16Apr2025

Latest News & Report / Vietnam Briefing

Comments: No Comments.

1. Vietnam Sees Highest Q1 Growth Since 2020 Amid External Challenges

According to the National Statistics Office (NSO), Vietnam’s GDP grew by 6.93% in the first quarter of 2025 year-over-year, which is the highest Q1 growth rate since 2020. All major economic sectors outperformed Q1 of last year, with the services sector leading at 7.7% growth.

Despite this solid performance, the growth rate fell short of the 7.7% Q1 target outlined in Decree No. 01/NQ-CP, which aims for an 8% GDP increase for the full year. Global headwinds, particularly recent shifts in U.S. trade policies, Vietnam’s key export market, pose challenges to sustaining growth momentum.

In its Taking Stock: Viet Nam Economic Update report, the World Bank projects Vietnam’s GDP to grow by 6.8% in 2025, easing to 6.5% in 2026[1].

2. Vietnam’s Trade Expands Sharply in March

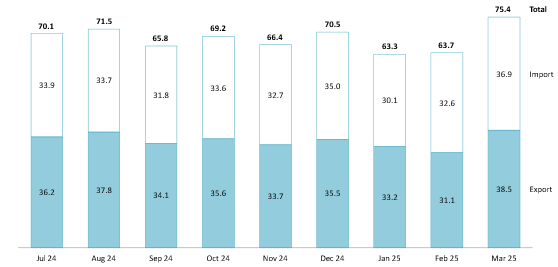

Vietnam’s total trade value in March reached 75.4 billion USD, marking an 18.2% increase from the previous month and a 16.6% rise year-over-year. Exports surged by 24% compared to February, raising Q1 2025 export value to 102.8 billion USD—up 10.6% from the same period last year. Processed industrial goods led the export structure, contributing 90.92 billion USD and accounting for 88.4% of total exports.

Imports also recorded strong growth, rising 13% month-over-month. Total import value in Q1 2025 reached 99.7 billion USD, a 17% increase year-over-year. Production materials remained the dominant import group, totaling 93.51 billion USD and representing 93.8% of total imports.

Vietnam’s import and export value, from July 2024 to March 2025

Unit: Billion USD

Source: The General Department of Vietnam Customs, NSO

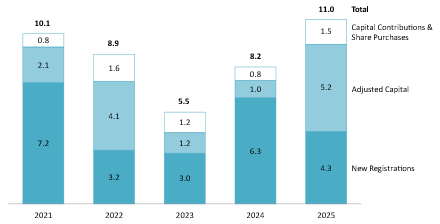

3. New foreign direct investment capital surged in Q1

Vietnam attracted nearly 11 billion USD in registered FDI capital in Q1 2025, marking a 34.7% year-over-year increase. Disbursed FDI also rose by 7% to 5 billion USD, reflecting strong investor confidence in Vietnam’s investment climate.

Notably, capital adjustments soared nearly five-fold, reaching 5.2 billion USD, while capital contributions and share purchases increased 84% to 1.5 billion USD. In contrast, newly registered capital dropped 32%, from 6.3 billion USD to 4.3 billion USD. However, March showed signs of recovery, with newly registered capital 2.4 times higher than February and 67% higher than January.

The manufacturing and processing sector remained the top recipient, attracting 6.8 billion USD, up 26% year-over-year, and accounting for nearly 62% of total investment. Singapore remained the largest investor with over 3 billion USD (28%), followed by South Korea with 2.04 billion USD (8.5%). Mainland China, Japan, and Taiwan also ranked among the top contributors.

Registered Foreign Direct Investment Capital in Vietnam in the first quarter, from 2021 to 2025

Unit: Billion USD

Source: VnEconomy

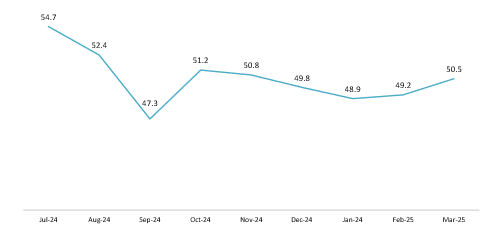

4. Vietnam’s Manufacturing Recovers in March

According to S&P Global, Vietnam’s Manufacturing Purchasing Managers’ Index (PMI) rose from 49.2 in February to 50.5 in March, ending a three-month streak below 50, signaling improvements in the business conditions. While new orders prompted the increase in production, international demand remained soft, as the number of new orders from foreign countries continued to decline for five consecutive months. Overall, despite positive sentiment, manufacturers’ optimism remained below the long-term average, reflecting cautious expectations.

Vietnam Manufacturing Purchasing Managers’ Index, from July 2024 to March 2025

Source: S&P Global

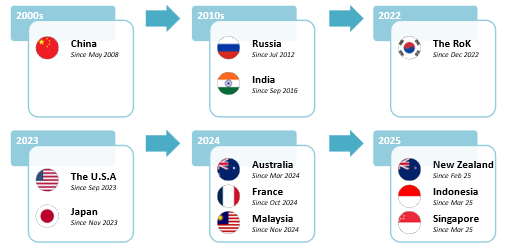

5. Vietnam Enters New Comprehensive Strategic Partnerships with ASEAN Countries

In March, Vietnam strengthened its regional integration by announcing Indonesia and Singapore as its 11th and 12th comprehensive strategic partners. Both countries are key regional trade partners, with bilateral trade in 2024 reaching 16.7 billion USD with Indonesia (2nd in ASEAN) and 10.5 billion USD with Singapore (4th in ASEAN). Singapore also remained Vietnam’s top source of foreign direct investment, contributing 10.21 billion USD—nearly 27% of total FDI.

12 comprehensive strategic partners of Viet Nam as of March 2025

Source: B&Company synthesis

6. Vietnam Strengthens Bilateral Comprehensive Strategic Relationship with South Korea

Since establishing their comprehensive strategic partnership in 2022, Vietnam and South Korea have made notable progress in bilateral relations. In 2024, Vietnam became South Korea’s third-largest trading partner, with total trade reaching 86.7 billion USD.

On March 20, South Korea announced the launch of an integrated logistics center in Dong Nai, a key logistics hub in Vietnam. Developed by LOTTE Global Logistics, the Cold Chain Logistics Centre marks a pioneering FDI project in the province’s industrial parks. This development is expected to contribute to the two countries’ shared goal of reaching 100 billion USD in trade by 2025 and 150 billion USD by 2030.

LOTTE Global Logistics’ Cold Chain Logistics Centre in Nhon Trach Industrial Park, Dong Nai Province

Source: Vietnamnews

7. Vietnam Boosts Renewable Energy Development

On March 3rd, 2025, the government announced Decree No. 58/2025/ND-CP to promote the development of renewable energy in Vietnam. The decree offers key incentives for electricity-generating projects that use 100% green hydrogen, green ammonia, or a combination of both. These include exemptions from sea area levies and land use fees for up to 3 years during the capital construction phase, followed by continued reductions. Additionally, such projects are guaranteed a minimum contracted electricity output of 70% during the principal loan repayment period—up to 12 years—helping to ease the early operational phase.

Perspective view of TGS Green Hydrogen Electrolysis Plant

Source: VnEconomy

8. Vietnam Central Region Welcomes New Data Centre, Semiconductor and AI Projects

Da Nang International Data Centre JSC has officially launched the city’s largest data hub at the Hi-tech Park, featuring a 1,000-rack system for seamless operations. The first phase, with an investment of 32 billion USD, is designed to meet global standards and support cloud computing, AI applications, and cybersecurity. Full operations are expected by 2027, with an additional 48 billion USD planned for the second phase.

Meanwhile, Vietnamese ICT leader FPT Group has inaugurated its AI and semiconductor-focused R&D center at the newly opened Da Nang Software Park No. 2—the first facility of its kind in the park. This move reinforces the group’s 20-year collaboration with Da Nang in IT development and supports the city’s vision of becoming Vietnam’s “Silicon Bay,” inspired by Silicon Valley in the U.S.

Launch ceremony of the semiconductor & AI R&D Centre of FPT Group in Da Nang

Source: Vietnamnews

[1] World Bank. Taking Stock: Viet Nam Economic Update, March 2025 <Source>

* If you wish to quote any information from this article, please kindly cite the source along with the link to the original article to respect copyright.

| B&Company

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |