14Nov2025

Highlight content / Highlight Content JP / Highlight content vi / Industry Reviews / Latest News & Report

Comments: No Comments.

Vietnam’s mergers and acquisitions (M&A) market showed steady recovery in early 2025, supported by improving investor sentiment and new policy reforms. Real estate, technology, and healthcare led activity, with major transactions such as Vinaconex ITC’s ownership transfer, UOA Vietnam’s expansion in Ho Chi Minh City, and Dale Investment Holdings’ acquisition of Tam Tri Medical. Industrial and energy deals also signaled ongoing consolidation, while education and digital sectors attracted fresh investment. Recent laws, including the Land Law and Decree 19/2025, have strengthened transparency and shortened approval times, creating a more predictable environment for investors

Vietnam’s M&A Market Overview (2024 – Q1 2025)

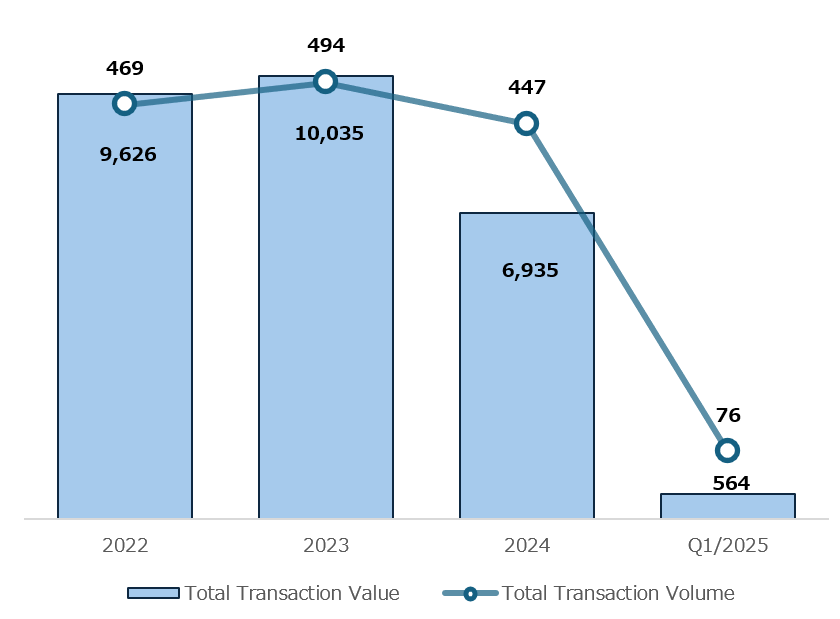

Vietnam’s M&A market remained active through 2024, although overall value and deal size were lower than the previous year. According to Grant Thornton Vietnam[1], the country recorded 447 transactions in 2024 with a total disclosed value of about USD 6.93 billion, equal to a decline of around 30 percent compared with 2023.

Total value and number of M&A transactions

Unit: USD million

Source: Grant Thornton analysis

This decrease mainly reflected a smaller number of large-scale transactions and tighter global financing conditions. As Grant Thornton reported, only 14 deals exceeded USD 100 million in 2024, compared with 17 in 2023, and just one was recorded in the first quarter of 2025. The drop in these high-value transactions had a strong impact on total market value, even though overall deal volume continued to grow.

In addition, the average deal size also declined noticeably—from USD 52.3 million in 2023 to USD 41.5 million in 2024, and further to USD 23.5 million in Q1 2025 (see table below). This pattern indicates that most M&A activity shifted toward smaller or mid-market deals, often involving domestic buyers or regional investors rather than large foreign acquisitions. Combined with the effect of higher global interest rates and rising capital costs[2], which made financing large-scale deals more difficult, these factors explain the 30 percent fall in Vietnam’s total M&A value in 2024. The average deal size for 2024 and Q1 2025 is summarized below.

Vietnam M&A Deal Size and Volume Overview (2022–Q1 2025)

| USD million | 2022 | 2023 | 2024 | Q1/2025 |

| Average deal size | 48.5 | 52.3 | 41.5 | 23.5 |

| Transaction volume | 143 | 192 | 232 | 24 |

| Count of large-scale deals > 100 million USD | 14 | 17 | 14 | 1 |

Source: Grant Thornton analysis

(Note: Figures in the table represent only deals with publicly disclosed values; total transaction volume, including undisclosed deals, is shown in the chart above (Grant Thornton Vietnam, 2025).)

Domestic investors played a larger role than before. Their announced deal value made up 29 percent of the market in 2024, compared with 16 percent in 2023[3]. This increase shows that local businesses and financial groups continued to take part in M&A activity even when foreign investment slowed. Meanwhile, foreign-led transactions decreased in total value, mainly due to global economic uncertainty and higher financing costs in major markets.

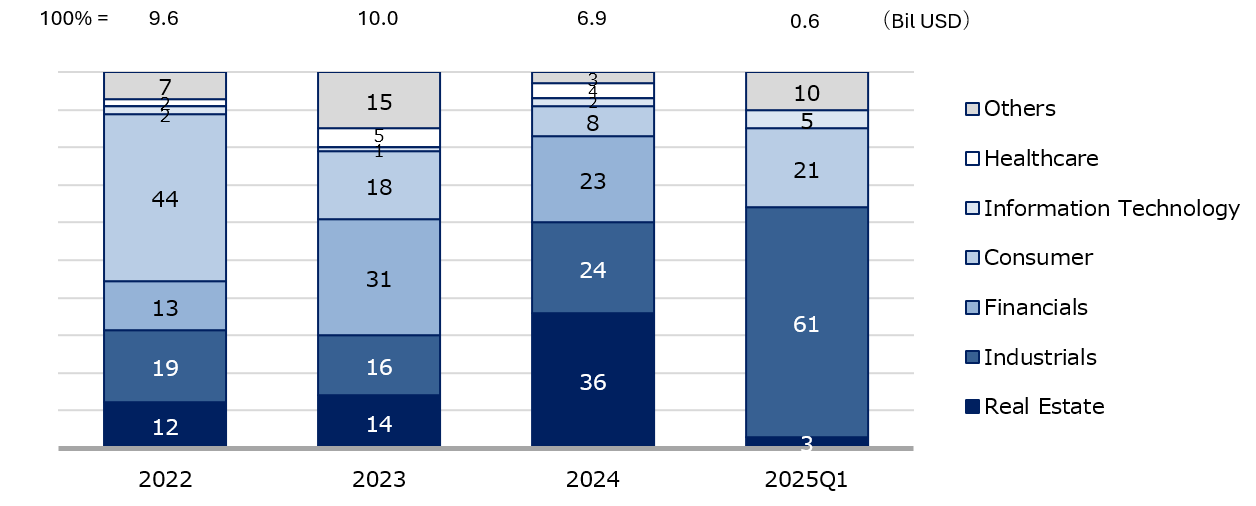

By sector, real estate returned to the top position, accounting for 36 percent of total deal value in 2024. The rise came after a slow period in 2022 – 2023 and reflected improving conditions in the property market. Industrial manufacturing ranked second with 24 percent, supported by ongoing investment in supply-chain expansion. Financial services stayed among the three largest sectors, helped by continuing demand for consumer credit and banking reforms. The consumer sector declined in both value and number of transactions, while technology remained small—around 2 percent of total value—but continued to attract attention from venture funds and digital-service investors.

Sectoral Breakdown of M&A Deal Value in Vietnam, 2022–Q1 2025 (%)

Source: Grant Thornton analysis

Overall, available data for 2024 and Q1 2025 describe a market that stayed active but at a smaller scale than in earlier years, while Healthcare and Financials recorded no significant transactions during the same period. The mix of sectors and investor types suggests gradual adjustment rather than rapid growth. Future activity will depend largely on the impact of new laws and economic policies that took effect in 2025.

Emerging Trends in Early 2025

Vietnam’s M&A market in early 2025 continued to gain stability, supported by steady investor confidence and policy reforms. Activity was concentrated in four key sectors—real estate, industrial manufacturing, technology, and healthcare—each showing distinctive drivers shaped by both market conditions and new regulations.

Real Estate: Revival under a clearer legal framework

Vietnam’s real estate sector has regained momentum in early 2025 as long-awaited legal reforms took effect, creating a clearer and more predictable business environment for investors. Three key laws — the Land Law (2024)[4], Housing Law (2023, revised)[5], and Law on Real Estate Business (2023, revised)[6] — together mark the most comprehensive overhaul of Vietnam’s property legislation in over a decade

The new Land Law redefines land-use rights and valuation methods, allowing more transparent land pricing and fairer compensation for project clearance. It also narrows the definition of foreign-invested entities to those with more than 50 percent foreign ownership, enabling minority-foreign developers to enjoy the same land-use rights as domestic firms.

The revised Housing Law simplifies procedures for project licensing and expands eligibility for home ownership, while the Law on Real Estate Business introduces stricter disclosure and escrow requirements to prevent speculation and strengthen buyer protection.

Together, these measures reduce administrative uncertainty, restore investor confidence, and reopen financing channels that had stalled during the previous downturn. With clearer legal foundations and improving credit conditions, Vietnam’s property market is now better positioned for sustained M&A and project development activity through 2025.

Industrial Manufacturing and Energy: Driven by Supply-Chain Shifts

Industrial and energy-related M&A activity in early 2025 remained solid, reflecting Vietnam’s continued integration into regional production networks and growing investor interest in manufacturing assets. The country’s position as a key alternative to China [7] in global supply-chain restructuring has driven steady inflows of foreign direct investment (FDI), particularly from Japan, South Korea, and Singapore. This movement has encouraged consolidation in supporting industries such as logistics, components, and energy supply.

Policy developments have further reinforced this momentum. The government’s Decree 19/2025/ND-CP [8]introduced a special investment procedure that allows licensing for priority projects within about 15 days, significantly reducing administrative time for large-scale manufacturing and infrastructure investments. Parallel to this, public investment in transport corridors, ports, and energy facilities continues to improve the country’s industrial ecosystem, making asset-based M&A an attractive entry route for both domestic and foreign investors.

Energy-sector consolidation is also supported by Vietnam’s Power Development Plan VIII (PDP8)[9], which emphasizes renewable and natural gas projects to meet growing electricity demand. The push for green transition and energy security has motivated investors to acquire existing assets as a faster route to market entry. Together, these economic and policy factors position Vietnam’s industrial and energy sectors as steady pillars of M&A growth in 2025.

Technology: Growing Confidence in Digital and AI Sectors

Vietnam’s technology sector continues to attract increasing M&A interest, supported by government priorities on digital transformation and emerging innovation ecosystems. Although it still represents a modest share of total deal value, activity has broadened beyond fintech to include artificial intelligence, e-commerce, cloud services, and digital infrastructure.

Several factors explain this momentum. Vietnam’s government has made digital transformation a national priority under the “Digital Economy Development Strategy to 2025, vision 2030,” which targets digital industries to contribute 20 percent of GDP by 2025[10]. The newly enacted Law on Digital Technology Industry (2025) [11] further promotes investment in emerging technologies, offering incentives for high-tech projects, R&D centers, and data infrastructure.

Healthcare and Education: Rising Domestic Demand

Healthcare and education have become increasingly active sectors have become increasingly active sectors in Vietnam’s M&A market, supported by clear demographic and income trends. According to the General Statistics Office (GSO)[12], Vietnam’s middle class is expanding rapidly, with rising household incomes and greater consumer spending power contributing to to higher demand for quality services. At the same time, by 2036, people aged 60 and above are expected to account for 20% of the nation’s population [13], leading to growing needs for healthcare, pharmaceuticals, and elder-care facilities.

In healthcare, these trends align with the government’s National Strategy for Healthcare Development 2030[14], which promotes private investment through hospital modernization and public–private partnerships.

Education follows a similar trajectory but is being shaped more directly by Vietnam’s national EdTech policies.

– Decision 1373/QĐ-TTg (2021) on building a learning society targets the adoption of digital learning technologies by 90 percent of universities and 80 percent of vocational training centers by 2030, while funding open digital libraries and workforce-oriented EdTech tools.

– Decision 131/QĐ-TTg (2022) emphasizes digital infrastructure in schools and aims for over half of higher-education programs to offer e-learning by 2025.

– Circular 30/2023/TT-BGDDT (2023) regulates the management of online education platforms, ensuring content quality, accessibility, and collaboration between public and private providers.

These coordinated policies create a stable foundation for mergers and partnerships in digital education, making EdTech one of the most promising areas of Vietnam’s service-sector M&A landscape.

The table below shows five major M&A deals in early 2025. These examples cover different sectors, including real estate, energy, technology, healthcare, and education. They highlight how investors are active across both traditional and new industries as Vietnam’s market becomes more open and stable.

| Name of Deal | Sector | Investor / Buyer | Value (USD million) | Type of Transaction | Source | |

| 1 | Vinaconex ITC | Real Estate | Domestic consortium | 250-300 | Equity acquisition | Việt Báo |

| 2 | Harbour Energy’s Vietnam assets | Energy/Industrial | EnQuest plc | 84 | Equity acquisition | Vietnam + |

| 3 | AI Hay – Series A funding | Technology / AI | Regional investors | 10 | Fundraising round | tuổi trẻ news |

| 4 | Tam Tri Medical | Healthcare | Dale Investment Holdings / Quadria Capital | 31 | Equity Acquisition | The Investor |

| 5 | Galaxy Education – fundraising | Education / EdTech | East Ventures (Singapore) | 10 | Fundraising round | The Straits Times |

B&Company’s synthesis

B&Company’s Strategic Support

B&Company is a Japan-based boutique research and strategy consulting firm with deep experience in Vietnam and East Asia. The company supports investors and businesses through every stage of market entry and M&A activity with integrated, hands-on services:

– Market Research: Collecting reliable data and insights to help clients understand industries, competitors, and customer behavior.

– Market Entry Consulting: Guiding investors through regulations, local procedures, and investment feasibility to ensure smooth business setup.

– Business Matching & Tours: Arranging meetings, field visits, and networking sessions with potential partners, suppliers, or customers.

– Business Support: Assisting with office setup, recruitment, accounting, and day-to-day operational needs after investment.

By combining research, strategy, and on-the-ground support, B&Company helps foreign and local investors navigate Vietnam’s M&A market with clarity and confidence.

* If you wish to quote any information from this article, please kindly cite the source along with the link to the original article to respect copyright.

| B&Company

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |

[1] https://www.grantthornton.com.vn/ (M&A Outlook 2025)

[2] https://asart.com.vn/how-high-usd-policy-interest-rates-are-impacting-vietnams-fdi-and-ma-activities

[3] M&A outlook remains cautiously optimistic

[4] https://thuvienphapluat.vn/van-ban/Bat-dong-san/Luat-Dat-dai-2024-31-2024-QH15-523642.aspx

[5] https://thuvienphapluat.vn/van-ban/Bat-dong-san/Luat-Nha-o-27-2023-QH15-528669.aspx

[6] https://thuvienphapluat.vn/van-ban/Bat-dong-san/Luat-Kinh-doanh-bat-dong-san-29-2023-QH15-530116.aspx

[7] https://www.vietnam-briefing.com/news/vietnam-versus-china-manufacturing-cost-quality-infrastructure-comparison.html/

[8] https://thuvienphapluat.vn/van-ban/Dau-tu/Decree-19-2025-ND-CP-elaborating-Law-on-investment-regarding-special-investment-procedures-645116.aspx

[9] https://thuvienphapluat.vn/van-ban/Tai-nguyen-Moi-truong/Quyet-dinh-768-QD-TTg-2025-Dieu-chinh-Quy-hoach-phat-trien-dien-luc-quoc-gia-thoi-ky-2021-2030-651977.aspx

[10] https://www.mpi.gov.vn/en/Pages/2024-10-11/Digital-transformation-in-businesses-for-a-sustainegpc5n.aspx

[11] https://thuvienphapluat.vn/van-ban/Cong-nghe-thong-tin/Law-71-2025-QH15-Digital-Technology-Industry-668801.aspx

[12] https://www.nso.gov.vn/tin-tuc-thong-ke/2025/05/thong-cao-bao-chi-ket-qua-khao-sat-muc-song-dan-cu-nam-2024/

[13] https://special.vietnamplus.vn/2025/09/29/care-for-the-elderly-in-vietnam-needs-early-and-sustainable-strategy/

[14] https://english.luatvietnam.vn/legal-news/vietnams-hospital-network-planning-strategy-20252030-4729-102001-article.html