208월2025

최신 뉴스 및 보고서 / 베트남 브리핑

댓글: 댓글 없음.

베트남의 제조업은 국가 GDP의 약 4분의 1을 차지하며 경제 성장의 핵심 동력이 되었습니다.[1]베트남의 낮은 인건비와 무역 친화적 정책에 힘입어 외국인 직접 투자(FDI)가 이 부문으로 계속 유입되고 있습니다. 정부는 산업 확장을 적극적으로 장려하고 있으며, 대부분의 제조 분야를 외국인 소유에 개방했습니다.[2]B&Company의 이 개요에서는 시장 규모와 전망, 산업 특성과 FDI 추세, 규제 환경, 주요 업체 프로필에 대한 데이터 기반의 통찰력을 제공합니다.

베트남 제조업 시장 규모 및 전망

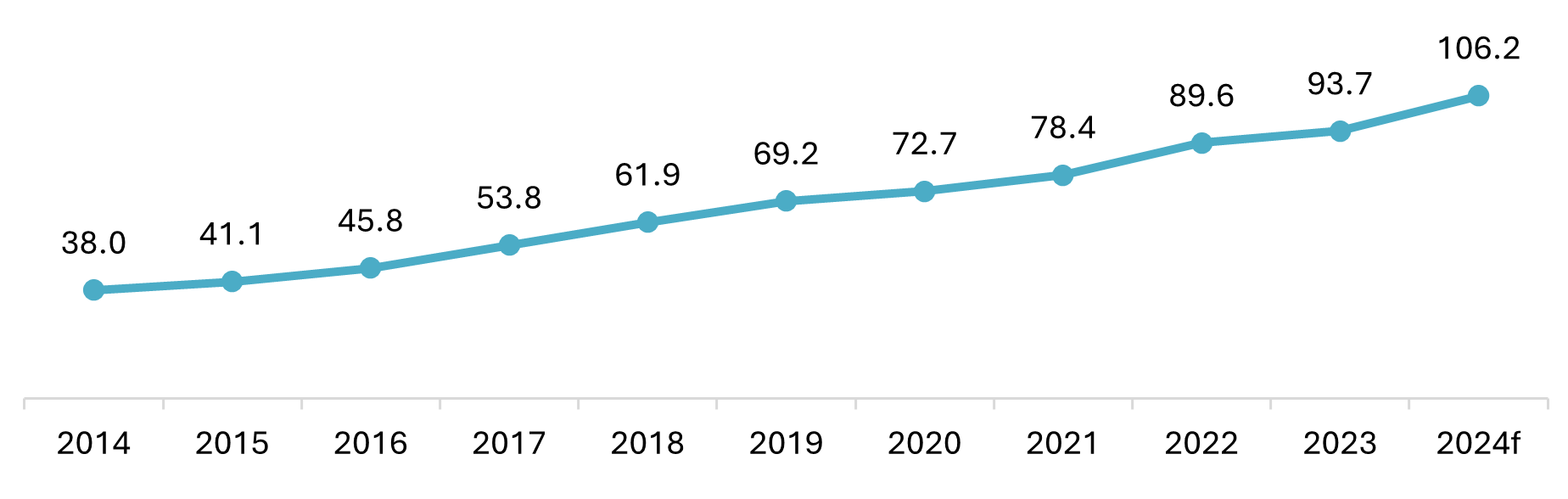

베트남의 제조업 부문은 2005년 이후 강력하고 꾸준한 성장을 거듭하며 국가 경제에 가장 크게 기여하는 부문 중 하나로 자리매김했습니다. 데이터에 따르면 제조업 부문의 생산 가치는 2019년부터 2023년까지 29% 증가하여 2019년 795억 3천만 달러에서 2023년 1,026억 달러로 증가했습니다. 2023년 베트남의 총 GDP는 약 4,300억 달러로 추산됩니다.[3]제조업은 국가 총생산에서 약 24~25조 1,000억 원을 차지하며 경제 성장에서 핵심적인 역할을 담당하고 있음을 강조합니다. 정부는 2025년까지 GDP에서 제조업 비중을 약 25조 1,000억 원 수준으로 유지하고 2030년까지 30조 1,000억 원까지 확대한다는 목표를 설정했습니다.[4].

Vietnam’s Manufacturing Industry Output at Current Prices (2014–2024)

단위: 10억 달러

출처: NSO[5]

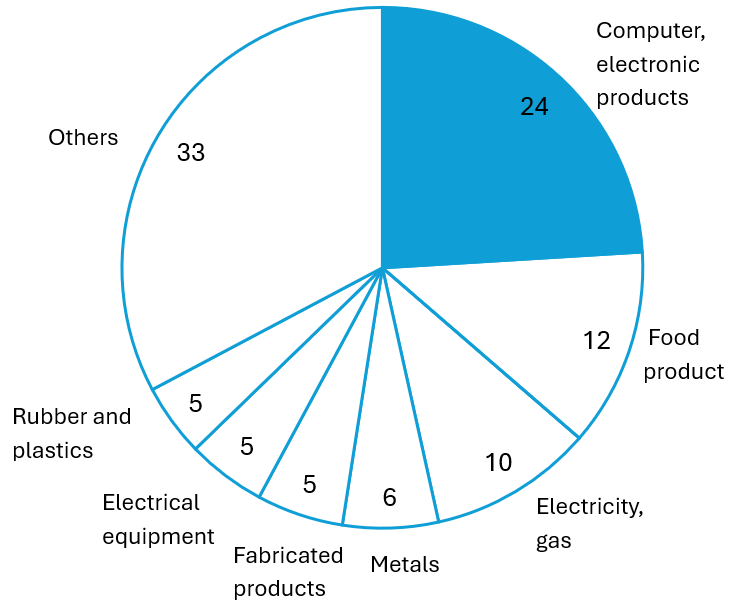

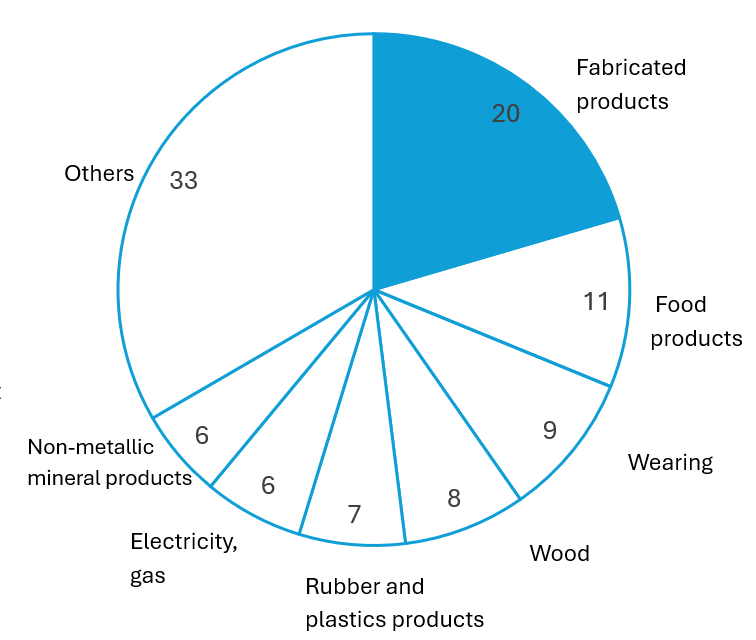

B&Company의 기업 데이터베이스를 기반으로 한 아래 차트는 2023년 제조업 매출 및 기업 분포를 하위 부문별로 보여줍니다. 전자제품과 식품이 매출에서 우위를 차지하는 반면, 조립 금속 제품, 식품, 의류가 기업 수에서 우위를 차지하며, 이는 베트남 제조업 기반의 다양성을 보여줍니다.

| 제조업 수익 하위 부문별, 2023년 단위: 100% = 5380억 달러 |

제조업체 수 하위 부문별, 2023년 단위: 100%= 135,642개 회사 |

|

|

출처: B&Company의 EDB

베트남 제조업의 시장 특성

베트남 제조업 시장은 강력한 수출 지향성과 산업별 전문화를 기반으로 형성됩니다. 국내 기업들은 철강, 화학, 농업, 소비재 등의 산업에서 경쟁력을 확보하고 있는 반면, 전자, 휴대폰, 섬유, 신발, 기계 등 첨단 기술 분야는 주로 수출을 위한 대규모 생산에 의해 주도됩니다.

FDI 주도 성장

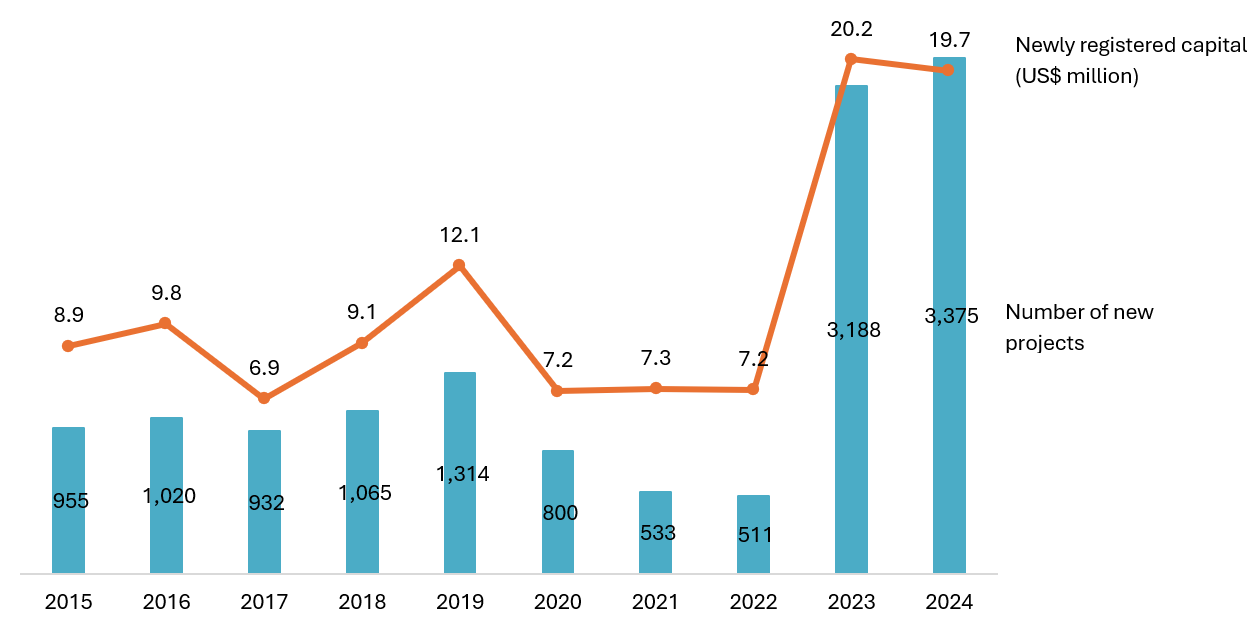

베트남의 제조업은 외국인 투자에 힘입어 크게 성장하고 있습니다. 2015년부터 2024년까지 가공 및 제조 분야에 대한 연간 등록 외국인 직접투자(FDI)는 70억~100억 달러 규모였으나, 2023년과 2024년에는 각각 200억 달러를 돌파했습니다. 팬데믹 기간에도 글로벌 기업들이 공급망 다각화를 모색함에 따라 이 분야로의 유입은 탄력적으로 유지되었습니다. 2024년에는 제조업이 약 206억 달러로 전체 FDI에서 가장 큰 비중을 차지했습니다. 이러한 추세는 2025년까지 이어져, 2025년 첫 7개월 동안 등록 외국인 직접투자(FDI)는 241억 달러에 달했고, 그중 61%(약 121억 달러)가 제조업에 투자되었습니다. 최근 프로젝트로는 신규 전자 공장, 재생에너지 장비 공장, 자동차 조립 시설 등이 있습니다. 주요 투자자는 한국, 싱가포르, 중국, 일본, 대만 등에서 유입되고 있으며, 이는 첨단 기술 산업의 확장과 지역별 공급망 변화를 반영합니다.

FDI into the Manufacturing Sector by Year (2015–2024)

원천: 오픈 개발 베트남/MPI[6]

경쟁력 있는 노동력과 비용

베트남은 제조업에서 상당한 비용 우위를 유지하고 있습니다. 공장 근로자의 평균 시급은 미화 3달러 정도로, 중국의 절반에도 미치지 못합니다.[7]젊은 노동력과 결합되어 의류, 신발, 전자 제품 조립과 같은 노동 집약적인 제조업을 유치합니다. 2023년 제조업 종사자 수는 1,200만 명에 달하여 전체 고용의 약 23%를 차지할 것으로 예상됩니다.[8]임금은 점진적으로 상승하고 있으므로 경쟁력을 유지하려면 생산성 향상이 매우 중요합니다.

동시에 중국의 비용 상승과 지정학적 불확실성은 동남아시아로의 공장 이전 추세를 가속화했으며, 베트남은 주요 수혜국 중 하나로 부상하고 있습니다. 투자자들은 베트남의 경쟁력 있는 임금, 안정적인 투자 정책, 그리고 광범위한 무역 협정에 매료되어 매력적인 대체 생산 기지로 자리매김하고 있습니다. 이러한 변화는 글로벌 공급망에서 베트남의 입지를 강화했지만, 장기적인 경쟁력 유지를 위한 인프라 개선 및 생산성 향상의 필요성 또한 증가시켰습니다.

다양한 산업 기반

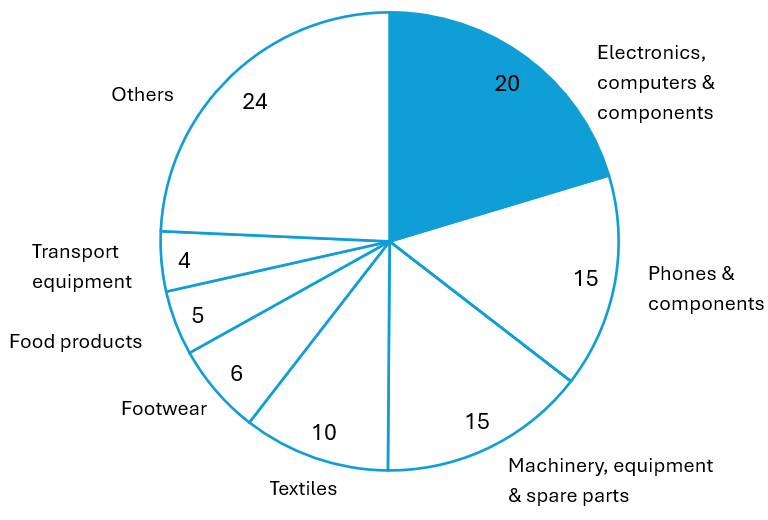

베트남의 제조업은 첨단 전자 제품부터 전통적인 노동집약적 산업에 이르기까지 여러 핵심 산업에 걸쳐 있습니다. 전자, 휴대폰, 기계류는 베트남 전체 수출액의 401조 3천억 원 이상을 차지하며, 삼성, LG, 인텔과 같은 다국적 기업의 주도로 성장하고 있습니다. 한편, 섬유, 의류, 신발 산업은 숙련된 노동력과 광범위한 무역 협정에 힘입어 여전히 강력한 전통 산업으로 자리매김하고 있습니다. 반도체, 운송 장비, 고부가가치 목재 제품 등 신흥 산업 또한 꾸준한 성장을 보이고 있으며, 이는 베트남이 더욱 다각화된 산업 기반으로 전환하고 있음을 보여줍니다. 특히 반도체 조립 및 테스트 분야는 상당한 외국인 투자를 유치하기 시작하면서 베트남이 글로벌 반도체 공급망의 잠재적 허브로 자리매김하고 있습니다.

Vietnam Manufacturing Export Breakdown (2024)

100%= 3,567억 달러[9]

출처: 트레이딩 이코노믹스[10], GSO

2024년 베트남의 무역 실적은 제조업 수출이 주도하여 3,567억 4천만 달러에 달했고, 이는 베트남 전체 수출의 8,813조 원(TP3T)을 차지했습니다. 이 중 전자, 컴퓨터 및 부품 분야가 726억 달러로 1위를 차지했으며, 전체 제조업 수출의 2013조 원(TP3T) 이상을 차지했습니다. 이는 베트남 수출 경제의 근간인 제조업과 가장 크고 경쟁력 있는 단일 동력인 전자 산업의 중요성을 동시에 보여줍니다.

무역 친화적 정책

베트남의 제조업 성장은 CPTPP와 EU-베트남 FTA를 포함한 15개 이상의 자유무역협정을 통해 세계 무역 네트워크에 편입되면서 수혜를 받고 있으며, 이러한 협정들은 국제 시장에 대한 우선적 접근을 제공합니다. 베트남은 380개 이상의 산업단지를 운영하고 있으며, 첨단 기술 및 지원 산업에 대한 세제 혜택을 제공하여 투자자들에게 유리한 생태계를 조성하고 있습니다.[11].

원자재 및 중간재 수입에 의존

현재 생산의 상당 부분이 기본 조립 단계에 집중되어 있어, 역내 경쟁국에 비해 국내 부품의 비중이 상대적으로 낮습니다. 또한, 베트남은 간헐적인 전력 부족, 항만 혼잡 등 인프라 병목 현상과 첨단 제조업 분야의 지속적인 기술 격차에 직면해 있습니다. 노동 생산성은 향상되고 있지만, 일부 인접국에 비해 여전히 뒤처져 있습니다. 이러한 문제를 해결하기 위해 베트남 정부는 인프라 개선에 투자하고, 산업 4.0 도입을 촉진하며, 인력 역량 강화를 위한 직업 훈련을 확대하고 있습니다. 이러한 어려움에도 불구하고, 베트남 제조업은 빠른 성장, 높은 외국인 직접 투자 의존도, 그리고 다각화 확대를 바탕으로 저기술 노동 집약적 생산에서 전자 및 자동차와 같은 더 복잡하고 고부가가치 활동으로 점차 전환하고 있습니다. 지속적인 개혁과 투자를 통해 베트남은 동남아시아의 선도적인 제조업 중심지로서의 역할을 공고히 할 수 있는 유리한 위치에 있습니다.

베트남 제조업의 규제 및 투자 환경

베트남의 제조업 부문은 명확한 규제와 경쟁력 있는 인센티브를 바탕으로 외국인 투자자에게 대체로 개방되어 있으며, 소수의 전략적 산업에 대한 통제력을 유지하고 있습니다. 등록 절차가 간소화되어 있으며, 대부분의 공장은 인프라가 잘 갖춰져 있고 통관 절차가 신속한 산업단지에 위치해 있습니다.

2020년 투자법과 2020년 기업법에 따라 외국인 투자자는 일반적으로 100% 지분으로 제조업을 설립할 수 있으며, 일부 인접국처럼 포괄적인 합작 투자 요건은 없습니다. 베트남 법률(투자법 부록 IV 및 시행령 31/2021/ND-CP)에 따라 특정 활동은 여전히 "조건부"로 남아 있으며, 현지 파트너 또는 외국인 지분 한도 제한이 적용됩니다. 예를 들어 29인승 이상 자동차, 항공기, 담배, 특정 화학 물질 제조가 있습니다. 마약, 특정 화학 물질, 국방 관련 무기와 같은 민감한 품목만 제조가 전면 금지되는 경우는 드뭅니다.

인센티브에는 법인세 우대, 세제 혜택, 첨단 기술 및 수출 지향 프로젝트에 대한 토지 이용 혜택이 포함됩니다. 수출가공구역(EPZ) 및 지원 산업단지와 같은 특별구역은 수입 투입재에 대한 관세 면제와 같은 추가적인 혜택을 제공합니다. 결정 1658/QD-TTg와 같은 정책은 녹색 성장, 첨단 제조업, 그리고 에너지 효율을 촉진합니다.

베트남의 WTO 협정 및 무역 협정(예: CPTPP, EVFTA)은 시장 접근을 더욱 자유화하지만, 특정 제품은 여전히 특정 규제(예: 차량 관련 법령 70/2018)의 적용을 받습니다. 노동, 안전 및 환경 관련 법률이 전반적으로 적용되며, 고위험 프로젝트의 경우 환경영향평가가 의무화됩니다.

베트남의 투자 체계는 전반적으로 개방적이지만, 제조업에는 여전히 몇 가지 제약이 있습니다. 자동차 생산, 담배, 제약, 화학 등 일부 사업은 투자법에 따라 "조건부"로 분류되며, 이러한 사업들은 외국인 지분 제한이 있거나 현지 파트너와의 합작 투자가 필수적입니다. 투자자들은 또한 고위험 분야에 대한 추가 허가와 더욱 엄격한 환경 및 노동 규정 준수에 직면합니다. 더욱이, 세금 및 토지 이용 인센티브는 산업 지구와 첨단 기술 프로젝트에 집중되어 있어, 이러한 지역 외 제조업체는 동등한 혜택을 누리지 못할 수 있습니다.

베트남 제조업의 주요 참여자

베트남의 제조업은 선도적인 외국인 투자 기업과 경쟁력 있는 국내 기업들이 어우러져 형성됩니다. 삼성, LG, 인텔과 같은 다국적 기업은 전자 및 반도체와 같은 첨단 기술 분야를 주도하는 반면, 빈패스트, 비나밀크, 호아팟 그룹과 같은 국내 대기업들은 자동차, 소비재, 중공업 분야에서 중추적인 역할을 담당합니다.

베트남 제조업의 주요 참여자

| 회사 | 국가 | 설립됨 | 본부 | 웹사이트 | 부문 |

| 삼성전자 베트남 | 대한민국 | 2008 | 박닌 | https://www.samsung.com/vn | 휴대폰 및 전자제품 |

| LG디스플레이 베트남 | 대한민국 | 2016 | 하이퐁 | https://www.lgdisplay.com | OLED 디스플레이 |

| 인텔 제품 베트남 | 미국 | 2006 | 호치민시 | https://www.intel.com | 컴퓨터 칩 |

| 빈패스트 | Vietnam | 2017 | 하노이 | https://vinfastauto.com | 자동차 |

| 비나밀크 | Vietnam | 1976 | 호치민시 | https://www.vinamilk.com.vn | 유제품 |

| 호아팟 그룹 | Vietnam | 1992 | 하노이 | https://www.hoaphat.com.vn | 강철 |

| 마산 소비자 | Vietnam | 1996 | 호치민시 | https://www.masanconsumer.com | 음식 및 음료 |

| 포우첸 베트남 | 대만 | 1994 | 동나이 | https://www.pouchen.com | 신발류 |

| 포모사 하띤 스틸 | 대만 | 2008 | 하띤 | https://www.fhs.com.tw | 강철 |

| 네슬레 베트남 | 스위스 | 1995 | 동나이 | https://www.nestle.com.vn | 음식 및 음료 |

원천: B&Company 엔터프라이즈 데이터베이스

결론

베트남의 제조업은 급속한 성장, 외국인 투자, 그리고 점점 더 다각화되는 산업 기반을 바탕으로 국가 경제의 초석으로 자리매김하고 있습니다. 글로벌 공급망에 통합되고 강력한 정책 지원을 통해 베트남은 동남아시아 최고의 생산 허브 중 하나로 자리매김했습니다. 그러나 수입 원자재에 대한 높은 의존도, 조립 산업 집중으로 인한 낮은 국내 부가가치, 인프라 부족, 그리고 첨단 제조업 분야의 기술 부족 등 한계점도 여전히 존재합니다. 공급망 현지화 강화, 인프라 개선, 그리고 인력 개발을 통해 이러한 과제를 해결하는 것은 베트남이 경쟁력을 유지하고 글로벌 가치 사슬에서 한 단계 더 도약하는 데 필수적입니다.

[1] 국가 통계청, 4분기 및 2022년 사회경제 상황평가하다>

[2] Lexology, 베트남에 제조 사업을 시작할 때평가하다>

[4] Lexology, 베트남에 제조 사업을 시작할 때평가하다>

[6] 베트남 브리핑, 베트남 제조업 추적: 2025년 7월 업데이트평가하다>

[7] 베트남 시장 조사, 2025년 베트남 제조업 분야 동향 분석평가하다>

[8] 베트남 브리핑, 베트남 제조업 추적: 2025년 7월 업데이트평가하다>

[9] NSO, 4분기 및 2024년 사회경제 상황평가하다>

[11] 맥킨지, 베트남 제조업 부문 육성: 저비용에서 고생산성으로평가하다>

* 본 기사의 내용을 인용하고자 하시는 경우, 저작권을 존중하여 출처와 원 기사의 링크를 함께 명시해 주시기 바랍니다.

| 비앤컴퍼니

2008년부터 베트남에서 시장 조사를 전문으로 하는 최초의 일본 기업입니다. 업계 보고서, 업계 인터뷰, 소비자 설문 조사, 비즈니스 매칭을 포함한 광범위한 서비스를 제공합니다. 또한, 최근 베트남에서 900,000개 이상의 기업에 대한 데이터베이스를 개발하여 파트너를 검색하고 시장을 분석하는 데 사용할 수 있습니다. 문의사항이 있으시면 언제든지 문의해주세요. info@b-company.jp + (84) 28 3910 3913 |