The meat processing industry in Vietnam has undergone substantial growth over the past decade, emerging as a critical component of the nation’s economy. This industry not only ensures food safety and increases the value of the livestock sector but also contributes significantly to import and export activities. The expansion of this sector is attributed to rising domestic demand, booming export markets, and investments in infrastructure.

Domestic production of Meat products

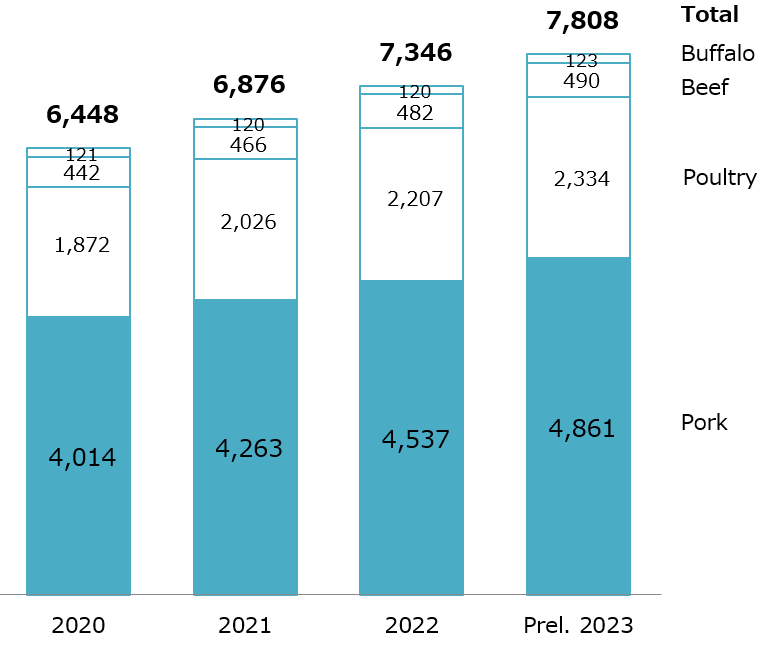

Vietnam’s domestic meat production plays a vital role in its agricultural sector, with output showing consistent growth, from 6.4 million tons in 2020 to an estimated 7.8 million tons in 2023. Of which, pork remains the dominant product, accounting for the largest share of national meat production. Poultry is also a significant contributor with steady growth of approximately 25% from 2020 to 2023, while beef and buffalo production remains limited due to land constraints, high feed costs, and competition from imported beef[1].

Output of major livestock products

Unit: thousand tons

Source: Statistical Yearbook 2023

This growth reflects an rising demand for meat products driven by population increase, strong urbanization trends, and economic growth. In 2023, Vietnam’s population grew by 0.8% year-on-year, urbanization reached 38.1%, and GDP increased by 5.05%, totaling $430 billion[2].

Export & Import value of Meat products

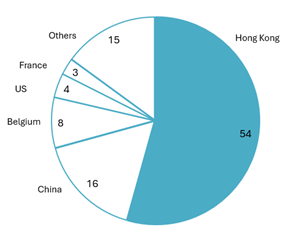

According to the Vietnam Livestock Editorial Office[3], in 2023, Vietnam exported 22 thousand tons of meat products, valued at over $110 million, marking a 19% increase in volume and a 30.4% rise in value from the previous year. Key export products include fresh, chilled, or frozen pork. The primary export markets were Hong Kong (54.4% share), followed by China, Belgium, and the US.

Structure of Vietnam’s main export markets for meat and meat products (% by value)

100% = 110.3 million USD

Source: Livestock Editorial Office

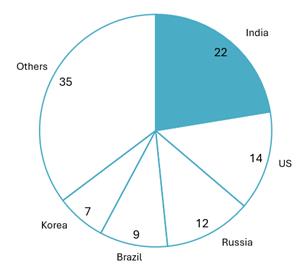

Besides, in 2023, Vietnam imported 717 thousand tons of meat and meat products, worth more than 1 billion USD, up 5.4% in volume, but down 3.9% in value compared to 2022. Imported products are mainly meat and edible by-products of poultry; edible by-products of live pigs, buffaloes, and cows, chilled or frozen;… In the same year, Vietnam imported mainly from India (22.4%), and countries such as the US, Russia, and Brazil,…

Imports primarily consisted of meat and edible by-products. Vietnam’s import value was ten times higher than its export value, reflecting limitations in meat quality and deep processing capabilities, which hinder competitive exports.

Structure of Vietnam’s main import markets for meat and meat products (% by value)

100% = 1.4 billion USD

Source: Livestock Editorial Office

Overview of Meat processing companies in Vietnam

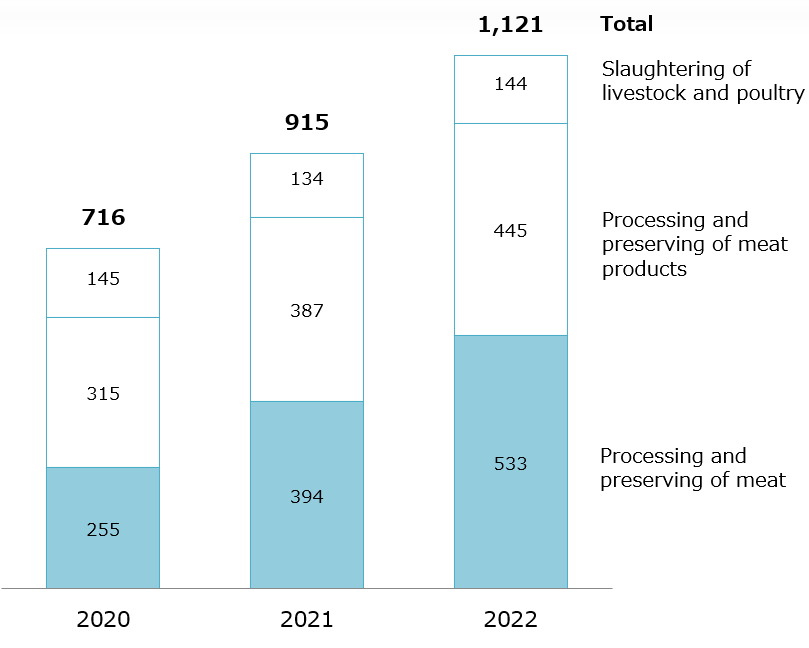

As of 2022, the meat processing industry in Vietnam consisted of approximately 668 enterprises, slightly fewer than in previous years. However, the sector has demonstrated impressive revenue growth, with a total valuation of over $1 billion, reflecting a growth rate of 35%. This is a significant increase compared to the growth rates of 25% in 2020 and 2021. In addition, meat processing enterprises are mainly concentrated in the South East and Red River Delta regions in Vietnam, with the proportion of large enterprises and SMEs at 5% and 30% respectively in 2022[4]

Revenue of companies in processing and preserving of meat industry in Vietnam

(Unit: Million USD)

Source: B&Company’s Enterprise database

Introduction of some main players in the Meat processing industry in Vietnam

The table below provides more information about the top 5 meat processing companies in Vietnam. In addition to Vietnamese domestic companies, major international players like CP and Japfa have invested in Vietnam. Main products include pork, beef, and chicken. Also, key players are increasingly focusing on advanced processing and establishing modern, high-standard factories. These efforts aim not only to meet domestic market demand but also to expand into export markets:

| Name | Website | Establish

ment |

Overview | Main Products | Production Scale |

| Vissan JSC | vissan.com.vn | 1970 | Vissan is one of Vietnam’s leading meat processing companies, specializing in fresh and processed meat. It is a subsidiary of SATRA (Saigon Trading Group) | Fresh pork, beef, chicken, sausages, canned meat | Operates modern facilities processing 60,000 tons/year of meat |

| CP Vietnam | cpvietnam.com | 1993 | CP Vietnam is a subsidiary of Thailand’s CP Group. It integrates farming and food processing, focusing on high-quality meat production | Pork, chicken, ready-to-eat products | A leader in livestock farming and meat processing, exporting globally |

| Masan MEATLife | meatdeli.com.vn | 2015 | A subsidiary of Masan Group, it focuses on supplying clean and fresh chilled meat under the MeatDeli brand | Fresh pork, chicken, and processed meat. | Operates large-scale facilities, including a MEATDeli plant in Ha Nam |

| Dabaco Group | dabaco.com.vn | 1996 | Dabaco is a Vietnamese group specializing in livestock farming, feed production, and meat processing | Pork, chicken, eggs, processed meat | Large-scale vertical integration from farming to food processing |

| Japfa Vietnam | japfavietnam.com | 1996 | A subsidiary of Indonesia’s Japfa Group, it operates in animal feed, livestock farming, and meat processing | Pork, chicken, processed meat | Focuses on sustainable farming and supplies to domestic and export markets |

Source: B&Company’s synthesis

Investment and Infrastructure Development

The meat processing industry has seen a surge in investments aimed at modernizing infrastructure and expanding capacity. For instance, egg producer Ba Huan has shifted into producing various processed egg and poultry products, while Masan MEATLife, a subsidiary of Masan Group, commissioned a US$77.6 million MEATDeli Saigon Meat Processing Complex in Long An Province in 2020[5].

In addition, the industry has attracted considerable domestic and foreign investments aimed at developing processing facilities. Notably, in March 2023, Vinamilk entered into a joint venture with the Japanese Sojitz Corporation to establish a beef cattle farming and processing complex in Vinh Phuc Province, northern Vietnam, with an estimated investment of US$127 million[6]. Spanning 75 hectares, the facility is designed to house up to 10,000 heads of cattle, with an annual processing capacity of approximately 10,000 tons of beef.

The complex includes a modern livestock farm and processing plant

Source: Vinamilk

Challenges and Opportunities

Despite its growth, the meat processing industry faces challenges such as disease outbreaks, including African swine fever (ASF). In July 2024, the Vietnamese government reported a significant increase in ASF outbreaks, leading to the culling of over 42,000 pigs, a fivefold increase compared to the same period in the previous year[7]. These outbreaks pose risks to food supply and inflation.

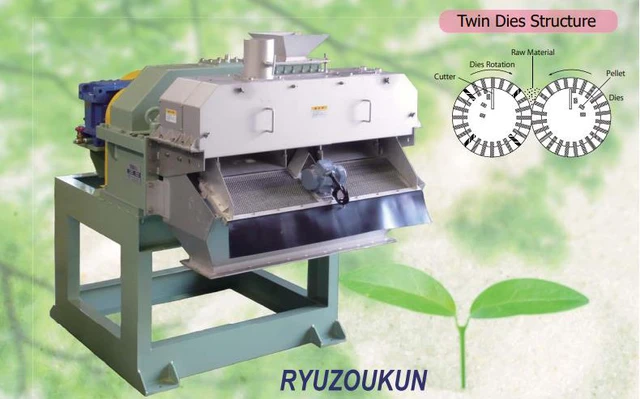

Conversely, the industry’s expansion presents opportunities for technological advancements and the adoption of international best practices. Companies are increasingly investing in state-of-the-art processing equipment and adhering to global food safety standards to enhance product quality and safety.

Conclusion

The meat processing industry in Vietnam is poised for continued growth, supported by increasing domestic demand and expanding export markets. Ongoing investments in infrastructure, coupled with a focus on disease control and adherence to international standards, are expected to bolster the industry’s resilience and competitiveness.

In summary, this industry is at a pivotal stage, balancing growth opportunities with evolving challenges. With continued investments, innovative practices, and strategic partnerships, the sector is poised to meet rising global and domestic demand while contributing significantly to the economy.

[3] Livestock editorial office

[4] B&Company’s Enterprise Database

| B&Company, Inc.

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |

Read other articles