Vietnam’s organic food market is experiencing rapid growth as consumers increasingly prioritise healthy and green consumption. The use of organic food in Vietnam has risen recently due to higher incomes, better living standards, health concerns after the COVID-19 pandemic, and increased environmental awareness. Strict organic standards in key export markets also affect local preferences. In this article, B&Company will analyse the organic food market’s dynamics and valuable insights for business.

Overview of the Organic Food Market and Trend in Vietnam

The market for organic food in Vietnam has grown significantly in recent years. Euromonitor reports show that Vietnam’s organic food market reached USD 100 million in 2023, a 20% increase from 2020[1]. The proliferation of organic offerings at major supermarkets like Co.opmart, WinMart, Lotte Mart and MM Mega Market further evidences this growth.

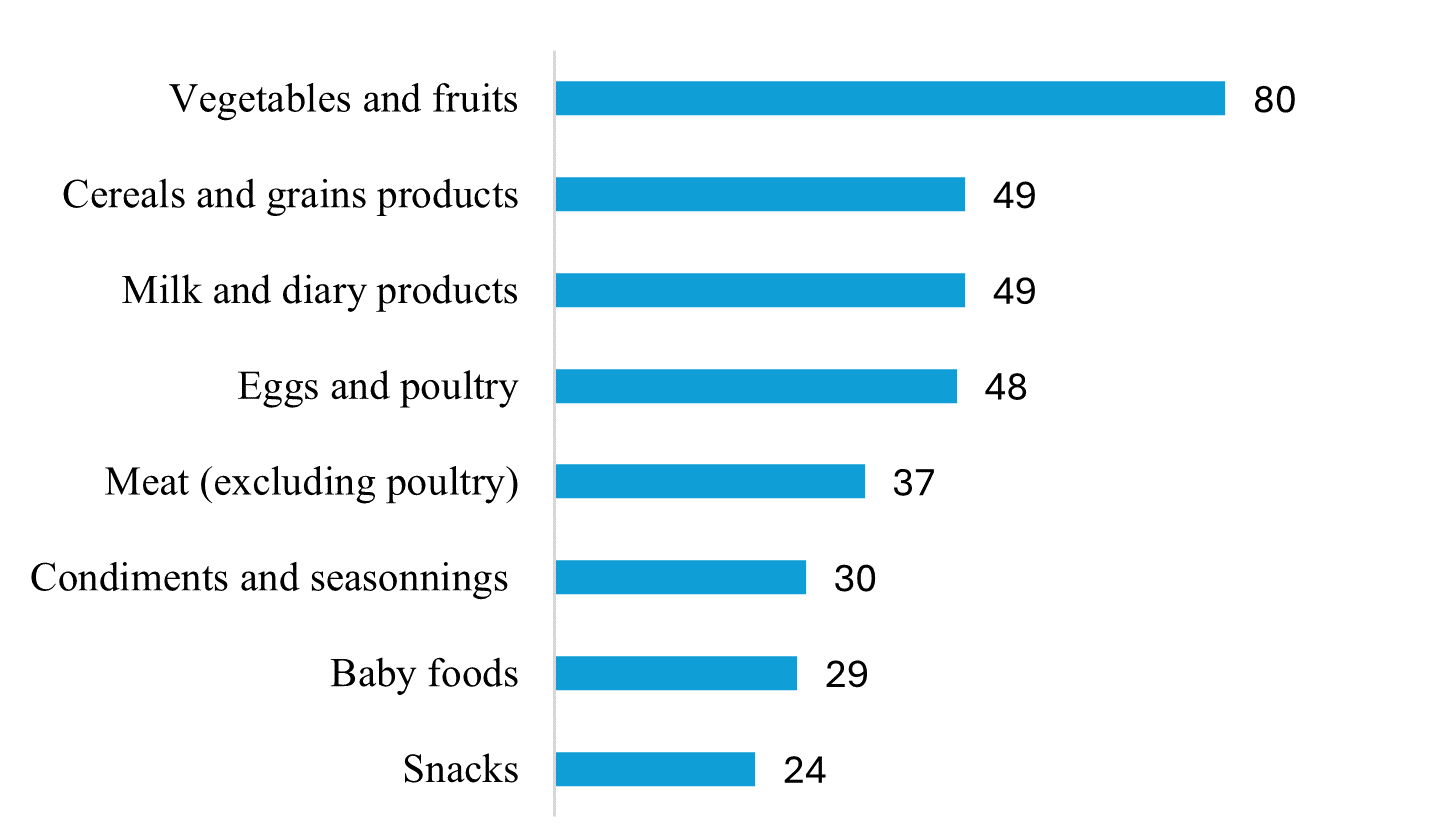

Given such context, Vietnamese consumers are embracing organic food at an unprecedented rate. Vegetables, fruits, cereals, grains, milk and dairy products are among the most popular organic food categories. A September 2023 survey by Rakuten Insight among 4,649 respondents[2] found that 80% of Vietnamese respondents purchased organic vegetables and fruits, followed by cereals, grains, milk and dairy. This shift in consumer behaviour reflects a growing desire to lead healthier lifestyles and consume foods that are free from harmful chemicals, pesticides, and synthetic additives.

Most purchased organic food categories among consumers in Vietnam in 2023

Unit: %

Source: Statista

Notably, Vietnamese consumers are willing to pay a premium for organic products. The Rakuten survey in 2023 revealed[3] that 45% would spend up to 25% more on organic versus conventional foods, while 6% had no spending limit. To illustrate, according to Central Retail Vietnam in 2024, organic vegetables from Churu ethnic minority women consistently sell out despite costing 25-35% more than regular produce in their stores[4]. This willingness to pay more for organic products demonstrates the value that Vietnamese consumers place on their health and well-being, as well as their support for sustainable farming practices and rural communities.

Organic Food Supply and Production

Domestic production of organic foods has flourished in Vietnam. The Ministry of Agriculture and Rural Development reports that the organic farming area quadrupled from 53,350 hectares in 2016 to nearly 240,000 in 2020, spanning 46 provinces with over 100 enterprises and 17,000 farmers[5]. In addition, major players like Vinamilk and TH True Milk have made significant investments in organic production. Vinamilk, an early adopter, launched its “Organic” brand in 2016 through its US subsidiary in partnership with California Natural Products. In 2017, Vinamilk transitioned to sourcing from its own organic dairy farm in Dalat, touted as the first European-standard organic farm in Vietnam and Southeast Asia. Moreover, TH True Milk debuted its organic farm in 2013 and introduced the TH True Milk Organic brand in 2017. There is also the Vinamit Organic brand, known for its organic dried vegetables, fruits, and nutritious seeds, as well as oatmeal and grains, etc., from the Xuân An brand.

TH True Milk Organic brand and grains products of Xuan An

Source: Suachobeyeu and AEON Mall

Imported organic foods also remain competitive in Vietnam, offering a diverse range of products from various categories such as dairy, cereals, snacks, condiments, and baby food. International brands, especially from Japan, have a strong presence in Vietnam’s organic market. For instance, the product of TopValu Organic, owned by AEON TopValu Company is produced and processed according to organic standards, ensuring no toxic chemicals, chemical fertilizers, or unwanted additives are used. Some products of this brand include honey, fruit jam, green tea, wine, noodles, juice, etc, with extremely flattering Japanese-style packaging. In addittion to tea, there are also other Japanese organic food products ranging from from staples like organic miso, tofu, and matcha to snacks and condiments. These imported products offer consumers a wider range of organic options and help meet demand in segments where domestic production is still developing.

TopValu Organic products

Source: AEON Mall

Organic Food Distribution Channels

Given their premium positioning, organic foods are primarily sold through modern urban retail channels targeting middle and high-income consumers. For instance, supermarkets and organic speciality stores offer wide organic selections, with some retailers like Saigon Coopmart and WinMart developing their own organic brands. Moreover, COVID-related social distancing and remote work further accelerated online shopping across all categories, including high-value organic products. Almost all leading retailer chains in Vietnam have developed their own online platforms with organic F&B products listed, including Vinmart, Aeon, Lotte, Big C, Bach Hoa Xanh, and BRG Mart.

Furthermore, organic products are also distributed through e-commerce platforms such as Shopee, Lazada and Tiki. For example, on Shopee, consumers can easily find organic products from popular brands like Organica, Dalat GAP, and Vinamit, as well as from smaller, niche producers. Lazada has partnered with local organic retailers like Bách hóa Xanh and VinEco to expand its organic offerings, while Tiki has launched a dedicated “Organic & Healthy” category, featuring products ranging from organic rice and honey to natural personal care items. This has made organic products more accessible to a broader range of consumers, including those in smaller cities and rural areas who may not have easy access to physical organic speciality stores.

Online Channels of Organicfood.vn

Source: Organicfood.vn

Drivers and Challenges of Organic Food Market

The trend of using organic food in Vietnam has accelerated in recent years, driven by a combination of factors. Rising disposable incomes have enabled more consumers to afford premium organic products, while elevated living standards and heightened health concerns, especially in the wake of the COVID-19 pandemic, have spurred demand for safe, high-quality foods. Additionally, growing environmental awareness has fueled interest in green consumption and sustainable, eco-friendly products. The stringent organic standards in key export markets like the EU, US and Japan have also influenced domestic preferences, as Vietnamese consumers seek out products that meet these rigorous criteria.

However, the high costs associated with organic production and certification pose challenges for small-scale Vietnamese producers. This creates an opening for imported organic products to help satisfy the expanding market. The EU-Vietnam Free Trade Agreement (EVFTA) has also made European organic products more affordable and accessible to Vietnamese consumers. As the organic food market grows, it will be important for the government and industry stakeholders to support small-scale farmers and producers in overcoming these challenges, ensuring that the benefits of organic agriculture are shared across the value chain.

Future Outlook

Vietnam is on the verge of an organic food boom as the government, businesses, and consumers prioritize safe and sustainable products. Moreover, the future of organic food in Vietnam looks promising as the country embraces green consumption and sustainable development. With rising incomes, health awareness and environmental consciousness, Vietnamese consumers will continue to drive demand for organic products that promote well-being while minimizing ecological impact. As domestic production scales up and international partnerships deepen, Vietnam is well-positioned to become a dynamic hub for the organic food industry in Southeast Asia. By investing in organic agriculture and promoting sustainable consumption, Vietnam can not only meet the growing demands of its own citizens but also emerge as a leading exporter of high-quality organic products to the region and beyond.

In which, Japanese organic food products show promising potential in the Vietnamese market, as consumers increasingly seek out premium, healthy, and internationally recognized food options. Products such as organic matcha, miso, natto, and baby food are particularly well-positioned for growth, appealing to health-conscious consumers and those looking for unique, high-quality flavours. High-end supermarkets, speciality stores, and e-commerce platforms in major cities like Hanoi, Ho Chi Minh City, and Da Nang are likely to be the most promising sales channels for these products, as they cater to urban, affluent consumers who are more familiar with and receptive to international organic brands. As awareness of the benefits of organic food continues to grow in Vietnam, Japanese organic products are poised to capture a larger share of the market, driven by their reputation for quality, safety, and taste.

Conclusion

The organic food trend in Vietnam is a testament to the country’s commitment to sustainable development, green consumption, and the health and well-being of its citizens. By embracing organic farming practices, supporting small-scale producers, and fostering international partnerships, Vietnam can create a thriving organic food industry that benefits consumers, farmers, and the environment alike.

[1] https://vnexpress.net/hang-hoa-sach-huu-co-dat-khach-4780120.html

[2] https://www.statista.com/statistics/1008415/vietnam-most-important-organic-food-categories-among-consumers/; N= 4,649 respondents; Original question: “Which of the following type(s) of food products is/are important to you to buy organic?”

[3] https://www.statista.com/statistics/1008424/vietnam-consumers-willingness-to-pay-for-organic-food/

[4] https://vnexpress.net/hang-hoa-sach-huu-co-dat-khach-4780120.html

[5]https://apps.fas.usda.gov/newgainapi/api/Report/DownloadReportByFileName?fileName=Vietnam%20Organic%20Market_Ho%20Chi%20Minh%20City_Vietnam_08-03-2021.pdf

| B&Company, Inc.

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |

Read other articles

Summary of the 10 most read articles on BC website in 2024 - B-Company