Northern Vietnam has emerged as a hub for industrial development, leveraging its strategic location and robust infrastructure. Over the past decade, the region has played a pivotal role in Vietnam’s economic landscape, attracting significant foreign and domestic investments. In 2024, industrial real estate continues to be a cornerstone of the region’s economic growth, driven by increasing demand from manufacturing and logistics sectors. This trend is expected to accelerate further in 2025 and beyond.

Overview of Industrial Park in Northern Vietnam

Industrial Park in Northern Vietnam has undergone rapid development in the last decade, combining with support from the government’s policies such as law No. 43/2024/QH15 on amending provisions related to land, housing, real estate business[1]. With a skilled labor force and competitive costs, the area continues to attract investments from multinational corporations in electronics, textiles, and high-tech manufacturing. Provinces such as Bac Ninh, Hai Phong, Hung Yen, and Ha Noi have become focal points for industrial expansion, hosting numerous industrial zones and technology parks.

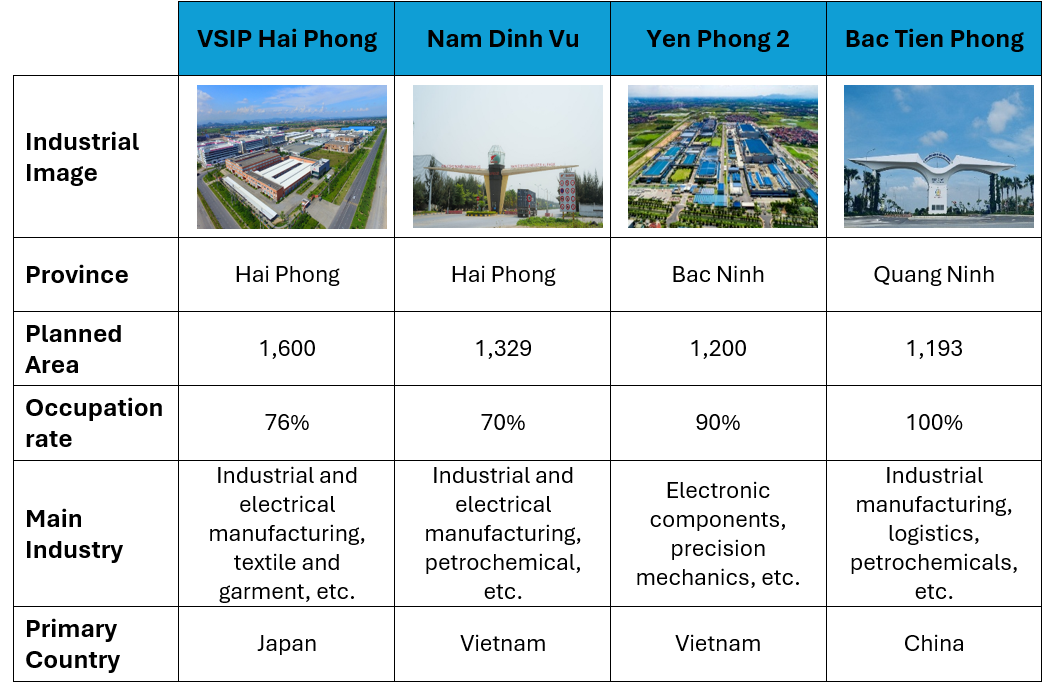

Some notable Industrial parks in the Northern Vietnam

Source: B&Company Complication

The current situation of Industrial real estate in Northern Vietnam in 2024

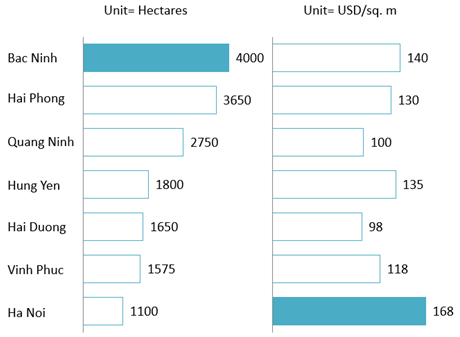

As of Q3 2024, the total industrial land area in Northern Vietnam reached 16,700 hectares, marking a 16% increase compared to 2023. With the addition of new industrial parks has reduced the overall occupancy rate in Northern Vietnam to 68%. Moreover, the average rental prices for industrial land are set at 130 USD per square meter, a 5.7% increase from 123 USD in 2023. This situation is even more pronounced in Bac Ninh and Hung Yen, where demand is high, leading to a 10% surged in rental prices. The supply of industrial land in Northern Vietnam is primarily concentrated in provinces like Bac Ninh, Hai Phong, and Quang Ninh, which boast large areas and numerous industrial parks nationwide.

Existing industrial land supply and rental price by region (2024)

Source: Cushman&Wakefield Report

By September 2024, the region also witnessed significant growth in its industrial parks, with six projects completed in areas like Hai Duong, Vinh Phuc, Bac Ninh, and Hai Phong. These new industrial parks provide nearly 2,000 ha of leasable area for the market, reflecting strong demand from sectors such as electronics, textiles, and automotive manufacturing[2].

Some new launched industrial park in Northern Vietnam in 2024

| Region | Industrial Park | Planned Area

(hectares) |

| Hai Duong | Gia Loc | 197 |

| Luong Dien – Ngoc Lien | 150 | |

| Hai Phong | Xuan Cau | 752 |

| Vinh Phuc | Son Loi | 265 |

| Song Lo II | 180 | |

| Bac Ninh | Gia Binh II | 261 |

Source: B&Company Complication

Prospects for the industrial real estate market in Northern Vietnam in 2025

With the industrial sector growing by 8.3% in the first nine months of 2024, particularly in manufacturing, processing, and automobile industries achieving a growth rate of 9.8%, the industrial land rental prices for 2024–2027 are projected to grow at an annual rate of 4–8%. There are many factors that contribute to this growth. Firstly, infrastructure development such as the $67 billion USD high-speed rail project connecting Hanoi and Ho Chi Minh City[3]. Secondly, government incentives, such as tax breaks and streamlined land acquisition policies, are expected to attract more investors[4]. Finally, the region is also likely to benefit from the relocation of global supply chains as companies seek to diversify away from China[5].

Additionally, in 2025, Vietnam is planning to add 15,000 ha of industrial land to meet the sharp rise in demand[6]. Industrial Park specialized in high-tech and logistics hubs that focus on renewable energy and environmentally friendly are expected to emerge. Consequently, the Vietnamese government is prioritizing the development of green and sustainable industrial parks, emphasizing environmental protection and the promotion of a circular economy[7].

Industrial real estate in planning for 2025

| Property | Type | Region | Scale

(ha) |

Developer | Expected Launch |

| Tien Thanh IP | Industrial park | Hai Phong | 315 | Viet Phat JSC | 2025 |

| Trang Due Phase 3 | Industrial park | Hai Phong | 481 | Kinh Bac City | 2025 |

| Core5 Vinh Phuc | Ready-built factory | Vinh Phuc | 15.5 | Indochina Kajima | 2025 |

| BW ESR Nam Son Hap Linh | Ready-built factory | Bac Ninh | 11.2 | BW Industrial | 2025 |

| DPL Vietnam Minh Quang | Ready-built warehouse | Hung Yen | 3.5 | Daiwa House & WHA | 2025 |

| Mapletree Thuan Thanh 3 | Ready-build warehouse | Bac Ninh | 14 | Mapletree | 2025 |

Source: Cushman&Wakefield Report

Conclusion

In 2024, Northern Vietnam’s industrial real estate sector demonstrated resilience and growth, bolstered by government support and proactive infrastructure development. Looking ahead to 2025, the region is poised to capitalize on these strengths. The commitment to sustainable development and high demand for industrial land from investors, positions Northern Vietnam as a compelling destination for industrial expansion in the coming years.

[1] The National Assembly of Vietnam (2024). The Amendment of House, Land and Real Estate Law <Assess>

[2] Cushman and Wakefield (2024). The Northern Real Estate Market <Assess>

[3] The Reuters (2024) Vietnam Approve High-speed Railway Project <Assess>

[4]The Vietnam Briefing (2024). Tax Incentives for Foreign Enterprises in Vietnam <Assess>

[5]Vietnam Investment Promotion Portal (2024). Vietnam’s Foreign Investment Landscape in 2024 and Prospect <Assess>

[6]Vietnam Investment Review (2024). Industrial Real Estate Expected to Rise in 2025 <Assess>

[7] The Communist Party of Vietnam Online Newspaper (2024). Promotion of Eco Industrial Park in Vietnam <Assess>

| B&Company, Inc.

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |

Read other articles