11Dec2025

Latest News & Report / Vietnam Briefing

Comments: No Comments.

Vietnam’s pharmaceutical market is one of the fastest-growing in Southeast Asia, driven by rising incomes, ageing demographics, and expanding health insurance coverage. Pharmaceutical companies in Vietnam operate in a highly regulated but gradually liberalizing environment that encourages investment in manufacturing, generics, and high-value therapies. This article outlines the regulatory framework, market size, and structure, profiles 10 leading pharmaceutical companies in Vietnam, highlights recent trends such as M&A and generics expansion, and concludes with practical implications for foreign investors considering entry or expansion in this dynamic market.

Regulation

Under Vietnam’s WTO commitments and current regulations (governed by the Law on Pharmacy and Decree 09/2018/ND-CP), Foreign-Invested Pharmaceutical Enterprises (FIEs) are generally permitted to import pharmaceuticals (drugs and raw materials) but are prohibited from exercising the right to distribute (wholesale or retail) these products directly within Vietnam.

The key exception is for finished drugs that the FIE manufactures locally in Vietnam. Consequently, foreign pharmaceutical companies must sell their imported products through registered local wholesalers or domestic partners who then manage distribution to hospitals (ETC) and pharmacies (OTC).

Market overview

The Vietnam pharmaceuticals market was valued at about USD 6 billion in 2023, with projections of USD 8.7 billion in 2028 and USD 11.6 billion by 2033[1]. Besides, the market is heavily skewed towards generic drugs, increasing from 58.1% market share in 2023 to 62.4% in 2029[2], with domestic manufacturers focusing on common therapies (antibiotics, cardiovascular, pain relief, diabetes) and traditional herbal medicines. It was forecasted that the generic segment will grow at about 9.7% CAGR from 2024–2029, the fastest in ASEAN[3]. While Vietnam’s generic pharmaceuticals market remains underdeveloped, it is expected to accelerate quickly and unlock substantial growth opportunities[4].

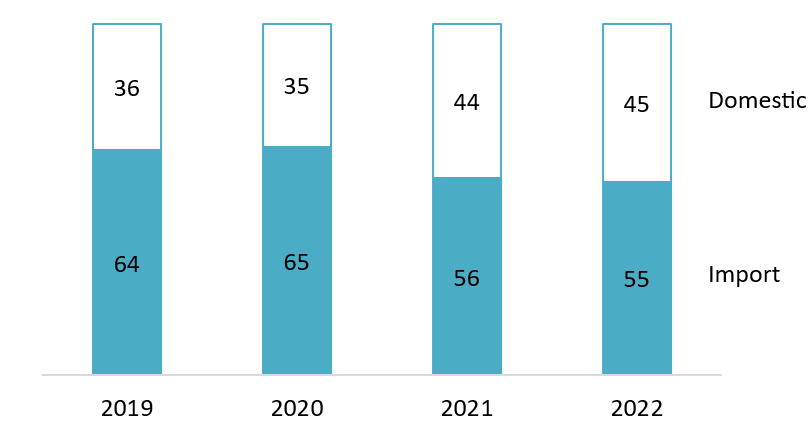

Additionally, Vietnam still depends heavily on imports for original brands, biologics, and vaccines. Specifically, these high-value imports are primarily sourced from developed markets, with France, Germany, and the US consistently ranking among the top suppliers of finished drugs[5], while India and China dominate the supply of generic drugs and active pharmaceutical ingredients (APIs)[6]. The EVFTA agreement has further cemented the EU’s role as a key source for innovative and high-quality pharmaceuticals.

Market share of imported and domestic pharmaceuticals in Vietnam from 2019 to 2022

Unit: %

Source: Statista[7]

In terms of macroeconomic drivers, Vietnam is undergoing a dramatic demographic shift. In 2024, nearly 14.2 million people (over 14% of the population) were aged 60 or older. By 2050, this demographic is expected to double to over 29 million. An aging population correlates directly with an increased burden of chronic non-communicable diseases (NCDs) such as cardiovascular disease, diabetes, and oncology, necessitating long-term medication regimens1.

Market trends

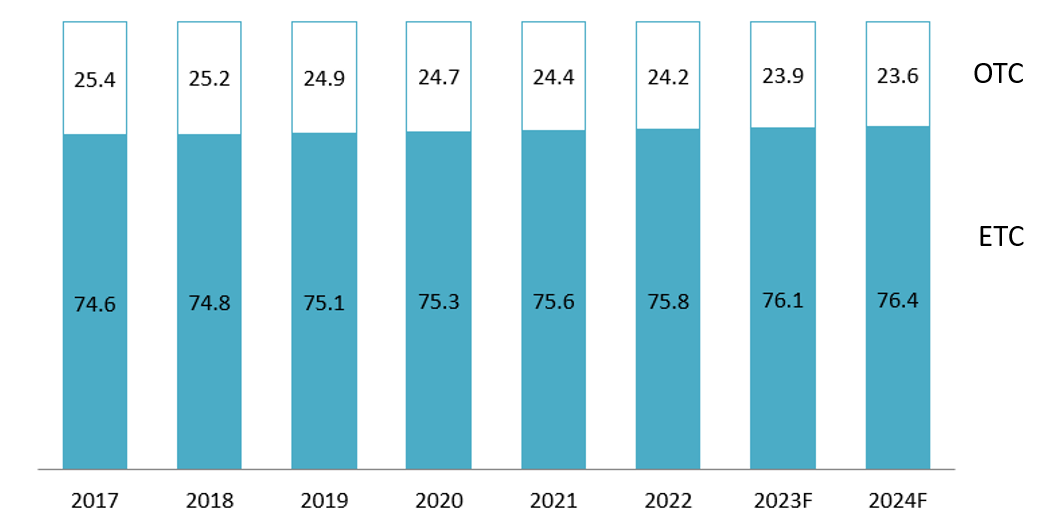

The ETC (hospital) segment remains the dominant and growing source of value, increasing its share from 74.6% in 2017 to a projected 76.4% in 2024. This trend is driven by high-value specialty drug consumption. Concurrently, the pharmacy and over-the-counter (OTC) retail channel is experiencing a structural expansion in terms of distribution reach, despite its value share decreasing from 25.4% to 23.6% over the same period. This expansion is currently marked by the rapid rise of modern drugstore chains, which are professionalizing the retail landscape, creating high competition in the OTC volume segment. In the retail landscape, while the market is increasingly dominated by three major drugstore chains, FPT Long Châu, Pharmacity, and An Khang, which reached a combined total of nearly 3,200 stores by 2024[8], the traditional fragmented model remains highly prevalent. Independent small pharmacies still account for an estimated 85% of the total retail market, which comprises approximately 50,000 retail pharmacies nationwide[9].

Revenue proportion of ETC/OTC

Unit: %

Source: Fitch Solutions[10]

Another prominent theme is M&A and strategic partnerships. The sector has experienced notable activity, including foreign investors acquiring larger stakes in local manufacturers, major M&A transactions anticipated to surpass VND 5.7 trillion in 2025, and the formation of long-term alliances for technology transfer, such as in vaccine production[11]. In 2023, South Korean firm Dongwha Pharm announced the acquisition of a 51 per cent stake in Trung Son Pharma[12]. In 2025, Livzon Pharmaceutical Group (China), through its wholly owned Singapore subsidiary Lian SGP Holding Pte. Ltd., announced plans to spend more than VND 5,730 billion in cash to acquire nearly 65% of Imexpharm Pharmaceutical Company[13]. Once the transaction is completed, Imexpharm will become an indirect subsidiary of Livzon.

The Vietnamese pharmaceutical sector is experiencing an accelerated drive toward stringent international standards like EU-GMP and Japan-GMP, moving beyond the historical reliance on WHO-GMP. While less than 10% of domestic facilities are currently projected to meet EU-GMP by mid-2025, this adoption is rapidly increasing among market leaders (e.g., Imexpharm, Pymepharco, DHG Pharma). Achieving these certifications acts as a crucial “passport” for market expansion, enabling companies to access high-value tenders and compete in demanding markets. This quality upgrade also facilitates the shift in production from basic generics to complex, high-margin products such as specialty generics for NCDs and oncology drugs, thus strengthening Vietnam’s position as a reliable regional manufacturing hub. [14]Successful examples, like Imexpharm exporting to the EU, demonstrate that this strategic investment in quality compliance positions Vietnam as a reliable regional manufacturing and export hub.

Finally, digitalization is reshaping the retail landscape. Modern pharmacy chains and digital distribution platforms are enhancing retail coverage and data visibility. Furthermore, digital optimization reduces operational costs, enabling major chains to implement aggressive pricing strategies and promotions to rapidly gain market share.

Main players

The largest domestic companies (DHG, Traphaco, Stellapharm, Imexpharm) each generate around VND 2 to nearly 6 trillion in annual net revenue. Foreign majors like Sanofi use Vietnam as both a growth market and a manufacturing/export base, and are increasingly involved in technology transfer and local partnerships, especially in vaccines and high-value therapies. Many local companies specialize in herbal/traditional medicines or generics with EU-GMP capacity, opening the door to export and contract manufacturing for multinational partners.

Additionally, in 2024, it was noted that around 159 foreign companies have invested roughly USD 1.8 billion into Vietnam’s pharmaceutical sector, underscoring the country’s appeal as a manufacturing and consumption base[15].

List of some main pharmaceutical companies in Vietnam

| No. | Company | Year founded | Head office | Home Country | Short profile | Net Revenue 2023 (Billion VND) |

| 1 | DHG Pharmaceutical JSC (DHG Pharma) | 1974 | Can Tho | Vietnam | Strong in branded generics, OTC, and functional foods with nationwide distribution. | 5,768 |

| 2 | Sanofi Joint Stock Company Vietnam | 1950 | Ho Chi Minh | France | Operates multiple WHO-GMP plants, wide portfolio of Rx, consumer health and vaccines; recently investing in local vaccine manufacturing. | 3,734 |

| 3 | Traphaco JSC | 1972 | Hanoi | Vietnam | Leading manufacturer of herbal and modern medicines; pioneer in GACP medicinal herb value chains and R&D. | 2,456 |

| 4 | Stellapharm J.V. Co., Ltd. | 2000 | Binh Duong | Vietnam | EU-GMP generics manufacturer, strong in cardiovascular, anti-diabetic and antiviral drugs, exporting to >50 countries. | 2,329 |

| 5 | Imexpharm Corporation | 1977 | Dong Thap | Vietnam | High-quality generics producer; early adopter of EU-GMP lines with strong hospital (ETC) presence. | 2,034 |

| 6 | Tenamyd Pharmaceutical Corporation | 1950 | Ho Chi Minh | Vietnam | Specializing in the production of pharmaceuticals, cosmetics, dietary supplements, medical protective equipment, etc. | 2,021 |

| 7 | Hatay Pharmaceutical Joint Stock Company | 1965 | Ha Noi | Vietnam | Manufacturing and distributing pharmaceuticals in Vietnam | 1,916 |

| 8 | Domesco Medical Import-Export Joint Stock Corporation | 1989 | Dong Thap | Vietnam | Produce pharmaceuticals, herbal-based medicines, dietary supplements, purified drinking water, and herbal beverages… | 1,72 |

| 9 | Pymepharco Joint Stock Company | 1989 | Phu Yen | Vietnam | Major antibiotics and generics manufacturer; now exporting EU-GMP products to Europe under the STADA group. | 1,582 |

| 10 | Binh Dinh Pharmaceutical & Medical Equipment JSC (Bidiphar) | 1980 | Quy Nhon | Vietnam | Top-tier manufacturer with strong hospital channel coverage (ETC) and oncology portfolio. | 1,582 |

Source: B&Company’s enterprise database and compilation

Implications for foreign investors

For investors looking at pharmaceutical companies in Vietnam, several practical implications emerge:

Opportunities

The Vietnamese pharmaceutical market is currently highly attractive, presenting significant opportunities driven by three main factors. Firstly, the market promises high, sustained growth; despite its current substantial value, the low per-capita spending suggests considerable upside potential, particularly in key segments like generics, specialty drugs, and vaccines. Secondly, this potential is reinforced by an FDI-friendly direction of policy, as the amended Law on Pharmacy clarifies the rights of Foreign Invested Enterprises (FIEs) and seeks to ease administrative burdens, specifically encouraging high-tech manufacturing and technology transfer. Finally, the market is ripe with partnership and M&A potential; the industry’s current fragmentation and the capital needs of local firms create extensive room for equity investments in domestic champions (like EU-GMP certified producers) and for establishing strategic alliances in areas such as R&D, branded generics, and vaccine production.

Challenges

Companies operating in Vietnam’s pharmaceutical sector must navigate several core challenges. Distribution restrictions for FIEs remain critical. Foreign pharma companies are prohibited from wholesale and retail activities of finished drugs, forcing reliance on local distributors, which often dilutes margins. However, the Amended Law on Pharmacy (2024) clarifies that FIEs with local manufacturing are now explicitly permitted to conduct certain internal logistics/value-added activities (e.g., storage, QC, internal transport) for their own products, offering a slight operational ease without changing the core distribution ban. Furthermore, the environment is marked by a complex pricing and reimbursement environment. Strict price declaration regulations and constantly evolving reimbursement policies demand that firms possess robust market access and strong health-economics capabilities to effectively manage their products. Lastly, the sector experiences intense price competition within a highly fragmented market. With hundreds of manufacturers fiercely competing, particularly in the generics segment, price pressure is exceedingly high. Therefore, success hinges on a company’s ability to achieve differentiation through superior quality, regulatory compliance, branding, and service.

* If you wish to quote any information from this article, please kindly cite the source along with the link to the original article to respect copyright.

| B&Company

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |

[1] https://www.trade.gov/market-intelligence/vietnam-pharmaceutical-industry-updates

[2] https://vneconomy.vn/thi-truong-thuoc-generic-viet-nam-co-hoi-55-ty-usd-va-rao-can-tu-tieu-chuan-chat-luong.htm

[3] https://ven.congthuong.vn/vietnam-forecast-to-spearhead-asean-generic-drug-market-expansion-58234.html

[4] https://assets.kpmg.com/content/dam/kpmg/vn/pdf/2025/10/future-value-of-vietnam-generics-market-eng.pdf

[5] https://mekongasean.vn/duoc-pham-la-mat-hang-viet-nam-nhap-khau-lon-nhat-tu-phap-33909.html

[6] https://vir.com.vn/pharma-to-experience-robust-growth-114808.html

[7] https://www.statista.com/statistics/1116617/vietnam-market-share-of-imported-and-domestic-pharmaceuticals/

[8] https://doanhnghiephoinhap.vn/giua-con-bao-quet-thuoc-gia-nhin-lai-cuoc-dua-cua-3-chuoi-duoc-pham-long-chau-pharmacity-va-an-khang-107314.html&link=autochanger

[9] https://vneconomy.vn/dan-dau-ve-so-luong-nha-thuoc-1-796-tren-toan-quoc-tong-doanh-thu-32-000-ty-con-rui-ro-nao-ma-frt-phai-luu-y.htm

[10] https://kirincapital.vn/wp-content/uploads/2023/11/Bao-cao-nganh-duoc-pham-VN.pdf

[11] https://vietnamnews.vn/economy/1718551/viet-nam-s-pharmaceutical-market-sees-major-m-a-deal.html

[12] https://vir.com.vn/south-korean-dongwha-pharm-buys-majority-stake-in-vietnams-trung-son-pharma-104172.html&link=autochanger

[13] https://tuoitre.vn/hang-duoc-trung-quoc-du-chi-hon-5-700-ti-dong-de-mua-gan-65-von-imexpharm-20250523015415335.htm

[14] https://thesaigontimes.vn/nganh-duoc-nang-cap-tieu-chuan-tim-duong-ra-the-gioi/

[15] https://assets.kpmg.com/content/dam/kpmg/vn/pdf/2025/10/future-value-of-vietnam-generics-market-eng.pdf