30May2025

Latest News & Report / Vietnam Briefing

Comments: No Comments.

The Southeast region of Vietnam is the country’s most dynamic economic zone, driving industrial output, export growth, and foreign investment. Following the 2025 provincial-level administrative unit mergers, the Southeast is entering a new era of streamlined governance and enhanced regional coordination, laying the groundwork for a more cohesive economic strategy.

Overview of the Southeast after the 2025 Administrative Unit Mergers

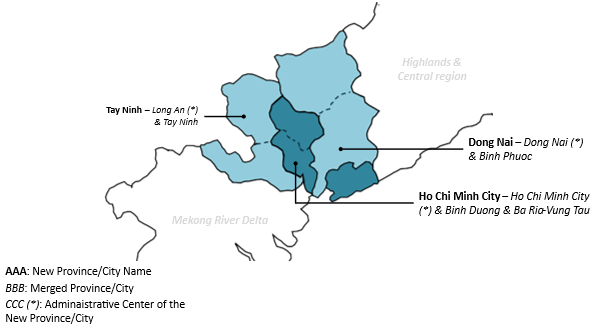

Vietnam’s Southeast region, the country’s burgeoning industrial and urban centers, is undergoing a major administrative restructuring to enhance regional coordination and economic efficiency. Under Decision No. 759/QĐ-TTg[1], 6 provincial-level units will be consolidated into one centrally governed city (Ho Chi Minh City) and two provinces (Dong Nai and Tay Ninh)[2]. This new structure, set to take effect on August 15 per Conclusion No. 157-KL/TW[3], signed on May 25, is expected to streamline governance, optimize infrastructure planning, and create a more attractive environment for investors.

The Southeast’s provincial-level administrative units after the 2025 mergers

Source: B&Company Vietnam

Alongside the Red River Delta, the Southeast region is one of Vietnam’s two major economic centers. In 2024, it recorded the highest GDP among the country’s six key economic zones, exceeding 3,600 trillion VND, representing nearly one-third of the national total. Following the administrative merger, the newly expanded Ho Chi Minh City incorporates Binh Duong and Ba Ria–Vung Tau, which were previously Vietnam’s third- and sixth-largest provincial economies. As a result, the new HCMC alone now contributes over 20% of the country’s GDP, solidifying its position as Vietnam’s dominant economic center. The post-merger Dong Nai and Tay Ninh are also set to see significant economic expansion, with both expected to rank among the top ten provincial economies nationwide in terms of GRDP.

Socio-economic indicators in 2024 of the Southeast’s provinces after the administrative mergers

| No. | Provinces | Population

(Unit: Thousand people) |

Total Area (Unit: Km2) | GRDP

(Unit: Billion VND) |

Growth rate

(Unit: %) |

| 1 | Ho Chi Minh City | 13,609 | 6,773 | 2,715,780 | 8.0 |

| 2 | Dong Nai | 4,428 | 12,737 | 609,176 | 8.3 |

| 3 | Tay Ninh | 2,959 | 8,537 | 312,464 | 7.5 |

| Total | 20,996 | 28,047 | 3,637,420 | 8.0 | |

Source: Resolution No. 60-NQ/TW, Decision No. 759/QD-TTg, General Statistic Offices (GSO), Provincial Statistics Offices, B&Company synthesis

Regional Economic Characteristics and Investment Situation of the Southeast

The Southeast region holds a highly strategic position that drives its economic development. It borders the Mekong Delta, Vietnam’s leading hub for agriculture and aquaculture; the South-Central Coast, with access to key maritime economic centers; and the Central Highlands, a major source of industrial crop materials. The region is positioned near the core of ASEAN and lies along vital international maritime and aviation routes. This prime location enables the Southeast to emerge as a major industrial powerhouse driven by foreign investment while also serving as a booming national and international center for logistics, finance, and high-value services.

Outlined under Resolution No. 24-NQ/TW[4] in 2022, Decision No. 370/QD-TTg[5], and Decision No. 1325/QD-TTg[6] in 2024, Vietnam’s Southeast region is oriented toward developing high-tech manufacturing and processing industries alongside high-value service sectors. The strategy also highlights the promotion of external economic relations as well as inter- and intra-regional cooperation. The 2025 administrative unit mergers are expected to further enhance regional connectivity by reducing administrative fragmentation, facilitating integrated regional planning, and accelerating the implementation of major infrastructure projects while maintaining the region’s key development orientation:

(1) Development of high-tech and emerging industrial sectors through the formation of new clusters and specialized industrial and technological zones around Ho Chi Minh City;

(2) Advancement of high-value and high-quality service sectors based on regional and provincial strengths, particularly in finance, commerce, logistics, and tourism;

(3) Strengthening the national and international logistics system connected to seaports, airports, international border gates, key economic corridors, and interregional trade routes;

(4) Expansion of the marine economy, including port logistics, oil and gas extraction and processing industries, supporting industries, etc.;

(5) Restructuring of agriculture toward a high-efficiency, smart, circular, ecological, and sustainable agricultural economy.

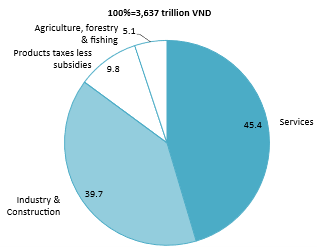

In 2024, the regional services sector was valued at nearly 1,700 trillion VND, the highest among all key economic zones and accounting for over 45% of the regional GDP. On the other hand, the industry and construction sector has undergone a notable transformation, with its structure shifting toward a greater share of manufacturing and processing industries while gradually reducing reliance on the mining sector. This transition also reflects a move away from labor-intensive industries, such as textiles and footwear, toward high-tech and high-value-added industrial products. Reportedly, the share of manufacturing and processing industries in the region’s GRDP increased from 24% in 2011 to 27.6% in 2015, 30.3% in 2020[7], and reached 33% in 2024[8] [9]. While only accounting for a small share of the GDP composition of the Southeast region, the agriculture sector is highly important, with its key industrial and fruit crops being Vietnam’s top export earners, generating billions of USD in export revenue[10].

GDP Composition of the Southeast in 2024

Unit: %

Source: General Statistic Offices (GSO), Provincial Statistics Offices, B&Company synthesis

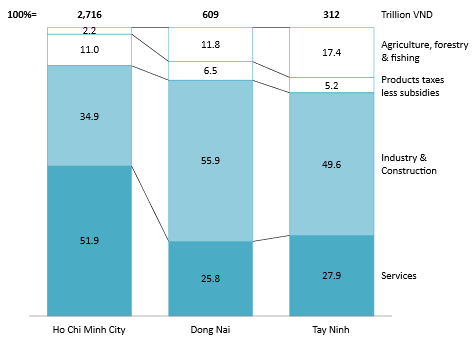

The GRDP composition of the southeastern provinces closely mirrors that of the Red River Delta, with a service-oriented regional center embedded within a largely industrial region. In 2024, Ho Chi Minh City recorded the highest share of the services sector in its GRDP, reflecting its role as both a national and international services hub. The newly merged Ho Chi Minh City also maintains a robust industrial base, integrating its high-tech industries with Binh Duong’s and Ba Ria–Vung Tau’s strengths in manufacturing and processing. Meanwhile, the newly formed Dong Nai, created from the merger of two heavily industrial provinces, holds the highest share of the industry and construction sector among the three Southeast provinces. Post-merger Tay Ninh stands out for its strong agricultural foundation, with current Tay Ninh specializing in industrial crops. At the same time, Long An contributes significantly to year-round crops and fruit production.

GRDP composition by provinces in the Southeast post mergers in 2024

Unit: %

Source: General Statistic Offices (GSO), Provincial Statistics Offices, B&Company synthesis

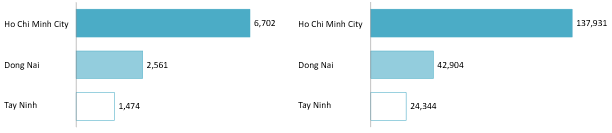

While the Red River Delta has risen to be the key economic zone with the highest registered FDI capital in 2024, the Southeast is still leading in total FDI capital with around 23 thousand projects and over 200 billion USD in investment value. In 2024, the region accounted for 28% of Vietnam’s total registered FDI capital, with the post-merged Ho Chi Minh City leading with nearly 7 billion USD, channeling into the manufacturing and processing industry (primarily in Binh Duong and Ba Ria-Vung Tau), wholesale and retail, repair of motor vehicles and motorcycles, and real estate business (Ho Chi Minh City).

New registered FDI capital in 2024 (Left) and Total accumulated registered FDI capital in 2024 (Right) by provinces of Southest Provinces

Unit: Million USD

Source: MPI, B&Company synthesis

Potential Changes in Economic Development Orientation of Southeast Provinces Following Administrative Unit Mergers

The provincial-level administrative unit merger is expected to revitalize Vietnam’s southern economic center and unlock new growth opportunities. Following the merger of Ho Chi Minh City with Binh Duong and Ba Ria-Vung Tau, the expanded metropolis is positioned to develop a more cohesive economy that effectively links industrial production with supporting service sectors. The city is poised to see a better influx of FDI in high-tech manufacturing and processing, supported by the expanded availability of industrial land from nearby provinces. Meanwhile, Dong Nai and Tay Ninh are expected to benefit from more synchronized development strategies following their mergers with provinces of similar economic structures, enabling the potential formation of specialized economic zones aligned with key sectoral strengths.

The economic landscape and the development orientation of Southeast Provinces after merging

| Provinces | Economic landscape | Possible economic development orientation |

| Ho Chi Minh City

Merged from: · Ho Chi Minh City; · Binh Duong · Ba Ria-Vung Tau |

The merger improves the connectivity between Binh Duong’s industrial sectors and major international logistics points. It also diversifies Ho Chi Minh City’s current economy, with further development potential in the sea economy, manufacturing & processing, and tourism, while also boosting its current services base. | · Prioritizing key manufacturing and processing industries, promoting high-tech and circular industries;

· Developing high-value services sector, particularly in finance, commerce, logistics, and tourism; · Enhancing logistics services integrated with the regional industrial ecosystem; · Advancing the marine economy to leverage coastal advantages |

| Dong Nai

Merged from: · Dong Nai; · Binh Phuoc. |

The merger combines Dong Nai’s established industrial base and logistics infrastructure with Binh Phuoc’s abundant land and emerging manufacturing zones. It allows better regional planning and attracts greater foreign and domestic investment. | · Prioritizing high-tech manufacturing sectors, including aerospace, semiconductors, chips & AI; and automation & IT devices;

· Expanding supporting industries to strengthen and deepen industrial value chains; · Developing airport and logistics services to enhance regional connectivity and international trade capacity; · Promoting agriculture, forestry, and aquaculture linked to high-value chains. |

| Tay Ninh

Merged from: · Tay Ninh · Long An. |

The merger forms large-scale agricultural production zones linked to high-value processing and export chains. The merger also enables better infrastructure planning, improved logistics, and stronger interregional connectivity. | · Developing manufacturing and processing industries based on regional strengths, such as mechanical manufacturing, textiles & garments; rubber & plastic; and agro-aquatic products processing.

· Developing logistics services connecting to Cambodia; · Strengthening the current agriculture, forestry, and aquaculture, linked to high-tech and high-value chains; · Developing ecotourism, agritourism, and rural tourism in connection with major tourism destinations. |

Source: Economic planning of Southeast provinces, B&Company synthesis

Conclusion

The 2025 administrative unit mergers in the Southeast region are more than just a governance reform; they are a strategic inflection point for regional economic development. By aligning infrastructure, industrial policy, and investment promotion across newly consolidated provinces, the region is set to lead Vietnam into a more integrated and competitive economic future.

[1] TVPL. Decision No. 759/QD-TTg approving the Proposal on Reorganization of Administrative Units at Various Levels and the Construction of a Two-Tier Local Government Structure <Source>

[2] For the analysis purposes under this article, we included Long An as the provinces is set to be merged with Tay Ninh. The provided figures are for reference only.

[3] TVPL. Conclusion No. 157-KL/TW on the implementation of the resolutions and conclusions of the Central Committee and the Politburo regarding the reorganization of the organizational apparatus and administrative units <Source>

[4] TVPL. Resolution No. 24-NQ/TW on Socio-Economic Development and National Defense and Security Assurance in the Southeast Region to 2030, with a Vision to 2045 <Source>

[5] TVPL. Decision No. 370/QD-TTg on the Approval of the Southeast Region Planning for the Period 2021 – 2030, with a Vision to 2050 <Source>

[6] TVPL. Decision No. 1325/QD-TTG on Promulgating the Implementation Plan for the Master Plan of the Southeast Region for the 2021–2030 Period, with a Vision to 2050 <Source>

[7] Communist Review. Restructuring the industrial sector in the Southeast region in accordance with the spirit of the Politburo’s Resolution No. 24-NQ/TW <Source>

[8] Capital Youth Newspaper. The Southeast region leads the nation in per capita income <Source>

[9] These reported figures do not include Long An as a province of the Southeast region.

[10] VINACAS. Sustainable Agricultural Development in the Southeast Region – Upgrading Key Agricultural Value Chains <Source>

* If you wish to quote any information from this article, please kindly cite the source along with the link to the original article to respect copyright.

| B&Company

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |