03Nov2025

Latest News & Report / Vietnam Briefing

Comments: No Comments.

The global Halal food market offers Vietnam much potential. Supported by a strong agricultural base, strategic proximity to major Muslim markets, and government initiatives, Vietnam is emerging as a promising Halal food supplier. Nearly 1,000 local enterprises have obtained Halal certification, signaling growing alignment with international standards. To realize its potential, enterprises should be aware of the challenges and committed to maintaining Halal standards, building transparent logistics, and leveraging partnerships and Vietnamese diplomatic relations.

Overview of the Halal food market

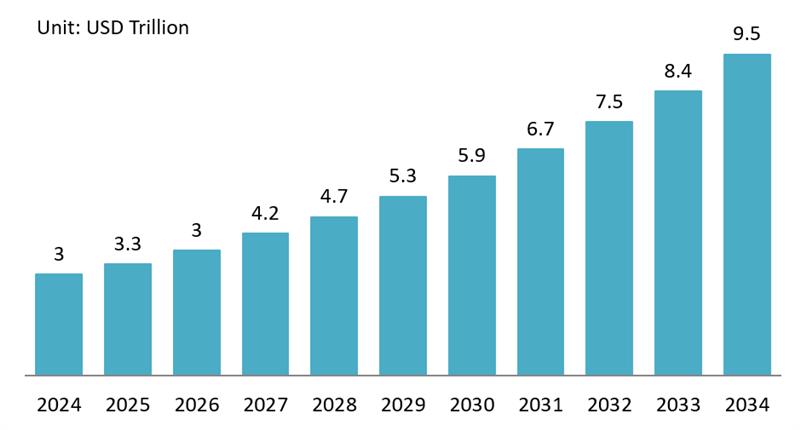

The term Halal food refers to products permissible under Islamic law, covering ingredients, processing, and handling. The global Halal food market, which is valued at over US $2.9 trillion in 2024[1], is expanding rapidly, driven by rising Muslim populations and global demand for safe, high-quality foods[2]. The global Halal food industry is forecast to reach nearly US $9.5 trillion by 2034, with annual growth near 10%. Muslim-majority countries such as Indonesia, Malaysia, and those in the Middle East are the largest consumers, but non-Muslim nations like Brazil, Australia, and China have already become major Halal exporters through strong certification and quality standards.

Halal Food Market Size 2024 to 2034

Source: Precedence Research (2024)

While fewer than 0.1% of Vietnamese are Muslim[3], Vietnam’s halal opportunity comes mostly from exports. Vietnam is actively positioning itself in this sector. In 2024, exports of Halal goods to the Middle East & Africa reached nearly US $700 millionMoreover, Vietnam currently exports only approximately 20 commodity types to halal markets, revealing significant expansion potential[7].

On the domestic side, demand for Halal food and Halal-friendly services is also emerging, especially via tourism. In 2024, Hanoi welcomed about 650,000 Muslim tourists, accounting for roughly 15% of its total international arrivals[8]. A growing number of supermarkets are stocking Halal-certified products to appeal to both visiting Muslim travelers and health-conscious Vietnamese consumers. Tourism infrastructure is also adapting: hotels and restaurants are offering Halal-certified dining, prayer facilities, and separate dining areas for Muslim guests[9].

Vietnam holds many growth drivers to expand into the Halal food market. As one of the world’s top exporters of rice, seafood, coffee, pepper, and tropical fruits, which are naturally compliant with Halal dietary standards, Vietnam possesses a diverse and scalable production base. Its seafood and poultry sectors already operate under VietGAP, GlobalGAP, and HACCP standards, which closely align with Halal principles[10]. Geographically, Vietnam sits at the heart of Southeast Asia, near major Muslim markets such as Indonesia, Malaysia, and Brunei.

Vietnam’s strong diplomatic and trade relations with Islamic countries, including Malaysia, Indonesia, Saudi Arabia, and the UAE, also enhance mutual recognition and business confidence. On the institutional side, a national Halal certification system (HALCERT) is established by the Ministry of Agriculture and Rural Development (MARD) and the Ministry of Industry and Trade (MOIT)[11]. The aim of the project is to integrate domestic standards with international Halal systems such as JAKIM (Malaysia) and MUIS (Singapore)[12]. Once fully operational, HALCERT is expected to reduce certification costs, attract foreign investment, and boost the credibility of Vietnam’s Halal exports.

Vietnamese notable players in the Halal food market

Vietnam’s participation in the global Halal food industry has expanded rapidly in recent years. Nearly 1,000 Vietnamese enterprises have already obtained Halal certification, enabling them to export food products to markets across ASEAN, the Middle East, and Africa. These certified enterprises range from multiple sectors, reflecting Vietnam’s diversified agri-food base, which can meet various demands of the Halal food market.

| No. | Name | Headquarter | Exporting products | Halal certificate status |

| 1 | Vinamilk JSC | Ho Chi Minh City | Powdered milk, condensed milk, yogurt | 387 export products are already certified in 2024 |

| 2 | Trung Nguyen Coffee JSC | Ho Chi Minh City | Coffee (instant, roasted, ground) | 26 products are already certified in 2023 |

| 3 | Ba Huan JSC | Ho Chi Minh City | Eggs | Certified by Halal Vietnam Co., Ltd for their eggs since 2014 and recertified frequently |

| 4 | Vinh Hoan Corporation | Dong Thap | Pangasius fish, seafood | Certified according to the GCC Certification Scheme for 5 products in 2021 |

| 5 | Visimex JSC | Hanoi | Cinnamon, Star anise, cashew, pepper seed | Certified by Halal Vietnam Co., Ltd for 6 products in 2021 |

| 6 | Nutifood JSC | Ho Chi Minh City | Nutritional beverages | Certified according to the GCC Certification Scheme for 12 products in 2022 |

| 7 | Binh Vinh Saigon Food Ltd | Ho Chi Minh City | Agriculture cake, seafood cake, instant cake | Certified according to the GCC Certification Scheme for 52 products in 2024 |

Source: B&Company’s Synthesis

Key challenges to expand in the Halal food market

Fragmented and non-uniform regulatory standards

While the framework of HALCERT is under development, Vietnam’s Halal certification remains fragmented and lacks international recognition. As a result, exporters face high costs and complexity in certifying their products to comply with Halal standards. In different markets, the certification requirements vary, leading to time-consuming and costly procedures[13].

Vietnamese firms lack resources and capabilities

Most Vietnamese food producers are small and medium-sized enterprises (SMEs) that have limited financial and managerial capacity to meet Halal standards. Instead of using a comprehensive approach in Halal market entry, many consider Halal certification as a short-term export deal, resulting in one-time orders or quick failure. Many Vietnamese firms lack a deep understanding of Muslim consumer culture, market demands, packaging, distribution, and export regulations[14].

Infrastructure and Supply Chain Constraints

Vietnam’s infrastructure and supply chain systems are still not fully aligned with Halal production and distribution requirements. Maintaining strict separation between Halal and non-Halal materials, ensuring traceability, and managing contamination risks all demand investment in logistics, cold-chain systems, and digital tracking. Many processing places have no dedicated Halal facilities, and exporters often face high transportation and certification costs. The shortage of Halal-compliant testing laboratories and trained auditors remains a key operational bottleneck[15].

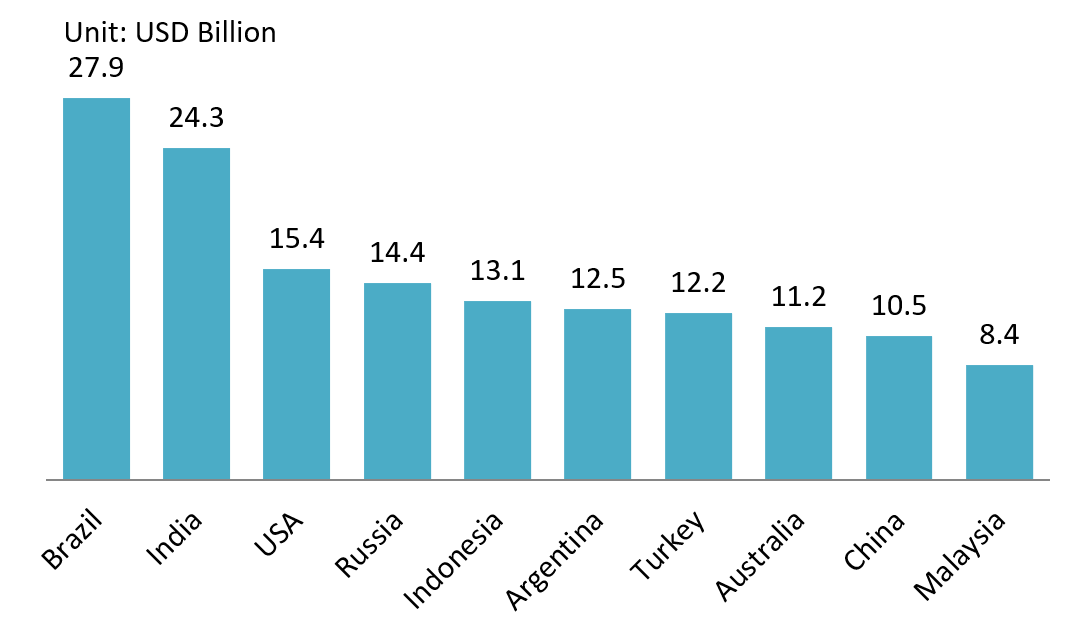

Strong regional competition

Vietnam is entering the Halal food market relatively late compared to regional competitors such as Malaysia, Indonesia, and Thailand, and global exporters like Brazil and Australia[16]. These countries have long-established certification systems, large-scale Halal industrial zones, and strong branding in Muslim markets.

Halal Food Export in 2024

Source: State of the Global Islamic Economy Report (2024)

Business Implication

Vietnam’s entry into the Halal food market presents clear opportunities, but realizing them requires coordinated action between the government, investors, and local enterprises. The country’s agricultural strength and export potential must be matched with internationally credible certification, industry training, and efficient logistics to ensure competitiveness.

Strategic actions for investors include:

– Target high-potential export categories with existing quality certifications, such as seafood, poultry, and processed foods.

– Upgrade and maintain operational standards across sourcing, processing, and logistics to comply with Halal certification norms, thereby getting the certified qualification.

– Forming partnerships with experienced local producers and internationally recognized certifiers to reduce compliance risk and enhance brand trust.

– Build traceability and brand transparency into production and marketing systems to strengthen consumer trust.

– Leverage existing Vietnamese diplomatic relations and trade agreements to reach ASEAN and Middle Eastern markets.

Learning from China, Australia, and Brazil, Vietnam should embed Halal standards into its mainstream export systems rather than treating them as a niche. With sustained reforms and credible certification, Vietnam can evolve from a promising entrant into a regional Halal food hub in the coming decade.

* If you wish to quote any information from this article, please kindly cite the source along with the link to the original article to respect copyright.

| B&Company

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |

[1] Precedence Research, Halal Food Market Size, Share and Trends 2025 to 2034 (https://www.precedenceresearch.com/halal-food-market)

[2] Canadian Halal Bureau, Halal Market Statistics: Food, Cosmetics, Pharmaceuticals, Supplements, Packaging & More (https://halalbureau.ca/halal-market-statistics/)

[3] World Population Review, Vietnam (https://worldpopulationreview.com/countries/vietnam)

[4] Nhan Dan newspaper, Vietnam strives to become global Halal food supplier (https://en.nhandan.vn/vietnam-strives-to-become-global-halal-food-supplier-post142578.html)

[5] Vietnam Plus, Vietnam strengthens trade promotion to tap Halal market potential (https://en.vietnamplus.vn/vietnam-strengthens-trade-promotion-to-tap-halal-market-potential-post306580.vnp)

[6] Voice of Vietnam, Vietnam targets stronger presence in US$2 trillion Halal market (https://english.vov.vn/en/economy/vietnam-targets-stronger-presence-in-us2-trillion-halal-market-post1200577.vov)

[7] Nhan Dan Newspaper, Vietnam possesses great opportunity to develop Halal Industry into a strength (https://en.nhandan.vn/vietnam-possesses-great-opportunity-to-develop-halal-industry-into-a-strength-post140662.html)

[8] Vietnam News, Hà Nội targets to develop halal tourism sector

(https://vietnamnews.vn/life-style/1719422/ha-noi-targets-to-develop-halal-tourism-sector.html)

[9] The Star, Hanoi ready to cash in on growing halal tourism market (https://www.thestar.com.my/aseanplus/aseanplus-news/2025/06/10/hanoi-ready-to-cash-in-on-growing-halal-tourism-market)

[10] Vietstock, Việt Nam taps halal market to boost agricultural exports (https://en.vietstock.vn/2025/06/viet-nam-taps-halal-market-to-boost-agricultural-exports-974-614931.htm)

[11] Vietnamese Government Committe for Religious Affair, Opening Ceremony of National Halal Certification Center – Halcert (https://btgcp.gov.vn/tin-trong-nuoc/le-khai-truong-trung-tam-chung-nhan-halal-quoc-gia-halcert-postgBa5KwQnW4.html)

[12] Commission for the Standards, Metrology and Quality of Vietnam, Promoting international cooperation: A premise for Vietnam’s Halal industry to reach out to the world (https://tcvn.gov.vn/thuc-day-hop-tac-quoc-te-tien-de-de-nganh-halal-viet-nam-vuon-ra-the-gioi/29/10/2024/)

[13] VCCI, Addressing bottlenecks in Vietnam’s halal exports (https://en.vcci.com.vn/addressing-bottlenecks-in-vietnam%E2%80%99s-halal-exports)

[14] VTV Online, Vietnam needs long-term strategy to make deeper inroads into Halal market (https://english.vtv.vn/news/vietnam-needs-long-term-strategy-to-make-deeper-inroads-into-halal-market-20250408105033336.htm)

[15] Vietnam+, Vietnam needs comprehensive strategy to tap Halal market potential (https://en.vietnamplus.vn/vietnam-needs-comprehensive-strategy-to-tap-halal-market-potential-post326089.vnp)

[16] Salaam Gateway, State of the Global Islamic Economy Report 2024 ( https://salaamgateway.com/story/infographic-sgie-202324-halal-food