15Feb2021

Industry Reviews

Comments: No Comments.

Overview

Not until 1920 when the French brought foreign dairy cows to Vietnam that the local people here got to know about cow milk. In 1924, Longevity & Dutch Lady products were first traded in Saigon (later renamed Ho Chi Minh City) and became the first player in the longtime dairy industry. Since then, the Vietnam dairy industry has developed dramatically. According to Euromonitor, the total size of Vietnam’s dairy market in 2019 has reached over USD 5.2 billion and a report from Vietnam Dairy Association also pointed out that the dairy market’s revenue already reached USD 4.7 billion in 2018, an increase of 9% compared to 2017, and made the CAGR of 12.7% over the period of 2010-2018.

The year 2020 with its COVID-19 pandemic has witnessed the struggle of many industries and FMCG in particular. Increased employment rate and dropped consumer confidence index have made consumers cut down their expense budget on many categories. However, the dairy industry only lost a little with a slight drop of 4% in market value (SSI Research). Based on recent Nielsen’s data, milk consumption still accounts for 12% of FMCG consumption in Vietnam in the first half of 2020, remained unchanged from 2019 statistics.

Consumers’ buying behaviors

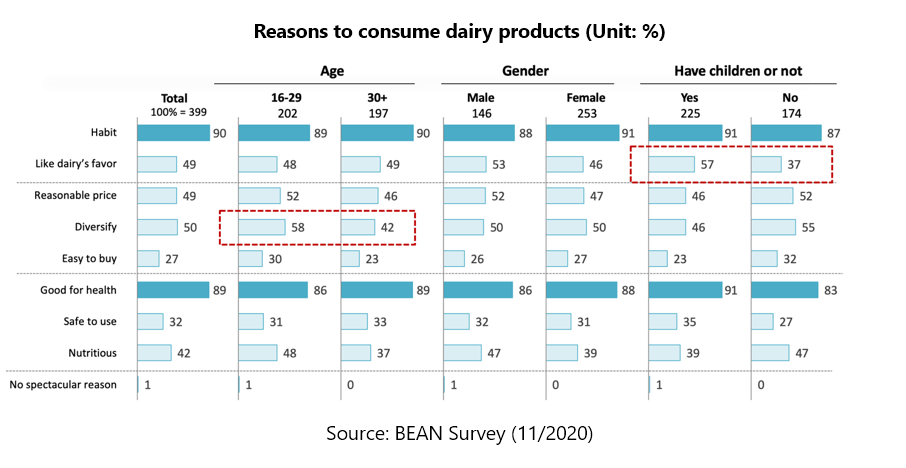

Results from the “Dairy consumption behaviors” survey conducted by BEAN Survey (11/2020) with 399 respondents have proofed the essential role of dairy products in Vietnamese daily life with 100% of respondents stated that they have used milk and other dairy products for the past three months. Especially, 64% used milk daily and 55% used other dairy products sometimes per week. As we are in the middle of the pandemic, consumers start seeking products that boost their health and milk has been believed to be a good product for the immune system. According to Ho Chi Minh Securities Corporation, demand for dairy products during the COVID-19 pandemic increased, most in yogurt. Besides habit-related and convenient reasons, 87.5% of respondents of BEAN Survey chose to use dairy products because “It’s good for health”, 42% consumed for “Nutritious” and 32% for “Safety”.

Market potentials for foreign players

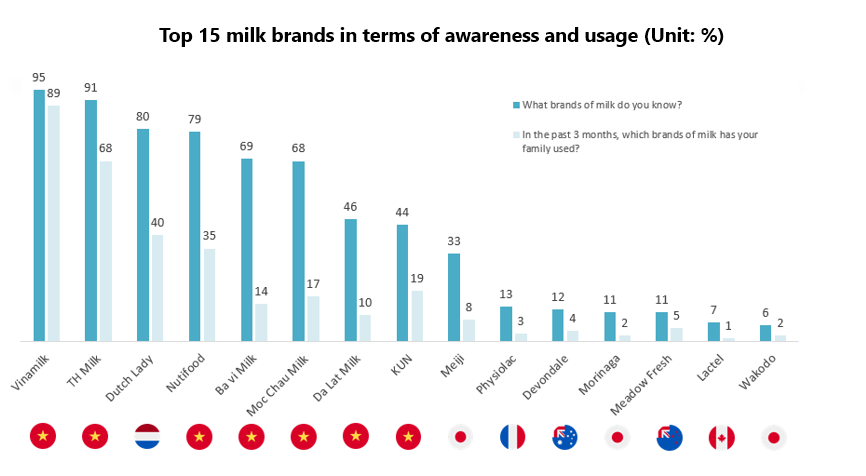

As the Ministry of Industry and Trade planned in 2010, even when the domestic companies have achieved 1 billion liters of fresh milk production by 2020, it would only cover 38% of domestic demand, not to mention export factors. The foreign milk brands have seized the chances and there are now more than 300 milk brands in the market (MOIT: 2017). From Japan, Morinaga established a local subsidiary in 2010 and Meiji in 2019, while Wakodo (Asahi Group Foods) entered the market through a joint venture partnership with Nutifood.

As the longest-term player, Dutch Lady has been catching with the domestic ones in terms of awareness and usage. The 2nd one – Meiji, even though has a 33% awareness but only 8% of customers have bought their products in the last 3 months. We believe that to make an entrance to Vietnam’s market, considerable promotional programs is essential. In fact, the top 4 reasons for choosing a brand already include “Promotion (78.4%)” and “Wide distribution system, easy to buy (76.2%)” (BEAN Survey – Dairy consumption behaviors). In 2019, the import value of milk and dairy products reached USD 1,048 billion, up 8.7% from 2018.

Conclusion

Of course, the product’s quality is still the most important. Currently, around 70% of milk in the local market is perceived as reconstituted milk with lower nutritional value than fresh milk in terms of vitamins and minerals. As a result of the CPTPP, dairy products from Japan, Singapore, and New Zealand are no longer subject to import tariffs and it may lead to a reduction in milk price and make the competition fire. However, consumers are clear about what they want for a milk brand with choosing reasons “No additives (89.5%)” and “Quality (73.4%). It’s necessary to make a clear distinction from low-priced products, and some of the domestic companies have already offered organic and highly nutritious products. Foreign companies have no choice but to make this their winning point. It will be interesting to see whether they can make a dent in the market.

Please read other industry review articles from us or request one!

Ly Nguyen

References: