25Mar2025

Latest News & Report / Vietnam Briefing

Comments: No Comments.

Vietnam’s beer market is a dynamic and culturally significant industry with increasing participation from foreign brands. With recent challenges like rising costs and strict regulations, the industry is rapidly evolving to meet the consumer’s ever-changing preferences.

Overview of Vietnam Beer market

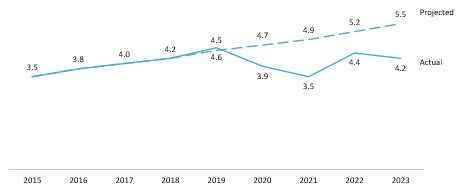

Vietnam is a top global beer market, consistently ranking among the top 10 in consumption since 2015. In 2023, it ranked 7th worldwide, consuming nearly 4.6 billion liters, or 2.4% of the global market[1]. It leads the ASEAN region and surpassed Japan in 2022 to become Asia’s second-largest beer market after China.

However, the domestic beer market has witnessed major shakeups recently. Total revenue fell to 2.7 billion USD in 2023, a year-over-year decrease of over 14.4%[2] as domestic consumption fell by 13.8%[3]. Domestic production lagged behind the expected 5.2% growth rate from 2018 to 2023[4], and the looming state ensued in the first three quarters of 2024 as beer volume fell by 4% compared to the previous year[5]. Heineken Vietnam Brewery, a market leader, also announced the temporary shutdown of its factory in Quang Nam province amidst a demand shortage and economic challenges, highlighting the difficult economic landscape[6].

Domestic beer production of Vietnam from 2015 to 2023 (Unit: billion liters)

Source: VBA, MB Securities, B&Company Vietnam synthesis

While the Covid-19 pandemic plays a major role in the decline of the market, the government’s anti-drunk-driving campaign significantly hampers the consumption of beer domestically. Decree No. 100/2019/ND-CP signed in 2019, introduced maximum fine levels of 8 million VND for two-wheeler vehicles and 40 million VND for four-wheeler vehicles[7], which detrimentally impact the consumption of beer and other alcoholic beverages. Global economic uncertainties further pressure the bottom-line of breweries as ingredient costs hike between 20 and 40%[8].

Heightened control and zero-tolerance policy for driving under the influence of alcohol

Source: Thanh Nien Newspaper

The dynamics and trends of the Vietnam Beer market

The domestic beer industry has undergone a major transformation in light of the current landscape. As consumer behaviors shift dramatically, the industry witnessed emerging consumption trends, notable of which are:

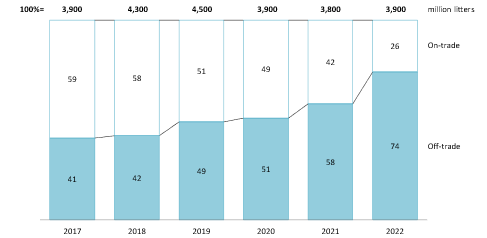

– The rise of off-trade consumption: The crackdown on driving under the influence of alcohol has significantly altered the purchasing channel of beer products. On-trade (Restaurants, pubs, bars, etc.) sales volume fell by over 55% from 2017 to 2022, while off-trade (Supermarkets, convenience stores, e-commerce platforms, etc.) sales volume boomed by 80% over the same period and was forecasted to increase by 7.5% annually from 2022 to 2026[9].

Sales volume of beer on on-trade and off-trade channels from 2017 to 2022 (Unit: %)

Source: VNDirect

– Premiumization of beer products: The country’s growing affluent group is expected to drive the consumption of premium beer products[10]. Reportedly, up to 88% of the consumers are willing to spend more for better quality beer products in 2022[11]. The trend has fueled the rise of premium beer brands, such as Heineken Vietnam, and resulted in new high-end options such as Tiger Platinum, Saigon Special, and the local craft beer industry[12].

– Increasing preference for zero and low alcohol beers: Under the pressure of Decree No. 100/2019/ND-CP and Gen Z’s demand for non-alcoholic beverages[13], many breweries have introduced non-alcoholic options into the Vietnamese market, such as Heineken 0.0, Sagota, and Suntory All-Free.

Non-alcoholic beers being promoted in modern trade channels

Source: B&Company Vietnam

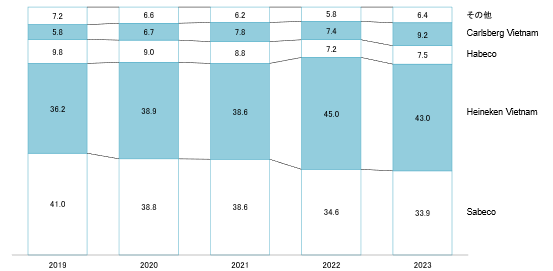

Foreign brands in the domestic market

The Vietnamese beer market is highly competitive and concentrated, as Heineken Vietnam, Sabeco, Habeco, and Carlsberg Vietnam accounted for over 90% of the domestic market share in 2023. While Vietnamese brands prioritize affordable mid-range products, international brands, such as Heineken Vietnam, Carlsberg Vietnam, Sapporo Vietnam, etc., are well-positioned to capitalize on the industry trends with their premium and diversified portfolios. Consequently, these companies have increased their market share and gradually edged out the local competitors.

Market share of Vietnam beer market by breweries from 2019 to 2023 (Unit: %)

Source: VnExpress

The domestic market has also seen rising competition with the entry of new international players over the past decade. Sapporo became the first Japanese brewery to establish a factory in Vietnam in 2011[14]. In 2012, AB InBev entered the Vietnamese market and quickly expanded with its three state-of-the-art breweries in Binh Duong in 2015. On the other hand, Asahi, a leading Japanese brewery, brought its signature Asahi Super Dry through a local authorized distributor in 2024.

Some foreign beer brands in Vietnam

Source: B&Company Vietnam synthesis

Opportunities and challenges

Emerging trends and new consumer preferences pave the way for growing opportunities. Companies areslooking to expand their market offerings to capitalize on the shifting demand. Partnerships with ride-hailing services are promoted as a way to revive the on-trade channel with unique services such as overnight parking services and special promotions at partnered restaurants. Advertising is also recommended for market leaders to cement their positions while new competitors are looking to capture the domestic consumer and position themselves in the market. Heineken Vietnam has been a leading company in leveraging these campaigns to boost brand recognition, fueling its growth to the dominant position in Vietnam[15]. The international market is also promising for domestic breweries, as export value grew steadily with a CAGR of 11% from 2016 to 2023, highlighting a possible expansion opportunity[16].

Grab’s overnight parking spot under partnership with Heineken Vietnam

Source: VnExpress

However, the market still faces significant pressure, especially from the government’s regulations. Due to the nature of the products, consumption of beer is generally discouraged by the government, indicated through a high exercise tax rate and exclusion from the 2% VAT cut[17]. Furthermore, the Ministry of Finance has planned to raise the exercise tax rate of beer incrementally, from the current applicable rate of 65% since 2018 up to 100% in 2030[18]. The increase in exercise tax is expected to damage up to 62,000 billion VND of the industry’s value added from 2026 to 2030[19].

Applicable exercise tax rate for beer products under the Draft Law on Special Consumption Tax (Amended) proposed by the Ministry of Finance in 2024

| Year | Option 1 (Unit: %) | Option 2 (Unit: %) |

| From 2026 | 70 | 80 |

| From 2027 | 75 | 85 |

| From 2028 | 80 | 90 |

| From 2029 | 85 | 95 |

| From 2030 | 90 | 100 |

Source: Government

Conclusion

Vietnam’s beer market is under pressure from regulatory constraints and shifting demand. However, foreign brands have made significant inroads by offering premium and innovative products. With continuous innovation and adaptability, Vietnam’s beer market will remain an attractive destination for both local and international brewers in the years to come.

[1] Kirin Holdings. Global Beer Consumption by Country in 2023 <Assess>

[2] B&Company Vietnam’s Enterprise Database

[3] Kirin Holdings. Global Beer Consumption by Country in 2023 <Assess>

[4] MB Securities. Equity research – Saigon Beer-Alcohol-Beverage Corporation <Assess>

[5] VnExpress. Beer industry struggles amid crackdown on drunk driving, higher costs <Assess>

[6] Vietnam Beer-Alcohol-Beverage Association (VBA). To stabilize production and restore the economy, it is necessary to avoid “shocks” to businesses <Assess>

[7] TVPL. Decree No. 100/2019/ND-CP on Administrative Penalties for Road traffic offences and Rail transport offences<Assess>

[8] VBA. To stabilize production and restore the economy, it is necessary to avoid “shocks” to businesses <Assess>

[9] KPMG. Filling up glasses and pouring out opportunities in Vietnam’s beer market <Assess>

[10] KPMG. Filling up glasses and pouring out opportunities in Vietnam’s beer market <Assess>

[11] FPT Securities. News Update Report <Assess>

[12] Vietnam Briefing. Why SEA Craft Beer Brewers are Choosing Vietnam <Assess>

[13] VnEconomy. Gen Z drives the “non-alcoholic industry” <Assess>

[14] Sapporo Vietnam. About us <Assess>

[15] Cafef. Sabeco Losing Market Share: Outdated Portfolio, Price Hikes Amid Fierce Competition, and Advertising Struggles Against Heineken <Asses>

[17] VBA. Report – Economic impact assessment of increasing special consumption tax on beer <Assess>

[18] Government. Draft Law on Special Consumption Tax (Amended) <Assess>

[19] VBA. Report – Economic impact assessment of increasing special consumption tax on beer <Assess>

* If you wish to quote any information from this article, please kindly cite the source along with the link to the original article to respect copyright.

| B&Company

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |