2025年9月25日

最新ニュースとレポート / ベトナムブリーフィング

コメント: コメントはまだありません.

ベトナムのエレクトロニクス産業は急速に成長し、経済の重要な支柱となり、世界的な製造拠点となっています。輸出は好調で、大きな潜在性を示していますが、依然として組立工程への依存、低い国内付加価値、そして外国直接投資への依存が依然として強い状況です。

最近、サムスンなどの大手企業のサプライチェーンにベトナム企業が参入するケースが増えており、まだ低付加価値段階ではあるものの、現地化は進展している。政府は特に半導体分野において明確な政策を推進している。バリューチェーンの上位に進出するためには、ベトナムは構造的な課題を克服し、「工場」から高付加価値のグローバルサプライチェーン拠点へと転換するための大胆な行動をとる必要がある。

規模と経済貢献の概要

エレクトロニクス産業はベトナムの主要な経済成長の原動力の一つとなり、製造業全体の17.8%(2023年のVCCIの報告書に基づく)を占め、先導的な分野としての地位を固めている。[1]業界の輸出規模は目覚ましい成長を遂げ、2024年には正式に1000億米ドルの大台を超え、2013年以来の最高水準となる見込みです。具体的には、2024年のエレクトロニクス業界の総輸出額は1265億米ドル近くに達し、2023年と比較して15兆5310億米ドル増加し、国全体の輸出額の3分の1以上を占めています。

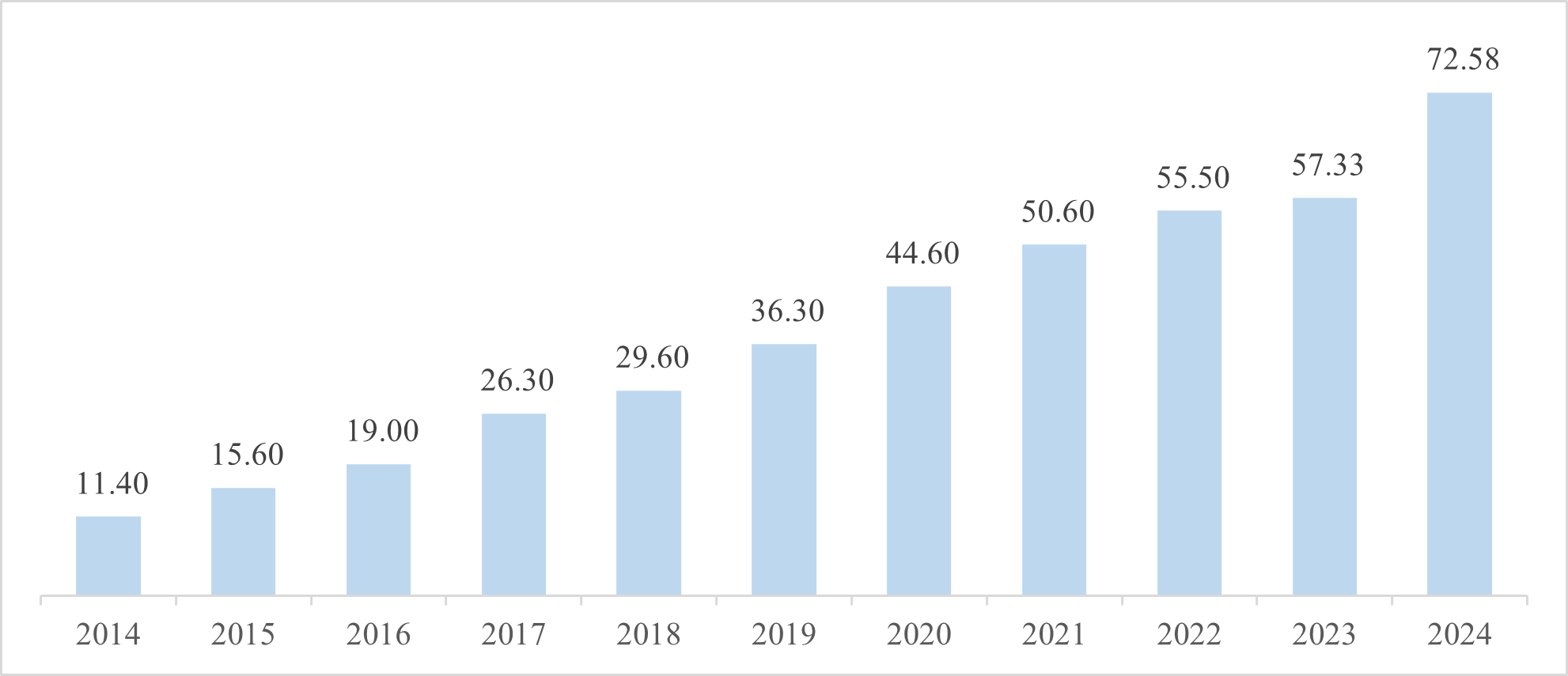

そのうち、コンピューター、電子機器、部品部門は2024年に725.8億米ドルに達し、2023年と比較して26.6%増加しました。一方、電話機および部品部門は539億米ドルに達し、2023年と比較して2.9%増加しました。[2]

2014年から2024年までの電子製品、コンピューター、部品の輸出額

出典:ベトナム統計総局(GSO)、ベトナム税関

この現実は、エレクトロニクス産業が困難な世界経済の状況においても高い成長率を維持し、重要な柱となっていることを示している。ベトナム統計局のデータによると、コンピューター、電子製品および部品の輸出額は69億ドルでトップを占め、2024年の同時期と比べて29.1%増加した。この力強い成長率は、グローバルサプライチェーンのシフトと、世界をリードするテクノロジー企業のベトナムでの存在に一部牽引されている。しかし、規模の拡大は国内価値の増加を意味するものではない。業界レポートによると、この産業の輸出額の約95%は依然としてFDIセクターに属しており、成長は主にコアテクノロジー能力ではなく、組み立てと加工活動によるものであることがわかる。研究開発、チップ設計、ブランド開発など、最も高い価値をもたらすコア活動は、依然としてこれらの企業によって母国に保持されている。[3]

しかし、戦略的な転換が始まっています。ベトナムは、現在の成長モデルの限界を認識し、より価値の高い段階へと移行するための慎重な措置を講じています。

ベトナムのエレクトロニクス産業の現地化状況

輸出額が大きく伸びているにもかかわらず、ベトナムの電子産業の現地化率は依然として非常に低く、わずか5~10%程度である。[4]グローバルサプライチェーンへの依存度が高いことが分かります。

ベトナムのエレクトロニクス産業におけるローカリゼーション

出典:Vietnamnews.vn

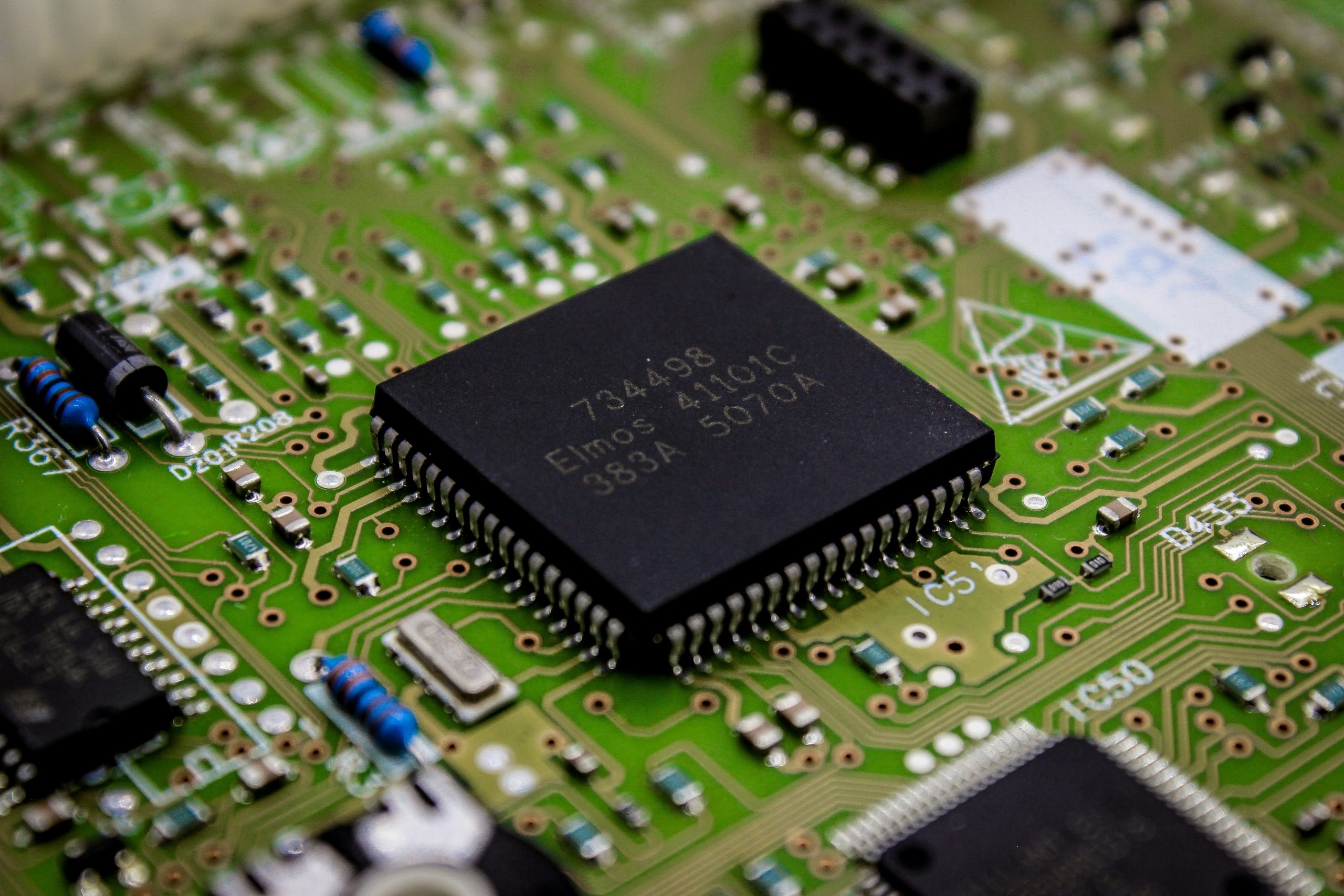

ベトナムでは現在、電子産業に携わる企業が2,000社を超え、企業総数の54.8%を占めていますが、そのほとんどは中小企業で、主に単純な加工工程を行っており、技術や設計を習得しているわけではありません。[5] 「生産できる」ことと「技術を習得できる」ことの間には大きな違いがあり、これが核心的な問題です。国内企業はテレビや携帯電話などの完成品の電子製品を生産できます。[6]しかし、そのほとんどは依然として輸入部品から組み立てられています。[7]

サムスンのような大手外資系企業のサプライチェーンにはベトナム企業が参画しているものの、その役割は限定的である。現在、サムスンのサプライチェーンには合計340社のベトナム企業が参画しているが、そのうちTier 1サプライヤーは35~39社程度にとどまっている。また、ベトナム企業は主に消耗品、包装材、印刷製品を供給しており、その供給額はこれらの企業の部品やスペアパーツの需要と比較すると非常に小さい。[8]

ベトナムの電子産業は輸入への依存度が非常に高く、コンピューター、電子製品、部品の輸入額は2024年に1,020億米ドルを超え、初めて1,000億米ドルの大台を突破し、前年比21.41億3千万トン増加しました。[9] このカテゴリーは、2025年の最初の8か月間の国の総輸入売上高の約36%を占めています。最大の輸入供給は中国からのもので、2025年8月には334.8億米ドルに達しました。[10]

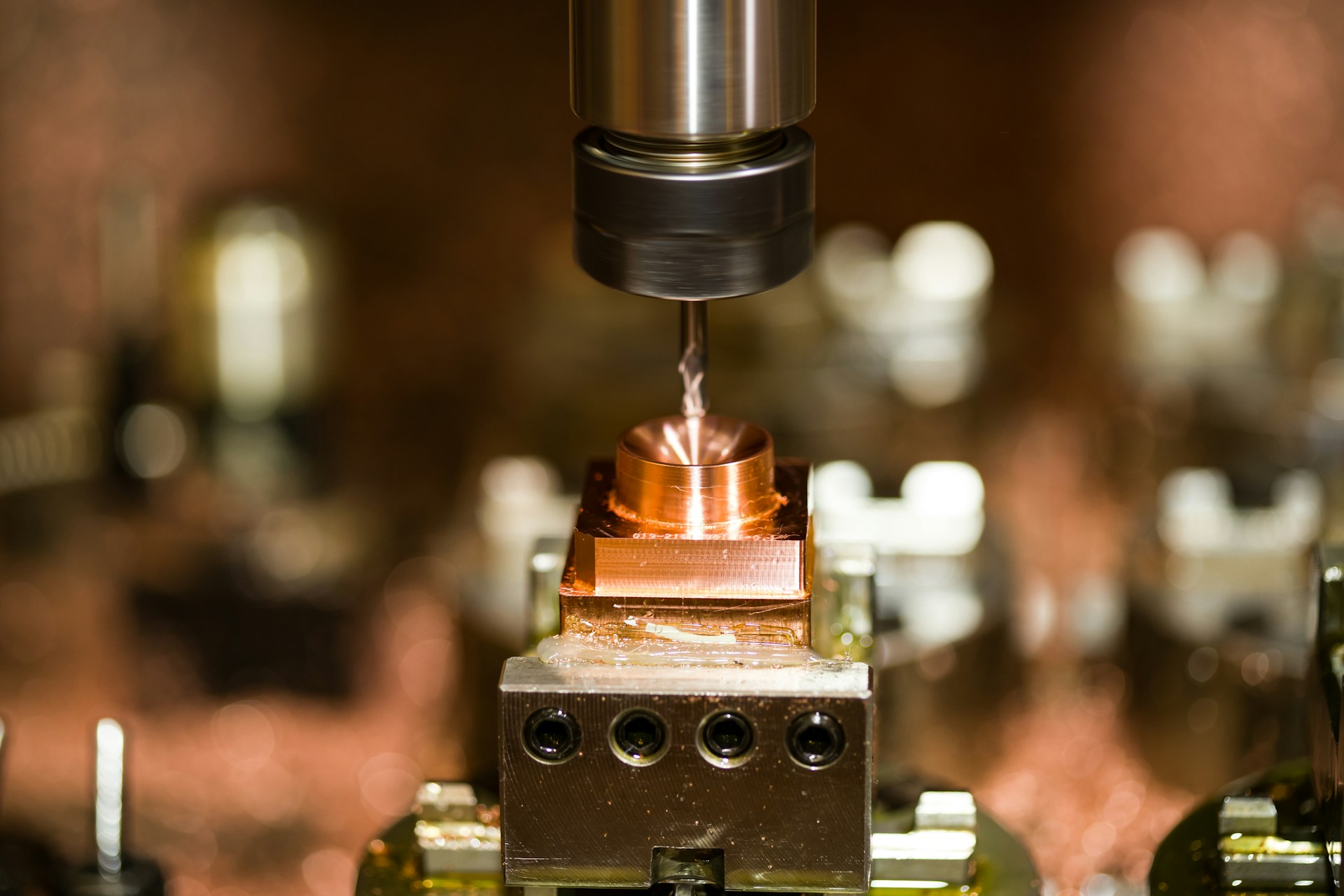

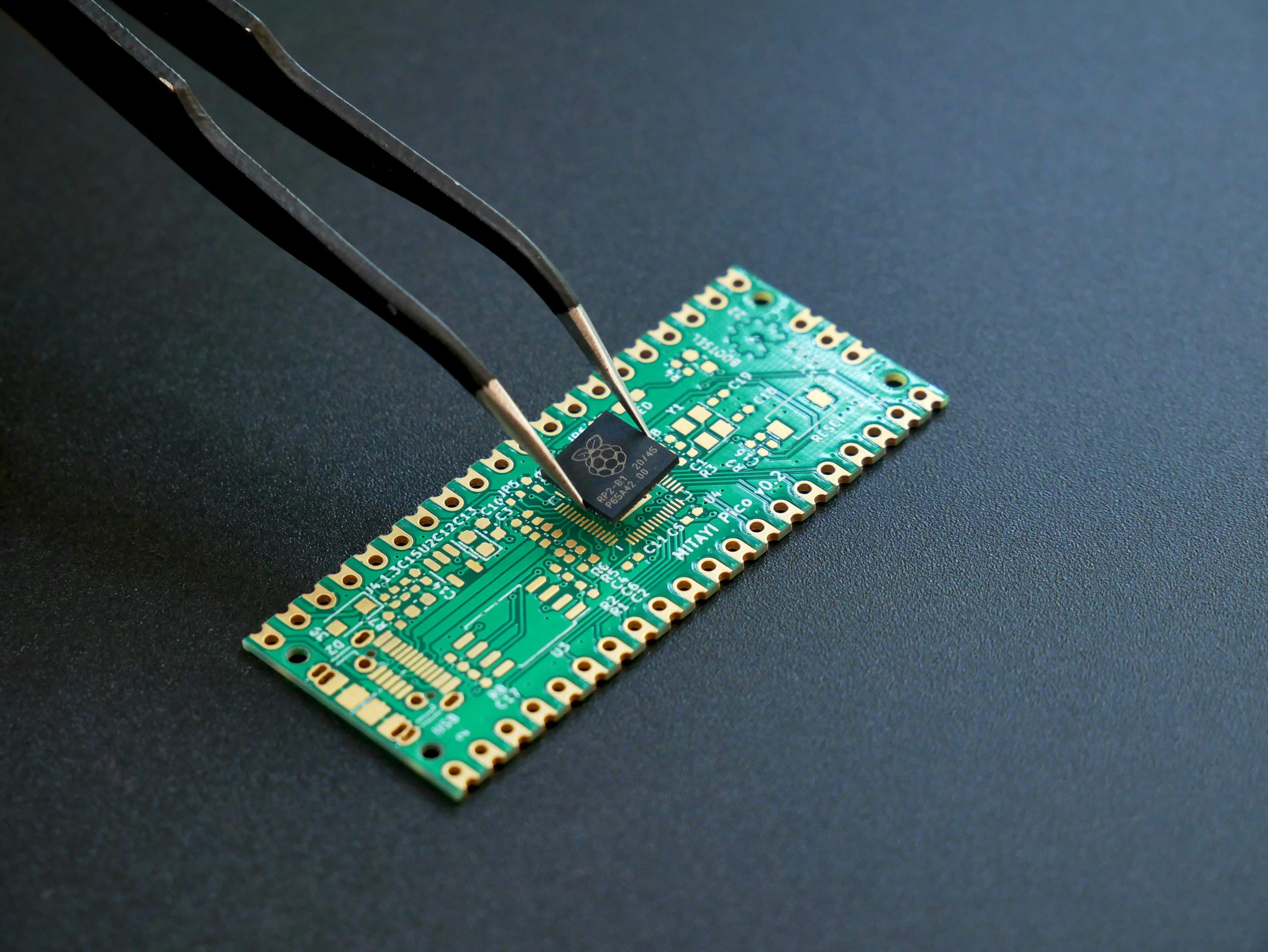

最も重要な輸入品の一つは半導体チップです。国内企業はチップの研究、設計、生産において自給自足がほぼ不可能であり、輸入に完全に依存せざるを得ません。半導体チップの不足は、ベトナムの多くの製造業、特に家電製品から自動車に至るまで、多くの産業に困難をもたらしています。[11]

現在の政策と支援メカニズム

決定第68/QD-TTg号は、2020年までに45%、2025年までに65%の国内需要を満たすという野心的な目標を設定しましたが、最近の専門家の分析によると、電子産業における実際の国産化率はわずか5~10%程度にとどまっています。このギャップは、より現実的な新たなアプローチの必要性を浮き彫りにしています。

政府の現在の戦略は、製品の現地化から付加価値の付加へと重点を移しており、2030年までにエレクトロニクスおよび半導体産業で10~15%の付加価値を達成するという、より控えめだが戦略的な目標を掲げている。[12] この変化は、表面的な指標を追いかけるのではなく、グローバルサプライチェーンにおける価値の高い段階(設計、パッケージング、テストなど)を捉えることに重点を置いた、より成熟した政策立案の考え方を反映しています。

ベトナムの半導体・エレクトロニクス産業

出典:政府ニュース

2050年までのビジョンを持つ2030年までのベトナムの半導体および電子産業の発展戦略は、画期的な公式C = SET + 1に基づいています。[13] この方式は、特殊なチップの開発に重点を置いています(S専門性の高い、質の高い人材(外資企業の進出が進む畜産市場アレント)、そしてエコシステムの構築(えベトナムを安全な旅行先にするために、(+1ベトナムは、世界の半導体サプライチェーンにおける重要な位置を占めています。半導体製造において(コストと複雑さが高すぎる)大手企業と競争するのではなく、ベトナムはより現実的な道を選び、知識と地理的な立地が決定的な役割を果たす設計、パッケージング、テストといった段階に注力しています。[14]

具体的な支援政策には優遇税率が含まれます。例えば、ハイテク分野への投資プロジェクトは、15年間にわたり10%の法人所得税(CIT)優遇税率を享受できます。[15] さらに、政府は戦略的投資家や多国籍企業を誘致するための投資支援基金の調査・設立を進めています。もう一つの重要なメカニズムは、行政手続きを簡素化し、半導体分野の企業にとってより有利な投資環境を整備するための「ワンストップサービス」メカニズムの創設です。 [16]

結論と戦略的提言

ベトナムは、特に組立・加工分野において、世界的な電子機器製造拠点としての地位を確立し、現在、より高付加価値な段階へと移行しつつあります。ベトナム企業のFDIサプライチェーンへの参加増加は、現地化の強い勢いを示していますが、人材、研究開発、そして裾野産業においては依然として課題が残っています。

FDI投資家にとって、これは機会とメリットの両方をもたらします。ベトナム政府は、2025年までに電子機器輸出額を1兆4千億元(1400億元)にするという野心的な目標や、半導体開発の長期計画を含む明確な戦略ビジョンを打ち出しています。この目標達成のため、ベトナムは以下の点を優先しています。

– 人材の飛躍的進歩 外国直接投資企業や大学との共同研修を通じて、熟練したハイテク労働力を確保します。

– より強力な研究開発インセンティブ 支援政策、税制優遇、知的財産保護によりイノベーションを促進します。

– サプライチェーンの強化 国内企業が世界基準をより適切に満たし、より価値の高いプロセスに統合できるようになります。

– 選択的なFDI誘致 資本だけでなく、有意義な技術移転と現地での研究開発の発展を重視します。

ベトナムはビジョンと政策において「準備」ができており、単なる「工場」ではなく、 世界の技術地図における戦略的かつ高付加価値のFDI誘致先.

[1] VCCI-HCM、ベトナムのエレクトロニクス産業の現状(https://vcci-hcm.org.vn/hien-trang-cua-nganh-cong-nghiep-dien-tu-viet-nam/ )

[2] Baodautu.vn、エレクトロニクス輸出は1400億ドルの目標を目指す(https://baodautu.vn/xuat-khau-dien-tu-huong-toi-moc-140-ty-usd-d239625.html)

[3] ベトナム社会主義共和国商工省、エレクトロニクス産業はバリューチェーンをシフトしている(https://moit.gov.vn/tin-tuc/phat-trien-cong-nghiep/cong-nghiep-dien-tu-can-tao-buoc-dot-pha-de-phat-trien.html )

[4] ベトナム社会主義共和国商工省によると、ベトナムの電子産業には多くの利点と発展の可能性がある(https://moit.gov.vn/tin-tuc/phat-trien-cong-nghiep/nganh-cong-nghiep-dien-tu-viet-nam-nhieu-loi-the-va-tiem-nang-phat-trien.html )

[5] Congnghieptieudung.vn、電子サポート産業とサプライチェーンへの深い参加の問題(https://congnghieptieudung.vn/cong-nghiep-ho-tro-dien-tu-va-bai-toan-tham-gia-sau-vao-chuoi-cung-ung-dt48176 )

[6] GSO、電子機器、コンピューター、部品の輸出入 - 2024年の成長要因と期待(https://www.nso.gov.vn/tin-tuc-thong-ke/2024/10/xuat-nhap-khau-dien-tu-may-tinh-va-linh-kien-dong-luc-tang-truong-va-ky-vong-nam-2024/ )

[7] ベトナム社会主義共和国商工省によると、ベトナムの電子産業には多くの利点と発展の可能性がある(https://moit.gov.vn/tin-tuc/phat-trien-cong-nghiep/nganh-cong-nghiep-dien-tu-viet-nam-nhieu-loi-the-va-tiem-nang-phat-trien.html )

[8] ベトナム社会主義共和国商工省、ベトナムの一部産業の現地化率は向上している(https://moit.gov.vn/tin-tuc/phat-trien-cong-nghiep/ty-le-noi-dia-hoa-cua-mot-so-nganh-cong-nghiep-tai-viet-nam-da-duoc-cai-thien.html )

[9] Kinhte.congthuong.vnによると、ベトナムのコンピューター、電子製品、部品の輸入額は1020億ドルを超えた(https://kinhte.congthuong.vn/nhap-khau-may-vi-tinh-san-pham-dien-tu-va-linh-kien-cua-viet-nam-dat-hon-102-ty-usd-366133.html )

[10] VnEconomy.vnによると、ベトナムは中国から最も多くのコンピューターと部品を輸入している(https://vneconomy.vn/viet-nam-nhap-khau-nhom-hang-may-tinh-va-linh-kien-nhieu-nhat-tu-trung-quoc.htm )

[11] Vietnamplus.vn、処理チップの不足、ベトナムの多くの製造業が困難に直面(https://www.vietnamplus.vn/thieu-hut-chip-xu-ly-nhieu-nganh-san-xuat-tai-viet-nam-gap-kho-post713522.vnp )

[12] Vjst.vn、ベトナムの半導体産業の2030年までの発展戦略、2050年までのビジョン(https://vjst.vn/chien-luoc-phat-trien-cong-nghiep-ban-dan-viet-nam-den-nam-2030-tam-nhin-2050-69695.html )

[13] B&Company Vietnam、ベトナムのコンピューターおよび電子機器製造:企業の概要と外国投資の動向 – B&Company (https://b-company.jp/computer-electronics-manufacturing-in-vietnam-overview-of-companies-and-foreign-investment-trends/ )

[14] Congly.vnによると、ベトナムは半導体産業の高付加価値分野に徐々に参入している(https://congly.vn/viet-nam-tung-buoc-tien-vao-khau-gia-tri-cao-trong-nganh-ban-dan-492852.html )

[15] B&Company Vietnam、ベトナムのコンピューターおよび電子機器製造:企業の概要と外国投資の動向 – B&Company (https://b-company.jp/computer-electronics-manufacturing-in-vietnam-overview-of-companies-and-foreign-investment-trends/ )

[16] Baochinhphu.vn、半導体産業の発展を促進するためのメカニズムと政策の完成(https://baochinhphu.vn/hoan-thien-cac-co-che-chinh-sach-thuc-day-phat-trien-nganh-cong-nghiep-ban-dan-102250106210838727.htm )

*ご注意: 本記事の情報を引用される場合は、著作権の尊重のために、出典と記事のリンクを明記していただきますようお願いいたします。

| B&Company株式会社

2008年に設立され、ベトナムにおける日系初の本格的な市場調査サービス企業として、業界レポート、業界インタビュー、消費者調査、ビジネスマッチングなど幅広いサービスを提供してきました。また最近では90万社を超える在ベトナム企業のデータベースを整備し、企業のパートナー探索や市場分析に活用しています。 お気軽にお問い合わせください info@b-company.jp + (84) 28 3910 3913 |