The pet food market in Vietnam is growing strongly due to the increase in the number of pets and the need for better nutritional care. Consumers increasingly favor imported products due to their high quality and superior nutritional value. The domestic market still lacks high-end products, creating great opportunities for import businesses to penetrate and expand. With modern consumption trends and strong growth potential, Vietnam is an attractive market for imported pet food products.

Overview of the pet food market in Vietnam

In 2023, the number of pets (dogs and cats) in Vietnam will be about 12 million, including about 5.6 million cats and 6.5 million dogs. It is expected that in 2027, there will be about 16 million pets in Vietnam. According to Euromonitor, in 2023, the Vietnamese market will consume more than 17,000 tons of pet food, an increase of 15% compared to 2022. [1]The dog food segment accounts for the largest proportion of the market, but cat food is growing rapidly due to the increase in the number of cats in young households.

According to the report, the pet food market in Vietnam is growing strongly, with an expected size of 142 million USD by 2024 and continuing to grow to 222 million USD by 2029 at a CAGR of 9.4% [2].

Distribution channels and consumer behavior

According to Kirin Capital’s 2024 report, pet food in Vietnam is mainly sold through pet shops, accounting for 75% of the distribution channel. Other channels such as supermarkets, hypermarkets and online stores account for a smaller proportion but are growing thanks to the development of e-commerce and the trend of online shopping among young people.[3]

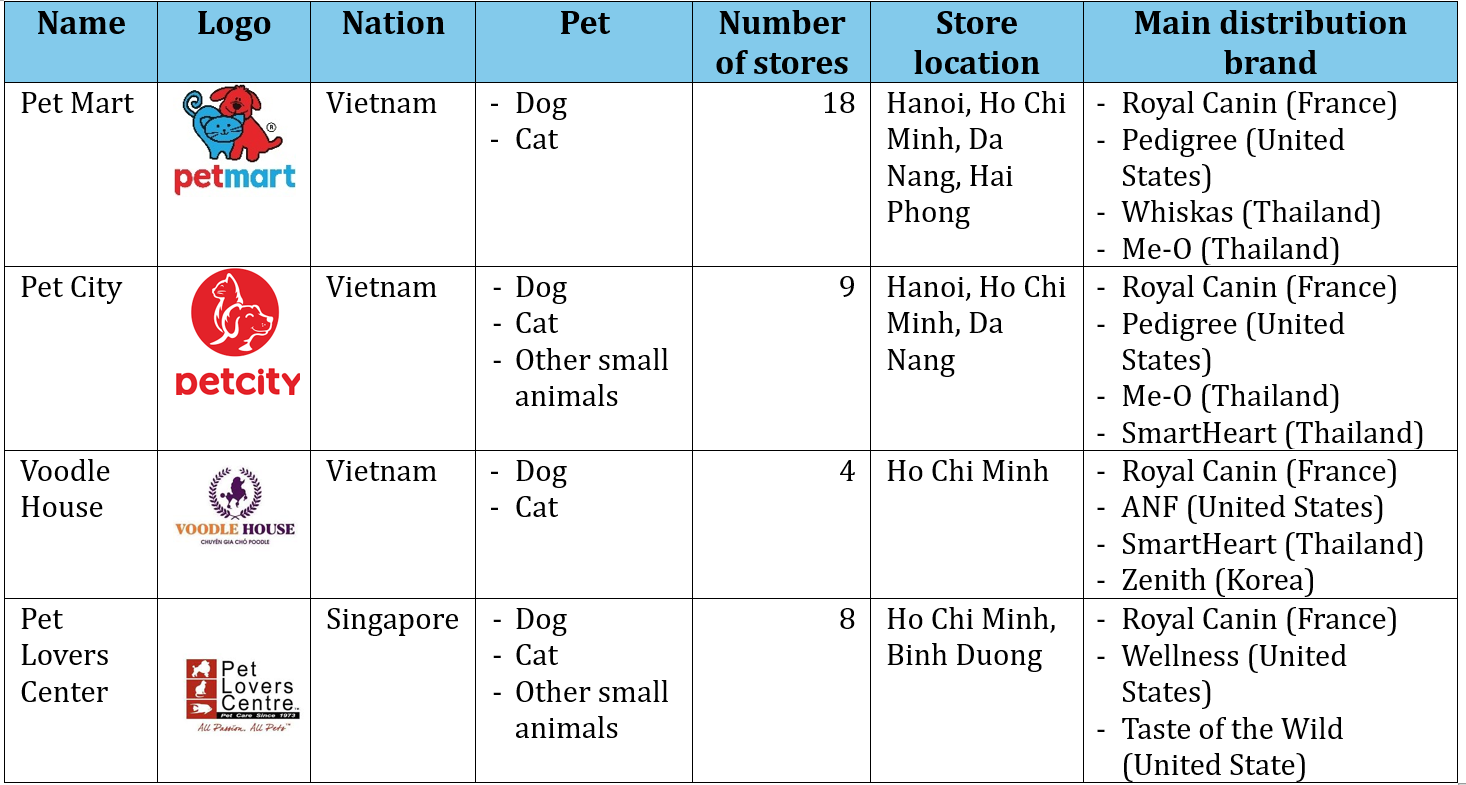

Some major pet food distributors in Vietnam

Source: BC synthesis

Consumer trends in Vietnam are also changing, with increasing attention to product quality and nutrition. Premium, organic, and preservative-free products are gaining popularity, especially among high-income customers.[4]

Assessment of the potential of imported pet food products

The development of the market creates favorable conditions for imported products, especially from countries with developed pet food industries such as the US, Thailand and France. Currently, about 35% of pet food products in Vietnam originate from Thailand, 22% from the US, and 15% from France.[5]

Variety of dog and cat food brands at Pet Mart

Source: Baodautu

The imported pet food market in Vietnam, especially for dogs and cats, focuses on dry food (grains), wet food (pate, soup), treats, jellies, and nutritional supplements. These products are often high quality, with many organic, grain-free, and hypoallergenic lines, aiming at the health and comprehensive nutrition of pets. Compared to domestic products, imported products are superior in quality but cost significantly more, often 2-3 times more. Although domestic products are improving, they still do not reach the high-end standards of imported products.

Development opportunities for Japanese businesses

Japanese companies have a great opportunity to penetrate this market thanks to their reputation for product quality. Brands such as DoggyMan have built trust with Vietnamese consumers by providing safe, nutritious products.

DoggyMan Participates and is One of the Main Sponsors at Petfair 2024

Source: DoggyMan

Japanese businesses have many opportunities to exploit the pet food market in Vietnam thanks to the following factors:

- Vietnamese consumers are increasingly interested in product quality and are willing to spend more on high-end imported pet food products. This is an opportunity for Japanese businesses to develop high-end product lines such as organic food, nutritional supplements or specialized health support products for pets. Advanced production technology from Japan will help businesses quickly capture the high-end segment.[6]

- The green consumption trend is spreading in Vietnam, with young consumers and middle-class households favoring products that are chemical-free, preservative-free, and made from natural ingredients. Japanese businesses can leverage their strengths in producing environmentally friendly pet food products to meet this market demand ( Vietnam Economy Finance ).

- The pet food market in Vietnam does not stop at regular food but also expands to special nutritional products such as pate, water-supplying treats, or health-supporting foods. Japanese businesses can develop new product lines, diversify consumer choices, and conduct further research to launch products that meet market needs.[7]

Besides, to penetrate and develop effectively in the Vietnamese market, Japanese enterprises should cooperate with large pet stores and e-commerce sites, social networks, and KOLs to increase [8]brand awareness and customer access.

Conclude

The pet food market in Vietnam is growing strongly and has great potential, especially for imported products. With the rise of the middle class and high-end consumer demand, this is a great opportunity for foreign enterprises such as Japan invest and expand its market share. Focusing on product quality, researching market demand and building an effective distribution system will help businesses succeed in capturing this market .

[1] https://thesaigontimes.vn/cua-rong-cho-nganh-cong-nghiep-thu-cung-viet-nam/

[2] https://www.mordorintelligence.com/vi/industry-reports/vietnam-pet-food-market

[3] https://kirincapital.vn/wp-content/uploads/2024/06/BAO-CAO-TRIEN-VONG-NGANH-CONG-NGHIEP-THU-CUNG-VIET-NAM.pdf

[4] https://kehoachviet.com/thi-truong-thuc-an-cho-thu-cung/

[5] https://thesaigontimes.vn/cua-rong-cho-nganh-cong-nghiep-thu-cung-viet-nam/

[6] https://cafef.vn/khai-pha-nganh-thuc-an-thu-cung-day-tiem-nang-tai-thi-truong-viet-nam-20221231095307632.chn

[7] https://thesaigontimes.vn/cua-rong-cho-nganh-cong-nghiep-thu-cung-viet-nam/

[8] https://kirincapital.vn/wp-content/uploads/2024/06/BAO-CAO-TRIEN-VONG-NGANH-CONG-NGHIEP-THU-CUNG-VIET-NAM.pdf

| B&Company, Inc.

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |

Read other articles