10Nov2025

Latest News & Report / Vietnam Briefing

Comments: No Comments.

The location shift of food and beverage (F&B) businesses in Vietnam from traditional street-front premises to shopping malls represents a significant change in the retail market. Historically, F&B owners preferred locations with high foot traffic, primarily through street-front houses. However, with the rise of shopping malls offering enhanced infrastructure and consumer convenience, a new trend has emerged. This article explores the factors driving this transition, the benefits and challenges of choosing mall locations, and provides implications for F&B brands navigating this shift.

Market Overview

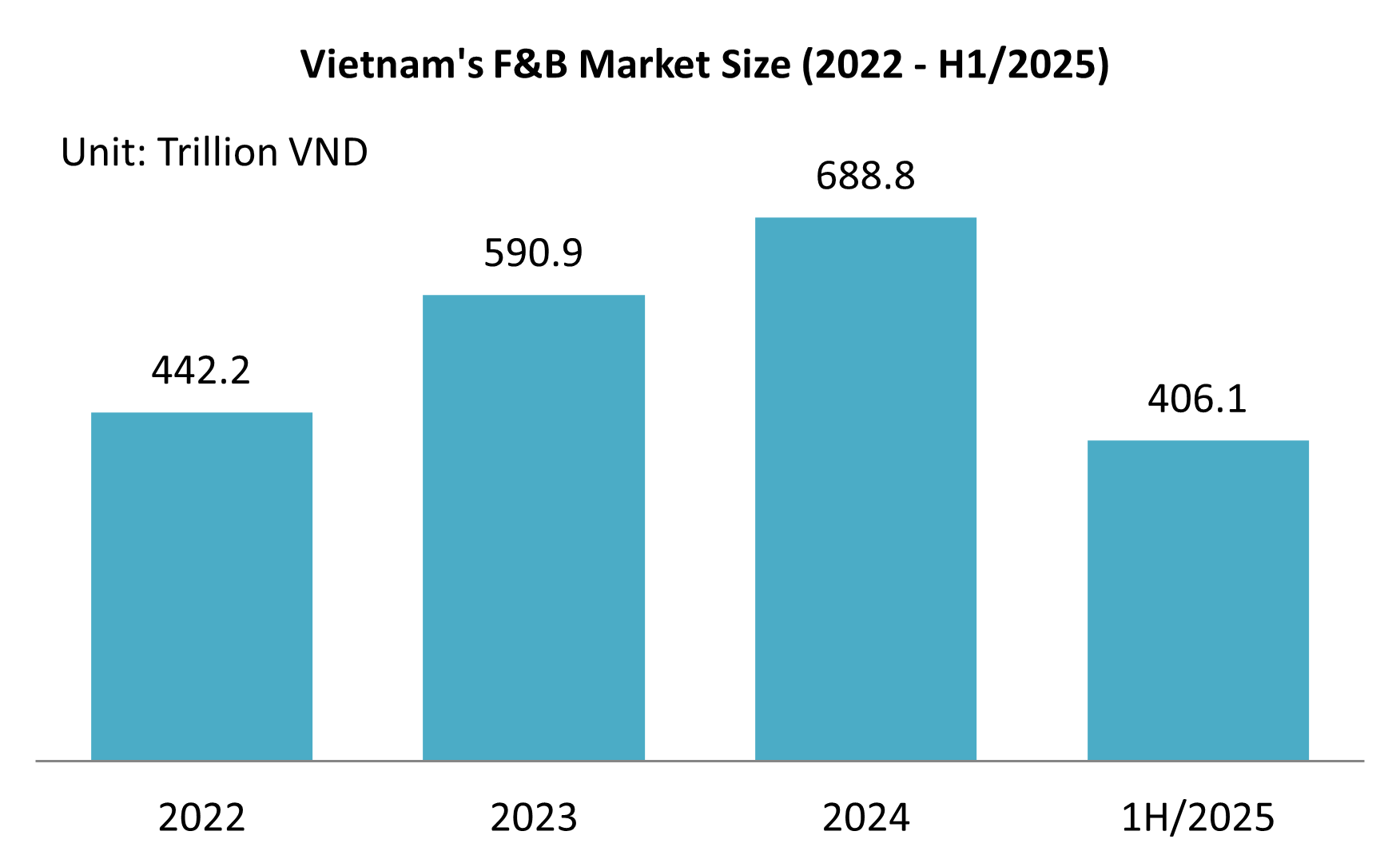

Vietnam’s food and beverage (F&B) industry generated revenues of VND406.1 trillion (US$15.4 billion) in the first half of 2025, representing 58.9% of the total revenue in 2024, with only a slight increase from the same period a year earlier. Despite expectations of double-digit growth, rising costs, including inflation, increased prices for food and materials, labor wages, and new regulatory requirements have tightened profit margins and limited promotional activities, resulting in a cautious growth environment[1].

Source: iPos and Nestle

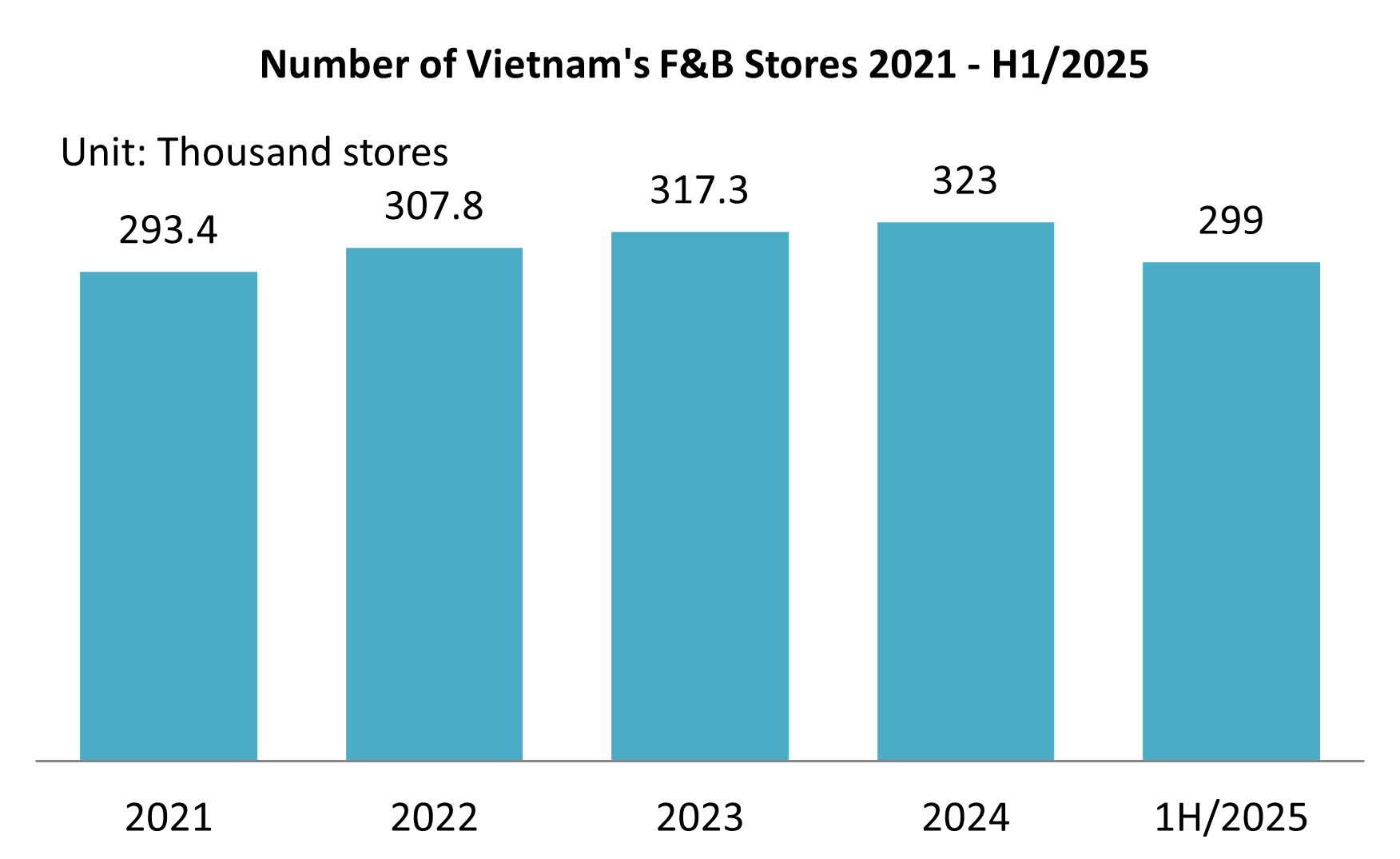

The F&B market presents a diverse range of store types, including fast food chains, coffee shops, casual dining restaurants, hot pot and buffet venues, healthy food outlets, beverage shops, and bakeries. There is also a trend of pop-up store formats that offer flexibility for startups and new brands. In mid-2025, there are approximately 299,000 registered F&B establishments nationwide, marking a 7.1% decrease. It can be explained by the pop-up stores (fail fast – learn fast) trend lately, where startups and new brands opened stores for 2-3 months then quit due to lack of financial capacity or not seeing market potential.

Source: iPos and Nestle

Most F&B outlets are concentrated in major urban centers such as Hanoi and Ho Chi Minh City, which host diverse consumer bases and larger spending power. These cities have become the focal point for F&B innovation and growth. Consumers are increasingly selective in their dining choices, focusing more on space, environment, quality, and experience[2]. They are more invested in their dining experience by eating out less frequently but spending more on each event.

The Transition from Street-front Locations to Mall Locations

Historically, F&B owners favored street-facing locations because they were seen as offering more direct access to foot traffic and potential customers. These premises were typically located in high-visibility areas with a large population base, such as downtown areas or busy street corners. The belief that street-front premises provided higher visibility and spontaneous customer visits has been deeply ingrained.

In recent years, however, the development of modern shopping malls in Vietnam has created a powerful alternative for F&B premises. In 2024, new shopping malls being opened across Vietnam added 277,000 square meters of retail space, with major players like VinGroup, AEON, Central Retail, and Lotte[3]. By 2025, there will be 123 department stores, 6% increase from 2024, thanks to new openings of AEON Mall and Vincom[4]. The demand for retail spaces in shopping malls remains strong. The first quarter of 2025 recorded an average occupancy rate of 94% in Ho Chi Minh City and 85% in Hanoi[5].

Among various brands and industries operating in Shopping Centers, F&B tenants account for almost one-third of the new leasing activity[6]. Shopping malls are often trusted by foreign brands that have strong financial backgrounds and value transparent contracts, clear pricing, and quality operation. Visitors in shopping malls can be familiar with foreign brands such as KFC and Starbucks (USA), Jollibee (Philippines), Haidilao and BanTianYao (China)[7]. Advantages of shopping malls are acknowledged by strong local players, including Phuc Long, Trung Nguyen coffee, and Highlands Coffee.

The shift towards shopping mall locations for F&B outlets in Vietnam is becoming more pronounced. F&B owners lose interest in street-front stores because these locations do not meet the necessary standards, such as uniform commercial planning, high-end shopping areas, or legal transparency. Legal barriers when applying for a business license at street-front stores are also the reason why brands hesitate[8]. From the customers’ perspective, instead of going to the restaurant directly, they would prefer online shopping for convenience or visiting shopping malls for comprehensive service[9]. In 2024, Starbucks closed its street store branch in Han Thuyen to open in Bitexco and Diamond Plaza, highlighting the strategy of leveraging service and quality standards [10].

Cost and Financial Considerations

Depending on the location, the rent for F&B owners can vary. In the Central Business District (CBD), especially in the ground and first floors of the shopping centers, the rent is high, even higher than hot street-front premises. On average, the rent is US$172.7/sqm/month in Hanoi[11] and US$278.6/sqm/month in Ho Chi Minh City[12]. However, the non-CBD areas report the average rents of US$38.1/sqm/month in Hanoi and US$52.9/sqm/month in Ho Chi Minh City. This price point can be attractive for mid-end brands, restaurant chains, and convenience stores whose target customers are working professionals, young consumers with moderate incomes, and local residential communities.

Overall, rental prices showed an upward trend, which indicates competitiveness and pressure for F&B owners. In addition to rent, businesses are often required to pay for utilities, security, and marketing contributions, which can add up to a substantial portion of a company’s monthly budget. Taking all the costs into consideration, small or independent F&B operators can see the burden and struggle to maintain profitability.

A shopping mall in Hanoi

Source: Phap Luat E-Newspaper

Weighing the pros and cons of street-front stores and shopping malls

The transition from traditional street-front stores to shopping mall locations when renting premises among F&B owners reflects the growing appeal of malls as modern, convenient, and high-traffic environments that align with changing consumer lifestyles. However, this model also presents challenges such as limited flexibility, high competition, and stricter operating regulations. Therefore, understanding the differences between mall and street-front locations is essential for F&B tenants to make informed decisions about expansion and long-term positioning.

| Criteria | Shopping mall | Street-front store |

| Procedure | Organized by a professional company, with transparent terms and a contract | Mostly owned by private landlords who can have subjective preferences |

| Customer Traffic | – Stable and consistent foot traffic from the mall’s customer base

– Access to diverse groups — families, tourists, office workers, and students |

– Variable traffic depending on street visibility, surrounding businesses, and time of day

– Mostly relies on local residents or passersby |

| Accessibility | Conveniently located in dense urban areas near schools, universities, hospitals, and residential zones | Depends on the location quality |

| Environment & Comfort | Fully equipped with air-conditioning, clean facilities, and sheltered spaces | Outdoor setting may be less comfortable during extreme weather; owners bear responsibility for environmental control and cleanliness |

| Security & Maintenance | Professional security systems and regular maintenance are provided by the mall management | Self-managed security and maintenance, increasing costs and operational risks, such as theft or vandalism |

| Support from surrounding services | Malls offer an “all-in-one” experience, and encourage impulse dining | Less possible, depends on the shops on the same street |

| Design & Layout Flexibility | Limited flexibility as stores have to follow mall design guidelines and structural constraints | High flexibility: owners can design and renovate freely to reflect brand identity |

| Operating Hours | Fixed mall hours: cannot open earlier or later than permitted | Flexible hours: can open late or early, depending on business type and customer habits |

| Competition | High competition as many F&B outlets are concentrated in the same area | Less direct competition nearby; easier to build a loyal local customer base |

Source: B&Company’s Synthesis

Business Implication

F&B brands with a focus on convenience, quick service, and premium experiences tend to perform well in mall locations. High-end coffee shops, international fast-food chains, and family-friendly restaurants are usually the ideal candidates[13]. For F&B owners desired to operate in shopping malls, there are some recommendations to be considered:

Location and Space Optimization: Choosing the right location within a mall is crucial for maximizing visibility and foot traffic. Despite not being in the CBD area, F&B brands can opt for high-traffic areas near entrances or anchor tenants (such as large department stores or cinemas) if possible. Within the limited renting space, the layout should be optimized for customer flow and operational efficiency.

Financial Management: Choosing to operate in a shopping mall can be a big investment for small and medium F&B businesses. The high rent, along with additional costs for maintenance, utilities, and marketing, can put pressure on profit margins. F&B brands need to adjust pricing strategies and carefully manage their budgets to ensure that the benefits of higher foot traffic outweigh the added financial burdens.

Differentiation strategy: Malls host numerous F&B outlets and mostly have food zones dedicated to dining, which creates a competitive environment where standing out is essential. Brands could focus on offering unique dining experiences, innovative menus, or customer-centric service to attract and retain customers regardless of the competition.

* If you wish to quote any information from this article, please kindly cite the source along with the link to the original article to respect copyright.

| B&Company

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |

[1] iPos and Nestle, Report of F&B Market In Vietnam First 6 Months Of 2025 (https://drive.google.com/file/d/1KcozbNF1tVWBQoMEoY8CGb0CdcpkL0E8/view)

[2] Thoi bao Tai Chinh (Financial Times), F&B industry passes through “narrow threshold”, businesses adapt to open the way up (https://thoibaotaichinhvietnam.vn/nganh-fb-vuot-nguong-cua-hep-doanh-nghiep-thich-ung-de-mo-loi-di-len-184747.html)

[3] Customer Insight Innovations, Vietnam Shopping Mall Openings in 2024: A Year in Review (https://ciigis.com/vietnam-shopping-mall-openings-in-2024-a-year-in-review/)

[4] Q&Me, Vietnam retail store (Modern Trade) trend 2025 (https://sinhvien.dinhtienminh.net/)

[5] Avison Young, Quarterly Knowledge Report Vietnam Real Estate Quarter 1 2025 (https://www.avisonyoung.vn/documents/d/vietnam/avison-young-vietnam_q1-2025_quarterly-report_eng)

[6] Savills, Factors Shaping Demand in Viet Nam’s Commercial Real Estate (https://www.savills.com.vn/blog/article/220807/vietnam-eng/0425-factors-shaping-demand-in-vietnam-commercial-real-estate.aspx)

[7] VNExpress, Chinese brands ‘cover’ Ho Chi Minh City shopping malls (https://vnexpress.net/thuong-hieu-trung-quoc-phu-song-trung-tam-thuong-mai-tp-hcm-4956613.html)

[8] Hanoi Times, Hanoi street-front stores rental market is sluggish due to high prices (https://kinhtedothi.vn/mat-bang-cho-thue-nha-pho-ha-noi-e-am-vi-gia-cao.700136.html)

[9] Voice of Vietnam, Street-front houses for rent are under fierce competitive pressure. (https://vov.vn/thi-truong/nha-mat-pho-cho-thue-chiu-nhieu-ap-luc-canh-tranh-khoc-liet-post1196541.vov)

[10] iPos and Nestle, Report of F&B Market In Vietnam First 6 Months Of 2025 (https://drive.google.com/file/d/1KcozbNF1tVWBQoMEoY8CGb0CdcpkL0E8/view)

[11] CBRE, Hanoi Real Estate Market Q2 2025 (https://mktgdocs.cbre.com/)

[12] CBRE, Ho Chi Minh City Real Estate Market Q2 2025 (https://mktgdocs.cbre.com/)

[13] Viet Nam News, Retail shake-up brews new opportunities (https://vietnamnews.vn/economy/1727739/retail-shake-up-brews-new-opportunities.html)