Overview of the Vietnam Confectionery Market

The confectionery market in Vietnam is consistently seen as a promising sector due to the country’s rapidly growing population, rising average consumer income, and the frequent celebration of festivals and holidays throughout the year. Vietnam celebrates many festivals, such as the Lunar New Year, the Mid-Autumn Festival, and various religious and cultural holidays. These events drive high demand for gifts, and confectionery products are especially popular for gifting.

An example of a holiday gift set in Vietnam

Source: Shopee

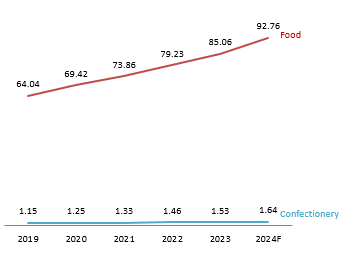

The Vietnamese confectionery market is projected to reach USD 1.64 billion by 2024. Compared to the food market in Vietnam, which is primarily dominated by bread and cereal products, the confectionery segment is smaller but still noteworthy with a compound annual growth rate (CAGR) of 7.3%, nearly matching the food market’s CAGR of 7.6% during the 2019-2024 period. The leading segment in the confectionery market is baked goods and biscuits, followed by candies, ice cream, and finally chocolate.

Revenue of confectionery and food market in Vietnam 2019-2024F

Unit: Bil USD

Source: Statista

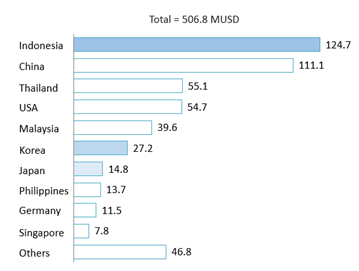

In Vietnam’s confectionery market, imported value is annually increased. According to Trademap data, Japan confectionery import increased 2.5 times from 2019 (7.4 Mil USD) to 2023 (14.8 Mil USD). The highest import value among confectionery from Japan in 2023 is Bread, pastry, cakes, biscuits (57%), the followings are sugar confectionery and chocolate (both are 19%), lastly, ice cream (5%). However, compared to other confectionery-exporting countries, Japan’s imports only accounted for 2.9% of the total imports and ranked 7th among the top 10 confectionery-exporting countries to Vietnam in 2023. The country where Vietnam imported the most confectionery was Indonesia, with an import value of 124.7 million USD. However, the most dominant confectionery brands in Vietnam are American and European, including Nestlé, Mondelez International, and Perfetti Van Melle. These brands have established production facilities in Indonesia and China specifically for export, which explains the higher import volumes from these countries compared to others. Just ahead of Japan is Korea, with the export value being twice that of Japan.

Top 10 confectionery exporters to Vietnam in 2023

Unit: Mil USD

Source: Trademap

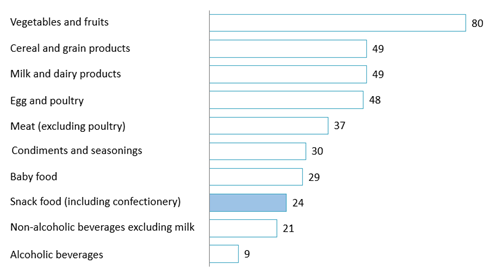

Overview of organic confectionery in Vietnam

The rise in income aligns with growing consumer interest in health-conscious choices. Euromonitor reports show that revenue from organic products in Vietnam increased by about 20% compared to 2020, reaching USD 100 million in 2022. Tetra Pak’s Index 2023 reveals that Vietnamese consumers are becoming more aware of their health and the environmental impact of their food choices. Daily staples like vegetables, fruits, grains, nuts, and dairy products are the most purchased organic items. A Rakuten Insight survey with 4,649 Vietnamese respondents revealed that 80% had purchased organic vegetables and fruits, followed by grains, nuts, and dairy products. Although organic confectionery is not yet a top priority for many, it is gaining traction. Notably, 24% of respondents reported purchasing organic confectionery and snacks at least once, signaling a growing interest in healthier snack alternatives within the organic food and confectionery markets.

Most important organic food categories among consumers in Vietnam in 2023

Unit: %

Source: Rakuten

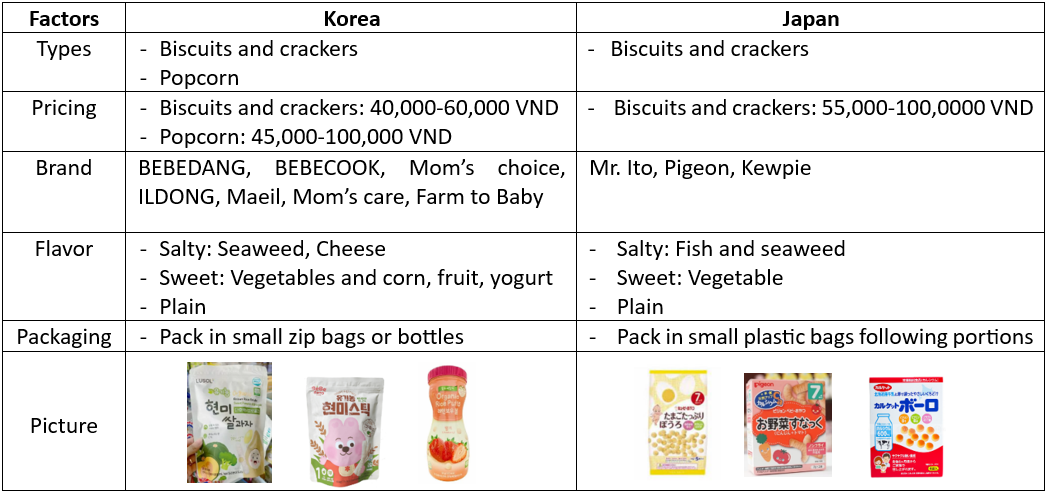

The organic confectionery market in Vietnam is largely driven by products for children, especially organic baby snacks. A search on the e-commerce platform Shopee reveals over 5,000 organic baby snack products, along with other organic items such as spices and pasta for children. Most of these organic confectioneries for children are imported from Korea and Japan. While Japanese organic confectionery tends to have fewer flavor options and higher prices, Korean products offer a wider variety of flavors at more affordable prices, catering to a broader range of consumer preferences. Additionally, the organic confectionery market in Vietnam also includes items like diet cookies, candies, gummies, chocolate, and ice cream, expanding the scope of healthy snack options available for Vietnamese consumers.

Comparison of organic baby snacks between Korea and Japan

Source: Compilation on Shopee

Organic products are typically distributed through supermarkets, mother and baby stores, and specialty import stores. Online sales have also significantly grown, providing a cost-effective option for consumers.

Organic products in Vietnam are mainly distributed through supermarkets, mother and baby stores, and specialty import shops. However, online sales have seen significant growth, providing a cost-effective and convenient option for consumers. The rise of livestream shopping and product links in videos has become a powerful marketing strategy, particularly for mother and baby brands. Brands are increasingly leveraging influencer marketing to boost sales. A 2023 Rakuten Insight survey found that 79% of Vietnamese consumers reported purchasing products based on influencer recommendations, underlining their influence on shopping decisions. There’s a growing trend where official brands and mother-and-baby supermarket chains collaborate with celebrities or influencers for livestream sales on e-commerce platforms like Shopee, Lazada, and TikTok Shop. For instance, the mother-and-baby chain Con Cung runs live streams across multiple platforms, including their website, app, and Shopee, while partnering with influencers, particularly mothers known as “hot moms.” These influencers help promote products via social media channels like Facebook and TikTok. The livestreams feature popular baby products such as baby feeding chairs, food processors, and organic baby food, offering a dynamic and engaging way to boost organic product sales.

Conclusion

Although the organic products market is growing, the organic confectionery segment remains significantly underdeveloped. This gap presents a major opportunity for Japanese brands to expand their offerings and meet the rising demand for healthier snacks in Vietnam. By introducing a broader variety of flavors and formats, and highlighting health benefits and eco-friendliness, Japanese confectionery brands can strategically position themselves in Vietnam’s expanding market. Utilizing both traditional retail and online channels, such as e-commerce platforms and livestream shopping, will allow Japanese brands to capitalize on the increasing demand for healthy snack options among Vietnamese consumers. This strategy will enable Japanese companies to cater to the preferences of a health-conscious market while strengthening their presence in the competitive organic confectionery sector.

| B&Company, Inc.

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |

Read other articles