17Dec2025

Latest News & Report / Vietnam Briefing

Comments: No Comments.

In 2025, Vietnam’s coffee market has seen a strong recovery in supply following a sharp decline during the 2023–2024 crop year, marking a turning point for the industry: for the first time in history, coffee export revenue for the 2024–2025 season surpassed USD 8.4 billion, making coffee one of Vietnam’s most valuable agricultural export commodities[1]. At the same time, both domestic consumption and export demand continue to grow, accompanied by emerging trends that are reshaping the market landscape — creating both opportunities and challenges for investors looking to enter Vietnam’s coffee sector.

Overview of Vietnam’s Coffee Supply

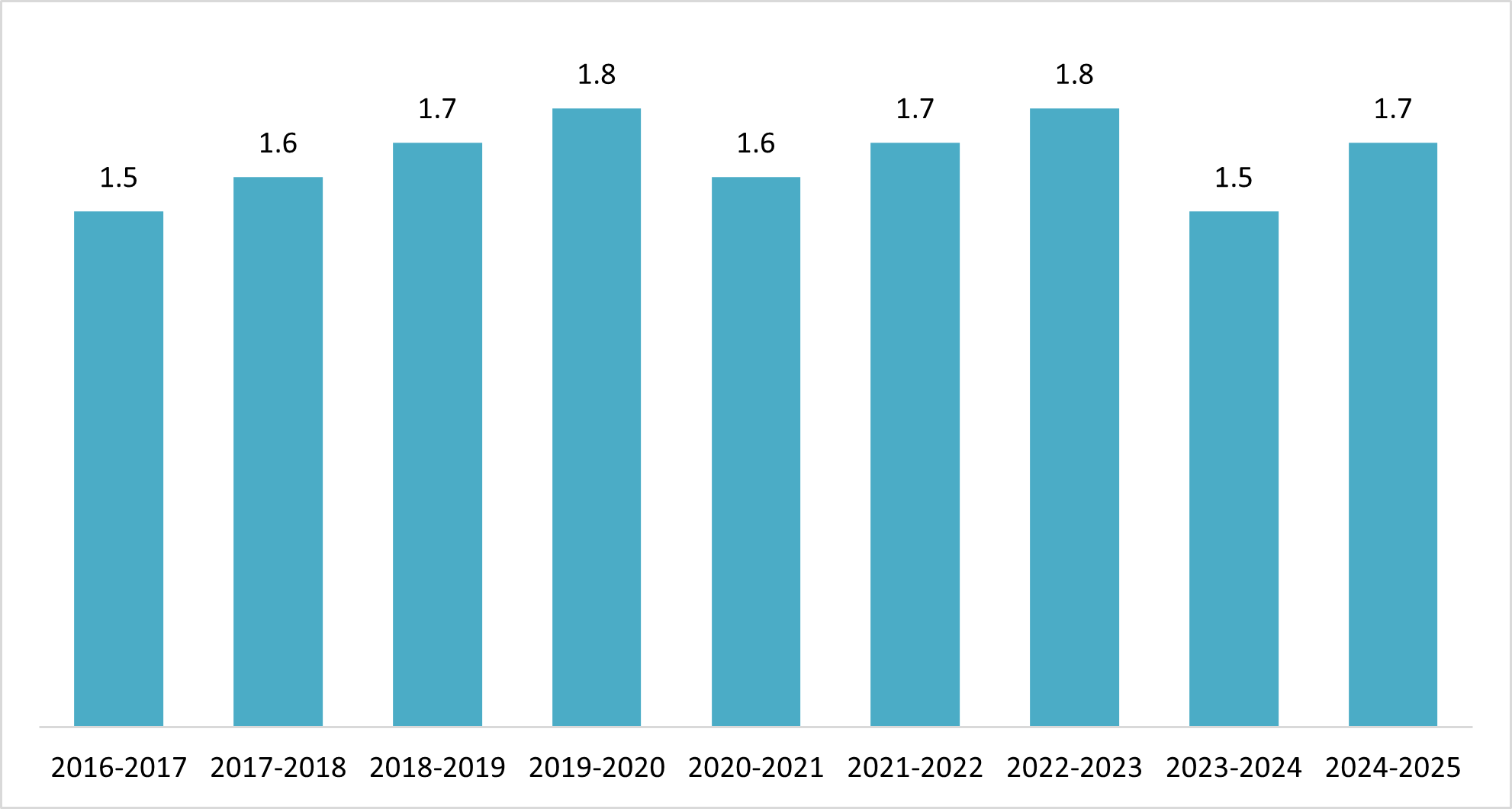

Vietnam’s coffee production shows an overall upward trend from 1.45 million tons in 2016–2017 to a peak of 1.80 million tons in 2019–2020. Output then fluctuates, with a temporary decline in 2020–2021 and a sharper drop to 1.5 million tons in 2023–2024. In the 2024–2025 crop year, production recovers to 1.7 million tons, though it remains slightly below the 2022–2023 level.

Vietnam’s Coffee Production from the 2016–2017 to the 2024–2025 Crop Year

Unit: Million tons

Source: VITIC ’s calculations based on data from Vicofa

In 2023–2024, Vietnam’s coffee output declined mainly due to prolonged drought in key growing areas, along with rising pests and diseases, and shrinking cultivation area such as Đắk Lắk and Đắk Nông. In 2024–2025, production recovered thanks to more favorable weather, improved farming practices, and greater investment and crop care. As a result, VICOFA reported total output of over 1.7 million tons, up more than 9% from 2023–2024[2].

Coffee Demand: Domestic Consumption and Exports

Vietnam is a country with a high coffee consumption rate. According to data from the Vietnam Coffee and Cocoa Association (VICOFA), per capita coffee consumption increased from 1.7 kg in 2015 to nearly 3 kg in 2023[3]. In addition, domestic consumption over the 2025–2030 period is projected to grow at an average annual rate of around 6.6%. By 2025, domestic coffee consumption is expected to reach 270,000–300,000 tonnes per year.

In terms of exports, Vietnam remains one of the world’s leading net coffee exporters and continues to hold its position as the world’s largest producer and exporter of Robusta coffee.

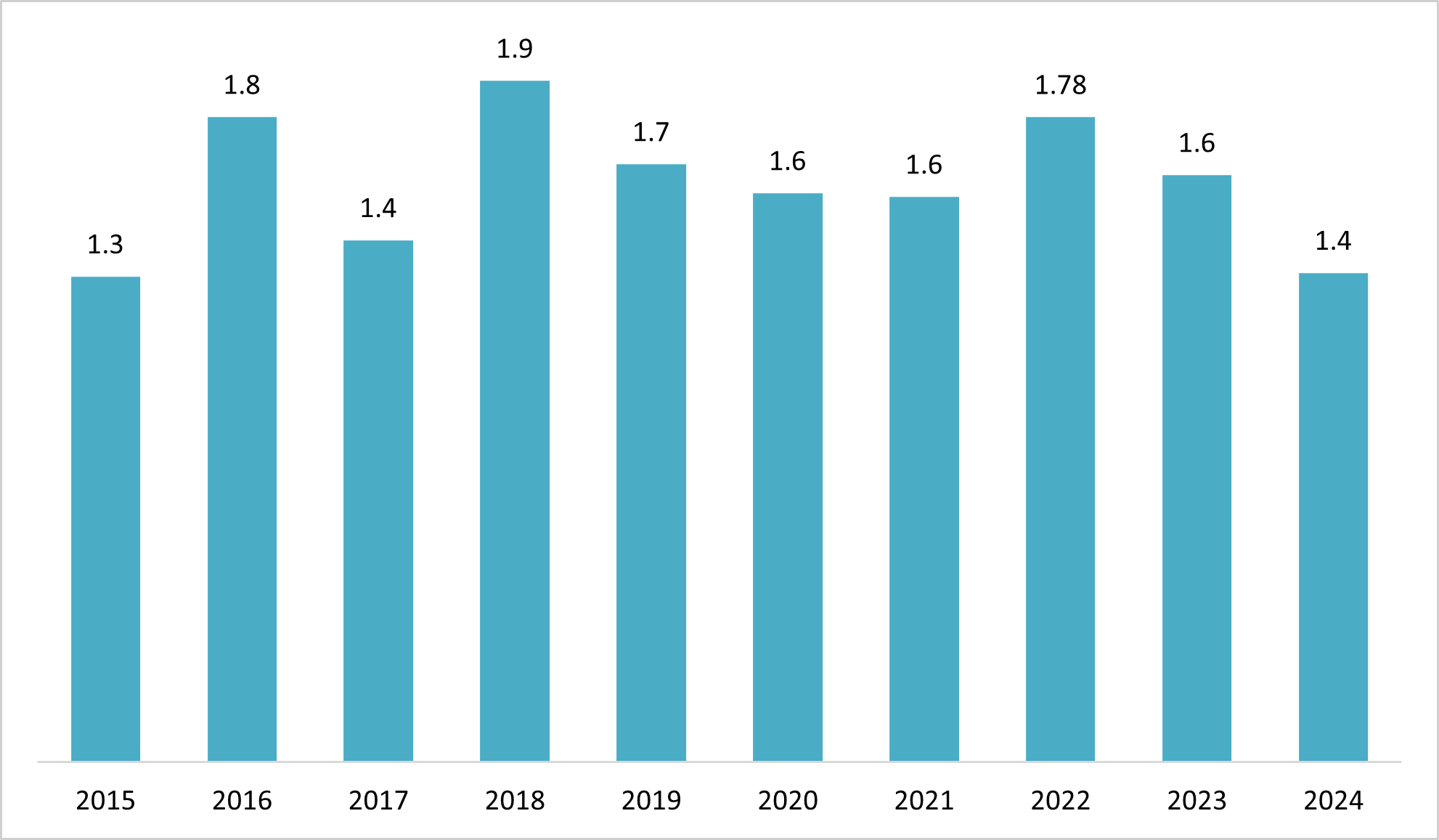

Vietnam’s Coffee Export Volume (2015-2024)

Unit: Million tons

Source: Export-Import Report 2024

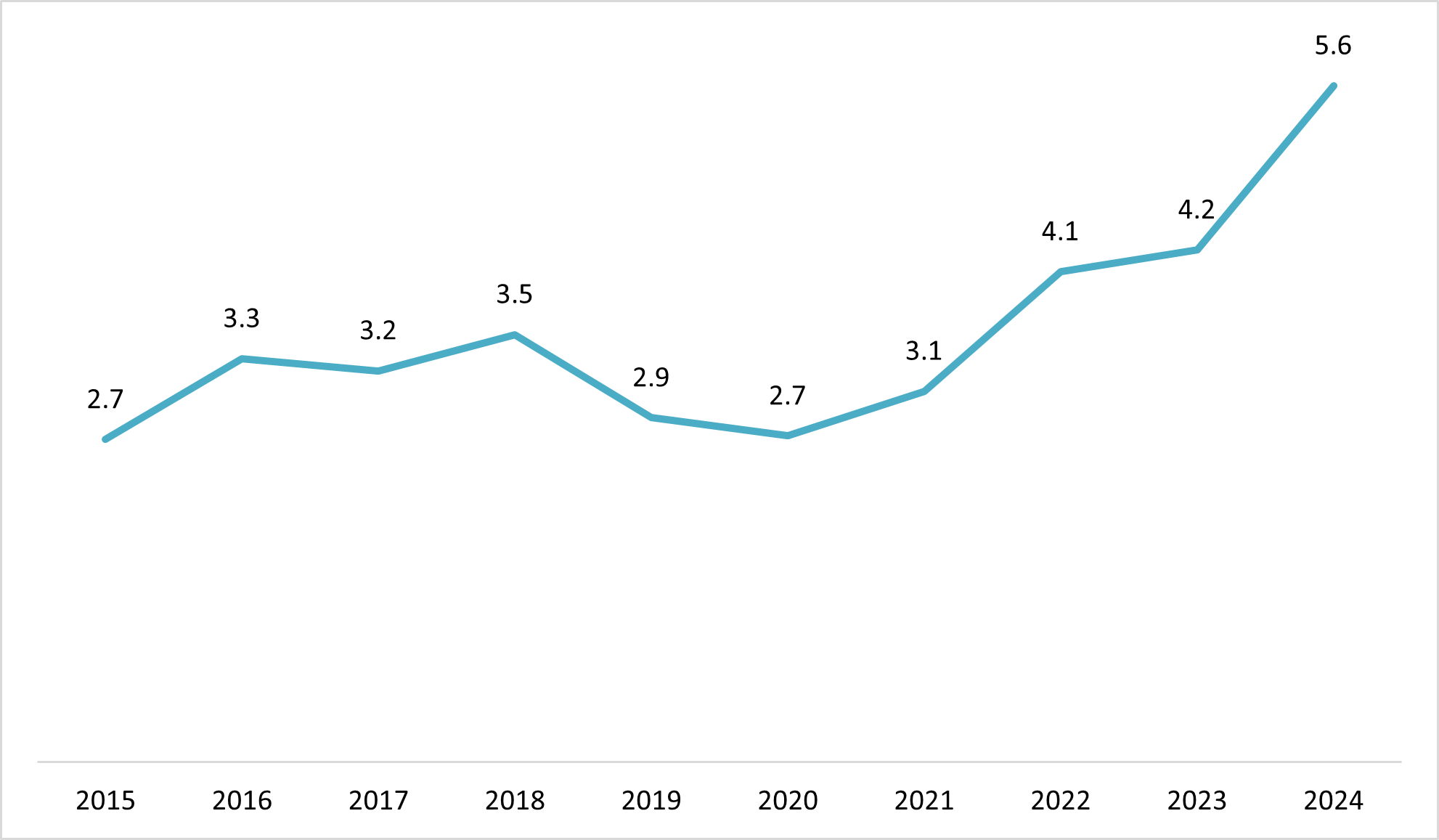

Vietnam’s Coffee Export Value (2015-2024)

Unit: Billion USD

Source: Export-Import Report 2024

In 2024, Vietnam exported 1.35 million tons of coffee worth USD 5.6 billion, representing a 17.1% decline in volume but a 32.5% increase in value compared to 2023. Notably, in the first 10 months of 2025, Vietnam’s coffee exports reached 1.3 million tons, with an export value of USD 7.4 billion. — an increase of 13.4% in volume and 62% in value over the same period in 2024[4].

For the whole of 2024, the average export price of coffee was estimated at USD 4,158 per ton, up 59.1% compared to 2023[5]. By mid-November 2025, the average export price rose to USD 5,662 per ton, up 41.6% year-on-year[6].

Key market trends

Amid continuously rising coffee consumption, evolving consumer behavior, and increasingly stringent sustainability standards imposed on the industry, the coffee market is witnessing several notable trends:

– Specialty coffee and quality are on the rise: Vietnamese consumers are increasingly gravitating toward specialty coffee that offers high quality, clear origin traceability, and sustainable production processes. Younger consumers see coffee drinking as a lifestyle statement and are willing to seek out distinctive experiences—quality beans, compelling origin stories, and refined roasting and brewing techniques. Coffee shops are no longer just places to drink coffee; they have become multifunctional spaces for work, entertainment, and social interaction. Hybrid concepts that combine cafés with co-working areas, art spaces, or even curated retail of specialty products are expected to become key highlights that attract customers[7].

– Health and sustainability take priority: Coffee is no longer consumed only for alertness or taste, more products are being positioned with added health benefits. Vietnamese consumers are increasingly drawn to lighter, smoother, and more creative flavor profiles, including coffee blended with fruit or plant-based ingredients, aligning with healthier lifestyles. In 2025, functional coffee products enhanced with collagen, vitamins, herbs, and similar ingredients have emerged as a new wave, targeting consumers who pay close attention to nutrition and overall wellbeing[8].

– Young consumers are paying more attention to “green” factors: They tend to prioritize brands that use environmentally friendly packaging and are willing to pay more for sustainable products. Surveys show that 57.4% of consumers are willing to choose products with “green” packaging if prices are comparable, and 41.1% are willing to pay a premium for sustainable products[9].

Main players update in the Vietnam coffee market

Vietnam’s coffee market is dominated by long-established and experienced enterprises that operate fully integrated value chains — from sourcing to processing and exporting.

| No | Company Name | Establishment Year | Headquarter | Short Update | URL

|

| 1 | Vinacafé Bien Hoa Joint Stock Company (VCF) | 1998 | Dong Nai, Viet Nam | – In Q3 2025, the company recorded net revenue of VND 546 billion, down 10% year-on-year, while profit after tax increased by 12% year-on-year.

– The company also announced a resolution from an extraordinary General Meeting of Shareholders regarding changes in the Board of Directors/audit committee personnel and adjustments to the Board’s structure. |

https://vinacafebienhoa.com/ |

| 2 | Gia Lai Coffee Joint Stock Company (FGL) | 1998 | Gia Lai, Vietnam | – In Q3 2025, revenue was 2.7 times higher than the same period last year, but the company still reported a post-tax loss of more than VND 3 billion due to high financial expenses and administrative overhead; for the first nine months of 2025, the loss totaled VND 11.4 billion.

– The company stated that revenue remained low because the harvest season had not yet started (beginning in October–December 2025), and it is still addressing issues related to the handover of assets and land following equitization.

|

http://gialaicoffee.com.vn/ |

| 3 | Thang Loi Coffee Joint Stock Company (CFV) | 1998 | Đak Lak, Vietnam | – Q3 2025: Revenue reached VND 22.2 billion (three times higher than the same period last year), but the company still posted a post-tax loss of VND 2.7 billion due to selling below cost.

– First nine months of 2025: Revenue totaled VND 304 billion (up 12%), yet the company recorded a post-tax loss of VND 1.5 billion, far below the same period last year when it remained profitable. |

https://thangloicoffee.com.vn/ |

| 4 | Phuoc An Coffee Joint Stock Company (CPA) | 1998 | Khanh Hoa, Vietnam | – Q3 2025: Revenue was VND 11.4 billion (almost unchanged year-on-year), but the company still recorded a post-tax loss of VND 361 million, despite lower interest and administrative expenses.

– First nine months of 2025: Revenue totaled VND 18 billion (down 26%), with a post-tax loss of VND 2.7 billion.

|

https://phuocancoffee.com.vn/ |

Source: Mediacdn

Overall, the latest updates show a clear divergence among the major coffee companies. Vinacafé Bien Hoa (VCF) stands out as the most resilient player, delivering higher profit despite lower revenue, which suggests stronger cost control and a more stable business foundation. In contrast, Gia Lai Coffee (FGL), Thang Loi Coffee (CFV), and Phuoc An Coffee (CPA) all reported losses—in some cases, revenue rose sharply in the quarter but profitability remained negative due to selling below cost, while others suffered from weak or declining revenue that could not offset fixed expenses. In short, the latter group is under pressure from core operating efficiency and cost absorption, whereas VCF appears better positioned to navigate market volatility.

Implications for foreign investors

Vietnam’s coffee market is undergoing a strong recovery following a period of production decline, with export revenue in 2025 surpassing USD 8.4 billion for the first time — a historic record. Domestic consumption is growing at an average annual rate of 6.6%, while the specialty coffee segment is also expanding rapidly with a CAGR of 7.32%, unlocking significant potential for high-quality products. Export prices for Vietnamese coffee continue to reach new highs, and the country maintains its global lead in Robusta coffee production.

Despite this promising outlook, Vietnam’s coffee sector faces notable challenges. Climate change is causing unpredictable fluctuations in yield. Many companies remain reliant on exporting green coffee, resulting in low value addition and limited global competitiveness. Furthermore, strict regulations such as the EU Deforestation Regulation (EUDR), which require full traceability and deforestation-free sourcing, are placing significant pressure on Vietnam’s coffee supply chain.

Foreign investors interested in entering the Vietnamese coffee market may consider the following recommendations:

– Invest in deep processing and value-added products such as instant coffee, roasted coffee, specialty coffee, or functional beverage lines, as the market is shifting from raw exports to finished consumer goods.

– Partner with local enterprises that already possess certified raw material areas and sustainability credentials, to leverage established supply networks and meet stringent market requirements like those in the EU.

– Focus on the fast-growing domestic market, especially urban youth segments who favor quality coffee experiences and origin transparency.

– Prepare for international compliance by investing in digital technologies, plantation data systems, and cooperative models linking farmers and businesses.

* If you wish to quote any information from this article, please kindly cite the source along with the link to the original article to respect copyright.

| B&Company

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |

[1] Vietnam coffee exports hit record USD 8.4 billion in 2025 <Access>

[2] Vietnam’s coffee exports set a historic record of USD 8.4 billion <Access>

[3] Vietnam’s coffee consumption trends and market outlook <Access>

[4] VietnamBiz – Coffee Market Report (October 2025) <Access>

[5] Government News – Sustainable Coffee Exports Require Effective Replanting <Access>

[6] Vietnam Investment Review – Vietnam’s Coffee Exports Shift Towards Higher-Value Products <Access>

[7] Vietnam Coffee Market Forecast 2025 <Access>

[8] Vietnam Coffee Market Forecast 2025 <Access>

[9] Instant Coffee Industry Seeks Opportunities Through Green Growth <Access>