04Sep2025

Latest News & Report / Vietnam Briefing

Comments: No Comments.

Vietnam’s healthcare system is under significant pressure due to rapid population aging and overburdened public hospitals, creating urgent demand for new and upgraded medical facilities. The growth of private hospitals, combined with government targets for hospital beds and workforce under the 2021–2030 Healthcare Network Master Plan, presents potential opportunities for domestic and foreign investors in hospital construction, signaling a transformation for healthcare infrastructure in the country.

Market overview

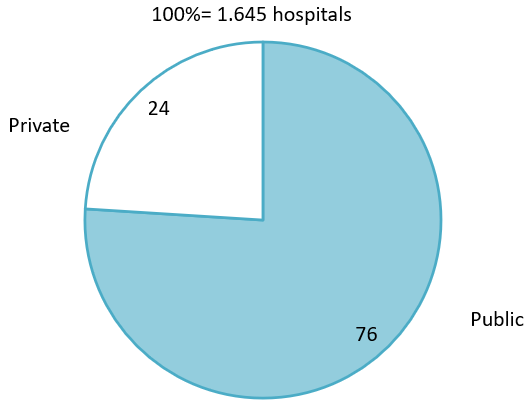

Vietnam’s healthcare system is currently dominated by the public sector, which accounts for 76% of all hospitals [1]. However, public hospitals are frequently overburdened, particularly in major cities, operating at over 200% of their designed capacity. This situation not only reduces the quality of care but also puts pressure on hospital infrastructure. Consequently, the construction and expansion of hospitals has become an urgent need to meet basic healthcare demands and alleviate overcrowding.

Currently, in addition to public healthcare facilities, there are 384 private hospitals nationwide out of 1,645 hospitals nationwide, representing 24% [1]. However, the number of beds in private hospitals accounts for only 5.8% of the total. In Hanoi, these figures are slightly higher: 44 private hospitals represent 29% of total hospitals, with nearly 3,000 beds accounting for 6.5% of the total [2]. Most private hospitals focus on specialized services such as ophthalmology, dentistry, dermatology, cardiology, and oncology, usually with fewer than 50 beds [2].

Percentage of public and private hospitals in Vietnam until 2024

Source: Ministry of Health

The growth of private hospitals in Vietnam reflects a necessary transformation. The country is aging rapidly. Vietnam’s population is aging rapidly, with those aged 60+ rising from 14.2 million in 2024 to an estimated 17.3 million (16.5% of the population) by 2029, driving higher demand for long-term care, geriatric departments, and rehabilitation centers. At the same time, stable economic growth and higher disposable incomes are encouraging people to seek high-quality, safe, and convenient healthcare services. This creates opportunities for both public and private sectors to invest in new hospitals or upgrade existing facilities to meet international standards.

Vietnam’s healthcare construction market features a diverse range of contractors that can be broadly categorized into three groups

– Leading Domestic Contractors: The market hosts several capable Vietnamese construction companies with proven experience in complex projects, such as Delta Group (Contractor of Vinmec Hospital, the expansion of the National Hospital of Obstetrics and Gynecology, the COVID-19 treatment hospital in Hanoi). The experience in building high-rise, complex structures in dense urban areas is a major advantage.

– Specialized Design & Construction Firms: The market is also maturing with companies specializing in healthcare, such as INTECH Group and Quoc Cuong, providing full-package solutions (design and construction) for medical facilities. Their presence demonstrates the market’s capacity for specialized players and highlights potential partners or direct competitors in niche segments.

– Other Major Groups: Leading Vietnamese construction companies such as Coteccons, Hoa Binh, Vinaconex, and Construction Corporation No. 1 are capable of competing in large-scale infrastructure projects, including hospitals.

Government targets in Healthcare

The approval of the Healthcare Network Master Plan for the period 2021–2030, with a vision to 2050 (Decision No. 201/QĐ-TTg), has set clear quantitative targets that directly translate into concrete construction demands [4]. Among these, hospital bed targets stand out as the most explicit indicators:

Key Healthcare Infrastructure Targets under the National Master Plan (2025, 2030, 2050)

| Indicator | Target 2025 | Target 2030 | Vision 2050 |

| Number of hospital beds / 10,000 population | 33 | 35 | 45 |

| Number of doctors / 10,000 population | 15 | 19 | 35 |

| Number of nurses / 10,000 population | 25 | 33 | 90 |

| Proportion of private hospital beds (%) | – | 15% | 25% |

Source: Ministry of Health

These figures are not merely theoretical targets—they also serve as key performance indicators (KPIs) for the Ministry of Health and provincial authorities. With a population of around 100 million, the 2030 target corresponds to a total of 350,000 hospital beds nationwide. This allows construction companies and investors to roughly estimate the market size and the number of beds that need to be newly built or expanded, forming the basis for viable business planning.

Setting a specific target for the private sector sends a strong policy signal. It not only permits but also encourages private participation, creating a protected market space for non-state investors. This reduces risks for private investors and their contracted construction companies, as their role is recognized as essential for achieving national healthcare strategy goals. In effect, this can be seen as an indirect invitation for investment from the government.

Entry models for foreign investors in Healthcare construction

Foreign investors can participate in Vietnam’s healthcare construction market through several legal models, including 100% foreign-owned enterprises, joint ventures (JVs), business cooperation contracts (BCCs), and public-private partnerships (PPPs). However, the healthcare sector still faces certain regulatory limitations compared to other industries, due to specific regulations on partnerships and construction that require foreign enterprises to collaborate with domestic contractors [5].

Among these models, joint ventures are the most common. Foreign investors collaborate with Vietnamese partners to implement hospital projects, typical examples being American International Hospital (AIH) and FV Hospital (France – Vietnam). The 100% foreign-owned model is less frequently applied due to licensing requirements and investment capital restrictions. BCCs are currently rare in healthcare, usually limited to specialized clinics or pilot projects.

American International Hospital

Source: American International Hospital’s website

Meanwhile, PPP models have traditionally been applied to public infrastructure, but the government is positioning PPPs as a strategic tool to mobilize private capital for healthcare projects, thereby reducing pressure on the state budget. The legal framework for healthcare PPPs is established under the PPP Law, effective from 2021, along with guiding decrees such as Decree 35/2021/ND-CP [6]. Recently, Decree 71/2025/ND-CP removed restrictions on sectors and investment scale, expanding opportunities to attract private resources across all healthcare fields, including healthcare IT projects [7].

Despite these advances, experts note that current regulations still have gaps, lack detailed guidance, and inconsistencies between the PPP Law and other laws, such as the Land Law and Construction Law, can create obstacles in implementation. The Ministry of Health is currently developing more detailed circulars to address these issues.

Market segments and Investment opportunities

Vietnam’s hospital construction market offers numerous opportunities for foreign companies, particularly in high-value, technically demanding segments. Based on market demand and competitive landscape, opportunities can be categorized into three main tiers:

– Mega Public Projects: Includes large-scale new builds and expansions funded by the state, such as Bach Mai Hospital Branch 2 or the three-hospital cluster in Ho Chi Minh City. Participation in this tier almost always requires forming a joint venture with top Vietnamese general contractors. The main challenge is the complex bidding process and the requirement for large-scale project management capabilities.

– High-End Private Projects: Targets rapidly expanding private hospital chains such as Vinmec or Tam Anh. Projects are smaller in scale but demand high construction quality, modern technology, and international standards. Direct cooperation with the investor enhances credibility but requires superior technical capacity, including high-tech and specialized construction for international-standard hospitals, oncology centers, and cleanroom facilities.

– Specialized High-Tech Subcontracting: For companies with specialized technological expertise, providing complex components such as operating rooms, cleanrooms, radiotherapy areas, or MEP (mechanical, electrical, plumbing) systems.

Recommendation

To effectively leverage opportunities, companies should:

– Prioritize local partners: Select general contractors or JV partners with strong technical capabilities, financial transparency, international experience, and cultural fit.

– Position in niche segments: Build a reputation as an expert in high-value specialty areas, e.g., JCI-standard operating theaters or radiotherapy solutions for oncology centers. As basic hospital bed demand is met, the trend will shift towards specialized, standalone medical centers (cardiology, oncology, pediatric hospitals), which require even higher levels of design and construction expertise.

– Invest in local capacity: Recruit Vietnamese engineers, project managers, and legal experts to ensure familiarity with Vietnamese construction standards (TCVN), licensing procedures, and work culture.

– Approach PPPs cautiously: Engage in dialogue with government agencies, prepare for lengthy and resource-intensive processes, and prioritize projects with strong commitment and clear vision from the managing authorities.

Conclusion

Vietnam’s hospital construction sector is at a pivotal point. While public hospitals will continue to play a dominant role, the expanding private sector offers significant opportunities for specialized, high-quality healthcare facilities. Strategic collaboration with local partners, investment in niche capabilities, and careful navigation of regulatory frameworks will be key for both domestic and foreign investors. With these conditions, the sector is poised not only to meet immediate infrastructure needs but also to shape the future of a modern, resilient healthcare system in Vietnam.

[1] Ministry of Health. 2024 Year-End Review and 2025 Task Implementation Conference of the Department of Medical Examination and Treatment Management <Access>

[2] Private healthcare accounts for 24% of the total number of hospitals nationwide <Access>

[3] VOV, Is the ‘aging population storm’ a cause for concern? <Access>

[4] Government News, Approval of the National Healthcare Network Planning for the 2021–2030 period, with a vision to 2050 <Access>

[5] Viet An Laws, Licensing for foreign contractors <Access>

[6] Vietnam Laws, Decree No. 35/2021/ND-CP detailing the implementation of the Law on Investment in the Form of Public-Private Partnership <Access>

[7] Decree No. 71/2025/ND-CP of the Government: Amending and supplementing a number of articles of Decree No. 35/2021/ND-CP dated March 29, 2021, of the Government detailing and guiding the implementation of the Law on Investment under the public-private partnership model <Access>

* If you wish to quote any information from this article, please kindly cite the source along with the link to the original article to respect copyright.

| B&Company

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |