12Nov2025

Latest News & Report / Vietnam Briefing

Comments: No Comments.

Vietnam’s logistics industry underpins trade, industrial production, and broad-based growth. Strong fundamentals—strategic geography, expanding infrastructure, and the rise of electronic commerce—are reshaping networks and raising service expectations. In October 2025, the Government approved a national strategy that will guide the sector through the next decade and beyond, creating new opportunities and obligations for international capital and operators.

Overview of the Vietnam Logistics Market

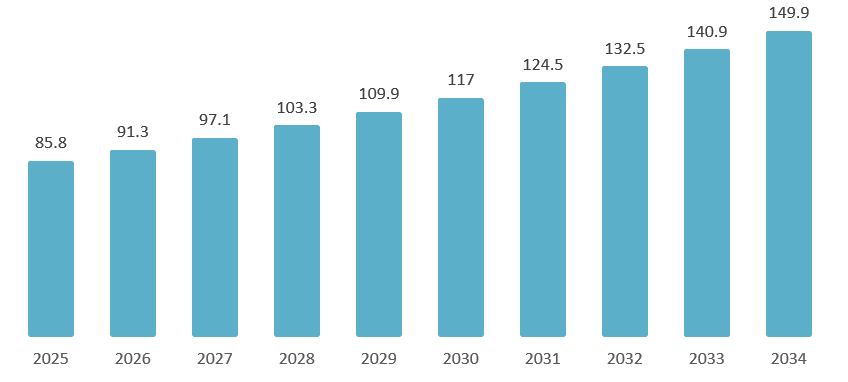

Vietnam’s logistics market is expanding rapidly. With the double-digit growth of the logistics service industry over the past years and contributing about 5.17% of Vietnam’s GDP by 2024, logistics is becoming one of the most dynamic service industries in the economy[1]. According to the Vietnam Logistics Market Size & Share Report 2025–2034, the market is projected to grow at a CAGR of 6.4% during 2025–2034, reaching approximately 149.9 billion USD by 2034[2].

Vietnam Logistics Market Forecast (2025–2034)

Unit: Billion USD

Source: Vietnam Logistics Market Size & Share Report 2025–2034, Expert Market Research

Besides that, Vietnam’s Logistics Performance Index (LPI) ranked 43rd out of 139 countries in 2023, up 21 places from 2016 — positioning the country among the leading emerging logistics markets[3]. The boom of e-commerce has become a key driver of logistics demand in Vietnam. Over the past several years, the e-commerce sector has consistently maintained an annual growth rate of 16–30%, sustaining strong double-digit expansion[4].

The rapid development of e-commerce has created strong demand for logistics services, particularly in transportation and warehousing. Vietnam is investing heavily in infrastructure to enhance national logistics capacity. Key projects such as Long Thanh International Airport, the expansion of Cai Mep–Thi Vai Port, and the North–South Expressway are improving connectivity between major economic centers and seaports[5].

Long Thanh International Airport is being rushed into construction

Source: Vietnamplus

Key Changes in Vietnam’s logistics service development strategy for the period 2025 – 2035, with a vision to 2050

In terms of policies and incentives, the government has launched the Logistics Development Strategy 2025–2035 (Vision 2050), focusing on building regional logistics hubs, promoting multimodal transport, and encouraging private and foreign investment in the logistics sector[6]. The new strategy broadens the vision and time horizon: instead of focusing only on an action plan to 2025 as before, it now sets long-term goals to 2050, laying the foundation for continuous and sustainable progress. At the same time, it adds two key pillars alongside the priorities of growth and cost optimization:

– Digital transformation with clear milestones – 80% of enterprises adopting by 2035, 100% by 2050

– Green transition aligned with the Net Zero goal, promoting clean energy use and environmental protection.

The new strategy is more realistic about the pace of growth but more ambitious about efficiency and service quality. Several sector indicators in logistics have been adjusted accordingly as follows:

Table: Key changes in some criteria in Logistics Development Strategy 2025–2035 (Vision 2050)

| No | Indicator | Old Strategy

(2025) |

New Strategy

(2025–2050) |

Remarks | |

| 2025 – 2035 | 2050 | ||||

| 1 | Annual growth | 15%–20% | 12%–15% | 10%-12% | Growth is set more realistically to align with infrastructure capacity and market maturity. |

| 2 | Outsourcing share | 50%–60% | 70%–80% | 80%-90% | Higher outsourcing targets deepen specialization and ecosystem strength |

| 3 | Logistics cost/GDP | 16%–20% | 12%-15% | 10%-12% | Savings come from digitalization, the intermodal shift, and streamlined borders. Lower logistics intensity strengthens export competitiveness. |

| 4 | LPI ranking | Top 50 | Top 40 | Top 30 | Reflects improved reliability, transparency, and connectivity. Reforms are needed on infrastructure bottlenecks and data sharing. |

| 5 | Contribution to GDP | 8%–10% (broad share) | 5%–7% (Value Added) | 7%–9% (Value Added) | Switching to VA better captures real sector strength. Focus moves to high-value services |

| 6 | Infrastructure: modern logistics centers | Not specified | At least 5 centers | At least 10 centers | Concrete numbers enable site planning, hub-and-spoke design. Must tie locations to corridors/ports and set performance standards |

| 7 | Workforce: professional training & degree ratio | Generic upskilling (no numeric targets) | 70% with specialized professional

30% with a university degree or higher |

90% with professional training

50% with a university degree or higher |

Quantified targets shift from “encouragement” to measurable capability. Needs competency frameworks, accredited programs, and industry placements to close skill gaps. |

B&Company’s Synthesis from Decision 200/QD-TTg in 2017 and Decision No. 2229/QD-TTg dated October 9, 2025.

Impacts of Decision No. 2229/QD-TTg (October 9, 2025)

The new strategy shifts the focus from “rapid increase in scale” to “sustainable increase based on efficiency”, thereby expecting to reduce service costs, improve service reliability, and export competitiveness. When the target is quantified and unified between ministries, branches, and localities, the policy chain will be more consistent: prioritizing corridors with large spillover effects, reducing resource dispersion, and limiting “bottlenecks” at ports, border gates, and logistics cities.

At the operational level, specialization and expansion of outsourcing will promote the development of the logistics outsourcing ecosystem, leading to service standards, data transparency, and pressure to improve customer experience (speed, accuracy, traceability). The synchronization between transport infrastructure, trade, and digital helps multimodal transport to be more substantial, shortening delivery times, supporting agricultural products, and e-commerce. Domestic enterprises have the opportunity to participate more deeply in value-added stages, instead of just competing on freight rates.

The two pillars of digitalization and green transformation create new operational “disciplines”: standardized processes, interconnected data, and analytics-based decision-making, while reducing environmental compliance risks and opening up to the “greening” global supply chain. However, the positive impact depends heavily on implementation: institutional reforms (PPP, cross-border procedures), shared data standards, investment risk-sharing mechanisms, and a skills framework – vocational certification linked to business internships. If these conditions are met, the strategy will create momentum to reduce system costs, improve service quality, and enhance the international position of Vietnam’s logistics in the long term.

Implications for foreign investors

The most prominent opportunities lie in the outsourced logistics and in value-added services. Companies that can design networks, manage cost-to-serve by customer, and integrate end-to-end data will have an advantage. High-potential segments include e-commerce fulfillment, last-mile delivery in urban areas, express transit, and returns management.

Infrastructure and logistics centers also open multiple avenues. Investors can participate through public–private partnerships, joint ventures with domestic partners, or private investment in regional logistics centers, inland container depots, bonded warehouses, cold storage, and nodes near seaports, airports, or railway stations. Site selection should follow major transport corridors and large industrial clusters to reach scale early.

The push for digitalization creates room for technology solutions. The market needs warehouse management systems, transport management systems, order management systems, equipment for tracking vehicles and cargo, and data connections with customs authorities and customers. A model that combines technology and operations enables rapid scaling without heavy asset ownership at the beginning.

The green transition is becoming a condition in bidding and contracts. Investors can differentiate through energy-efficient fleets, pilot use of electric vehicles on short routes, rooftop solar for warehouses, and efficiency upgrades for cold storage. Certifications for green warehouses and green fleets will improve technical scores with export-oriented clients.

For market entry, investors should select a gateway region together with a few priority sectors—for example, the Hanoi–Hai Phong corridor or the Ho Chi Minh City–Ba Ria Vung Tau–Dong Nai–Binh Duong cluster—and focus on electronics, textiles and garments, fast-moving consumer goods, or cold chains. Long-term contracts with anchor customers help achieve scale early and reduce risk.

Joint ventures with domestic partners are a practical path. Vietnamese partners understand procedures and land access, while foreign investors contribute management experience, technology, and environmental standards. In parallel, data and service-level agreements should be standardized from the outset, with clear indicators for on-time and in-full delivery, delivery time, damage rates, and transparent bonus–penalty mechanisms. Finally, closely monitor policy implementation timelines, land procedures, and cybersecurity requirements, and set aside a training budget for a digitally capable workforce to ensure long-term service quality.

* If you wish to quote any information from this article, please kindly cite the source along with the link to the original article to respect copyright.

| B&Company

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |

[1] Hanoimoi. The size of Vietnam’s logistics market is currently about 45-50 billion USD <Access>

[2] Expert Market Research. Vietnam Logistics Market Report <Access>

[3] World Bank. Logistics Performance Index 2023 – Report <Access>

[5] MN Shipping. Vietnam’s logistics boom: infrastructure investments, e-commerce growth, and rising costs in 2024 <Access>

[6] Thuvienphapluat. Decision 2229/QD-TTg (09/10/2025) <Access>