Market Overview of Athletic Footwear Products

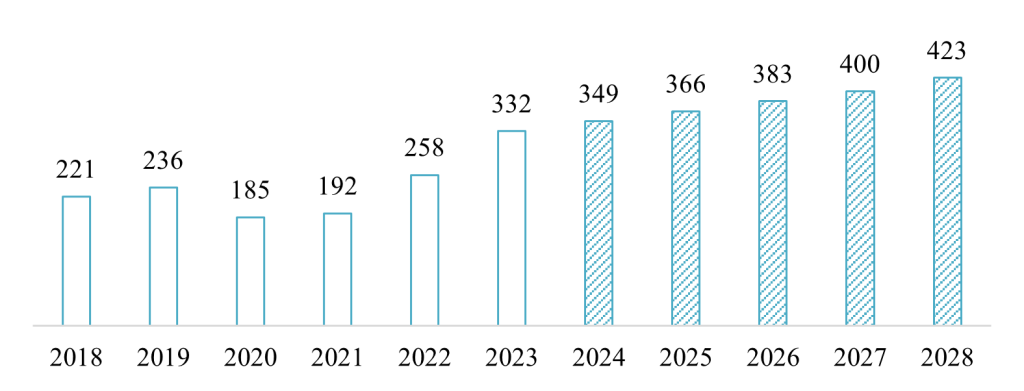

In recent years, Vietnam has witnessed a significant surge in the popularity of running and trekking, driving substantial growth in the athletic footwear market. This trend has created new opportunities for both local and international brands. According to Statista, the revenue of the Vietnamese sports shoe market achieved a CAGR of 8.5% from 2018 to 2023, reaching $333 million in 2023.

Revenue of Athletic Footwear in Vietnam from 2018-2028

Unit: Million USD

Source: Statista

This remarkable growth can be attributed to several key factors. Firstly, there has been a notable increase in health awareness, especially in the wake of the COVID-19 pandemic. The Vietnam Sports Administration reported that as of 2022, about 36%[1] of the Vietnamese population regularly engage in physical exercise. Secondly, the proliferation of organized running events has played a crucial role. In 2023[2], 41 full marathon events were held in Vietnam, marking a 25% increase from the previous year. These events attracted over 264,000 participants across 27 provinces and cities, with 13 events boasting at least 10,000 participants each. Thirdly, adventure tourism, including trekking in areas like Sapa and Dalat, has gained traction among both domestic and international tourists.

Da Nang 11th International Marathon in March 2024

Source: Lao Dong

Main Players

The Vietnamese athletic footwear market is characterized by a diverse mix of local and international brands, each vying for market share in the expanding running and trekking segments. Among local brands, Biti’s has successfully pivoted to capture the running market with its “Hunter” line of shoes, while Vietrek has gained popularity in the outdoor and trekking gear sector. Canifa, primarily a fashion brand, has also expanded into sportswear, including running apparel.

Examples of Biti’s Hunter

Source: Dosi

In addition, international giants like Nike and Adidas continue to dominate the premium segment, while Under Armour and New Balance have made significant inroads in recent years. The North Face and Columbia have established a strong presence in the trekking and trail-running segments. The development of e-commerce has further facilitated market growth, making it easier for Vietnamese consumers to access sports products from abroad. For instance, Decathlon (French) has successfully implemented a multi-channel strategy in Vietnam, maintaining a robust online presence with nearly 500,000 followers on Instagram since its entry in 2019 in addition to 7 operated physical stores.

Notably, Japanese sports brands have found particular success in the Vietnamese market, benefiting from a perception of high quality and cultural affinity between the two countries. ASICS has seen substantial growth, particularly among serious runners, while Mont-bell has carved out a niche in the outdoor gear segment. These Japanese brands have positioned themselves as high-quality alternatives to Western brands, often at a slightly lower price point.

Examples of running shoes of ASICS

Source: Asics

Future Outlook and Business Insights

Looking ahead, the future of the athletic footwear market in Vietnam appears promising. Statista projects steady growth in this sector, with an expected CAGR of 5% from 2024 to 2028[3]. This optimistic outlook is supported by several factors, including Vietnam’s continuing economic expansion, which is likely to increase disposable incomes and allow for greater spending on sports products. The country’s young, health-conscious population and increase in hiking, trekking, and exercising movements, are also some major factors. Additionally, rising environmental awareness may lead to increased demand for eco-friendly sports products.

Insight for business

For businesses looking to capitalize on these trends, several key insights emerge. The booming running trend is considered a catalyst for investors, opening up attractive opportunities in areas such as event organization and the provision of specialized products and services for runners. Successful brands will need to prioritize localization, tailoring their products and marketing strategies to Vietnamese preferences and body types. While there is a growing premium segment, most consumers remain price-sensitive, necessitating a range of price points to cater to different market segments. An omnichannel strategy, combining a strong e-commerce presence with physical stores for product trials, will be crucial in the evolving retail landscape. Brands that successfully foster communities around their products, whether through events or social media engagement, are likely to see stronger customer loyalty. Moreover, products offering tangible performance benefits will have an edge in the increasingly sophisticated market.

In conclusion, the running and trekking trends in Vietnam present significant opportunities for sports product businesses. As the market continues to evolve, adaptability and a deep understanding of local consumer preferences will be key to capturing market share and building brand loyalty. With the right approach, both local and international brands can tap into this growing market and contribute to the continued development of Vietnam’s sports and fitness culture. The combination of economic growth, increasing health awareness, and a young, active population positions Vietnam as an exciting frontier in the global sports product industry.

[1] https://polylionwool.com/dieu-huong-boi-canh-nang-dong-phan-tich-nganh-thi-truong-do-the-thao-viet-nam-nam-2024/

[2] https://cafebiz.vn/cu-hich-lon-cua-phong-trao-chay-bo-den-linh-vuc-kinh-doanh-the-thao-tai-viet-nam-176240623080055995.chn

[3] https://www.statista.com/outlook/cmo/footwear/athletic-footwear/vietnam#:~:text=Vietnam%20is%20expected%20to%20contribute,(CAGR%202024%2D2028).

| B&Company, Inc.

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |

Read other articles