07Aug2025

Latest News & Report / Vietnam Briefing

Comments: No Comments.

The Electric Vehicle boom in Vietnam

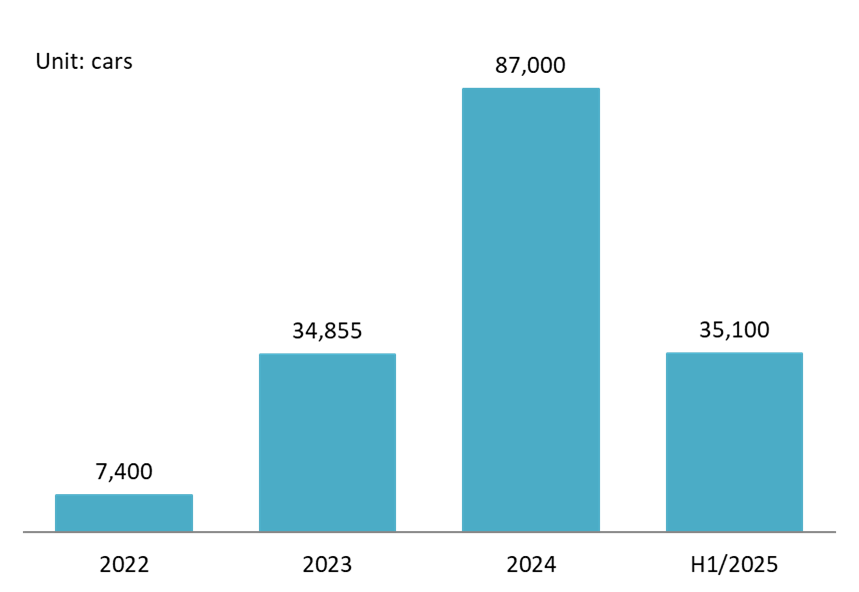

Vietnam’s electric vehicle (EV) market is projected to reach USD 3.12 billion by 2025 and grow to USD 7.41 billion by 2030, with a compound annual growth rate (CAGR) of around 19% [1]. This remarkable growth is largely driven by the domestic brand VinFast. As of July 2023, Vietnam had just over 20,000 electric cars on the road [2]. However, the number has been raised significantly. VinFast alone sold 87,000 EVs in 2024 (a 150% increase) and delivered another 35,100 vehicles in the first quarter of 2025 [3,4].

Number of VinFast vehicles delivered until H1/2025

Source: B&Company compilation

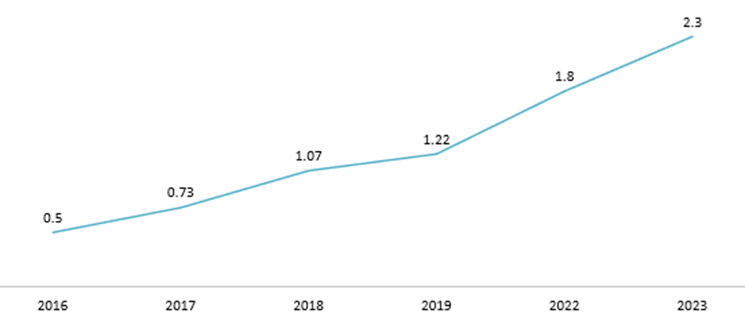

In the electric motorcycle segment, growth is equally impressive. The sub-50cc category—targeting students and young users—saw a 112.6% surge in sales during the early months of 2025 [5]. Vietnam is currently one of the world’s largest two-wheeler markets, with nearly 75 million registered motorcycles and an annual production volume ranging from 3 to 4.7 million units between 2019 and 2023. In this context, electric motorcycles are gradually gaining market share, with the number of registered units rising from 0.5 million in 2016 to 2.3 million in 2023, reflecting a CAGR of 24.3%. Leading brands in the market include VinFast, Yadea, Pega, and Yamaha [6].

Number of total registered E2W in Vietnam from 2016 to 2023[11] (Unit: Million units)

Source: GIZ

EV Battery lifespan

With an average EV battery lifespan of 8–10 years, the vehicles sold between 2023 and 2025 are expected to begin reaching end-of-life (EOL) and generating battery waste in bulk from 2031 to 2035. According to VAMA, around 1 million EVs will be in circulation by 2028, rising to 3.5 million by 2040 [7]. Based on this trajectory, battery demand is projected to reach nearly 5 million units by 2040 and 10 million units by 2050 to support the target of 100% EV penetration across most road vehicle segments in Vietnam. In terms of battery capacity, demand is expected to reach approximately 100 GWh in 2030, 360 GWh in 2040, and 1,170 GWh in 2050—highlighting a massive future demand and the corresponding rise of the battery recycling market [8].

Globally, the battery recycling market is projected to be worth tens of billions of USD in the next decade. In Vietnam, revenues in this sector come from two main sources: the sale of recovered metals such as lithium, nickel, cobalt, and copper, depending on global market prices; and EPR (Extended Producer Responsibility) service fees paid by manufacturers to comply with the mandated 8% recycling obligation. The EPR stream provides stable income and serves as a financial safety net against price volatility in the metals market.

Policy framework

The Environmental Protection Law 2020 and its implementing Decree No. 08/2022/NĐ-CP have laid a solid legal foundation for the recycling industry in Vietnam [9, 10].

– The recycling obligation for battery and accumulator producers and importers officially came into force on January 1, 2024. This is not a future proposal—it is a legally enforced requirement.

– In the first three years, producers are required to recycle at least 8% of the total battery volume they place on the market. For example, a company that sells 10,000 tons of batteries in 2024 must legally recycle 800 tons.

– The recycling process must achieve a minimum material recovery rate of 40% of the total waste volume processed. This sets a basic technical threshold that all recycling facilities must meet.

The early steps in EV battery recycling

VinES & Li-Cycle – A pioneering move toward a closed-loop supply chain

In late 2022, VinES (a subsidiary of Vingroup) signed a global strategic partnership with Li-Cycle, a leading battery recycling company based in North America [11]. The partnership aims to establish a closed-loop battery supply chain, in which valuable materials such as lithium, nickel, and cobalt are recovered and reused in the production of new batteries at VinES factories.

Through this collaboration, VinES gained access to world-class hydrometallurgical technology, featuring Li-Cycle’s patented “Spoke & Hub” model, which allows for up to 95% material recovery. This significantly shortens VinES’s R&D timeline and enables the rapid localization of international-standard technology in Vietnam.

The two parties are currently assessing the feasibility of building a “Spoke” recycling facility near VinES’s production complex in Ha Tinh. The final investment decision is expected to be made in 2025.

Ho Chi Minh City’s proposal – a proactive public sector initiative

Ho Chi Minh City, through the Ho Chi Minh City Institute for Development Studies (HIDS), has proposed the development of a specialized battery recycling center [12]. This is part of a broader plan to transition 400,000 gasoline-powered motorcycles—primarily used by delivery and ride-hailing drivers—to electric models.

The proposed facility would have an annual capacity of 3,000 tons, aiming to recover 90–95% of valuable metals from end-of-life batteries [12]. This strategic move anticipates the wave of battery waste generated by the city’s urban electrification push.

To support the project, the city intends to provide financing through the Environmental Protection Fund or preferential loan schemes for qualified investors, demonstrating the public sector’s proactive role in fostering Vietnam’s battery recycling ecosystem.

VinES leads, but the market is still wide open

Vietnam has laid a legal foundation for battery recycling, with the Environmental Protection Law and Decree 08/2022/NĐ-CP officially taking effect in 2024. These regulations create a mandatory market through the Extended Producer Responsibility (EPR) scheme. At the same time, VinES (a subsidiary of Vingroup) has emerged as the industry pioneer, pursuing a closed-loop supply chain strategy and planning to build its own recycling facility.

The current landscape can be described as a “bipolar intent”: it creates high entry barriers on one hand, while opening clear opportunities on the other. VinES’s move has established a vertically integrated giant—its ecosystem not only manufactures most EVs in Vietnam but also produces batteries, making Vingroup both the largest supplier and the largest customer within the recycling value chain. Their closed-loop ambition means they are likely to prioritize recycling their own batteries to secure raw material supply. As a result, it creates an almost impenetrable wall for any new player seeking access to VinFast’s end-of-life batteries.

However, the broader market includes other brands such as Yadea, Pega, Hyundai, and BYD. These companies are also subject to EPR regulations but may lack the scale to build their own recycling facilities. This presents a clear market gap. Ho Chi Minh City’s proposal for a public-private recycling center is a recognition of this gap. A new private company can position itself as a specialized recycler for the “non-VinFast” segment—operating as a pure B2B service provider rather than a vertically integrated material company.

Recommendations for new entrants

Rather than competing directly with large integrated players like VinES, investors and entrepreneurs should focus on addressing critical gaps in the ecosystem. Specifically:

– First, build a nationwide collection and logistics network for EOL (end-of-life) batteries;

– Second, operate “Spoke” facilities to produce black mass—a capital-efficient entry point;

– Third, specialize in second-life applications by testing, sorting, and repurposing used batteries for energy storage systems (ESS).

Meanwhile, industrial players such as automotive brands and logistics firms should consider forming alliances to develop shared recycling solutions. This not only ensures EPR compliance but also builds the scale needed for cost efficiency—especially in a market still in its early formation stage.

[1] Mordor Intelligence, Vietnam Electric Vehicle Market Size & Share Analysis – Growth Trends & Forecasts (2025 – 2030) <Access>

[2] The Investor, Electric vehicles in Vietnam: 7 years of development and double-digit growth prospect <Access>

[3] Enternews, Will EV dominate the Vietnamese market? <Access>

[4] Vietnam Plus, Vinfast delivers 12,100 EVs in March, leads Vietnam market <Access>

[5] Vietnam.vn, Vietnam Motorcycle Market – Electric Vehicles Grow Impressively <Access>

[6] GIZ, Electric Two-Wheelers in Vietnam <Access>

[7] Finance news, Vietnam’s EV charging infrastructure key to green transition <Access>

[8] Vietdata Research, The explosion of electric vehicles: Opportunity or Challenge for Vietnam’s battery market <Access>

[9] The Environmental Protection Law 2020 <Access>

[10] Decree No. 08/2022/NĐ-CP of the Government: Detailing the implementation of certain articles of the Law on Environmental Protection <Access>

[11] Vietnam News, VinES and Li-Cycle announce strategic, long-term battery recycling agreement <Access>

[12] VnEconomy, HCMC plans EV battery recycling plant with 95% metal recovery rate <Access>

* If you wish to quote any information from this article, please kindly cite the source along with the link to the original article to respect copyright.

| B&Company

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |