06Jan2026

Latest News & Report / Vietnam Briefing

Comments: No Comments.

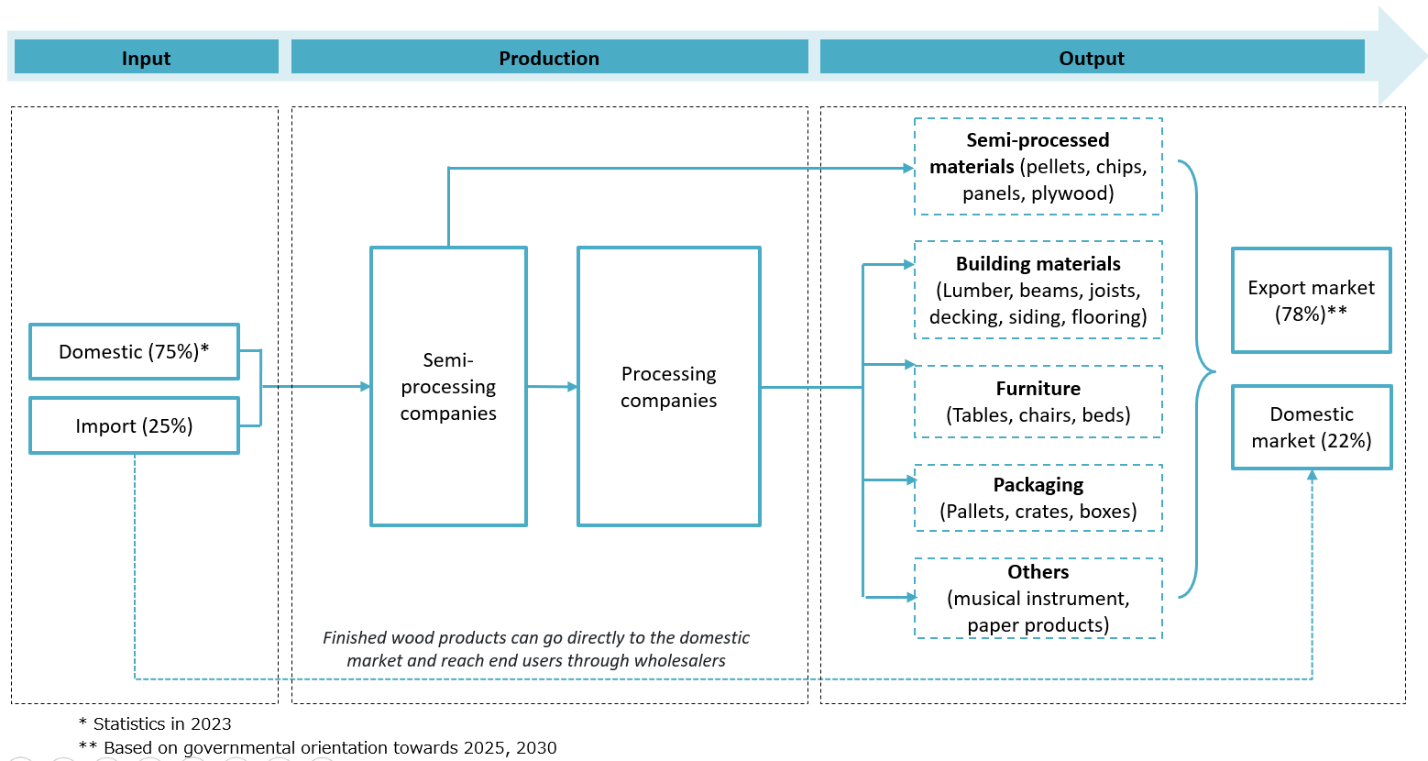

Vietnam’s timber market is a fast-growing sector driven by strong export performance and rising domestic demand. The value chain spans from input (including domestic and imported sources), primary processing, manufacturing, and then output, which serves both large global markets and rising domestic consumption. In this article, the wood import situation is examined to identify legal considerations and compliance requirements for foreign exporters. The geographical distribution of processing and distributing companies is then analyzed, followed by Vietnam’s export strengths and evolving domestic market trends. Finally, recommendations are suggested for foreign wood exporters seeking successful market entry and long-term competitiveness.

The value chain of Vietnam’s timber market

The supply chain in Vietnam timber market can be summarized as follows. Raw materials are sourced directly from domestic plantation forests and imported timber, accounting for 75% and 25% respectively[1]. Raw timber enters primary processing, where it is sawn, peeled into veneer, kiln-dried, or turned into plywood and other semi-finished materials. These materials flow into secondary manufacturing, a highly developed sector that produces furniture, interior components, flooring, packaging and craft products for both export and domestic use. Finished products move through wholesalers, exporters and distributors to two major markets: global export markets (78%) and the domestic market (22%)[2].

Vietnam timber value chain

Source: B&Company’s synthesis

Vietnam timber and wood products import

Current import situation

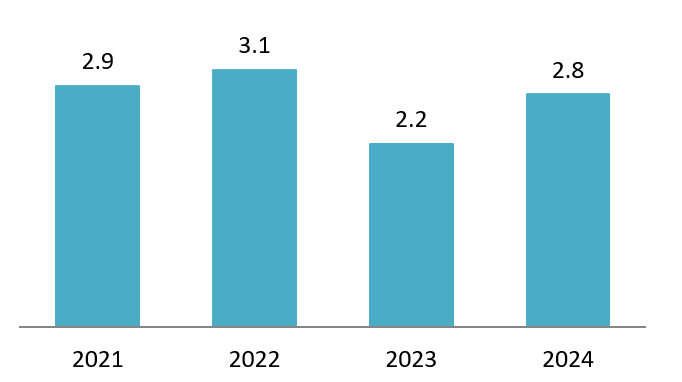

In 2024, Vietnam’s import value of timber and wood products reached over USD 2.8 billion, marking a strong 28.1% increase compared with 2023.

Vietnam import value of timber and wood products 2021-2024

Unit: USD Billion

Source: VIFOREST, FPA Binh Dinh, HAWA, BIFA, DOWA and Forest Trends

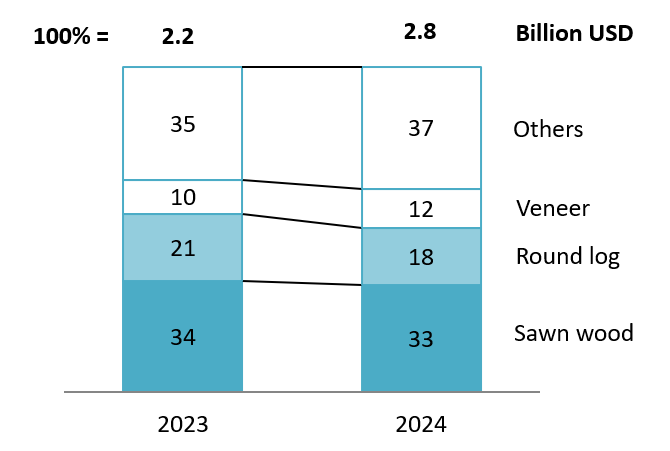

Vietnam’s wood-processing industry relies heavily on imported sawn wood and round logs, which together represented more than 50% of the total import value in 2024. Timbers from Vietnamese plantation forests mostly have small diameter, which could be used for veneer, providing input for plywood production. Importing is an important source for large diameter timbers which are commonly used for outdoor or indoor wooden products[3].

Imported timber and wood products value distribution 2023 -2024

Source: VIFOREST, FPA Binh Dinh, HAWA, BIFA, DOWA and Forest Trends

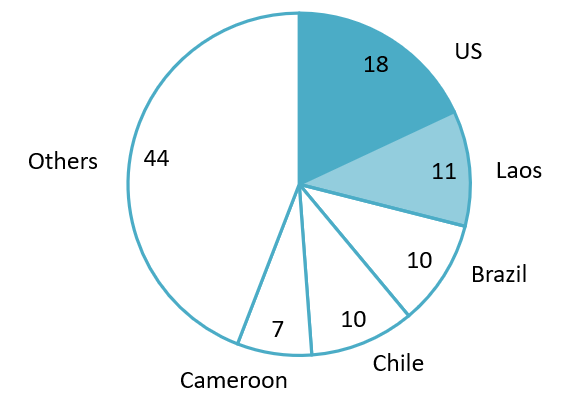

Sawn wood is the largest import category, accounting for 32.8% of Vietnam’s total wood import value in 2024. US, Laos, Brazil, and Chile remained the dominant suppliers.

Vietnam imported sawn wood origins distribution (2024)

100%= 923.1 million USD

Source: VIFOREST, FPA Binh Dinh, HAWA, BIFA, DOWA and Forest Trends

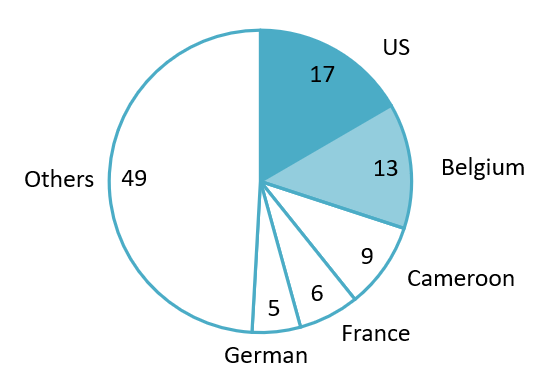

Round logs accounted for 17.7% of the total import value, remaining one of the two most critical raw materials for Vietnam’s wood-processing sector. The market was dominated by round logs from the US, Belgium, Cameroon, France and German, which account for 51% the total imported quantity.

Vietnam imported round logs origins distribution (2024)

100%= 497.8 million USD

Source: VIFOREST, FPA Binh Dinh, HAWA, BIFA, DOWA and Forest Trends

Legal considerations for importing timber and wood products

The core regulatory system is the Vietnam Timber Legality Assurance System (VNTLAS), which mandates proof that all imported timber has been harvested, processed, and exported legally. Under this system, exporters must provide complete legal documents, including forest-origin documents, harvest permits or forest management records, supply-chain traceability papers, sales contracts, invoices, packing lists, and a detailed timber declaration specifying scientific species names and volumes. These documents are checked at customs and must align with the requirements outlined in the Vietnamese government’s timber-import regulation[4].

In addition, the wood species should be checked to see whether in CITES (Convention on International Trade in Endangered Species of Wild Fauna and Flora) as endangered or regulated. Exporters could also refer to the list of imported wood species in Vietnam to check which species are currently allowed to pass the Vietnamese boundary[5].

Quarantine and phytosanitary measures are another consideration, based on the types of wood and how they have been processed. Vietnam requires a Phytosanitary Certificate for logs, green lumber, and any sawn wood retaining bark or biological matter. Timber and wood products are often classified under HS Code of chapter 44, the list of HS Code that requires plant quarantine treatment includes HS4403, HS4404, HS4406, HS4407, HS4415, and HS4421[6]. If plant quarantine is required, a sample of the products is taken according to the National technical regulation on phytosanitary sampling methods and sent to pest identification agents[7]. The heat treatment method is typically associated with the ISPM 15 standard, applying exclusively to wood packaging materials (e.g., pallets, crates) but not to finished wood products[8].

Vietnam also has a list of countries or regions recognized by Vietnam as compliant and actively exporting legal timber into the country under its timber legality assurance system. Among 51 countries spanning across 5 continents, Japan is one of them[9].

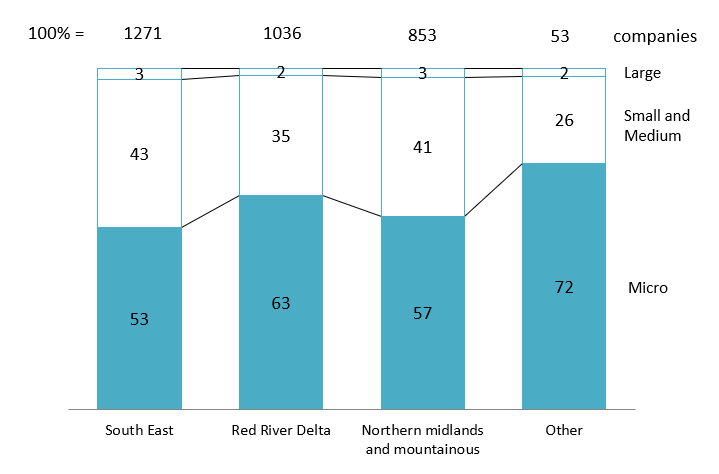

Wood processors and distributors in the market

In Vietnam, wood processors are mainly located in the Southeast region, the Red River Delta, and mountainous areas where forests are planted. Under the VSIC Code of 16210 (Manufacture of veneer, plywood and veneer panels) and 16220 (Manufacture of builders’ carpentry and joinery), most of them are micro-sized. The Southeast region has the largest proportion of small and medium processors, accounting for 43% of total regional processors. Mountainous areas also have 41% of regional processors being small and medium enterprises.

Wood processors in Vietnam (2023)

Source: B&Company enterprise database (VSIC code: 16210, 16220)

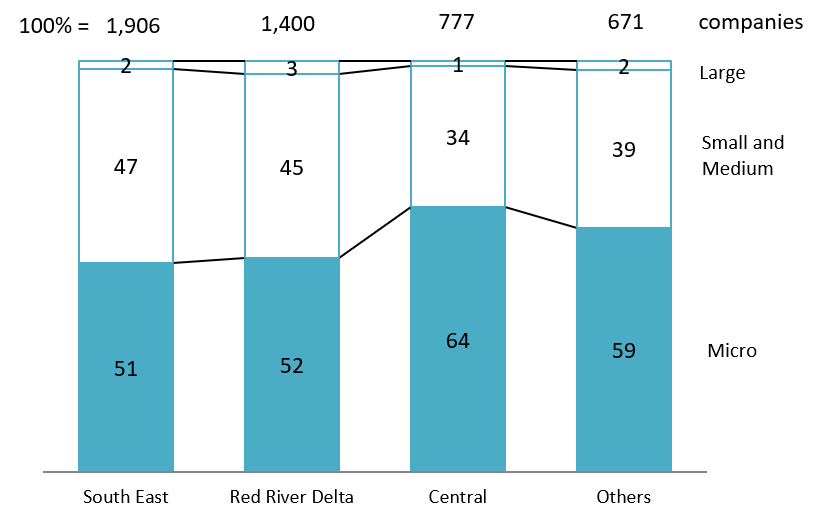

Vietnam’s wood market is served by a diverse network of distributors and wholesalers who act as the main link between foreign suppliers, processing factories, and domestic end users. Under the VSIC code of 46631 (Wholesale of bamboo, rough wood and processed wood as construction materials), there are around 5,000 companies of various sizes across Vietnam in 2023. 55% of them are micro-size, 43% are small and medium companies, leaving 2% (around 100 companies) are considered large. Those companies are mostly located in Southeast region (Ho Chi Minh, Binh Duong, Dong Nai provinces) and Red River Delta (Ha Noi, Bac Ninh, Nam Dinh provinces).

Wood wholesalers in Vietnam (2023)

Source: B&Company enterprise database (VSIC code: 46631)

In Vietnam, timber wholesalers are no longer focused solely on supplying low-cost domestically grown wood for the mass market, but are increasingly distributing high-quality imported species such as white oak, red oak, ash, walnut, beech, maple, pine, and alder. Representative distributors include Tavico (Tan Vinh Cuu), which is widely recognized as one of the leading timber importers and wholesalers in Vietnam, Nam Bac Timber, which specializes in imported hardwoods from Europe and the US, as well as Phuong Nam Wood, Lidowood, GreenEcoLife and My Duc Wood, all of which play an active role in supplying premium imported timber to furniture and interior manufacturers.

Vietnam wood export and domestic wood consumption

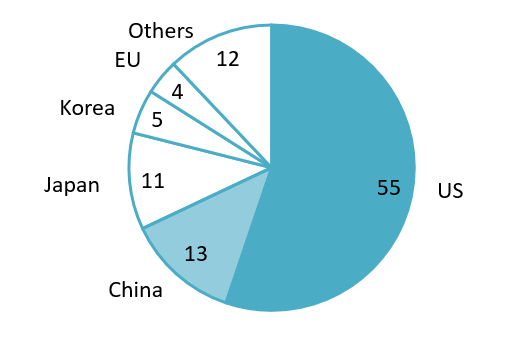

Vietnam’s timber and wood industry is one of the country’s most dynamic export sectors, reaching USD 16.3 billion in 2024. Vietnam’s main foreign market is the US, consuming over half of the exported timber and wood products. China is the second largest markets of Vietnam’s timber and wood products, accounting for 11% the export value. Other prominent markets include Japan and Korea, as well as countries from the EU. The government aims to expand this even further, targeting USD 20 billion in wood exports by 2025 and USD 25 billion by 2030[10].

Vietnam’s timber and wood products export value (2024)

100%= 16.3 billion USD

Source: VIFOREST, FPA Binh Dinh, HAWA, BIFA, DOWA, and Forest Trends

Vietnam’s primary strengths for exporting are wooden furniture, plywood, MDF (Medium Density Fiberboard), panel products, and innovative bamboo-based products[11]. Market demand is shifting toward sustainable, traceable, and certified timber, pushing Vietnam to expand its certified forest area and upgrade its supply chain. The country aims to have more than one million hectares of FSC-certified forest by 2030, aligning with global trends toward “green” and low-carbon wood products[12]. Many manufacturers are also moving toward high-value product lines and design-driven furniture to increase margins and reduce reliance on raw or semi-processed exports.

Alongside its strong global presence, Vietnam is witnessing a rapid rise in domestic demand for wood products, driven by rapid urbanization, infrastructure development, and a rising middle class with higher living standards. Wood consumption in the domestic market of 100 million Vietnamese citizens is projected to reach USD 5 billion by 2025, with further growth expected through 2030[13].

A key trend in domestic demand is the shift toward higher-value, domestically produced wood products, including furniture, construction materials, and decorative items, to meet both consumer preferences and government policies promoting local industries. The expanding urban markets and the guaranteed quality of domestically sourced plantation timber are driving this growth, although the industry continues to rely on imports for high-quality logs and exotic species, especially for premium furniture and construction applications[14].

The trend is toward integrating traditional craftsmanship with modern, sustainable technologies. As urban centers expand and the government promotes green building standards, the demand for sustainable, locally sourced wood in construction is expected to grow further. This development aligns with Vietnam’s long-term vision of expanding its domestic market while enhancing the global competitiveness of its wood industry.

Business implications and recommendations

Vietnam’s timber market presents opportunities for foreign exporters, supported by strong import demand, domestic consumption growth, and a deeply integrated wood-processing industry. To enter the market effectively, foreign exporters are recommended to consider these factors:

Exporters must first prioritize legal compliance and risk reduction. Vietnamese regulation requires complete and accurate legality documentation, especially the traceability and sustainable sourcing of wood products. Exporters must also meet quarantine and phytosanitary requirements for products falling under certain HS categories. Therefore, foreign exporters should investigate carefully the current industrial legal documents to find which categories their specific products fall within, which categories and require which procedure and treatment.

Partnerships with Vietnamese importers are recommended to receive support for navigating regulatory procedures, customs clearance, and inspection processes. Local importers can quickly update to evolving VNTLAS requirements, maintain relationships with inspection authorities, and can advise exporters on optimal documentation and shipment preparation. Their logistical capabilities also reduce risk for downstream buyers and improve product acceptance.

Local partners are critical in further steps of the Vietnamese timber value chain: processing, manufacturing and distributing wood products. Vietnam’s distribution system includes around 5,000 wholesalers and numerous processors concentrated in key industrial zones such as Ho Chi Minh City, Binh Duong, Dong Nai, Hanoi, and Bac Ninh. They are mostly of micro size and SMEs, which may require exporters to investigate them firsthand before closing the deals. Skillful processors can adapt imported wood to local standards, reducing the burden on end users and improving competitiveness.

Finally, considering the domestic market, exporters should tailor their offerings to Vietnam’s growing appetite for high-quality construction materials, decorative wood, and engineered products. Providing standardized dimensions, pre-finished surfaces, and durable, sustainable materials aligns well with trends in urban housing and green building standards. Collaboration with architects, designers, and real estate developers can further enhance visibility and long-term market penetration.

* If you wish to quote any information from this article, please kindly cite the source along with the link to the original article to respect copyright.

| B&Company

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |

[1] https://www.apec.org/docs/default-source/groups/egilat/2024/timberlegalityguidancetemplateforvietnam-march2024.pdf?sfvrsn=1961dea8_2&

[2] https://thuvienphapluat.vn/van-ban/Linh-vuc-khac/Quyet-dinh-327-QD-TTg-2022-De-an-phat-trien-nganh-cong-nghiep-che-bien-go-ben-vung-506116.aspx

[3]https://snrd-asia.org/wp-content/uploads/2025/09/Report-on-domestic-timber-trade-VPA-FLEGT-supply-chain-and-market-issues_VN.pdf

[4] https://datafiles.chinhphu.vn/cpp/files/vbpq/2020/09/102.signed.pdf

[5] https://thuvienphapluat.vn/van-ban/Xuat-nhap-khau/Quyet-dinh-4832-QD-BNN-TCLN-2020-cong-bo-Danh-muc-cac-loai-go-da-nhap-khau-vao-Viet-Nam-458434.aspx

[6] https://datafiles.chinhphu.vn/cpp/files/vbpq/2018/12/15-2.pdf

[7] https://www.ppd.gov.vn/FileUpload/Documents/vbhn_19_thong_tu_33_va_thong_tu_03_cua_bo_nnptnt.pdf

[8] https://www.ippc.int/largefiles/ISPM_15_Vietnamese_2012-12-11.pdf

[9] https://thuvienphapluat.vn/van-ban/Xuat-nhap-khau/Quyet-dinh-4832-QD-BNN-TCLN-2020-cong-bo-Danh-muc-cac-loai-go-da-nhap-khau-vao-Viet-Nam-458434.aspx

[10] https://thuvienphapluat.vn/van-ban/Linh-vuc-khac/Quyet-dinh-327-QD-TTg-2022-De-an-phat-trien-nganh-cong-nghiep-che-bien-go-ben-vung-506116.aspx

[11] https://van.nongnghiepmoitruong.vn/wood-exports-set-a-record-surpassing-17-billion-usd-d414834.html

[12] https://vneconomy.vn/phan-dau-den-nam-2030-co-1-trieu-ha-rung-dat-chung-chi-ben-vung.htm

[13]https://vietnamnews.vn/society/1661931/viet-nam-aims-to-reach-25-billion-in-wood-and-timber-exports-by-2030.html

[14] https://moit.gov.vn/tin-tuc/xuc-tien-thuong-mai/mo-rong-thi-truong-trong-nuoc-cho-nganh-go-viet.html

[1] https://www.apec.org/docs/default-source/groups/egilat/2024/timberlegalityguidancetemplateforvietnam-march2024.pdf?sfvrsn=1961dea8_2&

[2] https://thuvienphapluat.vn/van-ban/Linh-vuc-khac/Quyet-dinh-327-QD-TTg-2022-De-an-phat-trien-nganh-cong-nghiep-che-bien-go-ben-vung-506116.aspx

[3]https://snrd-asia.org/wp-content/uploads/2025/09/Report-on-domestic-timber-trade-VPA-FLEGT-supply-chain-and-market-issues_VN.pdf

[4] https://datafiles.chinhphu.vn/cpp/files/vbpq/2020/09/102.signed.pdf

[5] https://thuvienphapluat.vn/van-ban/Xuat-nhap-khau/Quyet-dinh-4832-QD-BNN-TCLN-2020-cong-bo-Danh-muc-cac-loai-go-da-nhap-khau-vao-Viet-Nam-458434.aspx

[6] https://datafiles.chinhphu.vn/cpp/files/vbpq/2018/12/15-2.pdf

[7] https://www.ppd.gov.vn/FileUpload/Documents/vbhn_19_thong_tu_33_va_thong_tu_03_cua_bo_nnptnt.pdf

[8] https://www.ippc.int/largefiles/ISPM_15_Vietnamese_2012-12-11.pdf

[9] https://thuvienphapluat.vn/van-ban/Xuat-nhap-khau/Quyet-dinh-4832-QD-BNN-TCLN-2020-cong-bo-Danh-muc-cac-loai-go-da-nhap-khau-vao-Viet-Nam-458434.aspx

[10] https://thuvienphapluat.vn/van-ban/Linh-vuc-khac/Quyet-dinh-327-QD-TTg-2022-De-an-phat-trien-nganh-cong-nghiep-che-bien-go-ben-vung-506116.aspx

[11] https://van.nongnghiepmoitruong.vn/wood-exports-set-a-record-surpassing-17-billion-usd-d414834.html

[12] https://vneconomy.vn/phan-dau-den-nam-2030-co-1-trieu-ha-rung-dat-chung-chi-ben-vung.htm

[13]https://vietnamnews.vn/society/1661931/viet-nam-aims-to-reach-25-billion-in-wood-and-timber-exports-by-2030.html

[14] https://moit.gov.vn/tin-tuc/xuc-tien-thuong-mai/mo-rong-thi-truong-trong-nuoc-cho-nganh-go-viet.html