02Aug2024

Industry Reviews / Latest News & Report

Comments: No Comments.

Market overview

In 2023 and early 2024, continuation of economic difficulties and reduced purchasing power have impacted many retail businesses. Street front rental properties and modern retail supply both experienced lower occupancy rate than pre-2019 levels, taking example of Hanoi and Ho Chi Minh City (HCM). However, many signs of recovery have been observed.

Situation of street front rental properties

For street front rental properties, as reported by Lao Dong newspaper on February 29, 2024, in Hanoi, numerous streets in central districts such as Ba Dinh, Thanh Xuan, and Dong Da are seeing closures and urgent lease signs. Mr. Nguyen Quoc Khanh, Vice President of the Vietnam Association of Realtors (VARS), notes that while there is demand, many potential tenants are in a waiting state, hoping for more affordable premises. The retail space market in Hanoi might start to recover in the second quarter of 2024, yet is only expected to reach about 80% of its pre-2019 levels.

However, contrary to the scene of mass leasing signs, several prime business locations in the Hoan Kiem district, such as Trang Tien, Tran Hung Dao, Ba Trieu, and Ly Thuong Kiet streets, continue to attract numerous brands. Specifically, areas in Hoan Kiem have recently welcomed and expanded stores of luxury to high-end brands, including Louis Vuitton, Dior, Berluti [1]

Situation of modern retail properties

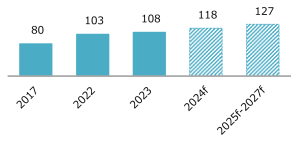

For modern retail supply, in HCM during 2023, the occupancy rate remained relatively stable quarterly at 90% and saw a 1.9 percentage point increase compared to the previous year, thanks to good occupancy rates in newly launched projects[2]. The year 2023 witnessed notable progress in the retail sector in HCM, with various new projects and projects aimed at revitalizing existing shopping destinations[3]. The future modern retail supply in HCM is expected to continue to increase, with an average annual growth rate of more than 4% during the 2022-2027 period.

Modern retail supply in HCM(10 thousand m2)

Source:Cushman & Wakefield(2022)

Examples of modern retail projects in Ho Chi Minh in 2023

Source:Cushman & Wakefield(2023)

Opportunities and challenges

The trend of new brands entering Vietnam and expanding scale is still strong in 2023. Many chose shopping malls to set up their stores such as Uniqlo, H&M, Miniso.

According to Savills, in economic difficulties, consumers are forced to tighten their spending, people tend to increase spending on essential goods sector while reducing expenditure on social services. Currently, brands in this sector have also been implementing expansion plans. Specifically, Central Retail—a Thai retailer—has announced plans to invest an additional 20,000 billion VND in the Vietnamese retail market over the next five years, aiming to increase their outlets from 40 provinces and cities currently to 55 nationwide with about 600 stores.

Another foreign retail company, Aeon Group, is also planning to build more mega stores in Hanoi. This company aims to develop 20 shopping centers in Vietnam by 2025, and 100 AEON MaxValu Supermarkets in Hanoi by 2025. Meanwhile, WinCommerce plans to open an additional 1,000 stores, and Saigon Coop aims to be the number one in the supermarket retail segment[4].

With advantage of a more than 100 million people market and a growing number of middle-class and above people, Vietnam is still a good destination for high quality products and services despite economic difficulties in recent years. It is important for brands to investigate the market to start entering or to reconsider their existence in Vietnam.

B&Company

This article has been published in the column “Read Vietnamese trends” of ASEAN Economic News.

|

B&Company, Inc. The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |

Read other articles

- All

- Business

- Economic

- Energy

- Environment

- Exhibition

- Food & Beverage

- Healthcare

- Human Resources

- Investment

- IT & Technology

- Manufacturing

- Multi-country Research

- Retail & Distribution

- Seminar

- Temporarily closed

- Tet

- Trade