05Nov2025

Latest News & Report / Vietnam Briefing

Comments: No Comments.

The wind power market in Vietnam is entering a period of strong growth, as the country possesses large onshore and offshore potential and is accelerating its energy transition. Rapidly increasing electricity demand, along with emissions reduction goals, makes wind power a strategic investment area in the renewable energy supply chain.

Market overview

Vietnam’s electricity demand is currently rising sharply, with power consumption expected to increase by around 10.5% –13% in 2025 compared to 2024[1]. In addition, the country’s commitments to emission reduction and environmental protection are driving stronger investment in renewable energy. At the COP26 conference, Vietnam pledged to achieve net-zero emissions by 2050[2]. To fulfill this sustainable commitment and reduce net emissions, the country has been actively investing in new renewable energy sources such as wind power. Specifically, Vietnam has achieved remarkable growth in wind power capacity — within about 10 years (2013–2023), the installed capacity increased from approximately 53 MW to around 5,888 MW[3], accounting for about 6% of total installed electricity capacity in 2023[4]. In the structure of installed electricity capacity in 2023, renewable energy sources (including wind power and solar power) ranked third, after thermal power and hydropower.[5].

Vietnam’s technical wind potential is enormous, estimated at up to 513,360 MW[6], including onshore, nearshore/offshore and continental shelf winds. While the installed wind power capacity in 2023 is 5,888 MW, it shows that Vietnam has only exploited about 1% of the total estimated potential capacity of 513,360 MW. As a part of the estimated potential capacity, the offshore Exclusive Economic Zone (EEZ) is believed to have a potential capacity of more than 100,000[7]MW.

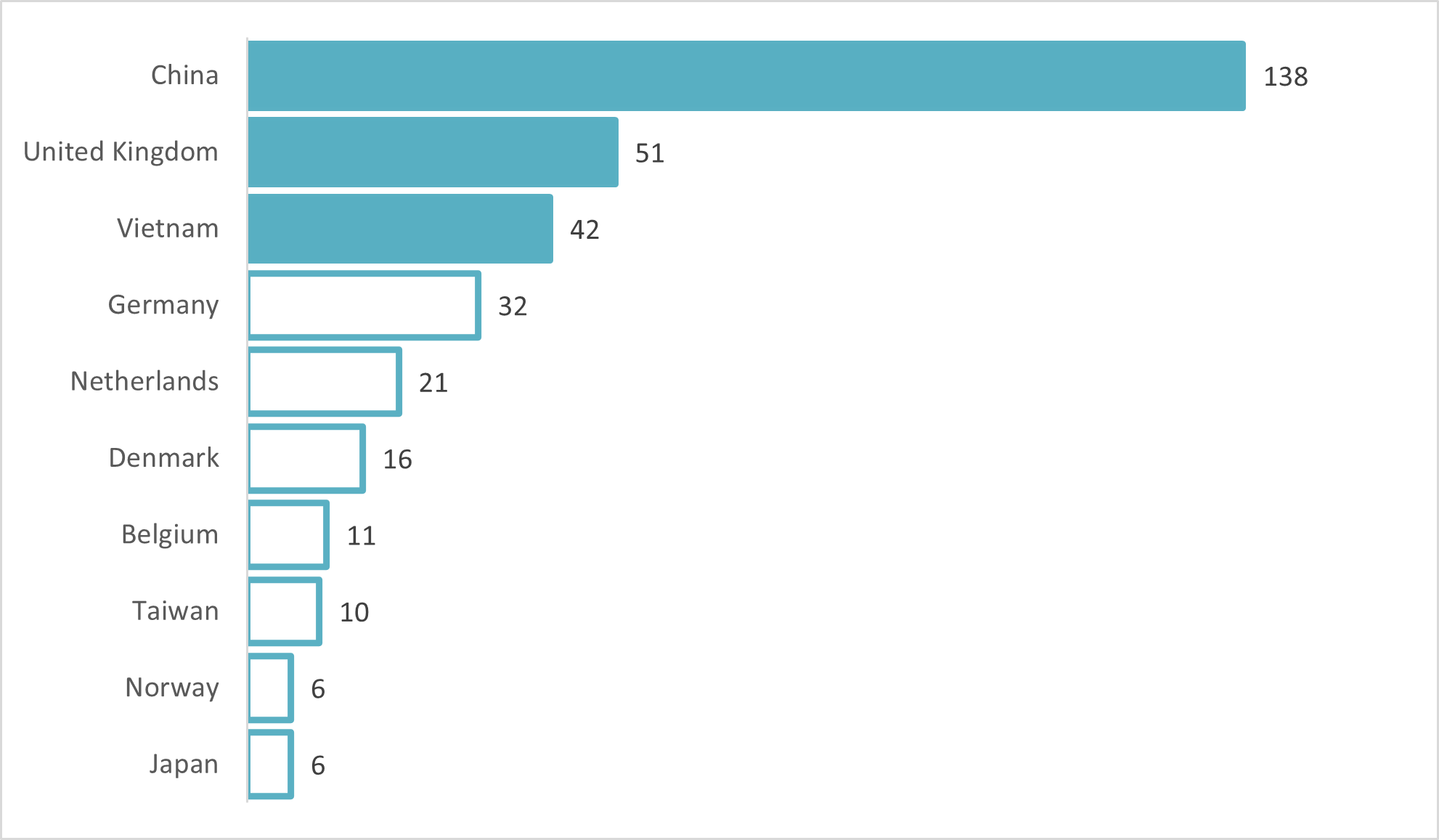

Number of offshore wind farms operating worldwide as of April 2025, by country

Source: Statista

As of April 2025, Vietnam has about 43 offshore wind power projects in operation or under active development, ranking third globally in the number of offshore wind projects, after China (138 projects) and the United Kingdom (51 projects). This reflects the country’s growing attention and strong development potential in the offshore wind sector, even though most projects remain in the survey or pre-investment phase. Compared with European countries with well-established offshore wind industries such as Germany, the Netherlands, or Denmark, Vietnam stands out for achieving a relatively high number of projects within a short period, highlighting its clear strategic orientation toward renewable energy development.

Key Characteristics of Vietnam’s Wind Power Market

The boom in wind power projects in recent years has reshaped the market. These shifts have created a new set of characteristics for Vietnam’s wind sector

– High potential but far from full utilization: Vietnam has a coastline of about 3,000 km and strong wind speeds, particularly in the central and southern regions, giving it vast potential for offshore wind power. However, optimal exploitation is still constrained by an incomplete legal framework, weak port and grid infrastructure, limited supporting industries, and a shortage of skilled labor[8]. Port infrastructure, roadways, and storage facilities in potential coastal areas do not meet the stringent technical requirements for the installation, operation, and maintenance of large-scale offshore wind farms. Besides that, the technical infrastructure for grid connection remains limited. The current power transmission grid has not been planned to meet the demand for integrating large and distant offshore wind sources. Supply chain and logistics services for offshore wind power remain limited, and research, training, and technology transfer centers should be established to build a high-quality workforce.

– Rapid growth but low share in total generation: Before 2021, the government implemented a FIT mechanism offering 8.5 US cents/kWh for onshore and 9.8 US cents/kWh for offshore wind, which attracted a wave of investment[9]. Yet, after the FIT expired in 2021, the absence of a new pricing framework caused many projects to stall, leaving wind power’s share at only around 4% of total generation in 2023[10]. By 2025, the Government introduced other wind power pricing mechanisms, including new pricing mechanisms for onshore and nearshore wind power, specifically classified by region.[11]. In particular, the price for offshore wind power has also been newly issued, which is the highest in the North at 3975.1 VND/kWh.[12].

– Policy and investment as decisive factors: The wind power market is driven by growing electricity demand and the need for large-scale investment from both domestic and international players[13]. Therefore, the government must further clarify policies on pricing mechanisms, grid connections, project scale, legal procedures, and financial incentives alongside the renewable energy targets under PDP VIII.

– Shift from onshore to offshore wind: Vietnam has officially identified offshore wind as a strategic development direction. The revised Power Development Plan VIII (April 2025) estimates offshore wind capacity of 6–17 GW by 2030–2035, with a development orientation toward reaching 113–139 GW by 2050[14]. Offshore wind has a higher capacity factor — about 50%, compared to around 35% for onshore wind. In simple terms, if a turbine could run at full power all the time, offshore turbines produce about half of that amount on average, while onshore turbines produce only about one-third. This shows that offshore wind can generate more electricity over time because winds at sea are stronger and more consistent.[15].

Key Projects of Wind Power Plant

The market presents abundant opportunities in both onshore and nearshore wind power, while several true offshore projects are currently being planned. As of 2023, Vietnam had around 106 wind power projects, with about 50% already in operation.

Table: Some high-capacity onshore and nearshore wind power projects

| No |

Type |

Name | Location | Operation year | Owner | Capacity (MW) | Number of turbines | Turbine capacity (MW) |

| 1 | Nearshore | Tan Phu Dong 1 | Tien Giang | 2023 | Gia Lai Electricity JSC | 100 | 24 | 4.2 |

| 2 | Dong Hai 1 | Tra Vinh | 2022 | Trungnam Group | 100 | 25 | 4 | |

| 3 | Bac Lieu 1&2 | Bac Lieu | 2013 (phase 1)

2016 (phase 2) |

Cong Ly Construction | 99.2 | 62 | 1.6 | |

| 4 | TWPC / Korea–Tra Vinh | Tra Vinh | 2021 | Tra Vinh Wind Power No.1 JSC (TWPC) | 48 | 12 | 4 | |

| 5 | Onshore | Ea Nam Dak Lak | Dak Lak | 2021 | Trungnam Group | 400 | 84 | 48×4.2 and 36×5.5 |

| 6 | Ea Nam Wind Complex | Ninh Thuan | 2021 | Trungnam Group | 400 | 100 | 4 | |

| 7 | Tra Vinh Wind Comples | Tra Vinh | 2022 | REE | 300 | 75 | 4 | |

| 8 | B&T Quang Binh | Quang Binh | 2021 | AMI AC Renewables | 252 | 60 | 4.2 |

Source: B&Company’s synthesis

Most of these projects are concentrated in the Central and Southern regions, where onshore projects generally have much higher capacities than nearshore ones. In addition, several large-scale true offshore wind projects are being proposed and developed, with estimated capacities reaching several thousand megawatts. Specifically, the La Gàn Offshore Wind Project, owned by Copenhagen Infrastructure Partners (CIP), located off the coast of Binh Thuan Province, is expected to have a total capacity of 3,500 MW, capable of supplying electricity to approximately seven million households[16]

Offshore wind turbines of the La Gan wind power project

Source: Laganoffshorewind

Implications for foreign investors

Opportunities

Vietnam’s wind power sector presents significant opportunities for foreign investors thanks to strong natural wind potential, particularly in coastal regions of the Central and Southern provinces, and the government’s long-term commitment to renewable energy under Power Development Plan VIII (PDP8). The country aims for 27% of total generation capacity from renewables by 2030, with offshore wind set to reach up to 6 GW. Growing electricity demand, rising carbon reduction commitments, and the need for energy diversification further enhance Vietnam’s appeal as a strategic renewable energy market in Southeast Asia.

Challenges

Despite this potential, foreign investors face notable challenges, including unclear legal frameworks for offshore projects, delays in permitting and site surveys, and the absence of a finalized Power Purchase Agreement (PPA) model for post-FIT projects. Grid infrastructure in coastal provinces remains underdeveloped, and power transmission constraints could limit the integration of new wind farms. In addition, the approval process for foreign participation in offshore surveys and ownership structures can be complex and time-consuming.

Recommendations

To capitalize on Vietnam’s wind power growth, foreign investors should pursue early-stage partnerships with reputable local developers and engage closely with authorities during the feasibility and approval phases. Investing in technical studies, environmental assessments, and grid connection solutions will help secure project readiness once policy conditions improve. Proactive involvement in policy dialogues and industry associations, as well as adopting flexible investment structures such as joint ventures or phased development models, will position investors to enter the market effectively once the regulatory environment becomes more stable.

* If you wish to quote any information from this article, please kindly cite the source along with the link to the original article to respect copyright.

| B&Company

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |

[1]https://en.evn.com.vn/d/en-US/news/Long-term-strategies-need-to-prepare-for-rising-power-demand-60-163-500430

[2] https://moit.gov.vn/bao-ve-moi-truong/no-luc-thuc-hien-cac-cam-ket-cua-viet-nam-tai-hoi-nghi-cop26.html

[3] https://www.statista.com/outlook/io/energy/renewable-energy/wind-energy/vietnam

[4] https://www.power-technology.com/data-insights/wind-power-in-vietnam/?cf-view

[5] https://evn.com.vn/d6/news/Mot-so-so-lieu-tong-quan-ve-nguon-dien-toan-quoc-nam-2023-66-142-124707.aspx

[7] https://theinvestor.vn/vietnams-exclusive-economic-zone-boasts-over-1000-gw-of-wind-power-potential-report-d15356.html

[8] https://tapchimoitruong.vn/news-13/offshore-wind-power-development-policy-in-vietnam-opportunities-challenges-31688

[9] https://thuvienphapluat.vn/van-ban/Dau-tu/Quyet-dinh-39-2018-QD-TTg-sua-doi-Quyet-dinh-37-2011-QD-TTg-co-che-ho-tro-cac-du-an-dien-gio-393826.aspx

[10] https://en.evn.com.vn/d6/news/Overview-of-national-power-sources-in-2023-66-142-4147.aspx

[11] https://thuvienphapluat.vn/van-ban/Tai-chinh-nha-nuoc/Quyet-dinh-1508-QD-BCT-2025-khung-gia-phat-dien-loai-hinh-nha-may-dien-gio-659318.aspx

[12] https://thuvienphapluat.vn/van-ban/Tai-chinh-nha-nuoc/Quyet-dinh-1824-QD-BCT-2025-khung-gia-phat-dien-loai-hinh-nha-may-dien-gio-ngoai-khoi-663582.aspx

[13] https://www.mfat.govt.nz/en/trade/mfat-market-reports/viet-nam-renewable-energy-market-september-2024.

[14] https://moit.gov.vn (Circular 768/QD-TTg 2025)