11Feb2025

Latest News & Report / Vietnam Briefing

Comments: No Comments.

Vietnam’s modern trade sector has expanded rapidly in recent years, driven by rising consumer income and shifting shopping behaviors. Consumers are gradually transitioning from traditional trade to modern trade, alongside increasing demand for healthy and safe products. Additionally, the untapped potential in suburban and rural areas presents a valuable opportunity for investors looking to enter the modern trade sector.

Vietnam’s Modern Trade Revenue Reach 57 billion USD in 2024

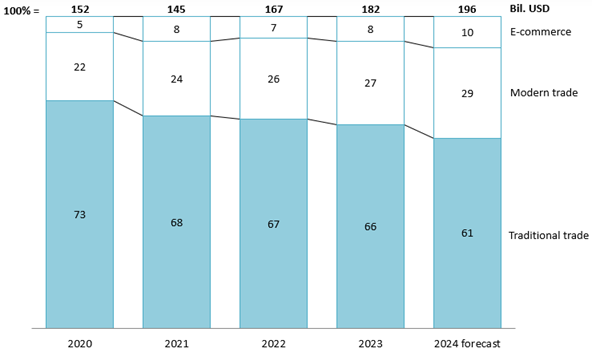

Modern trade in Vietnam has grown at a CAGR of 5% from 2020 to 2024, reaching 57 billion USD. Over the course of half a decade, Vietnam has been gradually shifting from a traditional market model to e-commerce and modern retail formats. Compared to 2020, the share of traditional markets in total retail revenue has decreased from 73% to 61%. In contrast, modern trade has increased from 22% to 29%, while e-commerce has grown from 5% to 10%[1].

Vietnam’s retail market revenue from 2020 to 2024 by type

Source: Cimigo

Increasing Trend of Modern Trade Stores [2]

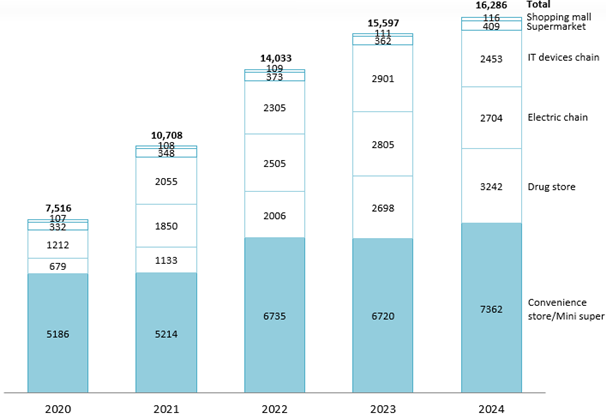

From 2020 to 2024, the number of modern trade stores in Vietnam experienced a rapid surge, growing by over 200%—more than doubling compared to 2020—to reach 16,286 stores by the end of 2024. Convenience stores and mini-supermarkets continue to dominate the store network, accounting for over 45% of the total. Following closely are drugstores, electronics chains, and IT device chains, each making up around 20%. Due to high investment costs and operational expenses, the number of shopping malls and supermarkets remains limited, representing only 3% of the total market[3].

Number of modern trade stores from 2020 to 2024

Source: Q&Me research

Modern trade stores in Vietnam are primarily concentrated in major cities such as Hanoi and Ho Chi Minh City, which together account for around 30% of all stores. However, there is a growing trend of expansion into surrounding areas. For instance, Co.op Food opened 21 new stores in the southern region, while Winmart+ expanded by nearly 195 stores nationwide. The supermarket sector has also experienced rapid expansion, driven by the growth of Winmart and Big C/Go!. Both brands now have a presence in most provinces across Vietnam, with each operating over 100 stores

On the other hand, the pharmaceutical, electronics, and IT segments have undergone notable structural shifts. By the end of 2024, the number of drugstores increased by 20% year-over-year, reaching 3,242 stores, largely driven by Long Châu’s aggressive expansion. In contrast, electronics chains have faced a downturn, with major brands like Dien May Xanh and Nguyen Kim closing 94 and 12 stores, respectively[4]. Similarly, the IT devices sector saw a 15% decline, impacted by the closure of more than 200 stores from FPT and The Gioi Di Dong

The closure of some electronics chains

Source: Financial and Monetary Market Review

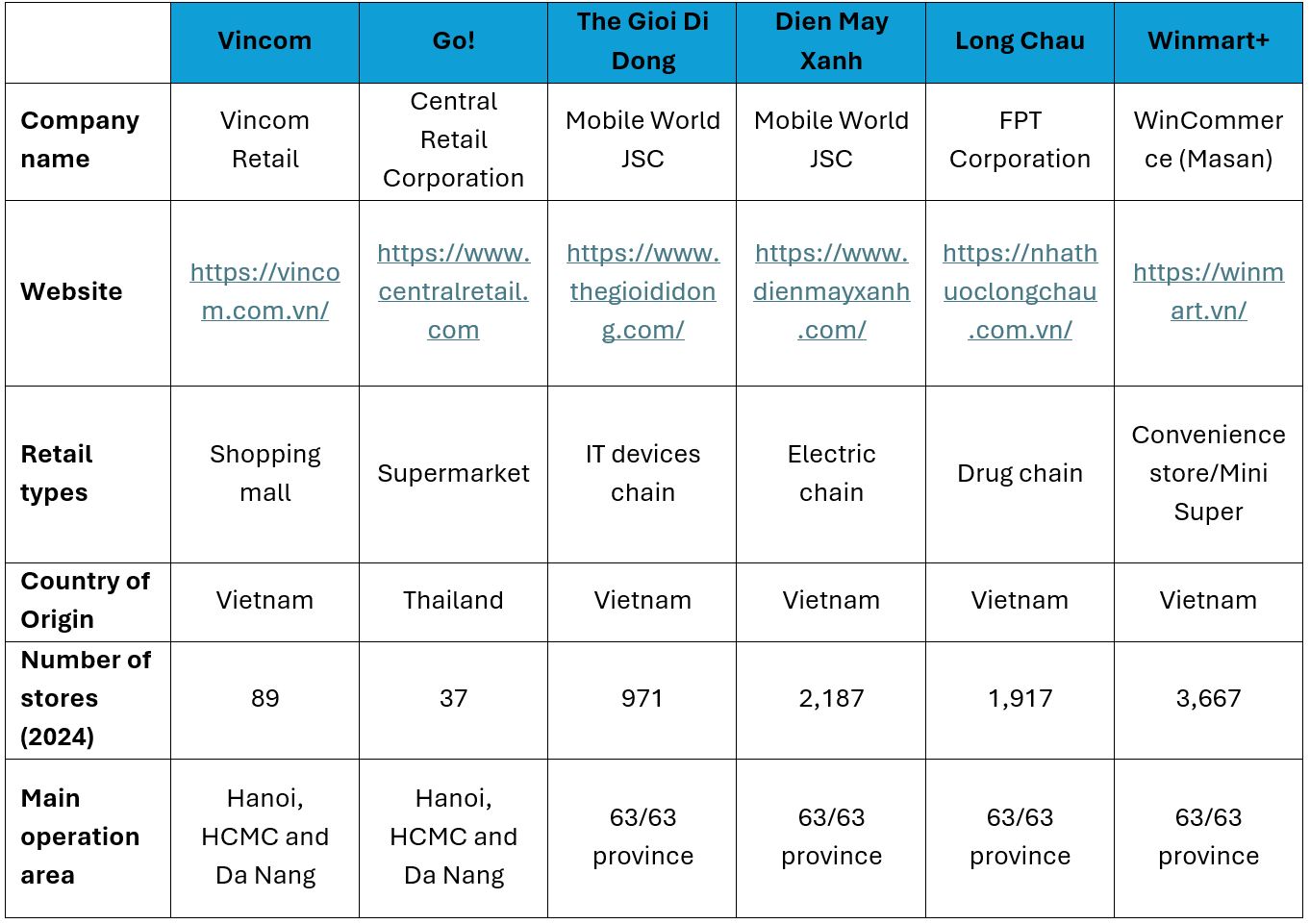

Main Player in the Modern Trade Market

As Vietnam’s retail market transitions toward modern trade, a diverse range of players have emerged to shape the industry’s landscape. From established domestic retailers like Vingroup to global corporations such as Lotte, Aeon and Central Retail, these key players are driving competition, innovation, and growth in the sector.

Some Major Players in Vietnam’s Retail Market

Source: B&Company

Large-scale modern stores, such as shopping malls, tend to develop in major cities like Hanoi, HCMC and Da Nang where population density, consumer demand, and purchasing power are high. On the other hand, smaller retail formats like chain stores and convenience stores, benefiting from lower setup and operational costs, are expanding across provinces. This widespread expansion allows them to capture a larger market share and strengthen competition with other investors in the sector.

Opportunities and Challenges for Modern Trade

Modern trade in Vietnam is expected to grow significantly over the next five years, with a projected CAGR of approximately 6% from 2025 to 2030. This growth is primarily driven by several key factors: (1) In 2024, Vietnam’s average monthly wage reached nearly 315 USD[5], marking an 8% increase from 2023 and a 40% rise since 2020[6]. Additionally, the country’s middle class has expanded significantly, now accounting for 56% of Vietnamese households[7]. (2) Consumers are increasingly adopting healthier and more mindful lifestyles, leading them to be more selective in their spending. The top spending categories include essentials such as groceries, clothing, and healthcare. As a result, there is a noticeable shift from traditional trade to modern trade, as consumers seek higher product quality and clearly sourced goods[8]. (3) While modern trade has been heavily concentrated in major cities, rural and suburban markets remain largely untapped despite their high potential. These areas account for 60% of Vietnam’s population, offering vast land availability for retail expansion with relatively low competition[9].

However, several challenges continue to hinder the development of modern trade in Vietnam. Firstly, although consumers are gradually shifting towards modern trade markets, traditional markets still account for over 60% of the retail sector. Shopping habits remain deeply embedded, as traditional markets offer quick and convenient buying without the need for parking. Secondly, fierce competition between domestic and international players has intensified. The entry of global retail giants such as Aeon, Lotte, and Central Retail Group has created a highly competitive environment, putting pressure on both local and foreign businesses. Finally, regulatory hurdles pose significant challenges, particularly for foreign investors. Investment procedures in Vietnam remain complex, and time-consuming, causing delays from project planning to implementation. Additionally, overlapping and inconsistent regulations create confusion and difficulties, even for domestic investors[10]

Conclusion

Vietnam’s retail sector is undergoing a remarkable transformation, with modern trade taking center stage. Despite challenges such as intense competition and the convenience of traditional markets, the sector presents vast opportunities, particularly in rural and suburban areas. With the right strategies, businesses can thrive in Vietnam’s dynamic and rapidly evolving retail market, solidifying its position as a key player in Southeast Asia’s retail landscape.

[1] Cimigo (2024). Vietnam Consumer Trends in 2024 <Access>

[2] This report will focus on: Shopping mall, supermarket, IT devices chain, drug store and convenience store/Mini supermarket.

[3] Q&Me Vietnam (2024). Vietnam Modern Trade Trend in 2024 <Access>

[4] Thanh Nien Newspaper (2024). The Closure of Many Electronics Stores <Access>

[5] Source of Asia (2024). Vietnam Labor Market 2024 Onwards <Access>

[6] General Statistics Office of Vietnam (2024). Vietnam’s Monthly Average Income by Province <Access>

[7] Cimigo (2024). Vietnam Consumer Trends in 2024 <Access>

[8] PricewaterhouseCoopers (PwC) (2024). Vietnam Consumer Survey 2024 <Access>

[9] General Statistics Office of Vietnam (2024). Population and Housing Census Results 2024 <Access>

[10] Tuoi Tre Online (2024). Vietnam’s Investment Procedures and are Still Too Complicated and Time-consuming <Access>

* If you wish to quote any information from this article, please kindly cite the source along with the link to the original article to respect copyright.

| B&Company

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |