03Sep2025

Latest News & Report / Vietnam Briefing

Comments: No Comments.

Southeast Asia offers rapidly growing markets and competitive manufacturing clusters. But each country has distinct strengths. This guide compares Vietnam, Thailand, Indonesia, Malaysia, and the Philippines on critical site-selection factors. We cover labor costs and skills, infrastructure and logistics, FDI incentives and land policies, and ease of doing business and trade access. This guide compares key market indicators that serve as a starting point for analysis. For an optimal investment decision, businesses are advised to align these factors with their industry context and strategic objectives.

1. Labor market: Costs & skills

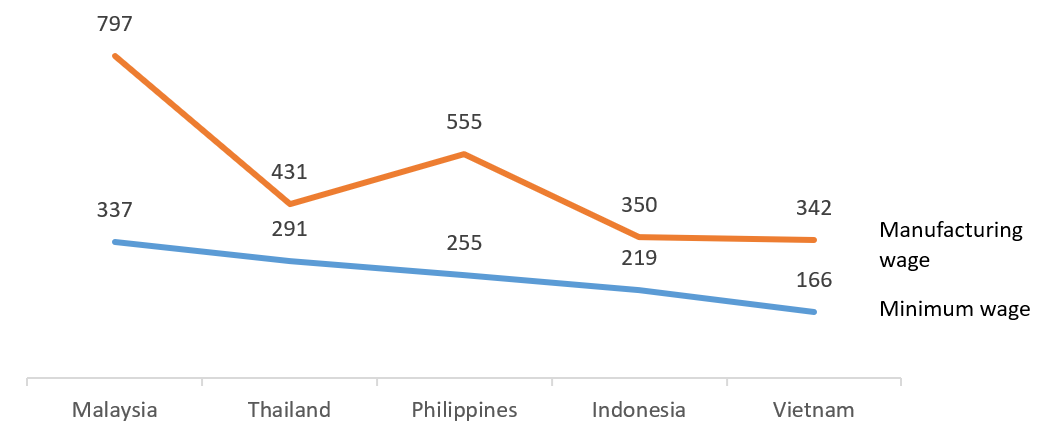

Asian manufacturing relies heavily on labor costs. The countries differ significantly in minimum wages and skilled‐worker salaries.

Avg. monthly minimum wage and manufacturing wage (2024)

Unit: USD

Source: Asean Briefing[1][2], B&Company’s synthesis

For entry-level factory labor, Vietnam ($342/month) and Indonesia ($350/month) stand out with the lowest wages offer the lowest wages, making them ideal for cost-efficient, labor-intensive manufacturing. In contrast, while Thailand ($431/month) and Malaysia ($797/month) have higher wages, their more skilled workforces and better vocational training systems may shorten production ramp-up times for advanced manufacturing. The Philippines presents a middle ground with moderate minimum wages but variable productivity, which may raise effective labor costs. Ultimately, the suitable location depends on whether a company prioritizes low costs or access to skilled workers.

2. Infrastructure & Logistics

A site’s connectivity to supply chains and markets is critical. We compare port quality, industrial parks, and logistics performance for our five countries:

Infrastructure & Logistics quality

| Country | Port infrastructure (Container Port Performance Index – CPPI 2023)[3] | No. of Industrial parks/zones[4] | Logistics rank (Logistics Performance Index – LPI 2023)[5] |

| Malaysia | Rank 5 (Tanjung Pelepas) | ~600 (wide network) | Score 3.6 (Rank 31) |

| Vietnam | Rank 7 (Cai Mep) | ~300 zones | Score 3.3 (Rank 50) |

| Indonesia | Rank 23 (Tanjung Priok) | 103 zones | Score 3 (Rank 63) |

| Thailand | Rank 45 (Laem Chabang) | Extensive IEAT zones (Industrial Estate Authority of Thailand) | Score 3.5 (Rank 37) |

| Philippines | Rank 143 (Cebu) | ~427 PEZA zones (Philippine Economic Zone Authority) | Score 3.3 (Rank 47) |

Source: B&Company’s synthesis

Infrastructure quality is uneven across the region, with Malaysia and Thailand offering the most advanced ports, industrial parks, and logistics networks. These countries provide speed-to-market advantages, particularly for export-driven industries. Vietnam has invested heavily in ports, highways, and industrial zones, positioning itself as a fast-improving contender, while Indonesia’s logistics costs remain relatively high despite the development of over 100 industrial zones. The Philippines offers many PEZA zones but faces challenges due to geography and congestion. For companies prioritizing supply chain reliability, Malaysia and Thailand are safer bets, whereas Vietnam offers a competitive balance of cost and improved infrastructure.

3. FDI incentives & Land policy

Governments compete with fiscal incentives and land-use rights to attract multinationals. This includes tax holidays, reduced land leases, and subsidies targeted to strategic sectors.

| Country | Corporate Income Tax (CIT) incentives | Land use & rental | Other subsidies |

| Vietnam |

|

Land rent reduction or exemption for 3–15 years in industrial parks | Waivers on import duties for machinery/equipment (which is to build a fixed asset of the investment project) |

| Thailand | Through the Board of Investment (BOI): 8–13 years CIT exemption (up to 10+ years for high-tech A1+ projects) | Favorable land leases in Free Industrial Zones under BOI (e.g., duty free) | Import duty exemptions on machinery/raw materials; grants for innovation (e.g., THB 10B fund) |

| Malaysia |

|

Long-term industrial park leases (20–99 years) | Import duty exemptions for capital equipment (e.g., Licensed Manufacturing Warehouses (LMWs) & Free Zones (FIZ)[6] |

| Indonesia | Tax holiday 5–20 years (100% CIT exemption) for projects ≥IDR 500B. Smaller (IDR 100–500B): 50% CIT cut for 5 years | Land rights: Hak Guna Bangunan (50 years, extendable), up to 70 years in SEZs | 30% investment tax credit over 6 years, accelerated depreciation |

| Philippines |

|

Land in PEZA zones can be leased for up to 50 years, renewable once for an additional 25 years | Duty-free import of equipment, training & employment deductions |

Source: B&Company’s synthesis

Each country’s fiscal package targets different priorities. Vietnam and Thailand offer the deepest income-tax holidays (especially for technology or export-oriented manufacturing). Indonesia’s new tax-holiday regime makes very large projects cheaper. Malaysia and the Philippines focus on moderate-length tax breaks but combine them with ease (Malaysia’s “Pioneer” program is straightforward; PEZA zones in the Philippines bundle incentives). In practice, one should match incentives to project profile: for example, an ICT manufacturing line might favor Vietnam or Thailand (long holidays and 5% rates), while a commodity processing plant might do well under Malaysia’s Pioneer status or Indonesia’s allowance.

4. Ease of doing business & market access

Regulatory and market factors—how quickly you can set up, navigate bureaucracy, and ship goods—are equally decisive.

| Country | Business-ready rank (B-ready 2024)[7] | Setup Time & Transparency | Trade Agreements & Market Access |

| Malaysia | 12 (2020) | Online registration possible; company setup in days. Strong legal transparency | ASEAN, RCEP, CPTPP, bilateral FTAs with Japan, Australia, NZ, etc. |

| Philippines | 16 | Registration often >1 month; fragmented across agencies | ASEAN, RCEP, AJCEP (Japan); fewer bilateral FTAs than peers |

| Thailand | 21 (2020) | Fast-track registration; efficient BOI support. Strong IP protection for manufacturing sectors | ASEAN, RCEP, multiple FTAs (e.g., Japan, Australia); EU FTA under negotiation |

| Vietnam | 26 | Company registration ~2–3 weeks. Reforms are improving, but bureaucracy persists | ASEAN, RCEP, CPTPP, EVFTA (EU), UKVFTA – broad global tariff-free access |

| Indonesia | 31 | Company incorporation ~4–6 weeks. Some bureaucracy and transparency concerns | ASEAN, RCEP, Japan CEPA, EU FTA under negotiation |

Source: B&Company’s synthesis

Until 2020, Malaysia and Thailand consistently ranked high in the World Bank’s Ease of Doing Business index. Although the index was discontinued and replaced by B-READY in 2021, both countries remain recognized for transparent regulations and efficient company setup processes. Vietnam remains more bureaucratic but compensates with extensive free trade agreement (FTA) coverage, including CPTPP and EVFTA, which provides unparalleled access to global markets. Indonesia balances its large domestic market with moderate business conditions, while the Philippines trails in regulatory efficiency and has fewer trade agreements beyond ASEAN. For companies focused on global supply chains, Vietnam and Malaysia are particularly attractive; those prioritizing smooth setup and legal transparency may lean toward Thailand and Malaysia.

5. Strategic Multi-Country View – B&Company’s Edge

No single country is “best” for every project. A cost-sensitive garment factory may favor Vietnam or Indonesia (lowest wages, solid textile parks), whereas an electronics assembly plant might choose Malaysia or Thailand (higher skill-level workforce, better utilities and incentives for high-tech). Meanwhile, the Philippines might win on language and cultural fit for certain multinationals despite higher logistics costs.

The key takeaway is a strategic match of project priorities to country profiles. For example:

– If lowest unit labor cost matters: prioritize Vietnam/Indonesia (min. wage ~$150–$210) and bolster through local skill training.

– If world-class infrastructure is crucial: favor Malaysia/Thailand (top-tier ports, highways, power).

– If maximal tax breaks for R&D: lean on Vietnam/Thailand incentives (5–10% CIT, long holidays).

– If rapid export to the EU/US is the goal: Vietnam/Malaysia’s FTAs can cut tariffs significantly.

Choosing the right country in Southeast Asia requires navigating multiple trade-offs—cost versus skills, infrastructure versus incentives, short-term setup versus long-term scalability. B&Company offers an integrated solution by leveraging its network with local research agencies across Southeast Asia. This enables one-stop support for investors, covering multi-country benchmarking, industrial park shortlisting, incentive assessment, and regulatory navigation. With this capability, B&Company helps multinationals move beyond fragmented country reports and make data-driven site selection decisions across the region.

Conclusion

Expanding into Southeast Asia requires balancing costs, infrastructure, incentives, and regulations—not just comparing single criteria. The right choice depends on both current metrics and future shifts like labor reforms, trade agreements, and logistics upgrades.

B&Company provides one-stop, multi-country analysis through its regional research network, giving decision-makers comparable data and sector-specific insights. With this support, investors can move beyond instinct and make expansion decisions in Southeast Asia that are competitive, well-informed, and future-ready.

[1] Asean Briefing (2024), Southeast Asia Manufacturing Tracker: Key Insights and Trends <Access>

[2] Asean Briefing (2024), ASEAN Labor Costs: Minimum Wage and Social Insurance Essentials <Access>

[3] World Bank (2024), The Container Port Performance Index 2023 <Access>

[4] B&Company’s synthesis from public data

[5] World Bank, Logistics Performance Index (LPI) <Access>

[6] PwC Malaysia, 2024/2025 Malaysian Tax Booklet <Access>

[7] B-READY report (by World Bank): evaluates aspects of a firm’s life cycle, including starting, operating, and closing a business. Its 2024 Edition covers only 50 economies, with the goal to cover 180 economies by 2026

* If you wish to quote any information from this article, please kindly cite the source along with the link to the original article to respect copyright.

| B&Company

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |