Vietnam’s wind energy sector has experienced significant growth, positioning the country as a leader in Southeast Asia’s renewable energy landscape. With a coastline exceeding 3,000 kilometers and favorable wind conditions, Vietnam offers substantial opportunities for wind energy development. This article examines the current state of Vietnam’s wind energy market, key projects, major players, prevailing trends, and the opportunities and challenges facing foreign investors.

Market Size of Wind Energy in Vietnam

Vietnam’s commitment to renewable energy has been significantly reinforced through its active participation in the 26th UN Climate Change Conference of the Parties (COP26) and the approval of the Power Development Plan VIII (PDP VIII) in 2023. These initiatives highlight the country’s resolute dedication to shifting from coal-based electricity to more sustainable energy sources, contributing to the net zero emission goal by 2050. Among these, the wind energy sector has emerged as a leading and highly promising avenue for growth and investment.

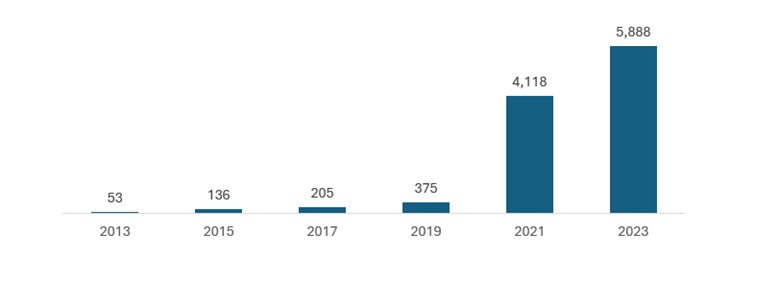

In 10 years from 2013-2023, Vietnam’s installed wind power capacity has growth a significant value from 53 megawatts (MW) to 5,888 MW (accounts for 6% total electricity production in 2023).

Total wind energy capacity in Vietnam, 2013-2023 [1]

Unit: MW

Source: Statista

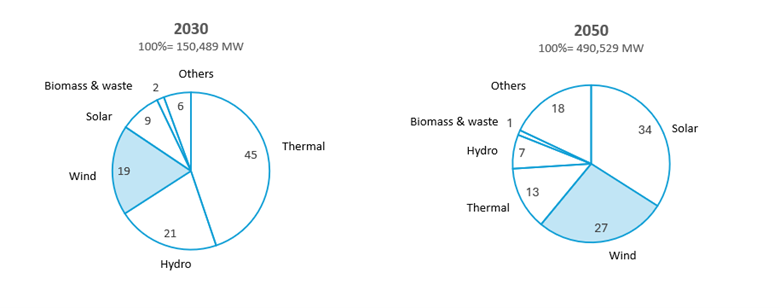

According to the Power Development Plan VIII (PDP VIII), the Vietnamese government has set ambitious targets to reduce reliance on thermoelectricity and transition to renewable energy sources, with a particular emphasis on wind and solar energy. Specifically, the plan outlines a goal of achieving 27,990 MW of wind energy capacity by 2030 (an increase of 5 times compared with 2023) and an even more ambitious 130,050 MW by 2050 (an increase of 22 times compared with 2023). These targets highlight Vietnam’s commitment to leveraging its abundant natural wind resources, particularly in offshore regions, where wind speeds and capacity factors are significantly higher.

PDP VIII Direction Install Capacity, By source (2030-2050) (%)

Source: PDP VIII

Key Projects of Wind Power Plant

Corresponding to the ambitious target for wind electricity, several notable wind energy projects have been developed or are underway in Vietnam. Until 2023, there are 106 projects across the country with more than 50% are in operation.

| Name | Location | Establish year | Operation year | Investor | Capacity

(MW) |

Number of turbines | Turbin capacity

(MW) |

| Ea Nam Wind Complex | Ninh Thuan | 2019 | 2021 | Trung Nam Group | 400 | 100 | 4 |

| Bac Lieu Wind Complex | Bac Lieu | 2020 | 2021 | TTC Group | 300 | 75 | 4 |

| Tra Vinh Wind Complex | Tra Vinh | 2019 | 2022 | REE | 300 | 75 | 4 |

| BIM Wind Power Plant | Ninh Thuan | 2021 | 2021 | BIM Group | 88 | 22 | 4 |

Not only Vietnamese investor, foreigner investor (including Japan) are also paying attention to the wind energy sector. In June 2024, Doosan Vina Company (Dung Quat Economic Zone, Quang Ngai) signed a memorandum of understanding “Cooperation in developing offshore wind power in Vietnam” with Marubeni Group (Japan), planning to manufacture foundations of wind turbines and other components for offshore wind farms at its 100-hectare industrial complex in Dung Quat Economic Zone.

Opportunities for Foreign Investors in Wind Energy

Vietnam’s wind energy sector offers a range of lucrative opportunities for foreign investors:

- – Unparalleled Offshore Wind Potential

Vietnam possesses one of the highest offshore wind energy potentials in the world, estimated at 311 GW. The southern and central coasts, including areas like Binh Thuan and Ninh Thuan provinces, offer consistently high wind speeds ranging from 7 to 9 m/s. These favorable conditions provide significant opportunities for large-scale offshore wind projects, which can generate high-capacity energy with minimal land-use conflicts.

Foreign investors with advanced offshore wind technology and expertise in project management stand to gain a competitive edge in these untapped regions.

- – Favorable Government Policies

The Vietnamese government has demonstrated strong support for renewable energy through its PDP VIII. Policies include incentives like feed-in tariffs (FiTs) and long-term tax breaks for renewable energy investors. Although FiTs for new projects are transitioning to an auction-based system, the supportive environment remains attractive for investors with long-term visions.

Investors also benefit from reduced import duties on wind power equipment, which lowers initial project costs. Furthermore, the government has committed to streamlining administrative processes to attract foreign capital into its energy sector.

- – Growing Energy Demand

Vietnam’s energy consumption is projected to grow 10-12 % annually from now through 2030 [2] due to industrialization and urbanization. By 2030, electricity demand is expected to more than double compared to 2020 levels. Wind energy, particularly offshore, is well-positioned to address this rising demand as the government limits new coal-fired power projects under its carbon neutrality goals for 2050.

This demand provides foreign investors with the assurance of strong market growth and high returns on investment.

- – Strategic Partnerships and Regional Collaborations

Vietnam actively participates in international collaborations for clean energy development, including partnerships with the European Union, Japan, and South Korea. For instance, the $2.2 billion Thang Long Offshore Wind Farm project in 2020 in Bình Thuan is backed by Enterprize Energy, a UK-based company. These partnerships demonstrate the potential for foreign investors to collaborate with local and global entities to access funding, expertise, and local knowledge.

Challenges

Despite the attractive opportunities, foreign investors in Vietnam’s wind energy sector must navigate several challenges:

- – Regulatory Uncertainties

While Vietnam has made strides in establishing policies to support renewable energy, inconsistencies and delays in implementation remain a concern. For example, the transition from FiTs to auction-based pricing for new wind projects has created uncertainty about future profitability. Foreign investors may also face challenges in navigating complex land acquisition processes, obtaining permits, and meeting compliance requirements.

Clearer regulatory frameworks and better coordination among government agencies are needed to foster a more predictable business environment.

- – Grid Infrastructure Limitations

Vietnam’s existing electricity grid infrastructure is not equipped to handle the large-scale energy influx expected from wind power projects, particularly offshore wind. Transmission bottlenecks, especially in central and southern Vietnam where wind resources are abundant, pose significant challenges.

For instance, several wind farms in Ninh Thuận and Bình Thuận provinces faced grid congestion issues in recent years, resulting in curtailments. Foreign investors must account for potential delays in grid upgrades and work with local authorities to plan for grid integration.

- – High Initial Costs for Offshore Projects

Offshore wind projects are capital-intensive, requiring substantial investments in advanced turbine technology, foundation structures, and transmission systems. Vietnam’s limited domestic manufacturing capacity for wind power equipment often necessitates the import of components, further driving up costs.

To mitigate risks, foreign investors may need to form joint ventures with local firms to access local expertise and minimize expenses. However, such partnerships can introduce complexities in management and profit-sharing.

- – Environmental and Social Impact Concerns

Offshore wind projects can have significant impacts on marine ecosystems and coastal communities. Concerns from local fishing industries and environmental groups about habitat disruption and navigation interference are common. For example, the Dong Hai-1 Wind Farm in Trà Vinh had to undergo extensive consultations with local communities to address potential socio-economic impacts.

Investors must prioritize sustainable development practices, including comprehensive environmental impact assessments and stakeholder engagement, to build community support and ensure project approval.

- – Competition from Solar Energy

While wind energy offers unique advantages, it faces competition from Vietnam’s booming solar sector. Solar projects generally have lower setup costs, faster implementation timelines, and fewer site-specific challenges, making them attractive to developers and investors. Foreign investors in wind energy must focus on optimizing costs and demonstrating the long-term benefits of wind over solar energy in terms of reliability and capacity.

Conclusion

Vietnam’s wind energy sector presents a dynamic and promising landscape for foreign investors. With substantial natural resources, supportive government policies, and a growing demand for clean energy, the country is poised to become a significant player in the global renewable energy market. However, navigating regulatory complexities, infrastructure needs, and environmental considerations will be crucial for investors aiming to capitalize on Vietnam’s wind energy potential.

[1] https://www.statista.com/outlook/io/energy/renewable-energy/wind-energy/vietnam

| B&Company, Inc.

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |

Read other articles