21Feb2025

Latest News & Report / Vietnam Briefing

Comments: No Comments.

Vietnam’s aviation industry plays a crucial role in the country’s economic development, supporting tourism, trade, and international connectivity. With a strategic location in Southeast Asia, Vietnam has become an important hub for both domestic and international air travel.

Vietnam market overview of the aviation industry

In 2024, the number of passengers passing through Vietnamese airports reached 109 million (decreased 3% compared to 2023)[1]. Among this, 41 million were international passengers, up 26% over the same period last year[2]. These figures align closely with 2019 levels, which were considered the industry’s peak before the pandemic-induced downturn[3]. This robust rise highlights the rising demand for air travel, increased connectivity between Vietnam and global markets, and favorable visa policies that attract international travelers[4]. Visitors from Asia make up nearly 80% of international arrivals to Vietnam, mainly from Northeast Asia, including Korea, China, Taiwan, and Japan[5].

Meanwhile, the number of domestic passengers was 68 million, a 15% decrease compared to 2023[6]. This decline was driven by reduced airline capacity, as Vietnamese carriers downsized their fleets for aircraft maintenance and corporate restructuring, along with weaker domestic travel demand, as consumers cut back on spending and shifted towards international travel in search of new destinations[7].

Currently, around 76 airlines are operating in Vietnam[8]. Regarding international routes, in the first six months of 2024, foreign airlines operated nearly 160 international routes connecting Vietnam with countries worldwide[9]. Overall, in the first 11 months of 2024, the on-time performance (OTP) rate was 73.7%, while 26.3% of the total 231,571 flights experienced delays[10]

Regarding technology application and digital transformation, the Airports Corporation of Vietnam (ACV) is planning to implement the ACV ID system this year, utilizing biometric recognition technology to automate security screening procedures and passenger identity verification[11]. Recently, Vietnamese airlines have embraced AI to enhance efficiency and service quality. For example, Vietnam Airlines launched VNA AI, powered by GPT-4 via Azure OpenAI, to streamline safety regulation access and workflow[12]. Vietjet partnered with OpenAirlines to implement SkyBreathe, using AI and big data to optimize fuel consumption and reduce CO₂ emissions[13].

Key players in the Vietnam aviation market

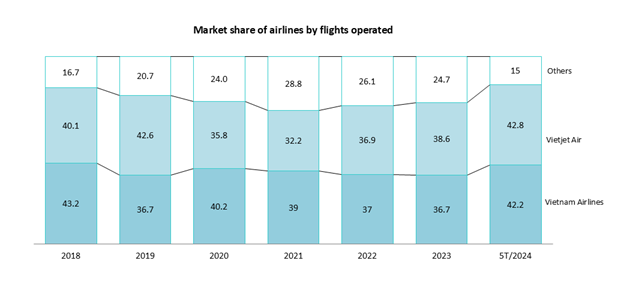

Within the passenger transport sector, Vietnam Airlines and Vietjet Air continue to dominate the market, with their market shares reaching 42.2% and 42.8%, respectively, in the first five months of 2024 [14]. This marks a significant increase from 2023, when their shares stood at 36.7% and 38.6% [15]. The growth in market share is largely attributed to the decline of Bamboo Airways, which has struggled following a major crisis involving its former chairman[16].

Source: Kirin Capital

Overview information of key players in the Vietnam aviation market

| Airline | Year of establishment | Number of routes | Number of operating countries | On-time performance (OTP) (2024) | |

| International | Domestic | ||||

| Vietnam Airlines | 1996 | 57 | 34 | 32 | 81.8% |

| Vietjet Air | 2007 | 111 | 38 | 13 | 63% |

| Pacific Airlines | 1991 | 57 | 12 | 23 | 74.7% |

| VASCO | 1987 | 61 | 22 | 32 | 86% |

| Bamboo Airways | 2017 | 9 | 20 | 8 | 83.6% |

| Vietravel Airlines | 2019 | 5 | 7 | 2 | 80.9% |

With travel demand rising ahead of the Lunar New Year, Vietnam Airlines and Vietjet Air have added 5 to 10 new aircraft to their fleets [17]. As of December 2024, Vietnam Airlines has resumed operations on most of its international routes and continues to expand by launching new flights to Munich (Germany) and Phnom Penh (Cambodia)[18]. Meanwhile, Vietjet Air has introduced a new Hanoi – Kuala Lumpur (Malaysia) route to capture the growing demand for tourism, trade, and employment.

Meanwhile, Bamboo Airways is showing signs of recovery after a period of stagnation due to corporate restructuring, having resumed flights to Phu Quoc and launched new international routes to Taipei and Kaohsiung (Taiwan) [19]. These expansions and new routes indicate that Vietnamese airlines are adapting to post-pandemic travel patterns and are gearing up for further growth.

Upcoming opportunities and challenges for Vietnam aviation industry

Looking ahead, the Vietnamese aviation industry is expected to benefit from several key developments. The recent Category 1 (CAT 1) certification for aviation safety oversight strengthens international confidence in Vietnam’s air transport sector [20]. Long Thanh International Airport, set to open in 2026, is expected to ease congestion and elevate Vietnam’s premium aviation sector[21].

Image of Long Thanh international airport terminal after 1 year of construction, August 2024

Source: VnExpress

In terms of policy, Vietnam’s simplified visa policies make the country an attractive destination for international travelers, while ongoing infrastructure upgrades—including new terminals, taxiways, and runways—will support growing passenger volumes[22]. Government collaboration with foreign airlines is also a key factor in restoring international routes that were disrupted during the pandemic, ensuring continued growth for Vietnam’s aviation market[23].

On the other hand, according to economic experts, Vietnam tourism is facing a historic opportunity to rise, becoming a tourist country in Asia with the expectation that the number of Vietnamese international tourists will increase by 18% over the same period[24]. This is regarded as an important premise to create conditions for the development of the aviation sector in the recent future.

However, the aviation industry in Vietnam still faces significant challenges regarding limited infrastructure, human resource shortages and investment budget. Major airports like Tan Son Nhat and Noi Bai are frequently overloaded, causing delays and affecting passenger experience[25]. In terms of human resources, the potential shortage of pilots and technical staff in the future may impact operational efficiency and flight safety[26]. The limited number of aviation experts proficient in digital technology poses challenges in implementing digital initiatives. In addition, investing in digital infrastructure and cybersecurity measures requires significant financial resources, creating challenges for airlines in balancing their budgets[27].

Despite these obstacles, Vietnam’s aviation industry remains poised for long-term growth. With expanding fleets, increasing global connectivity, and strong regulatory improvements, the market is set to thrive in the coming years. As Vietnam Airlines and Vietjet Air solidify their market leadership, and as infrastructure developments progress, the aviation sector is positioned to strengthen its role as a key player in Southeast Asia’s air travel market.

Conclusion

Vietnam’s aviation industry is experiencing significant changes, driven by growing international travel demand, airline expansions, and technological advancements. While major airlines continue to strengthen their market positions, challenges such as infrastructure constraints, workforce shortages, and digital transformation remain. Government initiatives, policy reforms, and new airport developments are expected to support long-term growth, positioning Vietnam as a key player in Southeast Asia’s aviation market.

[1] Vietnam Airports Corporation. 109 million passengers through Vietnam airports <Access>

[2] Vietnam Airports Corporation. 109 million passengers through Vietnam airports <Access>

[3] Vietnam Airports Corporation. 109 million passengers through Vietnam airports <Access>

[4] Open Sky. Vietnam aviation is a bright spot in recovery and growth. <Access>

[5] Government e-newspaper. More than 14.1 million international visitors to Vietnam in 10 months <Access>

[6] Open Sky. Vietnam aviation is a bright spot in recovery and growth. <Access>

[7] Open Sky. Vietnam aviation is a bright spot in recovery and growth. <Access>

[8] Phap Luat. Vietnam’s aviation industry re-establishes pre-pandemic ‘peak’ <Access>

[9] Thanh Nien News. How many planes do Vietnamese airlines own? <Access>

[10] VnEconomy. Airlines’ on-time flight rate before Lunar New Year reaches 68% <Access>

[11] Nhan Dan News. Airlines apply contactless check-in technology <Access>

[12] Vietnam Airlines. New opportunities for Vietnam’s aviation industry <Access>

[13] Microsoft. Vietnam Airlines: Harnessing the Power of AI to Realize the Goal of Becoming the Region’s Leading Digital Airline <Access>

[14] Kirin Capital. Air Freight Industry Report <Access>

[15] Kirin Capital. Air Freight Industry Report <Access>

[16] Kirin Capital. Air Freight Industry Report <Access>

[17] Phap Luat. Vietnam’s aviation industry re-establishes pre-pandemic ‘peak’ <Access>

[18] VnEconomy. Aviation market enters a period of stable growth <Access>

[19] Open Sky. Vietnam aviation is a bright spot in recovery and growth. <Access>

[20] Open Sky. Vietnam aviation is a bright spot in recovery and growth. <Access>

[21] Tin Tuc Newspaper. Long Thanh Airport will be a lever to elevate Vietnam’s business aviation<Access>

[22] Open Sky. Vietnam aviation is a bright spot in recovery and growth. <Access>

[23] Open Sky. Vietnam aviation is a bright spot in recovery and growth. <Access>

[24] VnEconomy. Three factors supporting the aviation industry in 2025 <Access>

[25] Business and marketing magazine. Concerns hindering the recovery of Vietnam’s aviation industry <Access>

[26] Business and marketing magazine. Concerns hindering the recovery of Vietnam’s aviation industry <Access>

[27] Ministry of Transport. Digital aviation and the challenges of the times <Access>

* If you wish to quote any information from this article, please kindly cite the source along with the link to the original article to respect copyright.

| B&Company

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |