08Jul2025

Latest News & Report / Vietnam Briefing

Comments: No Comments.

Amid Vietnam’s increasingly developing economy and noticeably improved living standards, people’s health awareness is rising. Especially in the corporate environment, periodic health checkups are not only a mandatory legal requirement but also regarded as an important welfare policy to retain workers. This leads to higher customer expectations: the service must be not only fast and convenient but also accurate in diagnosis, provide quality post-checkup consultation, and offer personalization tailored to each individual. In this context, periodic health checkup services are emerging as a field with strong development potential, opening significant business opportunities for healthcare enterprises, especially those that grasp the trend of enhancing experience and professional quality.

Periodic Health Checkup Market: Dynamic and Promising

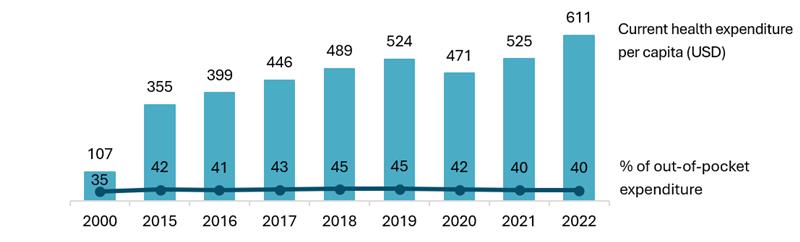

Per capita healthcare expenditure in Vietnam increased 5.7 times from $107 (2000) to $611 (2022), while out-of-pocket payments remain high (40–45%)[1]. This indicates that people are increasingly willing to invest in health and proactively pay for quality services. Whereas periodic health checkups used to be only mandatory for recruitment or paperwork, now more people actively choose this service as part of a modern lifestyle. A survey by the Ministry of Health shows that over 90%[2] of workers had periodic health checkups in the past year. This is a great opportunity to develop periodic health checkup services, an area with strong growth potential driven by demand for preventive care and proactive health management.

Current health expenditure per capita (USD) and % of out-of-pocket expenditure (%)

Source: World Bank

Furthermore, the Ministry of Health has set an ambitious goal: by 2030, all Vietnamese citizens will receive periodic health checkups at least once per year. “An estimated 100 million people, with each checkup costing about 250,000 VND, equals 25 trillion VND per year,” Deputy Minister of Health Tran Van Thuan stated[3]. Although this is a large number, it clearly reflects the government’s strong commitment to public health.

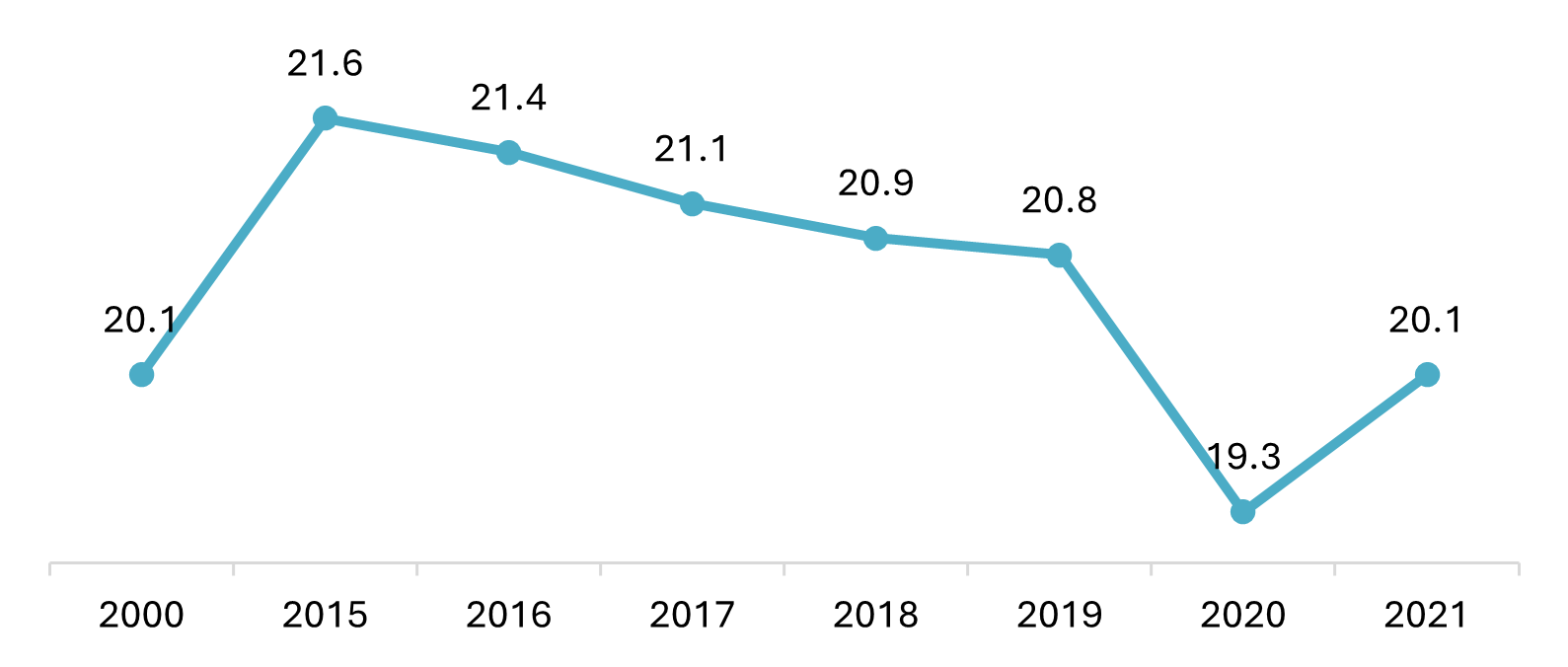

Despite an increasingly developed healthcare system and greater public health awareness, the mortality rate from cardiovascular disease, cancer, diabetes, or chronic respiratory diseases among people aged 30–70 remains quite high, around 20% of the population (quite high compared to Singapore at 10.3% in 2021 and Thailand at 14.5% in 2021). Causes may include unhealthy lifestyles and late disease detection. Therefore, demand for periodic health screening is increasingly emphasized in the community. Experts assess this as a promising market, expected to boom during 2025–2030.

Mortality from CVD, cancer, diabetes, or CRD between exact ages 30 and 70 in Vietnam (%)

Source: WHO[4]

Periodic Health Checkups: Increasingly Strict Legal Regulations

According to the Health Insurance Law and guiding documents (such as Circular 30/2023/TT-BYT[5]), health insurance only covers treatment when there are pathological signs, excluding periodic or general health checkups. However, periodic health checkups have been legislated for employees. Circular 14/2013/TT-BYT[6] and the latest Circular 32/2023/TT-BYT [7]clearly state that all businesses must organize health checkups for employees at least once a year. For special jobs involving heavy, hazardous work or vulnerable workers, checkups must be twice a year.

Notably, all periodic health checkup expenses for employees can be counted as legitimate deductible expenses when enterprises declare corporate income tax, helping reduce the financial burden for businesses fulfilling their legal obligations.

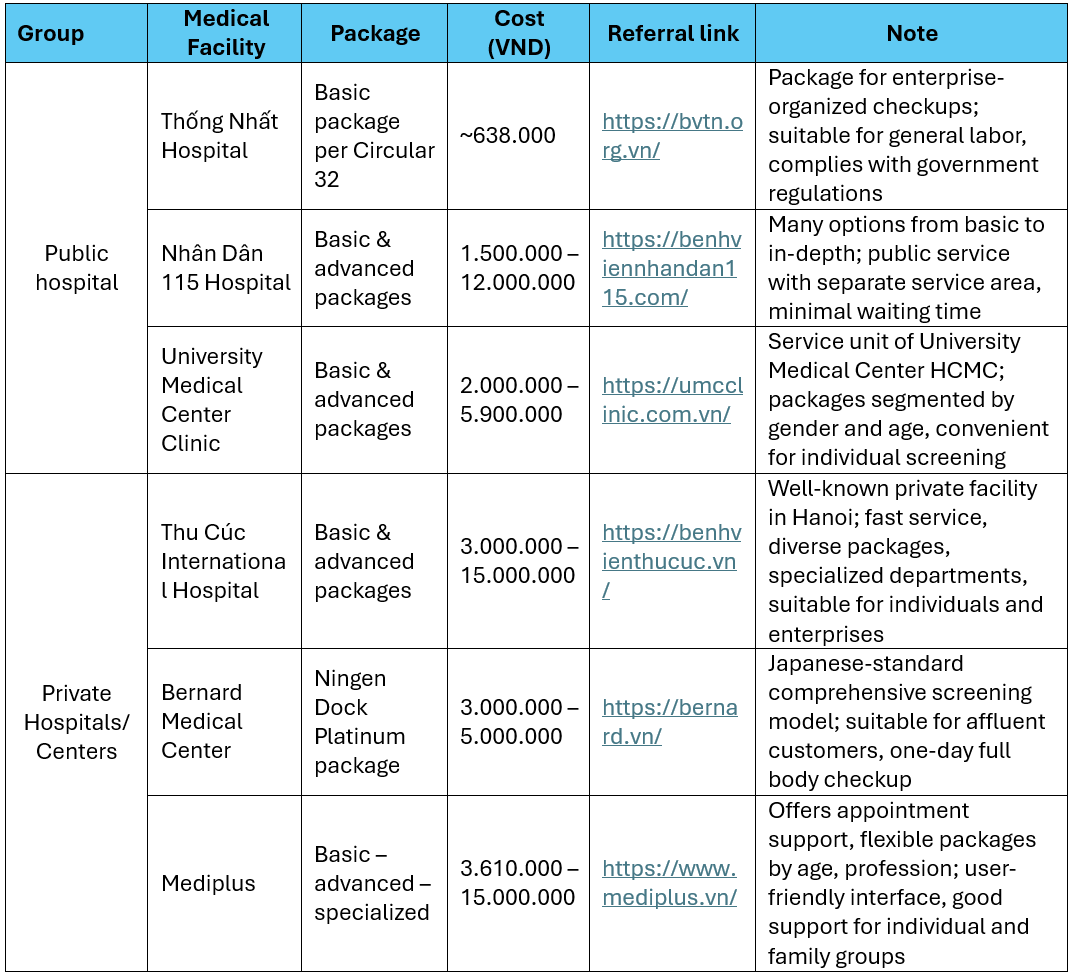

Periodic Health Checkup Services: Diverse Providers, Flexible Costs

Currently, periodic health checkups are offered by a wide range of providers, from national hospitals to private healthcare facilities. Packages are flexibly designed based on gender, age, and needs. Generally, public hospitals offer lower costs, mainly serving mandatory checkups, suitable for enterprises and workers. Meanwhile, private hospitals focus on high-quality services with diverse packages, modern facilities, flexible timing, suitable for those requiring in-depth screening, personalized care, and corporate checkups for senior staff.

Source: B&Company’s synthesis

New business trends: Opportunities for startups and technology businesses

With rapidly increasing and uneven demand across regions, Vietnam’s periodic health checkup market opens many new business models:

– Home health checkups: Blood sample collection, home testing, online result delivery, and remote consultation are deployed by healthcare startups in Ho Chi Minh City and Hanoi. This model is especially suitable for elderly and busy customers.

– Digital health management apps: Apps that help users track health indicators, store checkup results, remind appointments, and suggest specialist consultations are promising in the digital age.

– Comprehensive corporate health care packages: Integrating periodic checkups, psychological support, nutrition, and occupational health advice is a modern HR trend to retain talent.

– Specialized packages by customer group: Checkup packages for pregnant women, the elderly, and people with chronic diseases are well received by the market.

These models not only differentiate the market but also address key shortcomings of traditional healthcare: overload, waiting, and lack of post-checkup interaction.

———-

B&Company – Strategic Partner for Businesses Interested in This Market

As a 100% Japanese-owned company with over 15 years of operation in Vietnam, B&Company has strengths in market research and strategic consulting in many fields, especially healthcare and wellness.

B&Company can support:

– In-depth consumer surveys: behavior, willingness to pay, trust in private vs public services.

– Competitive analysis: assess existing providers, identify market gaps.

– Product development consulting: optimizing packages, pricing, and target market channels.

– Domestic partner connections: from hospitals to health tech startups, building a comprehensive cooperative ecosystem.

[1] World Bank: https://wdi.worldbank.org/table/2.12

[2] General Statistics and Information Department – Ministry of Science and Technology: https://sti.vista.gov.vn/publication/download/hE/qFsUesUehEIDsUe.html

[3] Dan Tri: https://dantri.com.vn/xa-hoi/bo-y-te-can-25000-ty-dong-moi-nam-de-kham-suc-khoe-mien-phi-cho-toan-dan-20250506171149430.htm

[4] World Health Organization: https://www.who.int/data/gho/data/indicators/indicator-details/GHO/probability-of-dying-between-exact-ages-30-and-70-from-any-of-cardiovascular-disease-cancer-diabetes-or-chronic-respiratory-%28-%29

[5] Legal Information Portal: https://thuvienphapluat.vn/van-ban/The-thao-Y-te/Thong-tu-30-2023-TT-BYT-danh-muc-benh-tinh-trang-benh-duoc-kham-chua-benh-tu-xa-593328.aspx

[6] Legal Information Portal: https://thuvienphapluat.vn/van-ban/The-thao-Y-te/Thong-tu-14-2013-TT-BYT-huong-dan-kham-suc-khoe-185665.aspx

[7] Legal Information Portal: https://thuvienphapluat.vn/van-ban/The-thao-Y-te/Thong-tu-32-2023-TT-BYT-huong-dan-Luat-Kham-benh-chua-benh-593360.aspx

* If you wish to quote any information from this article, please kindly cite the source along with the link to the original article to respect copyright.

| B&Company

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |