Vietnam’s clean food market is growing rapidly, driven by increasing consumer demand for healthier and safer food options. This expansion is fueled by rising disposable incomes, urbanization, and growing health awareness, particularly among younger generations. Clean food stores are primarily concentrated in major cities like Hanoi and Ho Chi Minh City, offering a mix of locally sourced and imported organic products. The market presents significant opportunities for foreign food brands, especially those offering organic and sustainable products, thanks to rising demand for premium, imported goods and the growth of e-commerce platforms.

Vietnamese Clean Food Market Overview

The clean food movement in Vietnam is relatively new but growing quickly. According to a survey from Decision Lab and Vero about this topic in 2024, almost half of the respondents (46.3%) said they were interested in changing their eating habits and 43.4% revealed they had improved their knowledge of healthy food[1]. Several factors contribute to its development, including heightened consumer concerns about food safety, especially after Covid-19 which have led to a demand for greater transparency in food production. Clean food, with its emphasis on organic or minimally processed products that meet international safety standards, has emerged as a natural solution.

Vietnam’s clean food market is also benefiting from rising disposable incomes and urbanization. The middle class is growing and is expected to expand to 26% of the population by 2026, up from 13% (approximately 13 million people) in 2023[2],particularly in major cities like Hanoi and Ho Chi Minh City, where consumers are increasingly willing to pay a premium for high-quality food. Alongside this trend, there is an increasing emphasis on health and wellness, influenced by global dietary trends. Younger generations, especially millennials and Gen Z, are particularly interested in clean eating and sustainable consumption, driving demand for organic, ethically sourced products.

Vietnamese consumers shopping from clean food store Organica in Hanoi

Source: Organica

The Vietnamese government has also implemented various policies to support and encourage the development of clean food, aiming to protect public health and promote sustainable agriculture. Of which, Decision No. 885/QD-TTg[3] about approving the Organic Agriculture Development Plan for the 2020-2030 period has set goals to increase the area of organic farming while encouraging partnerships between farmers and businesses in the production and consumption of clean food. This has led to a gradual increase in the availability of organic products and the establishment of more clean food stores.

Key Players in the Market

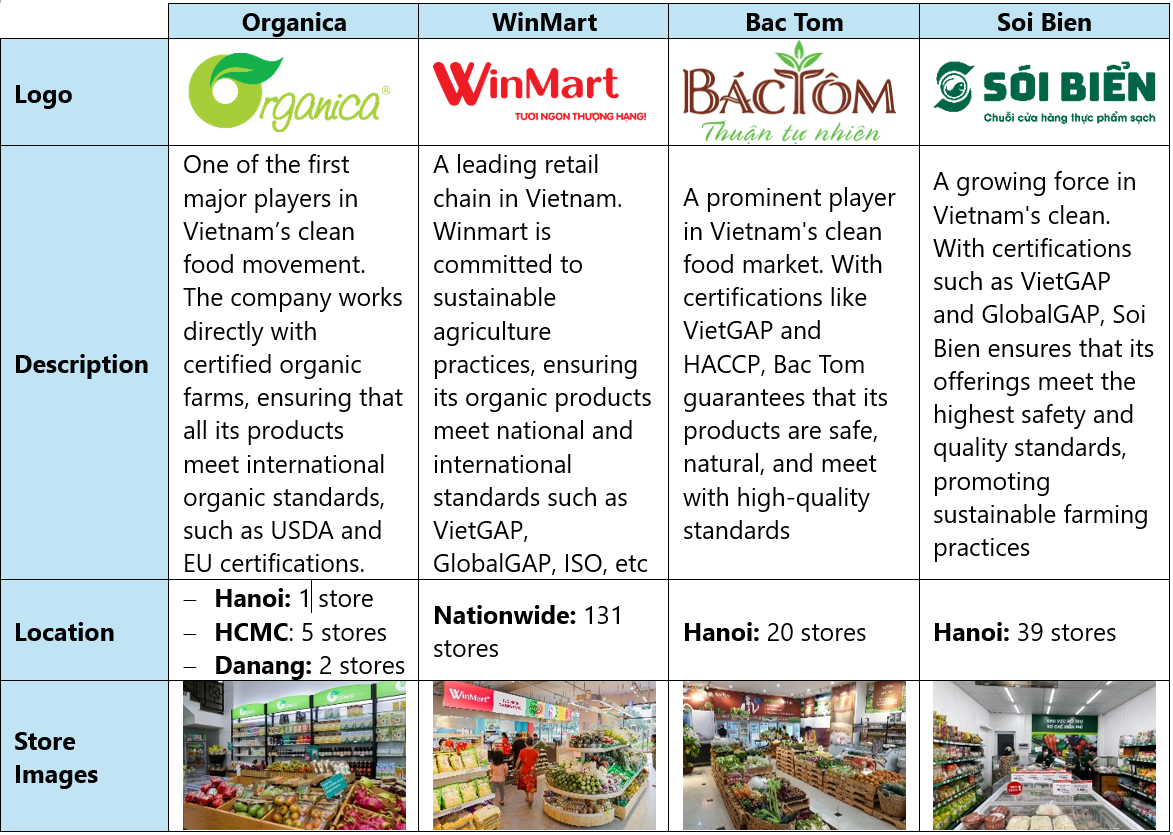

Several local and international brands have established themselves as key players in Vietnam’s clean food retail market. These companies have tapped into the growing demand for safe, organic, and clean food by offering products that meet the stringent requirements of consumers seeking healthier alternatives.

Currently, clean food stores in Vietnam are mainly concentrated in major cities like Hanoi and Ho Chi Minh City, where demand for healthy and convenient food is high, particularly among young consumers, office workers, and families seeking healthier lifestyles. These stores often offer products such as organic vegetables, clean meat, whole grains, and minimally processed foods without preservatives.

In addition to distributing products from Vietnamese farms, some stores import goods from countries with advanced agricultural industries like Australia, United States, Korea, Japan, etc. Imported items often include organic food, various nuts, and gluten-free products to cater to specific consumer needs.

As for sales channels, besides in-store purchases, e-commerce platforms, most commonly being the stores’ own websites are becoming increasingly popular. Consumers can easily place orders online, and many stores offer home delivery services, which cater to the growing demand for convenience in modern life.

The table below shows some of the key players in the clean food store chains in Vietnam:

Source: B&Company’s synthesis

These key players have helped shape the clean food market in Vietnam by offering consumers a trusted source for healthy, sustainable, and safe products. As the market continues to evolve, these companies are likely to expand their offerings and reach, further driving growth in the clean food sector.

Opportunities for Foreign Food Brands

The rapid development of Vietnam’s clean food market presents numerous opportunities for foreign food brands, particularly those specializing in organic, sustainable, and health-focused products. Several factors make Vietnam an attractive destination for foreign brands:

Firstly, rising demand for imported goods provides a significant advantage for foreign food brands. Vietnamese consumers have a strong preference for imported products, which are often associated with higher quality and stricter safety standards. Brands from countries known for rigorous food safety practices, such as Japan, South Korea, and European nations, can capitalize on this perception. Products that meet preferences for organic, non-GMO, or minimally processed foods are likely to find a receptive market.

Clean fishery products imported from overseas

Source: WinMart’s social site

Secondly, partnerships with local retailers such as VinMart offer a strategic entry point into the Vietnamese market. These collaborations give foreign brands access to an established customer base and help them navigate the local regulatory environment. Working with trusted local retailers also builds brand awareness and consumer trust, making it easier for foreign brands to succeed.

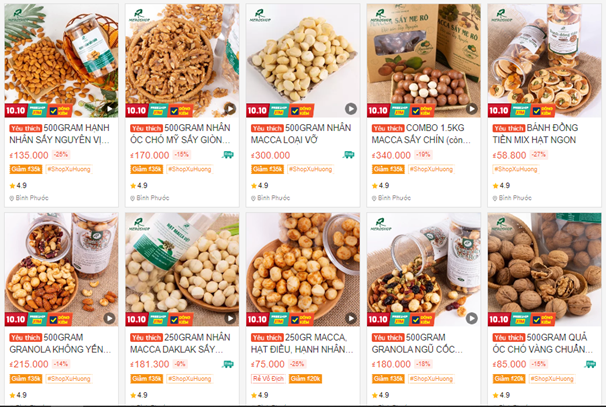

Thirdly, Vietnam’s booming e-commerce sector creates further opportunities for foreign brands. With high internet penetration and increasing online grocery shopping, especially in urban areas, foreign brands can establish an online presence on self-hosted websites or E-commerce platforms like Shopee. Additionally, partnering with local delivery services such as ShopeeFood, Grab or beFood allows brands to reach tech-savvy consumers looking for convenience and premium products that can be delivered right at home.

Fresh nuts on Shopee e-commerce site

Source: Shopee

Lastly, investment in local agriculture can be a valuable strategy for foreign brands. By investing in organic farming or forming joint ventures with Vietnamese producers, foreign companies can secure a steady supply of high-quality, locally grown ingredients while supporting Vietnam’s organic farming sector. This aligns with the government’s efforts to promote sustainable agriculture and food safety, creating a win-win situation for both foreign brands and local farmers. In recent years, agricultural cooperation between Vietnam and Japan has made significant advancements, particularly in green agriculture, one of the four sectors Japan is actively promoting in Vietnam, according to Mr. Kudo Yoshimoto, Deputy Head of the Japan International Cooperation Agency (JICA)[4].

Conclusion

Vietnam’s clean food market is rapidly evolving, driven by rising consumer demand for safer, healthier, and more sustainable food options. The development of clean food store chains in the country has created a vibrant retail landscape that caters to health-conscious urban consumers. For foreign food brands, this presents a wealth of opportunities, from tapping into the growing demand for premium imported products to partnering with local retailers and leveraging e-commerce platforms.

Despite some challenges, including regulatory hurdles and competition from local brands, Vietnam’s clean food market holds significant potential for foreign companies willing to invest in the country’s evolving food sector. As Vietnamese consumers continue to prioritize health and wellness, foreign brands that align with these values will be well-positioned to succeed in this dynamic market.

[1] Vietcetera (2024). The Pandemic Has Motivated Vietnamese To Eat Healthy, But Some Factors Are Holding Them Back <Assess>

[2] Vietnam Briefing (2024). Understanding Vietnam’s Middle Class: Size, Spending Patterns, and Opportunities for Businesses <Assess>

[3] Prime Minister (2020). Approval of the Organic Agriculture Development Plan for the 2020-2030 period. <Assess>

[4] Mekong ASEAN (2023). Strengthening green agricultural cooperation between Vietnam and Japan <Assess>

| B&Company, Inc.

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |

Read other articles