27Dec2025

Latest News & Report / Vietnam Briefing

Comments: No Comments.

Vietnam’s plastics industry is one of the fastest-growing manufacturing sectors, playing an important role in the supply chains of many industries such as packaging, construction, electrical and electronics, automotive, and consumer goods. However, alongside rising demand, the industry is also facing stricter environmental regulations, which are shaping new market trends. As a result, this creates both opportunities and challenges for foreign investors entering Vietnam’s plastics sector.

Overview of the Vietnam plastic industry

With robust growth momentum and rising demand across packaging, construction, automotive, and consumer goods, Vietnam’s plastics industry is asserting itself as one of the most dynamic markets in Southeast Asia. According to the Vietnam Plastics Association (VPA), the plastics industry is a key sector of the national economy, reaching a market size of USD 32 billion in 2024, up 23.9% from 2023, with more than 7,000 enterprises[1].

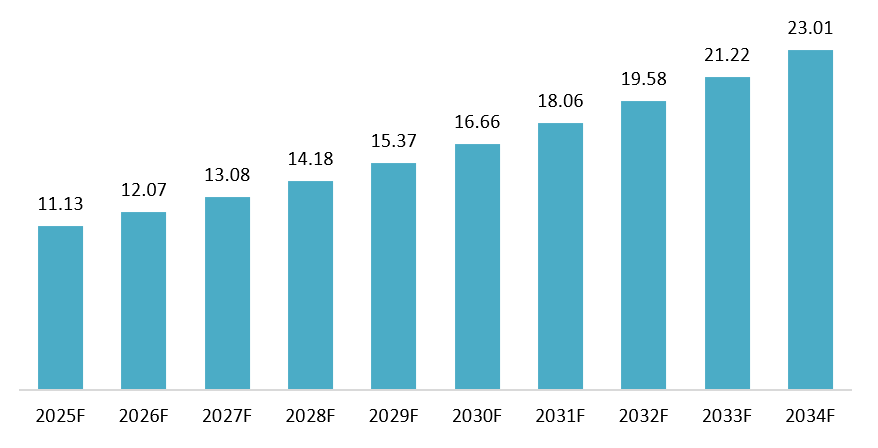

According to Expert Market Report, Vietnam’s plastics market output is projected to reach 11.13 million tons in 2025 and surpass 23 million tons by 2034, implying an average CAGR of 8%–9%[2].

Vietnam plastics market size forecast (2025-2034)

Unit: Million tons

Source: Expert Market Research

Vietnam’s plastics industry is being propelled by both rising end-market demand and accelerating investment flows. First, increasing FDI into plastic converting facilities is strengthening domestic production capacity, broadening product portfolios, and supporting a more resilient plastics supply chain over the coming years. In parallel, continued growth in domestic construction is boosting demand for plastic pipes, plastic building materials, and other project-related products, while the surge in food packaging and e-commerce is generating substantial short-term order volumes. In addition, the ongoing relocation of automotive and electronics manufacturing to Vietnam is driving demand for engineering plastics used in components, housings, and spare parts. Finally, longer-term policies promoting recycled plastics are expected to encourage companies to invest in technology and develop green products to meet evolving market requirements[3].

However, the industry’s raw-material localization rate remains low, only around 15–20%, meaning 80–85% of virgin plastic resin (PE, PP, PVC, PET, etc.) still has to be imported. This heavy import dependence makes the sector particularly vulnerable to fluctuations in oil prices and exchange rates[4]. In 2024, Vietnam’s imports of plastic raw materials reached USD 11.8 billion, up 20.7% compared with 2023. By source market, the five largest suppliers were China, South Korea, ASEAN, Taiwan, and Saudi Arabia, with China being the largest import source

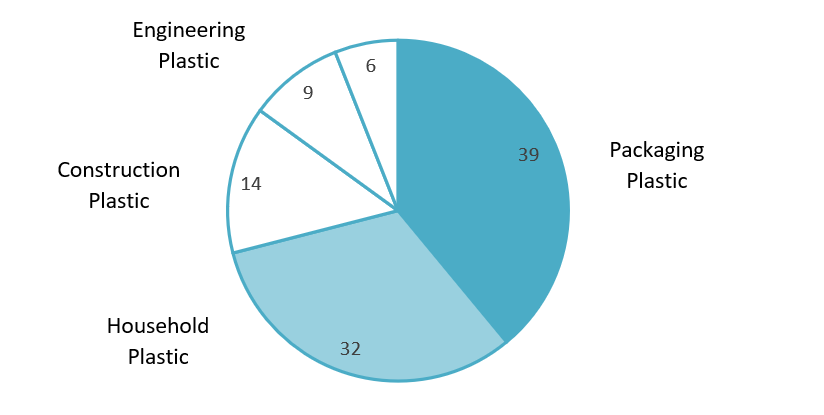

Main categories of plastic products produced by Vietnam in 2024

Unit: %, 100% = 3 million tons

Source: Viego

In terms of downstream plastic products, Vietnam currently manufactures a range of plastic applications with a total capacity of nearly 3 million tons per year. The largest shares are packaging plastic and household plastic products, followed by construction plastic and plastics used for engineering.

From an export perspective, in 2024, Vietnam’s export turnover of plastic products exceeded USD 6.7 billion, up 29.8% from 2023. In terms of markets, the United States, Japan, ASEAN, the EU, and South Korea were the five largest destinations, accounting for 83.1% of total plastic product exports. Among them, the United States led the way, with export value rising by 42.4%[6].

Vietnam’s plastic products are now shipped to more than 190 countries. In the first eight months of 2025, the industry continued to perform strongly, with exports up by nearly 20%, driven by the direct benefits of free trade agreements and the ongoing supply-chain relocation wave. Major investments such as LEGO’s approximately USD 1.3 billion project in Bình Dương further highlight Vietnam’s growing attractiveness as a hub for high-tech plastic manufacturing and advanced polymer materials[7].

Environmental regulations

Vietnam’s plastics industry has entered a new phase of development, as compliance pressure intensifies around environmental requirements, green standards, and international integration. The policy framework is also clearly shifting toward reducing single-use plastics, promoting a circular economy, and, in particular, strengthening the implementation of Extended Producer Responsibility (EPR). Key regulations include:

– Decree No. 05/2025/NĐ-CP (06 January 2025): Provides detailed requirements on mandatory recycling rates and recycling specifications for plastic products and packaging, as well as electronic devices containing plastic components—obligations imposed on manufacturers and importers under the EPR mechanism[8].

– Decision No. 687/QĐ-TTg (07 June 2022): Approves Vietnam’s National Action Plan on Circular Economy Development, emphasizing the application of circular economy approaches, source segregation, and EPR in managing plastic waste[9].

– Law on Environmental Protection 2020: Vietnam’s most recent overarching environmental law, which for the first time formally incorporates the concept of a circular economy and establishes mandatory EPR within the national legal framework. The law also sets principles for waste segregation, collection, and treatment, serving as the legal basis for subsequent regulations on plastic waste and circular economy implementation[10].

– Decree No. 08/2022/NĐ-CP: Clarifies the roadmap to restrict and prohibit single-use plastics, including[11]:

– After 2025: single-use plastic products and non-biodegradable plastic packaging shall no longer be placed on the market or used.

– After 31 December 2030: a complete halt to the production and import of single-use plastic products (except those certified with an eco-label) and non-biodegradable plastic packaging.

– EPR implementation: manufacturers and importers of plastic packaging must fulfill obligations for collection and recycling or make financial contributions in accordance with regulations.

– The decree also provides environmental protection fees related to the import of plastic scraps.

Recycling trends in the plastic industry

Against the backdrop of tightening environmental requirements, Vietnam’s plastics sector is accelerating its shift toward recycling and sustainable materials, reflected in the following trends:

– Expansion of recycling value chains: Plastics companies are increasingly investing in recycling plants that meet international standards. Over the past 3–5 years, a growing number of high-tech facilities have been established to process plastics such as PET and HDPE, including bottle-to-bottle models and food-grade HDPE recycling. Many large players are also building in-house collection and sorting systems and partnering with recyclers to secure stable feedstock supply[12].

– Rising public awareness: Consumers and retailers are placing greater emphasis on environmentally friendly products. Supermarket chains and packaging manufacturers are stepping up initiatives to replace single-use plastics and encourage waste separation at source. This trend is expanding demand for recycled or readily recyclable packaging and pushing companies to optimize product design—for example, shifting toward materials that are easier to process and recycle[13].

– Bioplastics and alternative materials: Although still small in volume, bioplastics are widely seen as the fastest-growing segment in the industry. In Vietnam, bioplastics are projected to grow at an estimated ~12.8% CAGR over 2025–2030, reflecting sustainability trends and government support. However, high costs and stringent certification requirements remain key barriers. From 2027 onward, Vietnam could potentially emerge as a regional hub for bio-based polymer production in Southeast Asia[14].

Vietnam Plastics Industry Leaders

Vietnam’s plastics industry is led by several prominent players, including foreign groups that have invested directly in Vietnam, key Vietnamese companies in raw material production, and major resin suppliers and distributors in the market.

Table: Some key players in the Vietnam plastics industry

| No | Name | Establishment year | Country | Short description | URL |

| 1 | Hyosung Vina Chemicals | 2007 | South Korea | Specializing in PP plastic production.

Production of 300,000 tons/ year of PP |

https://hyosungvinachemicals.com/ |

| 2 | SCG Chemicals | 1913 | Thailand | Specializing in PE, PP, PVC, POF plastic production

Production of 1.4 million tons/ year of POF |

https://www.scgchemicals.vn/en/home |

| 3 | Binh Son Refining and Petrochemical | 2008 | Vietnam | Specializing in PP plastic production.

Production of 150,000 tons/ year of PP |

https://bsr.com.vn/trang-chu |

| 4 | An Thanh Bicsol | 2017 | Vietnam | Specializing in PE, PP, PVC, PS plastic production

Export ~500,000 tons of resin supply per year

|

https://anthanhbicsol.com/ |

| 5 | TPC Vina Plastic and Chemical | 1997 | Vietnam | Specializing in PVC plastic production.

Production of 210,000 tons per year of PVC

|

http://www.tpcvina.com.vn/ |

| 6 | Duy Tan Plastics | 1987 | Vietnam | Specializing in PET plastic production.

Production of 60,000 tons per year of PET

|

https://duytan.com/ |

B&Company’s synthesis

Overall, Vietnam’s plastics industry features the parallel presence of foreign direct investment enterprises and domestic players. Hyosung Vina Chemicals and SCG Chemicals represent large-capacity foreign groups focusing on basic plastics such as PP, PE, and PVC, and they play a critical role in supplying raw materials. In contrast, Binh Son Refining and Petrochemical is a prominent Vietnamese producer of PP, helping strengthen domestic supply. Beyond producers, the market also includes companies specialized in resin distribution and supply, such as An Thanh Bicsol, as well as domestic PVC producers like TPC Vina and packaging and PET plastics producers, including Duy Tan. This indicates that the industry value chain extends beyond resin production to downstream plastic product manufacturing and raw material trading activities.

Business Implications for foreign investors

In terms of opportunities, Vietnam’s plastics market is widely seen as offering significant growth potential in the medium to long term. By 2034, the demand in Vietnam is still expected to rise strongly. Since plastics are widely used across sectors such as packaging, construction, electronics, and automotive, this creates ample room for foreign companies to set up new plants or expand the production of plastic materials, plastic components, and packaging solutions. Packaging remains the largest segment and is further supported by the growth of e-commerce, which drives demand for packing and shipping materials. Beyond serving domestic demand, Vietnam also exports plastic products to many markets, allowing investors to pursue both local sales and export-oriented growth.

In terms of challenges, Vietnam’s plastics industry still relies heavily on imported raw materials, making costs highly sensitive to fluctuations in oil prices, exchange rates, and geopolitical developments. At the same time, increasingly stringent environmental regulations require companies to invest more in collection and recycling systems as well as compliance management, raising operating costs. In addition, regional competition is intense because countries such as Thailand and Malaysia have more developed petrochemical industries and stronger domestic feedstock bases, while Vietnam’s market remains fragmented with many small and medium-sized enterprises that face constraints in capital and skilled technical manpower.

Recommendations for foreign investors

– Focus on high-growth, high-margin segments: prioritize packaging, especially for food and e-commerce and engineering plastics for electronics, automotive, and healthcare applications

– Prepare for “green” requirements from the outset: design products to be easily recyclable, establish a roadmap to meet environmental compliance requirements, and develop capabilities in high-quality recycling and/or bioplastics

– Reduce raw material risk: diversify sourcing, secure long-term supply contracts, and consider partnerships with suppliers and recycling players to stabilize input availability and costs

* If you wish to quote any information from this article, please kindly cite the source along with the link to the original article to respect copyright.

| B&Company

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |

[1] Vietnam’s plastics industry reaches USD 32 billion, intensifies “green transformation” to avoid falling behind Access

[2] Vietnam plastics market size, share and report 2035 Access

[3] Vietnam plastics industry analysis: market report, size & forecast Access

[4] The plastics industry is included in the priority investment group for the coming period Access

[5] Vietnam import-export report 2024 Access

[6] Vietnam import-export report 2024 Access

[7] Vietnam’s plastics industry is facing major development opportunities Access

[8] Decree No. 05/2025/ND-CP amending Decree No. 08/2022/ND-CP guiding the Law on environmental protection Access

[9] Plastic pollution is not plastics’ fault; the fault lies in how we use them Access

[10] Law on environmental protection 2020 (No. 72/2020/QH14) Access

[11] Decree No. 08/2022/ND-CP guiding the Law on environmental protection Access

[12] Vietnam’s plastics industry reaches USD 32 billion, intensifies “green transformation” to avoid falling behind Access

[13] Vietnam’s plastics industry reaches USD 32 billion, intensifies “green transformation” to avoid falling behind Access

[14] Vietnam plastic market: growth trends and forecast (2025–2030) Access