18Dec2025

Latest News & Report / Vietnam Briefing

Comments: No Comments.

Vietnam is rapidly emerging as a leading trade hub in ASEAN, with manufacturing remaining the core driver. This momentum is reinforced by competitive labor costs, macroeconomic stability, a broad network of FTAs, and geopolitical shifts. However, Vietnam faces persistent structural challenges, including skill shortages, reliance on imported inputs, and climate vulnerabilities. Looking forward, long-term competitiveness will depend on productivity upgrades, high-skilled labor, technological adoption, and climate-resilient infrastructure.

Current situation of Vietnam as an ASEAN trade hub for manufacturing

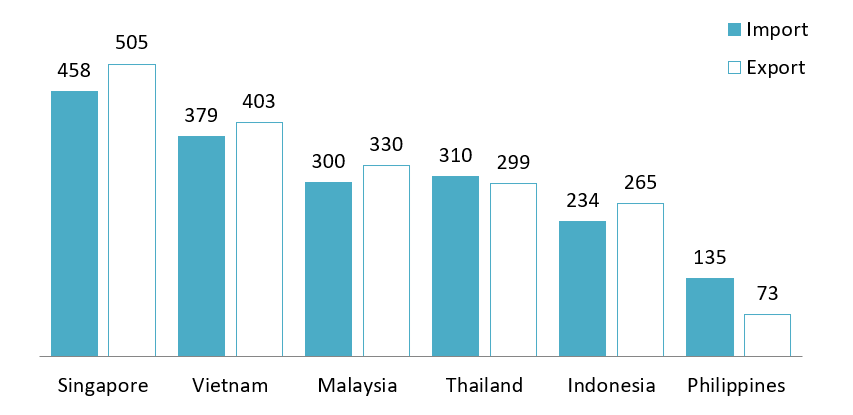

Among ASEAN countries, in 2024, Vietnam ranked second only to Singapore in both export and import turnover, surpassing traditional manufacturing bases such as Malaysia, Thailand, and Indonesia. While Singapore’s trade strength is largely driven by services, logistics, and re-exports, Vietnam’s trade performance is underpinned primarily by manufactured goods, reflecting its growing role as a production center[1].

Top 6 ASEAN countries with the highest trade performance in 2024

Unit: USD Million

Source: ITC Trade Map

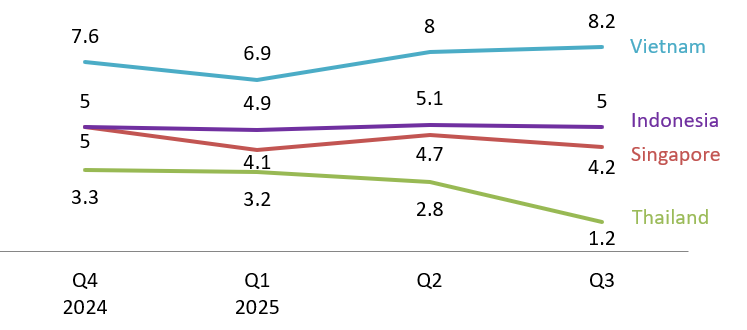

The potential of Vietnam is supported by its strong economic momentum: between late 2024 and 2025, Vietnam consistently recorded higher GDP growth than major ASEAN peers[2].

GDP Growth of 4 major ASEAN economies in Q4-2024 to Q3-2025

Unit: %

Source: McKinsey

In November 2025, Allianz Research ranked Vietnam as the second-most promising next-generation trade hub globally, behind only the United Arab Emirates, emphasizing its fast-growing export capacity, expanding free trade agreement coverage, and manufacturing capacities[3]. The report highlighted Vietnam’s resilience in maintaining strong export growth even amid shifting global supply chains and regional economic rebalancing. This evaluation reflects confidence in its long-term trade and manufacturing potential.

Vietnam is on its way of the world’s top 15 trade powers

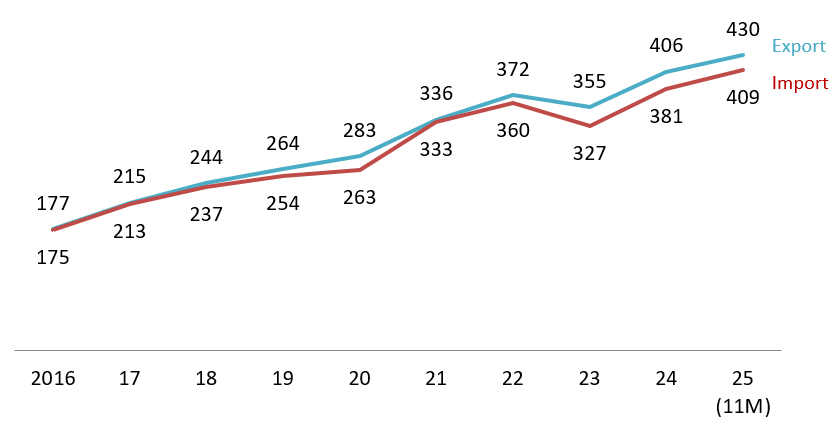

Vietnam’s total trade turnover in the first 11 months of 2025 reached nearly USD 840 billion, an increase of more than 17% from the previous year. With exports increasing by over 16% and imports by more than 18% compared to the same period last year, Vietnam managed to maintain a trade surplus of more than USD 20.5 billion and build momentum toward surpassing the USD 900 billion mark by year’s end[4]. The prospect of reaching USD 900 billion in foreign trade would elevate Vietnam into the top 15 trading economies globally based on total trade volume[5].

Vietnam trade turnover from 2016 to 11 months of 2025

Unit: USD Billion

Source: National Statistics Office

Manufacturing as Vietnam’s strength

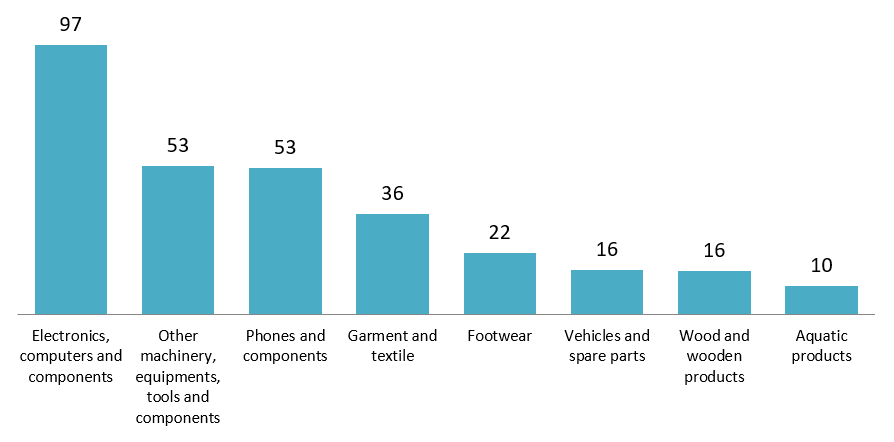

Manufacturing remains the key engine in Vietnam’s trading growth. Regarding the structure of export goods in the first 11 months of 2025, the processed industrial goods group reached USD 381.7 billion, accounting for 88.7%. In the import side, production materials reached 383.96 billion USD, accounting for 93.7%[6]. Several key manufacturing subsectors contributed significantly to export value, including electronics, machinery, , textiles, footwear, and other goods. Electronics and machinery have emerged as engines of export growth, benefiting from major foreign direct investments and integration into global value chains, while traditional industries such as textiles, garments, and footwear continue to provide employment and export volume.

Vietnam exported commodities worth over USD 10 billion in value (11 months of 2025)

Unit: USD Billion

Source: VnEconomy

Another indicator of Vietnam’s manufacturing strength is the S&P Global Vietnam PMI, which has remained above the expansionary threshold (50) for 5 consecutive months, from July to November. This means continued manufacturing output expansion, new order growth, and sustained export demand, even in the face of global economic headwinds and tariff uncertainties[7].

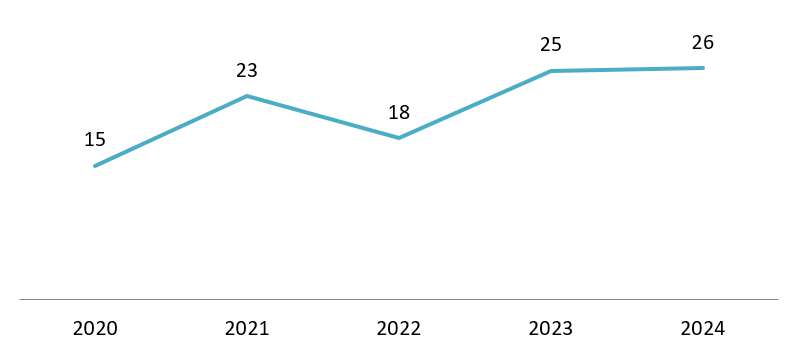

Factors Driving Vietnam’s ASEAN Trade Hub Status

Economically, Vietnam’s competitive labor costs remain an important attractor for manufacturing investment relative to regional peers, enabling cost-efficient production that appeals to global firms. Additionally, sustained FDI inflows into manufacturing sectors, particularly electronics and high-tech components, have enhanced capital formation and technology transfer, reinforcing the country’s industrial competitiveness. While global tariffs and economic uncertainties pose risks, Vietnam’s macroeconomic stability, evident in controlled inflation and positive trade balances, has provided a supportive environment for industrial growth and export expansion[8].

Total registered capital of FDI in Vietnam’s Manufacturing (2020-2024)

Unit: USD Billion

Source: National Statistics Office

Moreover, in policy and diplomatic relations, a network of strategic free trade agreements (FTAs) such as CPTPP, EVFTA, and RCEP has reduced tariff barriers and expanded market access across Asia, Europe, and the Pacific. For example, two-way trade with CPTPP partners reached a record US$102.8 billion in the first ten months of 2025, with exports up 26% year-on-year, demonstrating how preferential access contributes to trade diversification and export growth[9]. These FTAs not only facilitate tariff advantages but also encourage compliance with international standards, thereby improving Vietnamese firms’ competitiveness abroad.

In October 2024, the Comprehensive Economic Partnership Agreement (CEPA) was signed between Vietnam and the UAE

Source: Government News

Vietnam also benefits from geopolitical factors. The ongoing US–China trade tensions have increased the risks and costs associated with producing in China. To reduce exposure to these risks, global firms have adopted the China + 1 strategy, which means they keep some production in China but shift part of their supply chain to another country. Vietnam has become one of the top choices for this shift thanks to its long coastline and geographic proximity to China, thus reducing transportation time and expense[10].

Challenges and Constraints

Skilled Labor Shortages and Low-Value Productivity

Vietnam’s manufacturing sector continues to rely heavily on low-cost labor and final-stage assembly, creating a structural limitation that prevents the country from moving rapidly into high-value production. This pattern leads to rapid export growth driven mainly by volume rather than quality or innovation, suggesting that Vietnam’s manufacturing strength remains shallow in terms of technology depth and human-capital capacity. Skill shortages are particularly acute in fields such as electronics engineering, industrial automation, advanced materials, and supply-chain management, areas essential for Vietnam to transition from basic assembly to higher-productivity manufacturing[11]. While Vietnam benefits from a young labor force and low wages, these would not be sustainable advantages and require an increase in productivity and value added as labor looks for ligher quality of life.

Supply Chain Dependencies on Imported Inputs

A major constraint on Vietnam’s manufacturing sector is its strong dependence on imported raw materials, machinery, and intermediate inputs, particularly from China. Vietnam’s industrial base is not yet deep enough to supply essential components for key industries like electronics, textiles, footwear, and machinery. As a result, even industries with strong export performance rely on imported materials for production inputs, exposing manufacturers to supply disruptions, currency fluctuations, and global price volatility[12]. This reliance also limits domestic value retention, since a significant portion of export revenue leaks back out of the economy through imported components.

Environmental Concerns

Vietnam faces serious environmental vulnerabilities, including rising temperatures, flooding, saltwater intrusion, and frequent typhoons that disrupt manufacturing operations. The World Bank identifies Vietnam as one of the countries most exposed to climate risks, especially in the Mekong Delta and coastal industrial zones, where a large share of factories, ports, and logistics infrastructure are located[13]. These natural disasters not only halt production but also damage machinery, interrupt electricity supply, and delay shipment schedules, creating significant financial losses. Typhoons and severe storms particularly affect coastal provinces such as Quang Ninh, Hai Phong, and Da Nang.

Environmental pressures also create long-term sustainability challenges. Manufacturing industries generate considerable waste, emissions, and water pollution, while environmental regulations and enforcement mechanisms still lag behind international standards. Failure to strengthen environmental resilience through climate-proof infrastructure, disaster-preparedness planning, and greener industrial policies could undermine Vietnam’s attractiveness as a stable manufacturing hub.

Future Outlook and Implications for Foreign Investors

According to the World Bank, Vietnam’s growth model, currently powered by export-oriented manufacturing and large-scale FDI, will not be sufficient to sustain high growth over the next two decades unless productivity rises significantly. Instead, Vietnam must shift from extensive growth (labor, capital, low-cost production) to intensive growth driven by technology, skills, innovation, and value-added manufacturing[14].

Moreover, Vietnam’s aspiration to become a major manufacturing and logistics hub requires deeper structural upgrades in infrastructure, urban planning, and institutional reform. Climate risks such as flooding, extreme heat, and coastal erosion pose increasing threats to industrial zones and export infrastructure, requiring major investment in climate-resilient development.

Vietnam is entering a phase of rapid population aging, which will put pressure on labor supply and social protection systems[15]. To maintain competitiveness, Vietnam must move toward a more skilled, innovation-driven workforce. This shift will require reforms in education, vocational training, and digital skills development to support automation-intensive and high-tech manufacturing industries.

For foreign investors, Vietnam’s trajectory suggests a gradual move from a low-cost assembly platform to a more sophisticated manufacturing environment. This shift creates opportunities in sectors such as electronics, semiconductors, renewable energy technology, high-value machinery, and automotive components. However, investors should recognize that the era of purely low-cost labor advantages will diminish over time. Maintaining competitive operations in Vietnam will increasingly depend on technology adoption, digitalization, skilled workers training and the ability to build local supply partnerships that support higher-quality production.

Investors must also prepare for stricter compliance requirements related to sustainability, environmental standards, and labor practices. As Vietnam strengthens its regulatory alignment with EVFTA, CPTPP, and carbon-related export standards (such as the EU’s CBAM), manufacturers will need to invest in cleaner production technology, energy efficiency, and environmental monitoring systems[16]. Long-term competitiveness will favor firms that integrate ESG principles into their Vietnam operations from the outset.

* If you wish to quote any information from this article, please kindly cite the source along with the link to the original article to respect copyright.

| B&Company

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |

[1] Department of Statistics Singapore, Singapore’s International Trade (https://www.singstat.gov.sg/modules/infographics/singapore-international-trade)

[2] McKinsey & Company, Southeast Asia quarterly economic review: Markets reshape (https://www.mckinsey.com/featured-insights/future-of-asia/southeast-asia-quarterly-economic-review)

[3] Vietnam Plus, Vietnam emerges as ASEAN’s leading next-generation trade hub (https://en.vietnamplus.vn/vietnam-emerges-as-aseans-leading-next-generation-trade-hub-post332107.vnp)

[4] VnEconomy, Imports and exports in the first 11 months of 2025 reached $839.75 billion, breaking the record set in 2024. (https://vneconomy.vn/xuat-nhap-khau-11-thang-nam-2025-dat-83975-ty-usd-xo-do-ky-luc-nam-2024.htm)

[5] Bao dau tu, Vietnam’s trade is about to surpass $900 billion. (https://baodautu.vn/thuong-mai-viet-nam–sap-vuot-900-ty-usd-d453612.html)

[6] National Statistics Office, Report on the socio-economic situation in November and the first 11 months of 2025 (https://www.nso.gov.vn/bai-top/2025/12/bao-cao-tinh-hinh-kinh-te-xa-hoi-thang-muoi-mot-va-11-thang-nam-2025/)

[7] Vietnam Briefing, Vietnam Manufacturing Tracker: As of November 2025 (https://www.vietnam-briefing.com/news/vietnam-manufacturing-tracker.html/)

[8] Vietnam News, Việt Nam’s economy set to maintain solid recovery through 2026–2027: OECD (https://vietnamnews.vn/economy/1731055/viet-nam-s-economy-set-to-maintain-solid-recovery-through-2026-2027-oecd.html)

[9] Vietnam Plus, CPTPP drives Vietnam’s agro-fisheries exports (https://en.vietnamplus.vn/cptpp-drives-vietnams-agro-fisheries-exports-post334088.vnp)

[10] Vietnam Investment Review, Vietnam benefits from China+1 policy shift (https://vir.com.vn/vietnam-benefits-from-china1-policy-shift-112731.html)

[11] McKinsey & Company, Boosting Vietnam’s manufacturing sector: From low cost to high productivity (https://www.mckinsey.com/featured-insights/asia-pacific/boosting-vietnams-manufacturing-sector-from-low-cost-to-high-productivity)

[12] A1 Consulting, Overview of the manufacturing sector & the biggest challenges facing Vietnam’s manufacturing industry in 2025. (https://www.a1consulting.vn/en/blog/dx-blog-9/nganh-san-xuat-viet-nam-2025-272)

[13] World Bank, Key Highlights: Country Climate and Development Report for Vietnam (https://www.worldbank.org/en/country/vietnam/brief/key-highlights-country-climate-and-development-report-for-vietnam)

[14] World Bank & Australian Aid, VIET NAM 2045 – TRADING UP IN A CHANGING WORLD – Pathways to a High-Income Future

[15] Tuoi tre, To achieve rapid growth, Vietnam must prepare for an aging population early on. (https://tuoitre.vn/muon-tang-truong-nhanh-viet-nam-phai-chuan-bi-cho-gia-hoa-dan-so-som-20250711175023665.htm)

[16] Vietnam News, Vietnamese industries aim to meet higher environmental standards (https://vietnamnews.vn/economy/1730486/vietnamese-industries-aim-to-meet-higher-environmental-standards.html)