11Sep2025

Latest News & Report / Vietnam Briefing

Comments: No Comments.

Market overview

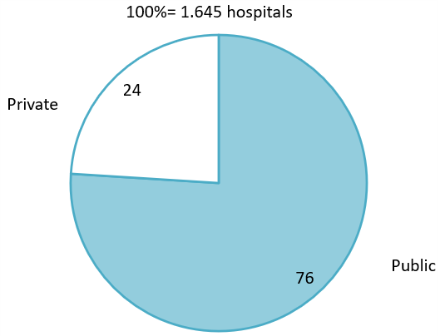

Vietnam’s healthcare system is currently dominated by the public sector, which accounts for 76% of all hospitals [1]. However, public hospitals are frequently overburdened, particularly in major cities, operating at over 200% of their designed capacity. This situation not only reduces the quality of care but also puts pressure on hospital infrastructure. Consequently, the construction and expansion of hospitals has become an urgent need to meet basic healthcare demands and alleviate overcrowding.

Currently, in addition to public healthcare facilities, there are 384 private hospitals nationwide out of 1,645 hospitals nationwide, representing 24% [1]. However, the number of beds in private hospitals accounts for only 5.8% of the total. In Hanoi, these figures are slightly higher: 44 private hospitals represent 29% of total hospitals, with nearly 3,000 beds accounting for 6.5% of the total [2]. Most private hospitals focus on specialized services such as ophthalmology, dentistry, dermatology, cardiology, and oncology, usually with fewer than 50 beds [2].

Percentage of public and private hospitals in Vietnam until 2024

Source: Ministry of Health

The approval of the Healthcare Network Master Plan for the period 2021–2030, with a vision to 2050 (Decision No. 201/QĐ-TTg), has set clear quantitative targets that directly translate into concrete construction demands [3]. Among these, hospital bed targets stand out as the most explicit indicators:

Key Healthcare Infrastructure Targets under the National Master Plan (2025, 2030, 2050)

| Indicator | Target 2025 | Target 2030 | Vision 2050 |

| Number of hospital beds / 10,000 population | 33 | 35 | 45 |

| Number of doctors / 10,000 population | 15 | 19 | 35 |

| Number of nurses / 10,000 population | 25 | 33 | 90 |

| Proportion of private hospital beds (%) | – | 15% | 25% |

Source: Ministry of Health

These figures are not merely theoretical targets—they also serve as key performance indicators (KPIs) for the Ministry of Health and provincial authorities. With a population of around 100 million, the 2030 target corresponds to a total of 350,000 hospital beds nationwide. This allows construction companies and investors to roughly estimate the market size and the number of beds that need to be newly built or expanded, forming the basis for viable business planning.

Healthcare access in urban and rural areas

Vietnam’s healthcare system faces a stark imbalance between urban and rural areas. According to the national census, four centrally governed cities recorded the highest doctor-to-population ratios in the country: Can Tho with 23 doctors per 10,000 people, Hanoi with 20.2, Da Nang with 17.9, and Ho Chi Minh City with 17.4—significantly higher than the national average at that time of around 11.5 per 10,000 [4]. This capability gap leads to a phenomenon of “medical migration”, where the rural population bypasses local facilities to go directly to higher-level ones. A vicious cycle forms: patients leave, major hospitals become overcrowded, the quality of care declines, and trust in local healthcare erodes further.

In rural areas, the barriers are not just a lack of personnel but also financial constraints, geographical distance, and psychological barriers such as cost aversion. As many as 94% of the population does not undergo regular health check-ups, and while the prevalence of non-communicable diseases is high, awareness is very low—only 24% of hypertensive patients are aware of their condition [5]. The healthcare culture is thus reactive, with people “only seeking care when sick,” which misses opportunities for prevention and early intervention.

Conversely, in urban areas, the healthcare system operates on a different trajectory. Urbanization and lifestyle changes have led to a rapid increase in non-communicable diseases such as cardiovascular conditions, diabetes, and cancer [6]. The middle and upper classes are not only concerned with treatment but also expect a healthcare experience that is fast, convenient, and personalized. This has fueled a boom in specialized clinics, at-home care services, and on-demand health solutions, creating a vibrant, multi-segmented market that stands in stark contrast to the challenge of trust in rural areas.

Niche market challenge

The rural healthcare market faces numerous barriers: financial constraints, a lack of awareness, and a psychological hesitation towards costs and complex procedures. However, this creates fertile ground for affordable, accessible, and user-friendly preventive health services. Urgent demand is concentrated in two major areas:

– Non-Communicable Diseases (NCDs): Prevalence is high but awareness is low, with only 24% of rural residents with hypertension aware of their condition [7]. This presents a significant opportunity for community screening models, mobile services, and remote monitoring devices.

– Maternal & Child Health: This remains an essential need, from nutrition in the first 1,000 days of life to convenient prenatal check-up packages and online consultations.

A viable approach is to start with “small touchpoints” such as measuring blood pressure, blood sugar, and BMI at pharmacies, commune health stations, combined with remote consultations. These low-cost initial interactions build trust while creating a customer funnel for higher-value services like NCD management, recurring prescriptions, and nutritional counseling.

The urban healthcare market is growing rapidly, driven by urbanization, lifestyle changes, and the demand for high-quality service experiences. This is a “multi-segmented” environment where sophisticated and personalized health solutions are increasingly essential. Prominent demand is concentrated in two major areas:

– Non-Communicable Diseases (NCDs) & Lifestyle: Sedentary habits and imbalanced diets are causing a rapid rise in the rates of obesity, cardiovascular disease, and endocrine disorders. In the next 5–10 years, this cluster of diseases will become the main driver for long-term treatment and health management demand.

– Premium & Personalized Services: The urban middle and upper classes desire a superior healthcare experience: no waiting, flexibility, and at-home or on-demand care.

A viable approach is to develop specialized clinics, mobile diagnostic services, at-home doctor visits, and corporate wellness programs. These solutions not only meet the need for convenience but also open opportunities for expansion into deeper segments such as pediatrics, geriatrics, mental health, wellness, and personalized nutrition.

Conclusion

In conclusion, Vietnam’s healthcare dichotomy is both an undeniable reality and a rare opportunity. The gap in resources and spending—concentrated in cities while the majority of the population lives in rural areas—creates an “arbitrage” that businesses can unlock by bridging it with technology, efficient processes, and restored trust. Models such as telehealth, B2B pharma, O2O platforms, and lean clinic chains are already market-proven and are now awaiting the catalyst of BHYT reimbursement, scheduled for July 1, 2025, to accelerate their growth. Those who prepare thoroughly—in technology, operations, policy engagement, and branding—will not only achieve strong financial returns but also play a vital role in reducing one of the most pressing social inequalities in Vietnam today.

[1] Ministry of Health. 2024 Year-End Review and 2025 Task Implementation Conference of the Department of Medical Examination and Treatment Management <Access>

[2] Private healthcare accounts for 24% of the total number of hospitals nationwide <Access>

[3] Government News, Approval of the National Healthcare Network Planning for the 2021–2030 period, with a vision to 2050 <Access>

[4] Ministry of Health, Vietnam Health Assessment Results from the 2021 Economic Census <Access>

[5] Journal of Medicine and Pharmacy – Hue University of Medicine and Pharmacy, Common health problems and trends in primary health care utilization among rural residents <Access>

[6] Dong Nai online, Non-communicable diseases are increasing and getting younger <Access>

[7] Tuyet Thi Nguyen, Maurizio Trevisan, Vietnam a country in transition: health challenges <Access>

* If you wish to quote any information from this article, please kindly cite the source along with the link to the original article to respect copyright.

| B&Company

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |