29Apr2025

Latest News & Report / Vietnam Briefing

Comments: No Comments.

In recent years, Vietnam has emerged as one of Southeast Asia’s most dynamic markets for renewable energy, specifically as of 2023, Vietnam led Southeast Asia with 18.6 GW of solar capacity, compared to Indonesia’s 900 MW and the Philippines’ 1.6 GW [1]. With its rapid economic growth and rising electricity demand, the country is actively seeking cleaner and sustainable alternatives. A notable contributor to this movement is Vingroup, Vietnam’s largest private enterprise, which has expanded from property and retail into technology, electric vehicles, and renewable energy. This shift presents a part of Vietnam’s broader ambition to reduce reliance on fossil fuels and align with global climate commitments, while addressing domestic energy security challenges.

Vietnam’s Renewable Energy Overview

Vietnam’s renewable energy sector has expanded dramatically over the past decade. Under the government’s Power Development Plan VIII (PDP8), approved in 2023, the country targets renewables to supply 30.9% of total electricity generation by 2030 and 67.5% by 2050 [2], marking a significant strategic shift in national energy priorities.

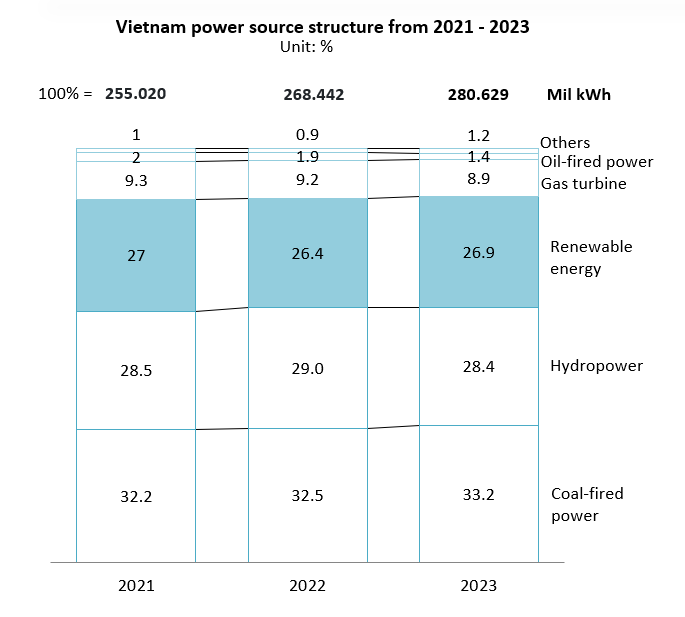

Source: EVN

Despite these long-term goals, Vietnam’s energy mix remains heavily reliant on traditional sources, primarily coal and hydropower. According to Vietnam Electricity (EVN), coal-fired power’s share increased slightly from 32.2% in 2021 to 33.2% in 2023, driven by its affordability and baseload reliability. Hydropower maintained a stable contribution of around 28-29%, while renewable energy held steady at 27%, reflecting consistent capacity growth but limited overall share gains.

Nevertheless, Vietnam’s favourable geography, with its extensive coastline and abundant solar radiation, has provided a strong foundation for the rapid expansion of its renewable energy sector. By the end of 2023, the country became Southeast Asia’s largest solar market, with 18.6 GW of installed capacity [3]. However, despite this impressive capacity growth, Vietnam’s power grid has struggled to keep pace. Grid congestion and renewable curtailment — particularly in southern provinces — remain significant issues, with an estimated 1.3 billion kWh of solar power curtailed in 2022 alone [4].

In response, recent policy measures have sought to address these challenges while bolstering long-term growth. Notably, Decree No. 58/2025/ND-CP prioritises projects integrating energy storage systems, offers land fee exemptions, and supports green hydrogen and ammonia initiatives, helping to manage grid loads more effectively [5]. The Direct Power Purchase Agreement (DPPA) mechanism under Decree 80/2024/ND-CP allows large consumers to buy renewable energy directly from producers, easing pressure on the central grid [6]. Additionally, a nationwide Rooftop Solar Initiative aims to equip 50% of homes and offices with solar systems by 2030, promoting decentralised generation and reducing reliance on grid-connected utility-scale plants [7].

These developments demonstrate Vietnam’s strong commitment to expanding its renewable energy sector while actively addressing operational and infrastructural constraints — a necessary step to increase renewables’ share in the national power mix.

Foreign Dominance and the Rise of Vingroup as a Vietnamese Energy Player

Vietnam’s rapidly growing renewable energy sector offers significant opportunities for both foreign and domestic investors. Foreign investment has been the primary driver, attracted by the country’s abundant natural resources, robust market growth, and favourable regulatory frameworks.

Developers from Singapore, Thailand, South Korea, Japan, and Europe have made significant contributions to Vietnam’s energy sector. Their investments, including large LNG and renewable energy projects, reflect sustained foreign involvement in the country’s energy infrastructure. These major projects and partnerships are summarised in the table below.

Table. Foreign Renewable Projects in Vietnam

| No | Project name | Investors | Nationality | Capacity |

| 1 | LNG-to-Power Plant in Thai Binh [8] | Tokyo Gas, Kyuden International, Truong Thanh Group | Japan, Vietnam | $2 billion LNG-to-power plant |

| 2 | Son My LNG Terminal, Binh Thuan [9] | AES Corporation, PV Gas | USA, Vietnam | $1.4 billion LNG terminal |

| 3 | Offshore Wind Project, Binh Dinh [10] | PNE AG | Germany | $4.6 billion, 2 GW offshore wind |

| 4 | Offshore Wind Project, Southwest Vietnam [11] | Renova, PetroVietnam | Japan, Vietnam | 2 GW offshore wind farm |

| 5 | Offshore wind farm in southern Vietnam 11 | Sumitomo Corp | Japan | 500 megawatts to 1 GW |

| 6 | Rooftop Solar Projects [12] | EDF Renewables, SkyX Solar | France, Vietnam | 200 MW rooftop solar capacity |

| 7 | Wind Power Projects, Dak Nong [13] | Sungrow Power | China | 300 MW wind power (3 farms) |

| 8 | Onshore Wind Farms, Gia Lai 13 | Gulf Energy Development | Thailand | $200 million, 2 onshore wind farms |

| 9 | Mekong Wind Project, Ben Tre 13 | Gulf Energy Development | Thailand | $200 million, 30 MW solar + 310 MW offshore wind |

| 10 | Hong Phong 1 Wind Farm, Binh Thuan 13 | Indochina Wind Pte., Ltd., Asian Wind Power 2 HK Ltd. | Singapore, Hong Kong | 40 MW wind farm |

| 11 | TTC 1 & 2 Solar Power Plants, Tay Ninh 13 | Gulf Energy Development, Thanh Thanh Cong (TTC) Group | Thailand, Vietnam | $200 million, 49 MW capacity |

| 12 | La Gan Offshore Wind Farm[14] | Copenhagen Infrastructure Partners (CIP), Copenhagen Offshore Partners (COP), Asiapetro, Novasia | Denmark, Vietnam | $10.5 billion, 3.5 GW |

Source. B&Company’s Synthesis

ES and PV Gas sign a joint venture agreement for Son My LNG Terminal

This dominance of foreign capital, however, has raised concerns about long-term energy security and the relatively limited role of domestic companies in large-scale renewable projects.

Amid this, Vietnam’s largest private corporation, Vingroup, is increasingly stepping up. Traditionally known for its automotive, real estate, and technology businesses, Vingroup launched VinEnergo in 2024, a subsidiary focused on renewable energy and energy services [15]. VinEnergo’s portfolio includes large-scale solar farms, onshore and offshore wind power, and advanced battery storage systems, with plans to develop gigawatt-scale projects across southern and central Vietnam by 2030.

Most notably, Vingroup has proposed a $4.5 billion offshore wind power project in Binh Thuan province, marking one of the most ambitious domestic-led renewable initiatives to date [16]. In addition, the group is planning major solar projects, including an 8,000 MW floating solar farm in Son La and a 9,000 MW solar-wind hybrid project in Dak Lak. Vingroup has also proposed a 5,000 MW LNG-fired power plant in Hai Phong and launched a 3.7 MWh battery energy storage system at Vinpearl Resort Nha Trang, further expanding its clean energy portfolio [17]. This aligns with Vingroup’s broader goals, complementing its electric vehicle expansion through VinFast and its vision for smart cities and green infrastructure.

Separately, other major renewable projects in Vietnam include the Trung Nam Thuan Nam Renewable Complex in Ninh Thuan, which combines 450 MW of solar and 151 MW of wind power [18], and the Ea Nam Wind Power Plant in Dak Lak — a 400 MW onshore wind project developed by Trungnam Group, currently the largest wind farm in the country [19].

The Dong Hai 1-Tra Vinh wind-to-power farm, invested by Trungnam Group, in Tra Vinh province, southern Vietnam. Photo courtesy of Trungnam Group

Vingroup’s emergence signals an important shift in Vietnam’s renewable energy landscape. While foreign investment remains critical, increased domestic involvement strengthens energy independence and diversifies economic benefits. VinEnergo’s projects may inspire other local companies to invest in renewables, fostering competition, innovation, and local supply chain growth.

Conclusion

Vietnam’s renewable energy sector is at a transformative moment. Driven by foreign investors and natural potential, the country has made impressive progress in building solar and wind capacity. Now, with domestic giants like Vingroup entering the market through initiatives such as VinEnergo, Vietnam’s energy transition is taking on a more locally anchored, strategic dimension.

This shift strengthens the country’s position in the global clean energy space while reinforcing its commitment to energy security, sustainability, and economic resilience. As foreign and domestic players continue to invest, innovate, and collaborate, Vietnam’s path toward a greener future looks increasingly promising.

[1] https://www.iea.org/reports/southeast-asia-energy-outlook-2024/executive-summary

[2] https://en.baochinhphu.vn/govt-approves-national-power-development-plan-8-111230516085506239.htm

[3] https://www.ren21.net/gsr-2024/snapshots/vietnam/

[4] https://vir.com.vn/power-market-prospects-in-vietnam-92310.html

[5] https://datafiles.chinhphu.vn/cpp/files/vbpq/2025/3/58-nd.signed.pdf

[6] https://vanban.chinhphu.vn/?pageid=27160&docid=210545&classid=1&orggroupid=2

[7] https://thuvienphapluat.vn/van-ban/Tai-nguyen-Moi-truong/Nghi-dinh-135-2024-ND-CP-co-che-khuyen-khich-phat-trien-dien-mat-troi-mai-nha-tu-san-xuat-tu-tieu-thu-590043.aspx

[8] https://vir.com.vn/2-billion-thai-binh-lng-thermal-power-plant-to-start-construction-in-september-123210.html

[9] https://vir.com.vn/aes-and-pv-gas-sign-joint-venture-agreement-for-son-my-lng-terminal-87932.html

[10] https://www.offshorewind.biz/2024/10/23/german-firm-sets-plans-for-usd-4-6-billion-offshore-wind-project-in-vietnam/

[11] https://www.orissa-international.com/business-news/foreign-investors-drawn-to-vietnams-booming-offshore-wind-market/

[12] https://vietnamtimes.org.vn/vietnams-renewable-energy-sector-continues-to-attract-foreign-investments-36743.html&dm=52ca6bcf3eb95248dccf2370722a393e&utime=MjAyMjAyMTAxMDUwMDM=

[13] https://vir.com.vn/foreign-investors-increase-acquisitions-of-renewable-energy-projects-in-vietnam-84090.html

[14] https://theinvestor.vn/danish-energy-fund-cips-105-bln-wind-power-project-to-create-45000-jobs-in-vietnam-d9306.html

[15] https://theinvestor.vn/vietnam-billionaire-pham-nhat-vuong-sets-up-energy-developer-vinenergo-d15268.html

[16] https://theinvestor.vn/vingroup-proposes-45-bln-wind-power-project-in-southern-vietnam-d15240.html

[18] https://e.vnexpress.net/news/business/companies/largest-solar-plant-in-southeast-asia-begins-operating-4175723.html

[19] https://www.power-technology.com/data-insights/power-plant-profile-ea-nam-wind-farm-vietnam/

* If you wish to quote any information from this article, please kindly cite the source along with the link to the original article to respect copyright.

| B&Company

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |