09Dec2024

Industry Reviews / Latest News & Report

Comments: No Comments.

Overview of Agriculture Sector in Vietnam

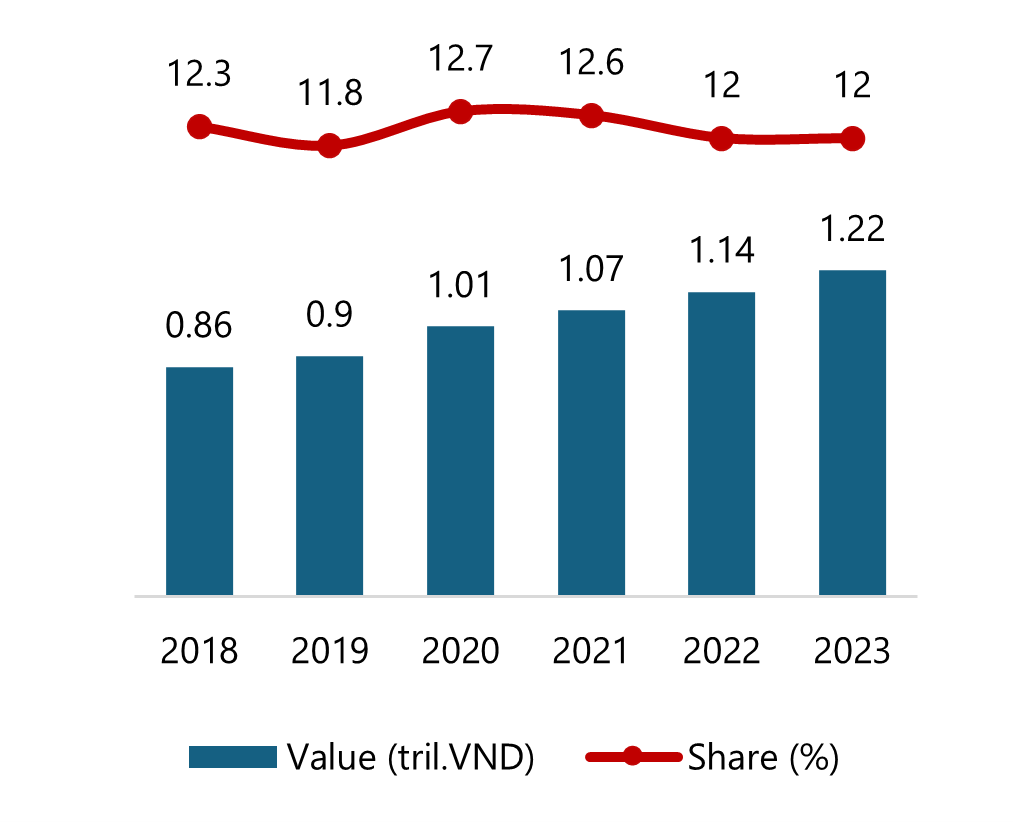

The agricultural sector[1] is one of the main three pillars of economy in Vietnam. Despite facing many difficulties and challenges during a period of economic stagnation, the growth rate of the agriculture sector continues to increase, with a CAGR of 7.2% from 2012-2023, reaching 1.22 trillion VND and accounting for 12% of GDP in 2023[2].

Percentage of GDP accounted for by agriculture, forestry and fisheries

Source: General Statistics Vietnam

In addition, the significant role of this sector is also reflected in Vietnam’s agricultural product export situation. Vietnam is currently ranked 2nd in Southeast Asia and 15th globally in agricultural exports[3].

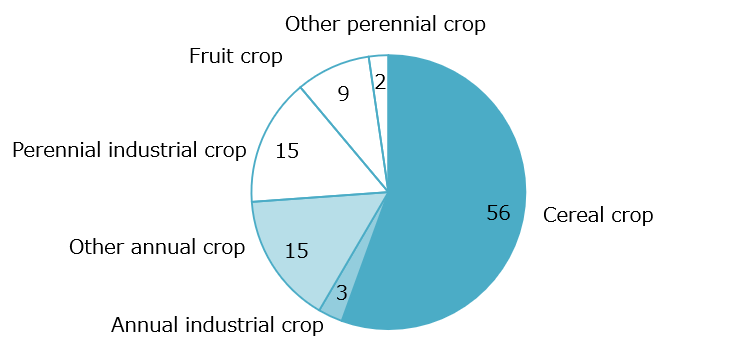

The agriculture sector focuses on two main types of crops: annual crops and perennial crops. Annual cereal crops, specifically, play the most crucial role in the country’s agriculture sector. Other types of important crops include fruit crops and industrial crops. The chart below shows the land area of each crop type in Vietnam[4].

Land area of crop types in Vietnam (2023)

Source: General Statistics Vietnam

In terms of production scale, agricultural sector in Vietnam is still dominated by small-scale farming, with 9.1 million agricultural, forestry, and fishery households in rural areas as of 2020 (in details, it was recorded that there were 8.1 million agricultural households, 162 thousand forestry households and 783 thousand fishery households)[5].

Mechanization in Vietnam Agriculture

Regarding policy directions, Decision 858/QĐ-TTg in 2022[6] from the Prime Minister has stated that developing mechanization in agriculture and the processing of agricultural, forestry, and fishery products (hereinafter collectively referred to as agricultural products) is a crucial task for the agricultural sector, aimed at enhancing added value, promoting sustainable development, and integrating into the global economy. The development direction will focus on comprehensive mechanization, aligned with production chains that integrate processing and product consumption. Additionally, there will be a strong emphasis on utilizing advanced machinery, equipment, technologies and smart technologies in agricultural production processes.

Following said Decision, the goal of synchronous mechanization of the agricultural sector has been set for each field:

The goal of synchronous mechanization of the agricultural sector

| Field | Crop production | Animal husbandry | Aquaculture | Fishery and preservation | Forestry | Salt production |

| Mechanization goal for 2030 | 70% | 60% | 90% | 95% | 50% | 90% |

Source: Decision 858/QĐ-TTg issued by The Prime Minister

In practice, mechanization in small-scale agricultural production has gained increasing popularity in recent years. Farming cooperatives and households have adopted machinery and technology in their production processes, with encouragement and support from local authorities. The table below presents examples of machinery and related technologies currently being applied in small- to medium-scale agricultural production across several key sectors in Vietnam.

Examples of machinery and related technologies currently being applied in small- to medium-scale agricultural production

| Crop production | Animal husbandry | Aquaculture | Fishery and preservation |

| · Plow

· Rotary tiller · Crop sprayer · Combine harvester · Rice transplanter · Lawn mower · Pesticides spraying drones · Organic fertilizer pellet machines |

· Livestock housing system

· Feed mixing system · Grass cutter · Automatic feed and water system · Feed pellets machines |

· Automatic feeder

· Algae vacuum · Aerator · pH, oxygen and temperature meter · Soil tiller for clam & oyster |

· Hybrid cold preservation technology

· Nano UFB preservation technology · Slurry ice preservation technology |

Source: B&Company’s synthesis from market information

Mechanization efforts have been adapted by many provinces across the nation, aiming to increase the number of machineries to push the mechanization process. Some practical examples include Hai Duong province has also made changes to encourage farmers to push the mechanization rate to 100% in rice farming, also known as the “non-footprints field”[7] model in 1,000 hectares[8]. Hung Yen province currently has 627 rice harvesters of all kinds for rice harvesting, the level of mechanization in rice harvesting reaches 96.5%[9].

Challenges and Opportunities for Japanese companies

Although the rate of mechanization is increasing, agricultural production in Vietnam remains small-scale, with fragmented land parcels making it difficult to implement mechanization uniformly across the country. Domestically manufactured machinery meets only about 32%[10], of industry demand, while 60-70%[11] of the market is supplied by foreign manufacturers. Thus, Low income in rural areas further hinders the mechanization process. Additionally, due to the dominance of small-scale farming, agricultural production remains highly dependent on weather and natural conditions, making mechanization risky and challenging to coordinate across all households in a synchronized manner.

Nevertheless, the Government and local authorities continue to actively promote the mechanization process in agriculture in Vietnam. As a result, the market for agricultural machinery and equipment, particularly for small-scale production, is expected to become increasingly dynamic in the future.

Besides, during long history, machinery products from Japan have long been trusted and appreciated in Vietnam market. Regarding machinery, plowing and rice transplanting brands from Japan are being used and preferred in Vietnam thanks to their high quality and durability. Of which, Kubota and Yanmar, most famous for their rice transplanters and combine harvesters, are the 2 most successful cases in the Vietnamese market. In 2014, Yanmar opened its first Vietnamese office and in 2018 joined a cooperation agreement with Agribank with the theme of “Bring Japanese technology to Vietnamese farmers”, helping farmers to easily access Yanmar products and machinery from Japan through Agribank’s capital[12]. Similarly, Kubota joined the Vietnamese market in 2008 and since then has opened more than 30 branches nationwide[13].

In recent years, agricultural cooperation between Vietnam and Japan has made significant advancements, particularly in green agriculture, one of the four sectors Japan is actively promoting in Vietnam, according to Mr. Kudo Yoshimoto, Deputy Head of the Japan International Cooperation Agency (JICA)[14]. Alongside these efforts, Vietnam has been making strides to create a conducive environment for Japanese businesses to invest and operate easily. This includes improving agricultural infrastructure, renovating outdated irrigation systems, supporting the formulation of agricultural promotion policies and strategies, and developing human resources by inviting Japanese experts to work in Vietnam.

In the near future, aligning agricultural production with mechanized equipment and synchronizing technical infrastructure will remain a key priority for local authorities. Additionally, enhancing scientific research, advancing technology development, and focusing on the transfer of agricultural machinery technology will be crucial for the sector’s growth. Thus, Japanese companies can explore opportunities to invest in technology transfer or to directly provide machinery and equipment solutions tailored to the needs of small-scale farming practices in Vietnam.

[1] Including crop production, animal husbandry, aquaculture, fishery and preservation, forestry and salt production

[2] General Statistics Office <Assess>

[3] VOV (2024). Vietnam is among the 15 largest agricultural exporting countries in the world. <Assess>

[4] Blue: Annual crop, Red: Perennial crop

[5] GSO (2020). Press release of mid-term rural and agricultural survey in 2020. <Assess>

[6] Government (2022). The strategy for developing agricultural mechanization and agricultural, forestry and fishery processing to 2030 <Assess>

[7] A form of mechanizing the entire production process and applying it to small-scale farming households, currently being implemented in various provinces

[8] Nhan Dan Newspaper (2023). Improving production efficiency through agricultural mechanization <Assess>

[9] Hung Yen Provincial Party Committee (2024). Pushing mechanization in agricultural production <Assess>

[10] State Audit Vietnam (2024). Mechanization: A Driving Force for Increasing Agricultural Production Efficiency <Assess>

[11] VnEconomy (2024). Vietnam is a promising market for agricultural machinery and equipment manufacturers <Assess>

[12] Yanmar Vietnam Co., Ltd (2018). Implementation of cooperation agreement between Yanmar and Agribank in Hanoi <Assess>

[13] Kubota Vietnam official website (2024). <Assess>

[14] Mekong ASEAN (2023). Strengthening green agricultural cooperation between Vietnam and Japan <Assess>

| B&Company, Inc.

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |

Read other articles

- All

- E-Commerce

- Economic

- Food & Beverage

- Healthcare

- Human Resources

- Investment

- IT & Technology

- Logistics & Transportation

- Regulation

- Retail & Distribution

- Seminar

- Temporarily closed

- Tourism & Hospitality

- White Book