09Oct2025

Latest News & Report / Vietnam Briefing

Comments: No Comments.

I. Executive Summary: The Investment Imperative in Vietnam’s Agri-tech Sector

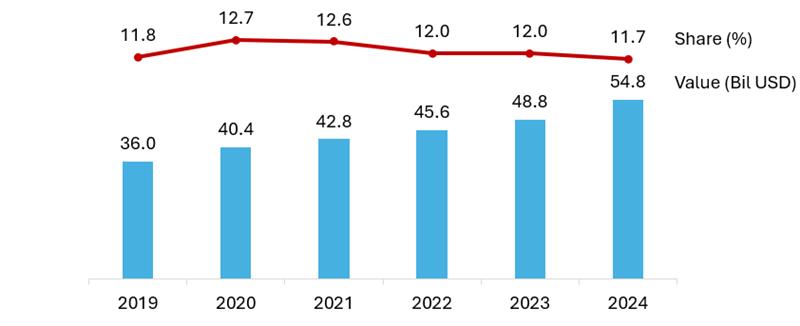

Vietnam’s Agriculture, Forestry, and Fishing sector remains a cornerstone of the national economy, contributing approximately 11.86% to GDP in 2024[1], maintaining a consistent share compared to previous years. From 2018 to 2023, the sector’s value added increased from 0.86 trillion VND to 1.22 trillion VND, reflecting a steady growth in absolute terms. However, the sector’s relative contribution to GDP remained stable, fluctuating between 11.8% and 12.7%[2], indicating that while the sector expanded in value, other areas of the economy grew at a faster pace, thereby maintaining its proportion of the overall economy.

GDP share of Agriculture, Forestry, and Fishing from 2018 to 2023

Source: GSO

The sector also faces significant challenges, including climate change[3], urbanisation-driven land shrinkage[4], and the necessity of meeting demanding international quality and sustainability standard[5] .These pressures are driving a structural transformation toward high-value, sustainable, and technology-driven practices. The adoption of AI, drones, and sensors is helping stabilise yields, reduce volatility in input and labour costs, and improve overall efficiency[6]. As a result, the market for AI in agriculture in Vietnam is projected to grow from USD 8.72 million in 2024 to approximately USD 43 million by 2033, reflecting a compound annual growth rate (CAGR) of 19%[7].

For foreign investors, the market presents three immediate, high-ROI opportunities: Precision Input Management (reducing costly fertiliser and feed waste), Premium Market Access (leveraging digital traceability for export compliance), and Service Monetisation (adopting the Agri-tech-as-a-Service model to address labour shortages and land fragmentation).

II. Introduction: Catalyzing Vietnam’s Sustainable Agricultural Transformation

The acceleration of Agri-tech adoption in Vietnam is driven by comprehensive policy frameworks, particularly the National Digital Transformation Program 2025[8], and national goals to restructure the agricultural sector for climate resilience and sustainability. Central to this transformation is the farmer, who stands to benefit most from these innovations. With climate risks, such as erratic weather patterns and rising temperatures, threatening the entire food chain, technology has become an essential economic safeguard against operational instability in agriculture3.

Vietnam’s continued success as a global leader in agricultural exports, projected at $62.4 billion in 2024[9], hinges on ongoing modernization efforts. This progress is supported by a surge in foreign capital investment, with venture funding for Agri-tech firms increasing ninefold, highlighting the sector’s strong monetization potential[10]. Early-stage projects, particularly those focused on optimizing inputs, are already demonstrating that technology investments lead to rapid positive cash flow and high returns.

The following case studies, focusing on high-value aquaculture and staple rice production, offer clear, data-backed examples of the return on investment (ROI) in these critical agricultural sectors.

a. Case Study I: Smart Aquaculture – Precision Shrimp Farming

The aquaculture sector, particularly shrimp farming, offers one of the clearest and most immediate paths to ROI through precision technology. Traditional shrimp farming is characterised by high operational risk and high operational costs, with feed and labour often dominating the expense profile[11]. Manual processes for monitoring water quality and disease control further increase inefficiencies and vulnerability to market fluctuations[12]. By integrating technologies like IoT sensors, AI-based monitoring, and automation, shrimp farms can optimise water quality, reduce waste, and improve productivity. These advancements lower costs, enhance farm health, and provide a more sustainable and profitable approach to shrimp farming[13].

Below is a table summarising key case studies in precision shrimp farming in Vietnam, highlighting the technologies used and the companies involved in these transformative projects.

Table 1. ROI Proof Points in Shrimp Aquaculture Projects

| No. | Project/ Initiative | Technology & Focus | Participants | Quantified Results (ROI) |

| 1 | ShrimpTech Vietnam 2024–2026[14] | Net-zero shrimp farming, IoT integration, and sustainable practices | OpenAsia, Skretting Vietnam, Tiptopp Aquaculture, Larive International | ROI metrics not publicly disclosed; aims for profitable net-zero shrimp production |

| 2 | Tepbac Smart Farming[15] | Combined software and hardware solutions for farm optimization and pollution reduction | Tepbac | Enabled farmers to save 20–30% on input materials through direct supplier connections |

| 3 | Mangrove-Shrimp Integrated Farming[16] | Eco-friendly systems combining mangroves and shrimp farming | Various local Vietnamese farmers and environmental organizations | Enhanced shrimp flavor profiles and reduced disease occurrences |

| 4 | 3-Stage RAS Shrimp Farming in Ha Tinh[17] | Recirculating Aquaculture System (RAS) for intensive shrimp farming | Local Vietnamese farmers in Ha Tinh City | Reported a profit of VND 600 million per hectare (approximately USD 25,078 per hectare) |

| 5 | Viet-Uc & Bosch: AquaEasy AI Partnership[18] | AI-powered shrimp farming with a focus on real-time monitoring and automated systems | Viet-Uc, Bosch, AquaEasy | Increased shrimp yield by 20–30%, optimized water and energy use, reduced operational costs by 15% |

| 7 | Minh Phu’s Rice-Shrimp Aquaculture Model[19] | Mixed rice-shrimp aquaculture, climate-resilient farming | Minh Phu Seafood, Local Farmers in Ca Mau, Tra Vinh, and Ben Tre provinces | Doubled shrimp productivity and tripled farmer incomes |

| 8 | NAGIS-FASEP Project[20] | National Aquaculture Geographic Information System (NAGIS), water quality monitoring stations | Local Farmers, Vietnamese Government, FASEP | Enhanced aquaculture management and water quality monitoring |

| 9 | Ca Mau’s Circular RAS-IMTA Model[21] | Recirculating Aquaculture System (RAS), Integrated Multi-Trophic Aquaculture (IMTA), and sustainability | Local Farmers, Ca Mau Provincial Authorities | Enhanced farm sustainability with long-term environmental and economic benefits |

Source: B&Company’s compilation

These case studies demonstrate the significant impact of precision technologies on shrimp farming in Vietnam. From AI-driven automation in the Viet-Uc & Bosch AquaEasy partnership to the sustainability-focused Minh Phu Rice-Shrimp Model, these projects show how integrating advanced technologies can improve yields, reduce costs, and enhance farm health. By adopting these innovations, the industry is not only increasing profitability but also promoting more sustainable and efficient farming practices, setting a strong foundation for the future of shrimp aquaculture.

b. Case Study II: Low-Emission Rice Farming – Scaling the Mekong Delta

Vietnam’s rice sector, particularly in the Mekong Delta, is undergoing a transformation with the “One Million Hectares High-Quality, Low-Emission Rice” initiative[22]. This program integrates technologies such as Alternate Wetting and Drying (AWD), fertilizer deep placement, mechanized direct seeding, and rice straw management to reduce emissions and enhance productivity. It aims to improve yields, lower input costs, and cut greenhouse gas emissions, contributing to both environmental sustainability and higher profits for farmers.

Table 2. ROI Proof Points in Low-Emission Rice Farming

| No. | Project/ Initiative | Technology & Focus | Participants | Quantified Results (ROI) |

| 1 | One Million Hectare Low-Emission Rice Program | Alternate Wetting and Drying (AWD), reduced fertilizer use, and straw management | Ministry of Agriculture and Rural Development (MARD), International Rice Research Institute (IRRI), World Bank | Increased yields by 12–20%, reduced input costs by 10–15%, and decreased GHG emissions per hectare |

| 2 | Low-Carbon Rice in Mekong Delta (Dong Thap)[23] | AWD, reduced water use, improved soil and water biodiversity | Dong Thap Department of Agriculture and Rural Development, Mekong Conservancy Foundation, Livelihoods Carbon Fund | Reduced GHG emissions by 3.13 tons CO₂ per hectare per crop cycle, increased profits by VND 4.6–4.8 million per hectare |

| 3 | Sustainable Rice Platform (SRP) Certification Project[24] | Sustainable rice farming practices, SRP standards adoption | Rikolto, BENEO, CarbonFarm, Dong Thap Department of Agriculture and Rural Development, Tan Binh Cooperative | Reduced GHG emissions by up to 48%, decreased water use by 30%, and lowered production costs by 10% |

| 4 | OM4040 Rice Variety Large-Scale Farming[25] | Mechanized farming, AWD, optimized fertilizer use, and straw reuse | Local farmers, agricultural cooperatives, and environmental research institutions | Reduced CO₂ emissions by 15.5% per ton of rice produced, and increased profitability when excluding land rental costs |

| 5 | AgResults Vietnam GHG Emissions Reduction Challenge[26] | Fertilizer optimization, AWD, rice straw management, mechanization, organic amendments | SNV Vietnam, Private Sector Competitors, Smallholder Farmers in Thai Binh Province | Increased yields by 4–14%, reduced GHG emissions by 375,000 tCO₂e, improved farmer incomes by 10–15% over four seasons |

| 7 | Green Carbon AWD Project[27] |

Alternate Wetting and Drying (AWD), methane reduction, water conservation, yield improvement |

Green Carbon, Local Farmers in Northern Vietnam |

Reduced methane emissions, improved yields, and increased farmer profits through AWD implementation |

Source: B&Company’s compilation

These projects demonstrate how technologies such as AWD, optimized fertilizer use, and mechanization reduce emissions, improve yields, and increase profitability. They lead to lower water usage, reduced costs, and significant emissions reductions, benefiting both the environment and farmers’ finances. These initiatives align with Vietnam’s climate commitments and offer a scalable model for sustainable rice farming, helping mitigate climate change while ensuring long-term agricultural productivity and economic resilience.

III. Interpreting the ROI: Actionable Business Lessons for Investors

Lesson 1: The TCO Reduction Imperative

The quickest path to ROI is through optimizing the largest operational expenses. In both shrimp farming and rice production, major costs come from inputs like feed, labor, and agrochemicals. By introducing technology to reduce these costs, whether through more efficient feed management, labor-saving automation, or optimized fertilizer use, the initial capital expenditure is quickly offset. This creates a self-financing model where cost reductions directly contribute to profitability, proving that lowering Total Cost of Ownership (TCO) offers immediate and sustainable returns.

Lesson 2: Sustainability as a Financial De-risker

Sustainability is increasingly becoming a financial imperative, not just an environmental one. As global regulations on environmental impact tighten, technologies that demonstrate measurable environmental benefits, such as reductions in emissions, water usage, or waste, will become essential for maintaining access to premium markets and avoiding potential penalties. By adopting sustainable practices, producers can ensure compliance with evolving global standards, reduce long-term regulatory risks, and safeguard the financial viability of their operations. Sustainability not only drives environmental value but also mitigates the financial risks associated with non-compliance.

Lesson 3: Leveraging Cross-Sector Digital ROI Benchmarks

The success of digital transformation in sectors like logistics, manufacturing, and other industrial applications provides valuable benchmarks for Agri-tech investments. As seen in these industries, digitalization through tools such as real-time data analytics, automation, and predictive modeling delivers measurable improvements in efficiency, resource management, and cost reduction. Applying these digital solutions to agriculture can lead to similar financial returns by enhancing productivity, reducing waste, and optimizing supply chains. Digital tools are key to unlocking scalable value in Agri-tech, and investors should look to cross-sector successes as proof of concept.

IV. Strategic Opportunities and Investment Challenges in Vietnam’s Agriculture Sector

Successful market entry requires business models tailored to Vietnam’s unique structural dynamics. The traditional model of farmers purchasing high-cost machinery is often unviable due to land fragmentation and limited access to capital[28]. This necessitates strategic focus on scalable service models and compliance-driven technologies.

a. Opportunities:

Agri-Technology-as-a-Service (AaaS): High equipment costs and fragmented landholdings make direct farmer ownership of technologies, like drones, impractical. The Agri-Technology-as-a-Service (AaaS) model overcomes this by allowing service providers to absorb capital costs and deliver operational efficiencies across multiple small plots. This model, seen in services like XAG’s drone rentals, helps address labor shortages and boosts efficiency. Investors should prioritize scalable AaaS platforms that can aggregate demand from fragmented farms.

Supply Chain Transparency for Premium Pricing: With global buyers requiring digital traceability, investing in robust systems unlocks higher pricing and ensures market access. For example, mango cooperatives in Ben Tre use GS1-compliant blockchain to track produce, gaining access to high-value markets like the U.S. Investors should focus on traceability platforms that are interoperable, utilizing RFID, IoT, NFC, and Blockchain, and comply with national standards like TCVN/GS1[29].

Specialized Diagnostic and Prediction Solutions: Limited access to specialized technicians leads to crop disease misdiagnosis and yield loss. Mobile AI tools, such as CABI’s “AI Plant Doctor” for Vietnamese dragon fruit, offer a low-cost solution for early, accurate diagnoses[30]. This minimizes crop loss and pesticide use. Investments should focus on developing localized AI models and computer-vision datasets for smallholder farmers to improve accessibility and ease of use.

b. Investment Challenges and Market Gaps:

Land Fragmentation: Land fragmentation creates a need for shared service models to aggregate demand across small plots. The AaaS model addresses this by allowing service providers to manage CAPEX and offer scalable solutions, such as drones and sensors. Investors should focus on companies that can manage these costs and work with cooperatives to expand technology access across fragmented land.

Technical Skill Gaps: A lack of specialized skills in agriculture creates a demand for simple, mobile-first solutions that integrate training. AI-driven tools like the AI Plant Doctor provide instant diagnoses, making it easier for farmers to make decisions without needing external expertise. Investors should support technologies that combine training with their core functionalities, improving accessibility for smallholders.

Cold Chain Infrastructure Deficit: Vietnam’s cold chain market is small but growing at 13.6% annually[31], signaling significant untapped demand. Investing in smart cold storage and IoT logistics can reduce spoilage and improve efficiency. Digitalizing logistics could also cut costs, offering a strong opportunity for growth in this sector.

Regulatory Frameworks: As regulations tighten, there is an opportunity for firms offering compliance solutions, such as blockchain for traceability. These platforms meet international standards and ensure market access. Investors should collaborate with consulting firms to navigate regulatory requirements and capitalize on early market entry opportunities.

In summary, while high initial capital expenditure remains a challenge, the market opportunities in AaaS, traceability, and mobile AI tools offer substantial growth potential. Investors should focus on service delivery models, financial innovation, and regulatory expertise to unlock value in Vietnam’s agriculture sector.

V. Conclusion and Strategic Outlook

The convergence of climate challenges, rising labor costs, and stricter export standards is driving the need for technological adoption in Vietnam’s agriculture sector. Investments in AI, drones, and sensors have delivered strong returns, reducing operational costs and ensuring compliance for access to premium markets. Policy initiatives, such as the One-Million Hectares rice program, are helping de-risk pilot projects and accelerate scalability. This environment favors well-capitalized companies offering Agri-Technology-as-a-Service (AaaS) models. Successful market entry requires localized strategies, strong partnerships, and expertise in regulatory frameworks. With significant market opportunities and measurable returns, Vietnam’s Agri-tech sector presents a strong investment opportunity in ASEAN.

[1] https://www.nso.gov.vn/

[2] https://www.nso.gov.vn/

[3] https://www.undp.org/vietnam/stories/transforming-viet-nams-agriculture-climate-resilience

[4] https://tdmujournal.vn/

[5] https://en.mae.gov.vn/vietnams-agriculture-shifts-from-quantity-to-quality-to-win-new-markets-9039.htm

[6] https://ctuav.vn/how-the-drone-revolution-is-transforming-agriculture-in-vietnam/

[7] https://www.imarcgroup.com/vietnam-ai-in-agriculture-market

[8] https://www.aseanbriefing.com/news/investing-in-vietnams-climate-smart-agriculture-transformation/

[9] https://www.agroberichtenbuitenland.nl/actueel/nieuws/2025/04/24/as14-vietnam

[10] https://vietnamnews.vn/economy/1716319/viet-nam-emerges-as-a-hotspot-for-next-generation-tech-investment.html

[11] https://vietfishmagazine.com/aquaculture/shrimp/the-cost-of-feed-accounts-for-up-to-60-of-shrimp-production-costs.html

[12] https://worldwideaquaculture.com/the-future-of-shrimp-farming-ai-and-machine-learning-in-aquaculture/

[13] https://vietfishmagazine.com/aquaculture/ai-revolutionizes-shrimp-farming-in-vietnam.html

[14] https://www.larive.com/shrimptechvietnam-2024-2026/

[15] https://agfundernews.com/tepbac-deploys-software-iot-to-boost-vietnams-shrimp-farming-sector

[16] https://pubmed.ncbi.nlm.nih.gov/28980188/

[17] https://aquaasiapac.com/2023/08/24/3-stage-shrimp-farming-with-the-application-of-ras-technology-in-vietnam/

[18] https://seabinagroup.com/en/press-release-when-ai-meets-aquaculture-viet-uc-partners-bosch-aquaeasy-transforming-the-shrimp-industry-in-vietnam.html

[19] https://wwfint.awsassets.panda.org/

[20] https://fisheries.groupcls.com/nagis-project-in-vietnam/

[21] https://vietfishmagazine.com/aquaculture/ca-mau-advances-circular-ras-imta-shrimp-farming-for-sustainable-aquaculture.html

[22] https://www.irri.org/news-and-events/news/vietnam%E2%80%99s-1-million-hectare-rice-program-shows-promising-results

[23] https://www.agtechnavigator.com/Article/2025/07/23/vietnams-low-emission-rice-project-cuts-costs-and-carbon-lifts-yields-and-profits/

[24] https://www.rikolto.org/projects/expanding-sustainable-rice-production-through-fair-value-chains

[25] https://www.frontiersin.org/journals/sustainable-food-systems/articles/10.3389/fsufs.2025.1617417/full

[26] https://agresults.org/projects/vietnam/

[27] https://green-carbon.co.jp/en/enawdprojectreport/

[28] https://ap.fftc.org.tw/

[29] https://www.eladpartners.com/case-studies/leveraging-ai-for-early-crop-disease-detection

[30] https://blog.plantwise.org/2021/02/18/ai-plant-doctor-app-launched-to-help-diagnose-pests-and-diseases-on-dragon-fruit-crops-in-vietnam/

[31] https://www.fedex.com/en-vn/business-insights/sme/cold-chain-logistics-boost-vietnamese-fruit-exports.html

* If you wish to quote any information from this article, please kindly cite the source along with the link to the original article to respect copyright.

| B&Company

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |