strongly in 2021 as social distancing measures create an increasing demand for electronics devices to serve communication and working purposes.

Rising Demand of Electronics Devices During Pandemic Creates Growth Opportunity

Electronics retail sector has profited from the pandemic thanks to rising demand. This phenomenon is also evident in the mushrooming of electronics retailers and e-commerce activities.

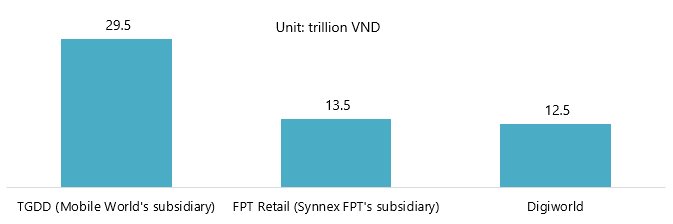

Net Revenue of Key Electronics Retail Shop in Vietnam (Mobile phone, Laptop, Tablet)

(2020)

Source: Companies’ financial reports 2020

Vietnam’s largest electronics retailer, TGDD (Mobile World’s subsidiary), reported the sales of over VND15.6 trillion in the first half of 2021, a year-on-year increase of 7%. Meanwhile, FPT Retail (Electronics retail shop of Synnex FPT) earned total revenues of over VND9 trillion in the same period, a 13% YOY growth[5].

Noticeably, in the smartphone sector, FPT witnessed a record high in iPhone sales with 5000 iPhone 13 sold on the first day of official launching. To aggressively increase its market share in Vietnam, Apple has made a strategic move to establish its authorised retailers (07/2020), minimizing the price gap and launching time between Vietnam and other countries[6]. Meanwhile, Samsung has announced its plan to expand production in Vietnam to meet the increase demand for smartphones[7] (09/2021) .

As a part of the strategy to quickly expand its operations and increase market share, leading retailer Mobile World has recently launched a collaboration program with small retailers, offering a commission of 5-20% for each product sold. This model brings a number of benefits to small retailers such as: no investment needed, no store inventory, diversify product portfolio, etc. As for customers, they can buy the product at a standardised price listed on Mobile World’s website, enjoy its after-sales and warranty policies[8]. Mobile World’s priority is to expand to remote areas where they have not had any retail outlet and only small electronics retailers are available[9]. The business collaboration model is expected to affirm the pioneering position of Mobile World.

With the long pandemic going so far, the “new normal” may not be temporary but transform into a new lifestyle of the post-pandemic era. This consequently would continue boosting the demand for electronics products as people have adapted to the new habits and realised they can do many things remotely and virtually.

[1] https://www2.deloitte.com/content/dam/Deloitte/sg/Documents/consumer-business/sea-cb-vietnam-consumer-survey-2020.pdf

[2] https://hkmb.hktdc.com/en/1X0AJMJN/hktdc-research/Vietnam%E2%80%99s-Consumer-Electronics-Market-Online-and-Offline-Sales-Channels

[3] https://www.statista.com/forecasts/1246666/vietnam-consumer-electronics-market-revenue-growth

[4] https://www2.deloitte.com/content/dam/Deloitte/sg/Documents/consumer-business/sea-cb-vietnam-consumer-survey-2020.pdf

[5] https://e.vnexpress.net/news/business/companies/h1-surge-in-phone-laptop-sales-4338575.html

[6] https://cafef.vn/fpt-shop-doanh-so-iphone-13-pha-ky-luc-voi-5000-may-thu-ve-200-ty-dong-tu-apple-fan-chi-trong-1-ngay-20211023171817889.chn

[7] https://vnexpress.net/samsung-du-dinh-mo-rong-nha-may-tai-viet-nam-4350996.html

[8] https://thanhnien.vn/mo-hinh-moi-cua-the-gioi-di-dong-tieu-thuong-vung-sau-khong-nen-bo-qua-post1069548.html

[9] https://e.vnexpress.net/news/business/companies/mobile-world-works-with-small-electronics-retailers-to-expand-reach-4278164.html